KuCoin AMA With Levva Protocol Token (LVVA) — Optimized Yield Strategies Enabled by Smart Vault Technology

Dear KuCoin Users,

Time: July 29, 2025, 10:00 AM - 11:18 AM (UTC)

KuCoin recently hosted an AMA (Ask Me Anything) session in the KuCoin Exchange Group, featuring Alex, Growth & Marketing Lead and Marcel, General Manager of Levva Protocol Token.

Official Website: https://levva.fi/

Follow Levva Protocol Token on X, Telegram & Discord

Q&A from KuCoin to Levva Protocol Token

Q: What is Levva, and what problems does it solve in DeFi?

Alex: Great question! Levva is an AI-powered DeFi protocol that makes crypto portfolio management effortless. Most users miss out on real yield because DeFi is too complex - there’s too much research, too many tokens, and way too much manual farming. So Levva fixes this. You connect your wallet, choose a risk level, and our AI does the rest. No trading, no yield calculators, no guesswork. Just smarter returns across protocols like Aave, Pendle, and Etherfi.

- Simplicity

- Real, sustainable yield

- Personalized, automated strategies

DeFi doesn’t have to feel like work. With Levva, it finally doesn’t.

You may join Levva 2.0 Beta now and start earning your share of 10 million $LVVA by depositing your favorite assets.

Q: What’s changing with Levva 2.0?

Alex: Pretty much everything to be honest! Levva 2.0 is a full upgrade - new UX, new vaults, and a new brain behind it all: LevvAI. We’ve gone from a lending platform to a full portfolio layer that automates everything.

Levva 2.0 introduces:

• AI-powered Smart Vaults

• Real-time rebalancing

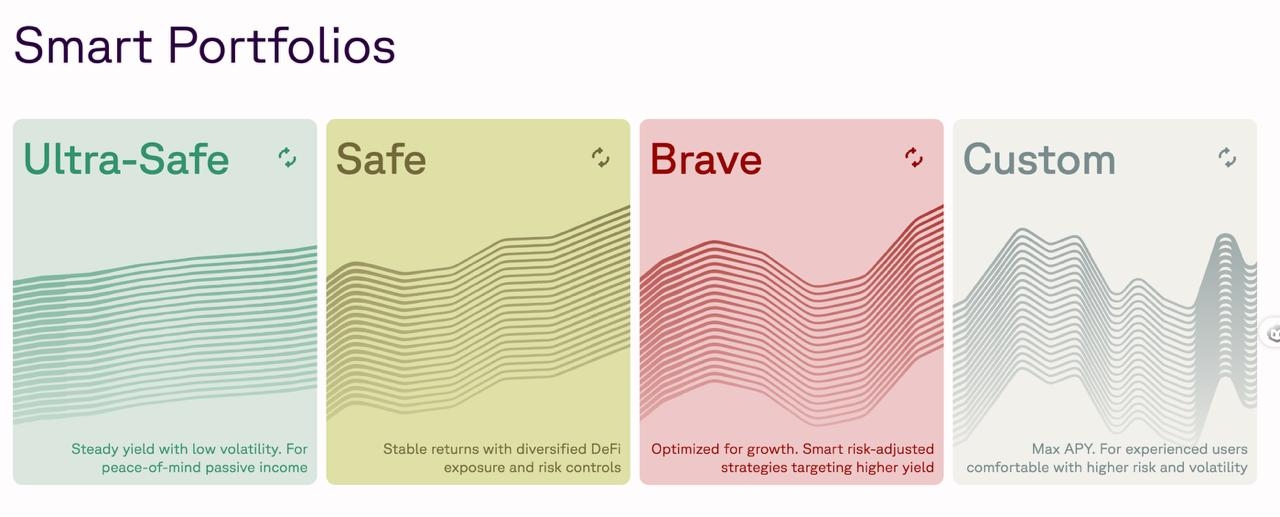

• Pre-built strategies by risk (Ultra Safe to Degen)

• Sustainable tokenomics: 100% of revenue flows back to users via $LVVA

It’s the first time DeFi yield feels like something you can actually use daily - without farming, swapping, or timing the market.

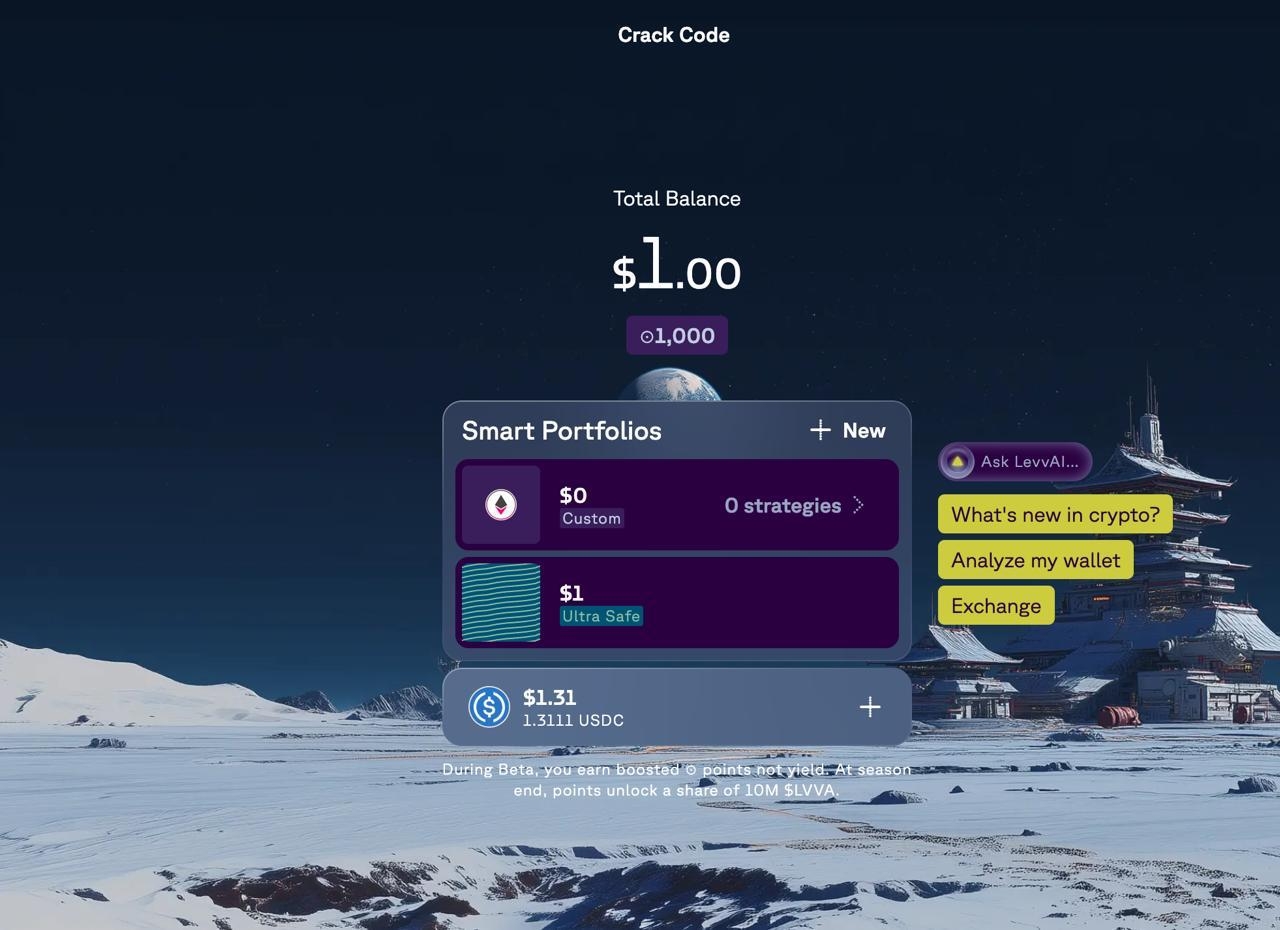

Again, Levva 2.0 Beta is live - deposit now at levva.fi to earn points toward 10M $LVVA (10 points for every $1 worth of assets deposited).

For example, I've just deposited $200 worth of ETH and already have 2,000 points, and if you signed up during our last AMA, you'd be eligible for another 1,000 points (you only need 10,000 points to qualify for a share of 10M $LVVA).

Q: What’s the liquidity bootstrapping campaign all about? How can users benefit from the current Beta?

Alex: Well, this is your chance to be early without taking market risk. We've given out over 2M $LVVA so far if you were an ambassador of through our various campaigns, so now, we want to give 5x that amount during the Beta via our incentive season.

So, from July 29 to Sept. 27, Levva is in “Bootstrapping Mode.”

During this phase:

• Vaults don’t generate yield - they earn points

• Every $1 you deposit = 10 points per day

• Top 1,000 wallets will share 10M $LVVA

• No lockups, no impermanent loss, no slippage

Think of it as a leaderboard season - but instead of playing a game, you just deposit and earn.

- First place gets 1 million $LVVA

- Even wallet #1,000 earns 4,500 tokens

Which is MASSIVE!! Start today at levva.fi - leaderboard is already live!

Q: What are “Smart Vaults” and how do they differ from traditional yield strategies?

Alex: This is the bread and butter of our product.

Smart Vaults are basically plug-and-play strategies built around your risk appetite. You don’t have to pick tokens or research farms. Just choose a vault (Ultra Safe, Safe, Brave, or Degen) and LevvAI will allocate across top protocols like Aave, Pendle, Etherfi, Lido - all automatically. They constantly rebalance, adapt to market conditions, and follow strict risk parameters. Unlike typical vaults, Levva’s are modular, AI-powered, and built for real users, not DeFi pros.

👉 Pick your vault at levva.fi, deposit, and let it work for you - you can earn big out of the 10 million $LVVA rewards!

Q: What is the $LVVA token used for, and how will its utility expand in the future?

Alex: $LVVA is the core of the Levva economy. It powers governance, staking, and the value flywheel.

• 100% of protocol revenue is used for buybacks, staking rewards, and ecosystem incentives

• veLVVA holders get to vote on emissions, strategy weightings, and treasury use

• No VC allocations. Over 90% of supply goes to the community

• Emissions follow a 5-year halving model - like BTC

Over time, holding $LVVA means owning a slice of protocol revenue and yield control.

👉 Earn your stake now via the Beta at levva.fi - you can be the winner of that 1 million $LVVA.

Q: How does the new points and rewards system work?

Alex: Well, it’s simple: if you deposit early, you can earn even more!

• 10 points per $1 per day

• No lockups or yield volatility

• Top 1,000 wallets share 10M $LVVA

• Multipliers via referrals and “Crack the Code” bonus

This is about rewarding early users without exposing them to strategy or market risk.

The more consistent your deposit, the higher you rank. It’s designed for everyone - from small retail to large whales.

Don’t wait! Every day counts: levva.fi. By the way, we’re giving away 10,000 $LVVA to one lucky winner if we reach 40,000 followers on X.

Q: What makes Levva 2.0 different from other AI-powered DeFi platforms? How will the AI Co-Pilot work in practice?

Alex: The truth is, most “AI in DeFi” platforms are dashboards or data tools.

Levva is different. LevvAI actually executes strategies for you. It can:

• Match your risk profile to a strategy

• Allocate across protocols

• Rebalance your portfolio

• Soon: even execute leveraged Pendle farming with a single prompt

Example:

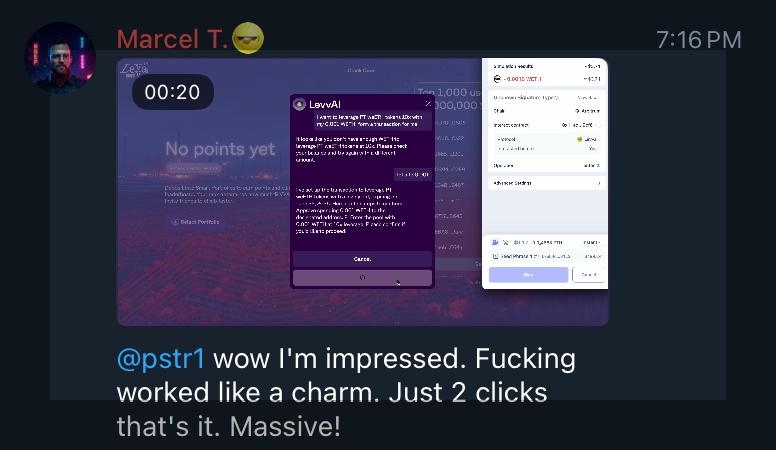

You say, “I want to farm with 10x exposure to PT weETH.”

LevvAI builds the transaction, routes it through Pendle, and executes it - all in one click.

It’s ready! Just look at Marcel's excitement when trying it out for the first time a few days ago!

Try it now in the Beta: levva.fi. Again ,we’re giving away 10,000 $LVVA to one lucky winner if we reach 40,000 followers on X. Like, RT, and follow us - so you can win 10k $LVVA

Q: What happens after the Beta phase? What’s the long-term vision for Levva?

Alex:

After Beta, Smart Vaults will start generating real yield, optimized by LevvAI.

We’ll roll out:

• Staking and veLVVA governance

• Vault strategy expansions across more chains

• Deeper AI portfolio intelligence and auto-rebalancing

• A fully automated, AI-managed DeFi experience

Our end goal?

A personalized, onchain wealth engine anyone can use - from first-time crypto users to DeFi veterans. Levva becomes the AI layer that runs your portfolio in the background - you just set the risk, and it grows.

👉 Don’t miss the early phase. Join the Beta now at levva.fi and don't forget that there's 10 MILLION $LVVA in rewards on the line

Free-Ask from the KuCoin Community to Levva Protocol Token

Q: What’s a bold prediction you have for your project in the crypto ecosystem by 2030, and what steps are you taking now to get there?

Marcel: By 2030, we believe DeFi will run silently in the background of mainstream finance — and Levva will be the AI layer managing it.

Think of Levva as the “Autopilot for Crypto Portfolios.” Most people won’t even know it’s DeFi under the hood — they’ll just know it works.

We're starting now by removing friction:

• One-click Smart Vaults

• AI that understands risk preferences

• Simple, secure UX anyone can use

Tomorrow’s users won’t “do DeFi.” They'll use Levva.

Q: How can participating users maximize their rewards in the Levva 2.0 Beta Bootstrapping campaign that would commence tomorrow?

Marcel: Sure, let me respond. It's actually easy:

• Deposit early — the earlier, the more points

• Stay in — 10 points per $1 per day

• Refer friends — earn 10% of their points

• Reach 10K+ points — leaderboard cutoff for $LVVA rewards

• Climb to the top — 1st place gets 1,000,000 $LVVA

Zero risk. No lockups. Just passive rewards.

Go to levva.fi, connect, deposit, and start earning.

Q: Can you list 1-3 killer features of your project that make it ahead of his competitors ? What is the competitive advantage your platform has that you feel most confident about?

Marcel: Sure! AI Portfolio Co-Pilot — LevvAI picks and manages your vault strategy based on your goals and risk profile

Smart Vaults — Automated, real yield strategies with zero complexity

Real Revenue Loop — Protocol fees go to buybacks, stakers, and veLVVA holders

It’s simple, smart, and sustainable.

Levva 2.0 Beta has just opened. Get in early as over 100,000 people signed up on our email list and you can qualify with just 10,000 points for a share of the 10M $LVVA rewards. We’re also giving away 10,000 $LVVA to one lucky winner if we reach 40,000 followers on X!

Q: How does LevvAI select and rebalance DeFi strategies across protocols like Pendle and Aave? What AI models ensure adaptability to market volatility, and how is transparency maintained? Also, with $LVVA’s 90% community allocation and 750M token minting over four years, how will you incentivize long-term holders and manage inflation?

Marcel: Great question! LevvAI monitors strategy performance and risk across Aave, Pendle, Etherfi, and others. It uses a combination of onchain analytics, heuristics, and basic ML logic to match users to strategies. It’s not just reacting to price — it’s balancing volatility, protocol risk, and user preferences. Transparency is key: all vault allocations are onchain and auditable.

For $LVVA:

• 80%+ of tokens are to the community

• Emissions follow a 5-year halving schedule

• veLVVA locks align long-term holders

• Protocol revenue = buybacks, burns, and staking rewards

👉 Stake your claim by joining Levva 2.0 Beta now at levva.fi - 10M $LVVA await!

Q: As someone new to Levva, I’m curious how you plan to build a strong, lasting user base. Many projects rely heavily on token rewards at first, but what’s your actual strategy to keep users engaged once the hype fades and the airdrop phase ends? What real value will keep people coming back long term?

Marcel: Good question. Many protocols rely on temporary yield — we don’t.

We’re building an actual product people use:

• LevvAI removes stress and complexity

• Vaults deliver real yield from blue-chip strategies

• The experience is as simple as opening a banking app

Once users see how effortless it is to earn yield without chasing coins or farming manually, they’ll stay — because Levva saves time and makes money.

👉 Try it during the Beta. No risk. Just results. Right now at levva.fi for a chance to earn up to 10M $LVVA in rewards

Again, we’re giving away 10,000 $LVVA to one lucky winner if we reach 40,000 followers on X!

Q: With $LVVA now live on KuCoin after the Open Custody merger, how will Levva use KuCoin’s reach to grow veLVVA governance, AI Copilot adoption, and vault rewards across global markets?

Marcel: KuCoin is a key piece of our ecosystem — we’re already seeing new users join through these AMAs and the Spot Market & Spotlight programs.

We’re planning:

• Co-marketing pushes

• Trading events

• Potential integrations with KuCoin Earn

👉 KuCoin users can deposit to Levva Vaults starting today. Don’t miss it - join in now at levva.fi.

Q: What were the main limitations or challenges in Levva 1.0 that you’ve addressed in Levva 2.0? What major improvements can early users expect in this new version?

Marcel: Levva 1.0 was infrastructure — isolated lending pools and manual yield routing. It worked, but required effort.

Levva 2.0 = full automation:

• AI handles strategy selection and rebalancing

• Vaults auto-deploy to Aave, Pendle, Etherfi

• UX redesigned for clarity and simplicity

• Points system for bootstrapping, not speculation

Less complexity, more results.

Levva 2.0 Beta is live - come see the difference at www.levva.fi

And don’t forget about the 10,000 $LVVA to one lucky winner if we reach 40,000 followers on X! RT, like, and follow us now.

Q: I read about the Levva Protocol's roadmap, and for the sake of curiosity, can you elaborate on what steps will be taken to transition to decentralized governance by Q4 2025?

Marcel: We’re rolling out veLVVA-based governance via Snapshot. Later, veLVVA holders will control:

• Emissions

• Treasury use

• Buybacks and burns

• Vault additions and strategy updates

Levva becomes community-owned — not just community-rewarded.

The first Snapshot vote launches post-Beta.

Stake. Vote. Shape the protocol. Start with the Beta. Levva.fi is now accepting deposits! Let’s smash it!

Q: What strategies are in place to attract non-crypto native users to Levva 2.0? Could we see integrations with fintech apps or centralized exchanges?

Marcel: Our edge is simplicity:

• AI does the work

• No dashboards, no jargon

• Mobile-first, clean UX

We’re exploring:

• Integrations with wallets like Trust, Coinbase, SafePal

• Partnerships with on/off ramps and fintech interfaces

• User flows that onboard without DeFi knowledge

Levva feels like a fintech app. But it’s powered by real DeFi under the hood.

👉 Try it now. Deposit once. Let AI grow your crypto.

RT, like, and follow us now to win 10,000 $LVVA if we reach 40,000 followers on X! RT, like, and follow us now.

Q: Can LVVA be integrated into KuCoin’s earn features like KuCoin Earn, or participate in trading competitions soon?

Marcel: We’re actively exploring these options with KuCoin. Earning integrations and campaigns are definitely on the table. We’d love to see $LVVA in flexible savings, trading battles, and more.

In the meantime, the best way to earn $LVVA is to join the Beta and climb the leaderboard.

Head to levva.fi - deposits are now open. Join our Telegram, and follow us on X.

Q: What role does the community play in the evolution of vault strategies? Will there be DAO voting on strategy proposals?

Marcel: Yes! The community will play a key role. Vault strategy weights and emissions will be governed by veLVVA votes starting post-Beta. Anyone holding and locking $LVVA can vote on proposals, allocations, and future strategy deployments.

Q: What is the income model of Levva Protocol Token (LVVA)? Many projects like to talk about "long-term vision and mission," but what are your short-term goals? What are you focusing on right now?

Marcel: Levva earns revenue from real DeFi activity—borrowers pay interest, and we deploy idle funds into protocols like Pendle and Aave for yield. That income flows back to the protocol and $LVVA holders.

Short-term focus:

- Scale Smart Vault deposits during Beta

- Launch veLVVA staking

- Kick off onchain governance

- Educate users on our point system and AI vaults

We're building real utility first—rewards, automation, and control. Not just promises.

Q: How will Levva ensure real-world adoption of its AI tools, and not just rely on blockchain hype?

Marcel: We’re focused on usability, not hype. Levva AI is built for real people, not just DeFi pros.

- One-click portfolios for different risk levels

- Plain-language prompts instead of complex dashboards

- No trading, no farming spreadsheets — just deposit and earn

Levva 2.0 is already live at www.levva.fi. Try it, no guesswork needed.

Q: What are the specific requirements for participation in the Levva 2.0 Beta Bootstrapping event? Is there a minimum deposit amount, and how does one get started?

Marcel: Getting started with Levva 2.0 Beta is simple:

- No KYC, no signup needed — just connect your wallet at www.levva.fi

- No minimum deposit — but to climb the leaderboard, larger deposits earn more points

- Top 1,000 wallets will share 10M $LVVA in rewards

- You earn 10 points per $1 per day during the 60-day Beta

- Boost rewards with referrals and bonus campaigns like Crack the Code

It’s live now — connect, deposit, and start farming points.

Q: What are the specific requirements for participation in the Levva 2.0 Beta Bootstrapping event? Is there a minimum deposit amount, and how does one get started?

Marcel: Levva 2.0 is a huge UX upgrade:

- One-click investing with Smart Vaults — no need to pick protocols or strategies.

- AI Co-Pilot (LevvAI) handles everything: allocation, rebalancing, strategy selection

- Risk-based vaults (Ultra-Safe to Degen) make it easy to choose what fits your profile

- No manual swaps, bridging, or strategy setup — just deposit and earn

- Full integration with protocols like Aave, Pendle, Etherfi, and more

- Clean UI, clearer rewards, and a smooth onboarding flow

Bottom line: no more

Q: How will Levva 2.0 improve the user experience compared to the current version?

Marcel: Levva 2.0 is a huge UX upgrade:

- One-click investing with Smart Vaults — no need to pick protocols or strategies

- AI Co-Pilot (LevvAI) handles everything: allocation, rebalancing, strategy selection

- Risk-based vaults (Ultra-Safe to Degen) make it easy to choose what fits your profile

- No manual swaps, bridging, or strategy setup — just deposit and earn

- Full integration with protocols like Aave, Pendle, Etherfi, and more

- Clean UI, clearer rewards, and a smooth onboarding flow

Bottom line: no more

Q: Do you have any Coin Burn / BuyBack systems or any Token Burn plans to increase the value of Token & attract Investors to invest?

Marcel: Yes — Levva 2.0 has a sustainable buyback and burn flywheel built into the protocol.

Here’s how it works:

- All protocol revenue (fees from vaults, lending markets, etc.) is used to buy back $LVVA

- Those tokens are either burned or redirected to veLVVA stakers

- No treasury hoarding, no hidden team wallets — it’s all transparent and community-directed

- veLVVA holders vote on how to use revenue: burn, distribute, or reinvest.

This creates constant demand for $LVVA, aligned with actual usage and real yield — not hype.

📍 Join now: levva.fi! Get in early, farm points, and be part of the next era of AI x DeFi.

Q: What’s the boldest thing Levva is building that no one sees coming?

Marcel: Great question! The boldest thing we’re building — and most people still underestimate — is:

LevvAI as your onchain portfolio co-pilot. Not a chatbot. Not a dashboard. A real AI agent that:

- Picks the right strategy based on your goals and risk appetite

- Allocates across DeFi protocols like Pendle, Aave, EtherFi, and more

- Executes multi-step transactions (like leveraged PT farming) for you

- Monitors performance and rebalances automatically

All with 1 prompt. It’s like having a personal DeFi quant, strategist, and execution bot — but way easier to use. Most platforms give you tools. Levva gives you a brain. We think this will change how people use DeFi — forever.

🚀 Try it now (Beta is live): levva.fi

Earn points, climb the leaderboard, and farm your share of 10M $LVVA.

Q: Partnership is always an important factor for every project. So who is the project?

Marcel: Partnerships are a huge part of Levva’s go-to-market. We’ve built Levva 2.0 on top of the most trusted protocols in DeFi:

- Pendle – for fixed and leveraged yield farming

- Aave, Morpho, MakerDAO – for lending, borrowing, and risk-managed strategies

- EtherFi, Lido – for LST and LRT integrations

- Warden Protocol – for AI agent interoperability and broader agentic infra

We’re also working with major wallets, aggregators, and DAO ecosystems to bring Levva to more users fast.

Levva is not just a protocol — it’s a platform built to connect the best of DeFi, automate it, and make it simple.

Explore our launch: levva.fi. Bootstrapping Beta is live. Points, rewards, and early access to 10M $LVVA.

Q: What happens if someone earns 10,000 points but is not among the top 1,000 wallets, despite having qualified for 10,000 points, does that mean there is no reward for that person?

Marcel: Correct! Only the top 1,000 wallets on the leaderboard will earn a share of the 10M $LVVA reward pool.

That means hitting 10,000 points is just the minimum to qualify, but your rank matters most. If you're outside the top 1,000, you won’t earn $LVVA rewards.

Tip:

- Deposit early

- Hold for longer

- Use referrals to boost your points

- Play Crack the Code for bonus rewards

Start now at levva.fi and climb that leaderboard.

Q: What is your strongest advantage that you think will make your team leading the market?

Marcel: Levva’s strongest advantage?

- AI-powered simplicity.

- Most DeFi platforms still expect users to

- Pick strategies manually

- Manage risk on their own

- Understand complex protocols like Pendle, Aave, etc.

Levva changes that. You connect your wallet, pick your risk level, and our AI (LevvAI) builds and manages your portfolio for you.

Why we lead:

- Built on battle-tested DeFi protocols

- Smart Vaults with real automation

- Community-first tokenomics (no VC games)

- Fully onchain, permissionless, transparent

Levva makes DeFi work for everyone — not just the pros.

Try the Beta now: levva.fi

Q: What is the main strategy that you think will boost your project's success for the long term vs high fluctuation market? In which core value that you think you could convince us (as investors) to put our investment into your project?

Marcel: Great question.

Levva's long-term strategy is simple: automate everything, manage risk, and give users peace of mind.

In a volatile market, most users either: do nothing and miss out on yield or get wrecked chasing hype.

Levva fixes both problems by using AI to: dynamically allocate capital across trusted protocols like Aave and Pendle, adjust strategies based on real-time data (volatility, liquidity, utilization), while letting users define their risk appetite, not pick individual farms or tokens

Our core value:

“We don’t want users to ‘do DeFi.’

We want them to benefit from DeFi.”

That means no complex interfaces, no guesswork — just a simple vault, a smart AI agent, and sustainable, transparent rewards.

And $LVVA? It captures the value of the entire system — buybacks, staking rewards, governance — all go to the community.

Join Levva 2.0 Beta now!

Q: Is your LVVA platform suitable for crypto beginners? Or is it only limited for professional users?

Marcel: Absolutely beginner-friendly.

Levva 2.0 was built for users who don’t want to spend hours learning DeFi.

Here’s how it works: no trading, no technical setup, and no complex interfaces

You connect your wallet, tell our AI your risk level (Ultra-Safe to Degen), and deposit with one click. Levva takes care of everything else — picking the best protocols, optimizing the strategy, managing risk.

If you’re new, use our Ultra-Safe vaults (think Aave-level security). If you’re advanced, you can explore leveraged Pendle strategies — also automated.

So whether you're holding stablecoins or ETH, Levva makes your assets work harder for you without needing to be a DeFi expert.

Start today at levva.fi and let the AI do the hard work.

KuCoin Post AMA Activity — Levva Protocol Token

🎁 Participate in the Levva Protocol Token AMA quiz now for a chance to win 5,000 LVVA.

The form will remain open for five days from publishing this AMA recap

Levva Protocol Token AMA - LVVA Giveaway Section

KuCoin and Levva Protocol Token have prepared a total of 961,076 LVVA to give away to AMA participants.

1. Pre-AMA activity: 400,000 LVVA

2. Free-ask section (Main group): 25,100 LVVA

3. Free-ask section (Other groups): 50,000 LVVA

3. Flash mini-game: 185,976 LVVA

4. Post-AMA quiz: 300,000 LVVA

Sign up for a KuCoin account if you haven’t done so yet, and ensure you complete your KYC verification to be eligible for the rewards.