KCV Weekly Report 0630-0706

2025/07/07 08:55:05

KuCoin Ventures Weekly Report: A Three-Front Market Battle: How Macro Easing Is Dividing the Market, RWA's Hype Meets Reality, and a New Guard Challenges the Old in Memes

1. Weekly Market Highlights

Amidst a Clearer Regulatory Landscape, CEXs Launch Stock Tokens as TradFi Embraces Crypto and Giants Pursue Compliance

Last week, the convergence of the crypto world and traditional finance took a significant step forward. Platforms like Robinhood, Kraken, and Bybit almost simultaneously launched US stock tokenization services, bringing mainstream stocks and ETFs to the crypto market. Notably, Robinhood plans to offer users access to tokenized equity in top-tier private companies like SpaceX and OpenAI, aiming to break down the investment barriers of the traditional primary market.

But this is far from the whole story. Listing new assets is merely the prelude to Robinhood's ambitious vision. Its ultimate goal is to leverage blockchain technology to revolutionize the underlying infrastructure of global asset trading. To this end, Robinhood has adopted a phased regional strategy: spearheading its tokenization strategy in Europe—where the regulatory environment is clearer—by launching tokenized trading for over 200 US stocks, perpetual contracts, and an all-in-one investment platform. Meanwhile, on its home turf in the US, the focus is on deepening services and consolidating its core user base by introducing features like crypto staking, an AI investment assistant, and advanced trading tools. All these initiatives will eventually converge into the Robinhood Chain, a public blockchain being built on Arbitrum (with plans for a native chain in the future), dedicated to bringing RWAs like stocks, derivatives, and private equity onto the blockchain.

However, a deeper dive into its product structure reveals a gap between vision and reality. According to official documents, the product Robinhood launched in Europe is not the stock itself, but an Over-the-Counter (OTC) contract named “US Stock Derivatives.” The core design of this official product is that all transactions are completed within the Robinhood platform. The user's sole counterparty is Robinhood Europe, and the assets cannot currently be freely transferred on-chain or withdrawn to other platforms. This represents a compliant attempt to "wrap" exposure to traditional assets for crypto users.

Adding a dramatic twist, just as the market was digesting this OTC derivative model, on-chain observers discovered that a wallet address associated with Robinhood's official press conference had deployed a series of tokens on-chain, including two named “O” and “S.” On July 6th, when a liquidity pool for the “S” token was created on Arbitrum's Uniswap, market sentiment ignited. Some investors speculated that “O” and “S” represented the private equity of OpenAI and SpaceX, respectively, triggering immediate trading of the “S” token. Its price was once driven up to $415 before gradually falling back to fluctuate around $230. As of now, Robinhood has not officially confirmed any connection between these on-chain tokens and its future products. In this information vacuum, the market has entered a phase of pure speculation and game theory.

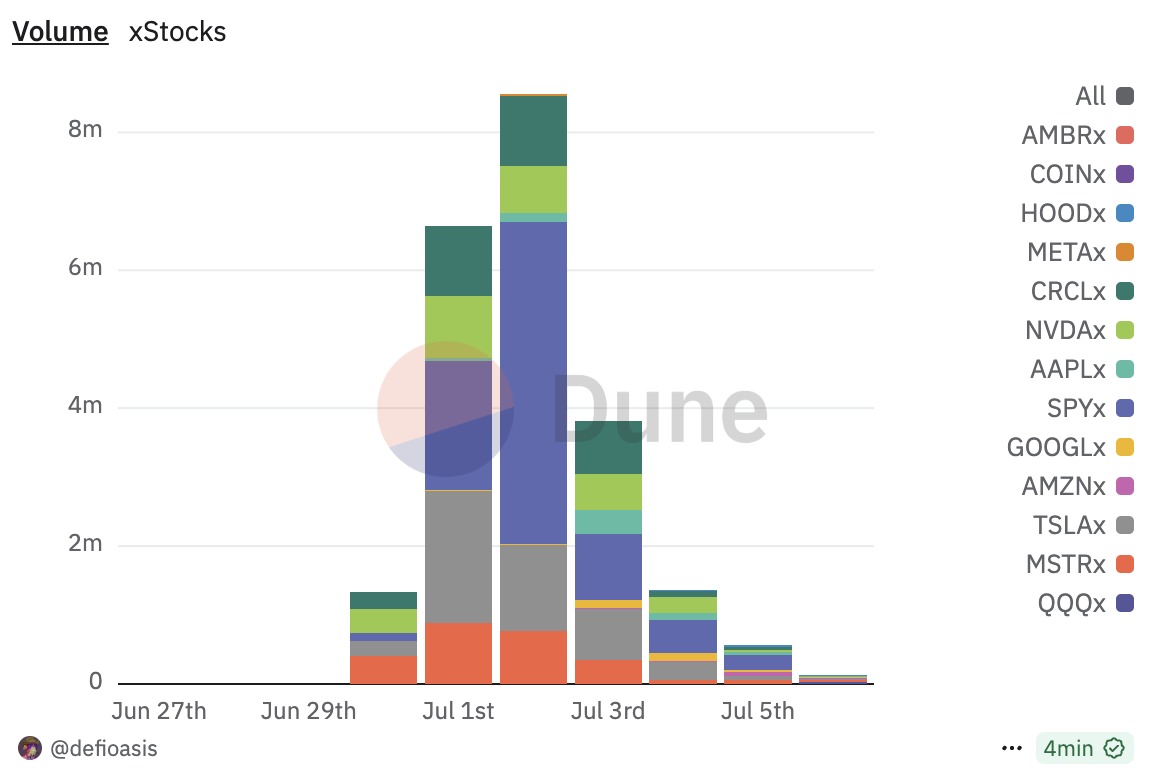

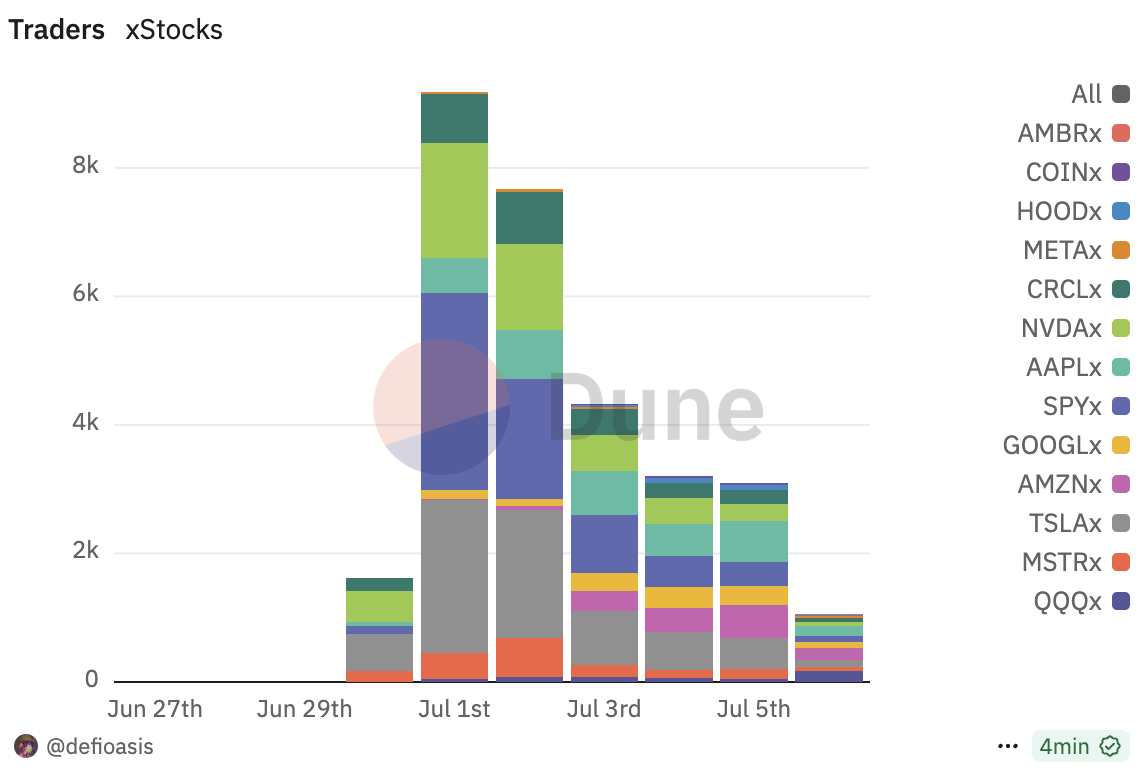

In contrast to the complexity of Robinhood's model, the xStocks tokens issued by the Swiss asset tokenization platform Backed Finance are already trading 24/7 on several CEXs and on-chain DEXs. According to on-chain data, trading volume is primarily concentrated in top tech stocks and major US stock indices. Although its technical approach is more native, as an emerging asset, its insufficient on-chain liquidity leads to a suboptimal user experience, with price charts frequently showing sharp volatility and “wicks,” highlighting the same gap between vision and reality.

Data source: DuneAnalytics

While accelerating product innovation, leading crypto firms are also making significant strides on the path to compliance. On July 2nd, Ripple announced it had applied for a federal bank charter from the US Office of the Comptroller of the Currency (OCC). Simultaneously, its regulated custody subsidiary in New York is also actively applying for a Fed Master Account, aiming to directly hold the reserves backing its stablecoin, RLUSD. Against the backdrop of increasingly clear global regulatory frameworks, crypto giants are proactively embracing the compliance systems of traditional finance.

Considering recent market dynamics, a "dual narrative" of convergence is becoming increasingly clear. On one hand, traditional assets like stocks and ETFs are actively "crossing over" into the crypto market to find new liquidity and growth scenarios. On the other hand, crypto-native forces are accelerating their "compliance push," proactively integrating into the infrastructure and regulatory frameworks of mainstream finance. A new, deeply integrated, and mutually empowering financial paradigm is rapidly taking shape.

2. Weekly Selected Market Signals

Intensifying Political Maneuvering and Fiscal Dominance Boost Markets in the Short Term

The $3.3 trillion "One Big Beautiful Bill Act" was signed into law by President Trump on July 4th. This move triggered a sharp public disagreement with Elon Musk, who officially announced the formation of the "America Party" on July 5th, targeting key seats in the 2026 midterm elections. The announcement is a direct challenge to Trump's authority within the Republican party and signals the definitive end of their political alliance. Musk revealed the new party will initially focus on 2-3 Senate seats and 8-10 House districts, aiming to become a pivotal force in congressional decision-making.

Of greater significance for the market is Trump's continued pressure on the Federal Reserve to cut interest rates to service the financing needs of this fiscal expansion (i.e., lower deficit financing costs). This "Fiscal Dominance" model, where monetary policy serves fiscal objectives, acts as a powerful short-term economic stimulus and is the core driver behind the current all-time highs in the stock market. Historically, however, this model is often associated with weaker central banks in emerging markets like Argentina, with long-term risks of leading to a combination of an inflationary crisis and economic stagnation.

Market Divergence Widens: BTC is Institution-Driven while Altcoin Recovery Signals Remain Pending

Under the expectation of strong fiscal stimulus, global risk assets have performed robustly, with US stocks reaching new highs and the DXY falling to a three-year low. The crypto market has broadly followed suit, with BTC's price remaining firm and approaching its all-time high. However, a significant divergence has emerged: the altcoin market, led by ETH, has shown weakness, with prices down nearly 40% from their peaks. This is corroborated by trading data: in June 2025, spot trading volume on centralized exchanges dropped to $1.07 trillion, a ~27% decrease from May's $1.47 trillion, marking a nine-month low.

Data Source: Trading View

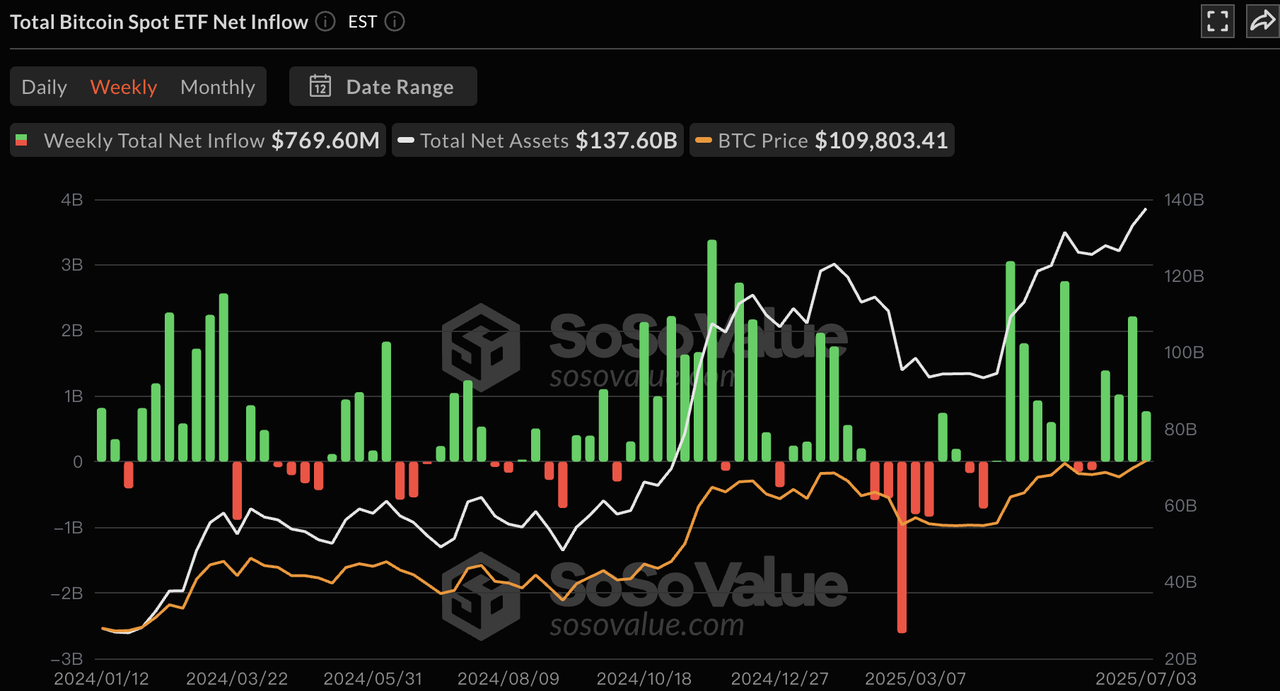

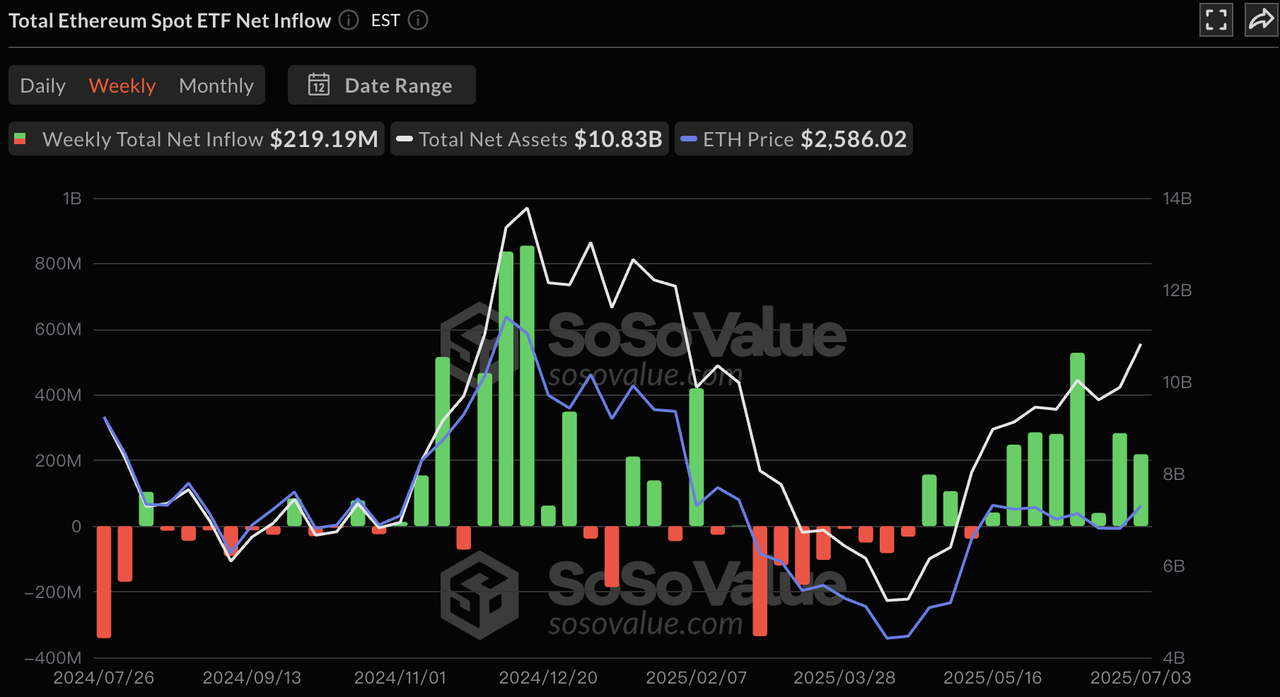

Market momentum is increasingly institution-driven. BTC ETFs have recorded four consecutive weeks of net inflows, with $769 million last week, indicating that institutional capital is the primary market driver. In contrast, retail participation in altcoins is notably lacking. Although ETH ETFs have seen eight consecutive weeks of net inflows, on-chain data has not recovered in tandem. Ethereum's network transfer volume and active addresses remain low, suggesting that user engagement and transaction demand are still subdued.

Data Source: SosoValue

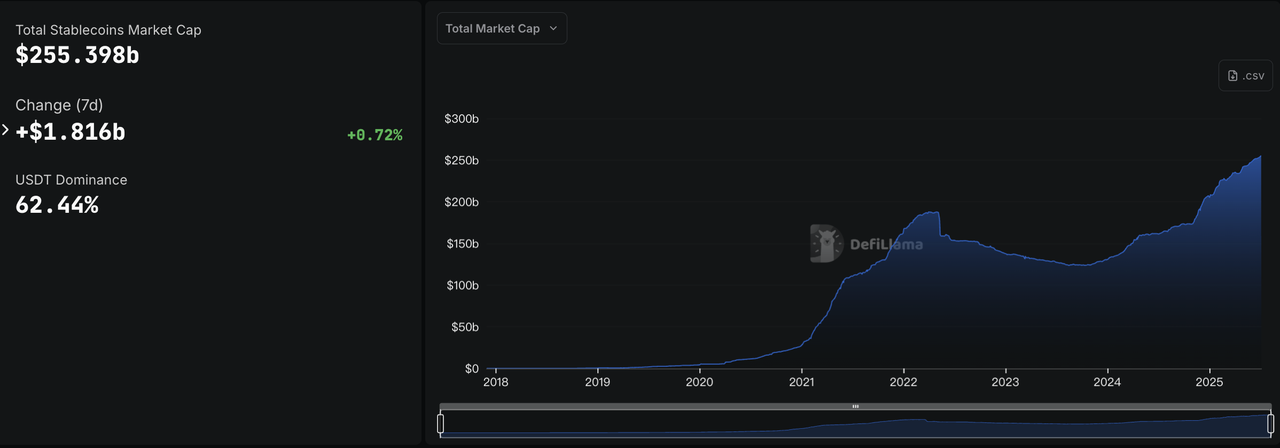

The total stablecoin supply grew by 0.72% (~$1.816 billion) over the past seven days, with all top stablecoins showing growth. Notably, with MakerDAO's official upgrade to Sky Protocol, DAI is gradually transitioning to USDS. Overall, a full recovery of the altcoin market hinges on the return of retail participation and a fundamental restoration of market liquidity.

Data Source: DeFiLlama

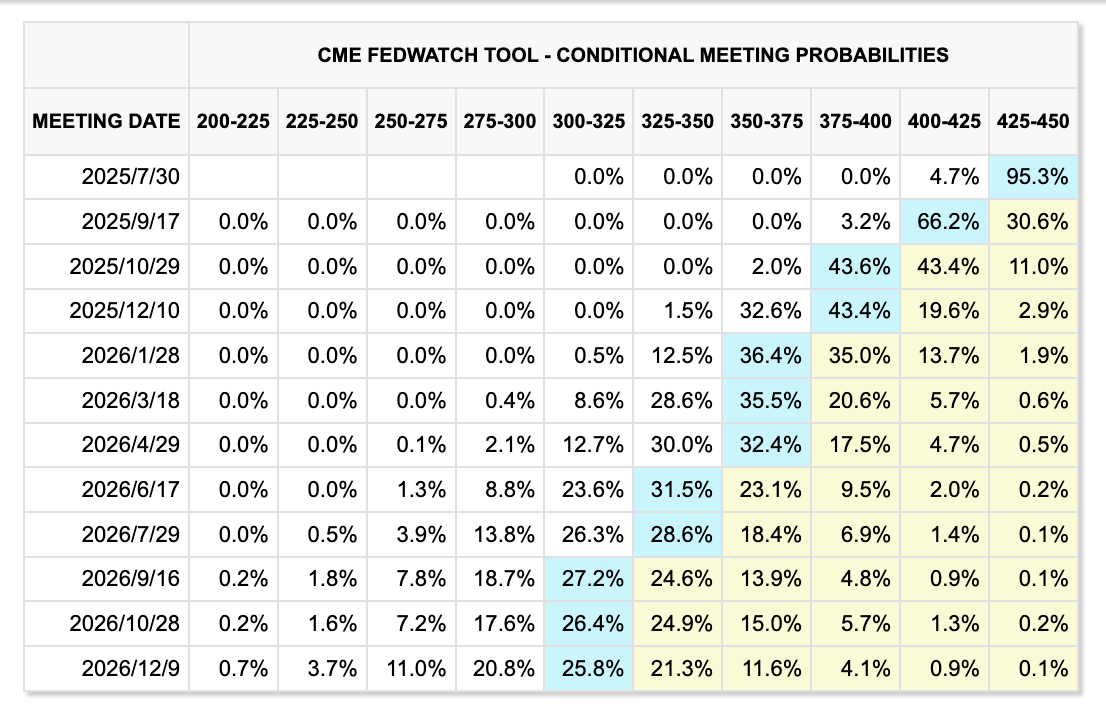

According to the FED Watch Tool, the market currently sees a less than 5% chance of a rate cut in July, but the probability for a September cut remains high at ~66%, with expectations for a total of 50 basis points in cuts for the year holding firm.

Data Source: FED Watch Tool

Key Macro Events to Watch This Week:

-

July 9: China's June CPI/PPI and July Total Social Financing data.

-

July 9: US "Reciprocal Tariffs" deadline. The Trump administration has stated it will issue notices of new tariff rates (ranging from 10% to 70%) to countries without a trade deal, with plans for implementation starting August 1st.

-

July 10: The Federal Reserve will release its monetary policy meeting minutes.

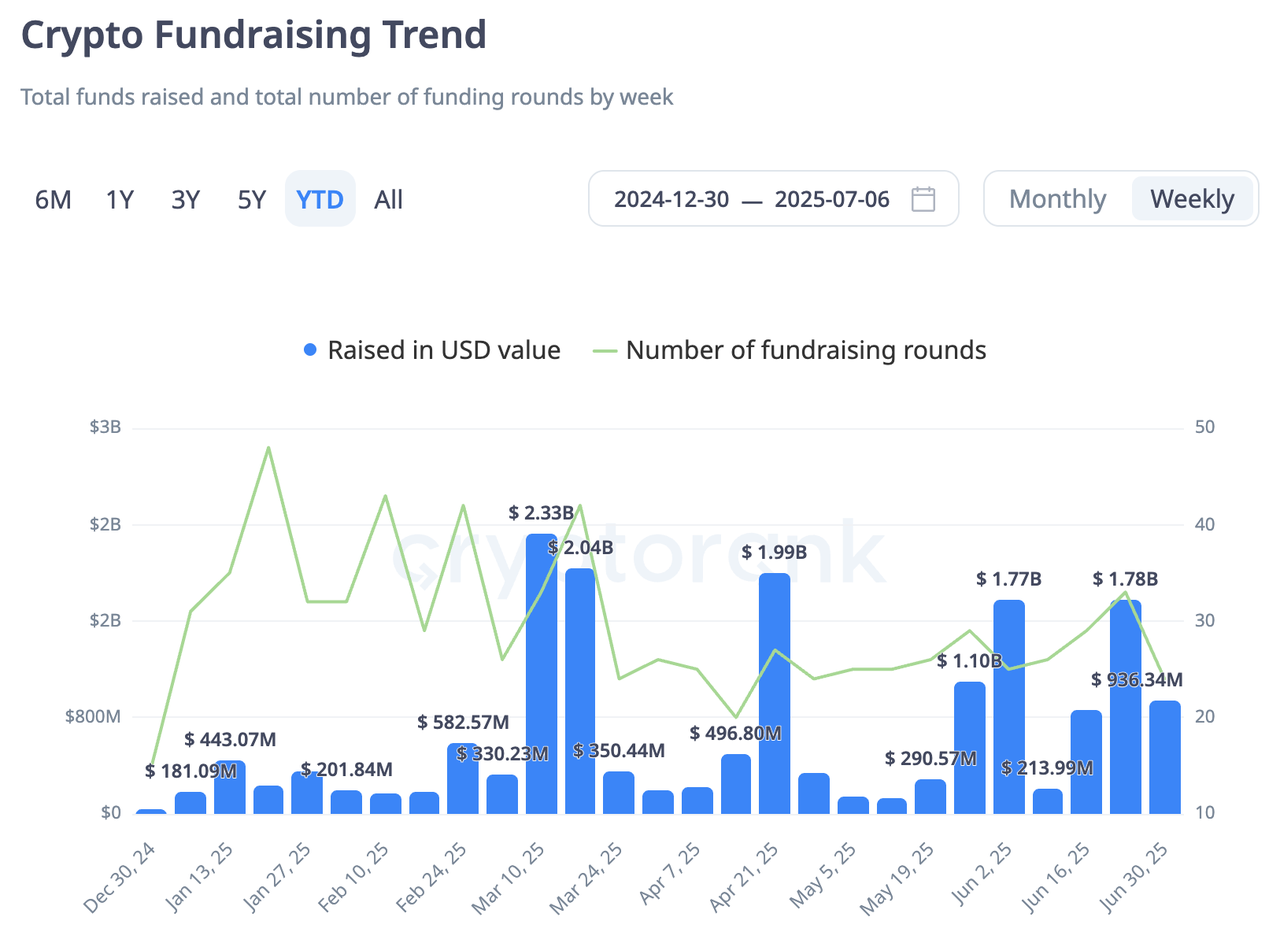

Primary Market Financing Observations

Last week, total primary market fundraising reached $936 million. The largest single deal was a $162.9 million Post-IPO financing round by Nasdaq-listed mining company Bit Digital (BTBT). The company stated it will use the proceeds to purchase ETH and fund its complete transition from BTC mining to ETH staking services. This move reflects a strategic pivot by miners seeking new growth avenues in the post-halving era. Following the announcement of its secondary offering, which is becoming a popular market trend, the company's stock rose by approximately 11%. Additionally, AllScale, a new crypto bank and stablecoin cross-border settlement provider, announced a $1.5M financing round with participation from KuCoin Ventures and Amber Group.

Data Source: cryptorank

Prediction Markets Heat Up with Limitless Gaining Traction

Driven by the launch of the FIFA Club World Cup, the approaching 2026 FIFA World Cup, and sustained interest in geopolitical topics, the prediction markets sector is experiencing a significant surge in popularity. On July 1st, Limitless announced a $4 million strategic funding round with participation from Coinbase Ventures and 1confirmation, and welcomed Arthur Hayes as an advisor.

Limitless's core product involves binary predictions on the short-term price movements of major assets like BTC and ETH, allowing users to bet on their performance over minutes, hours, or a day. As the largest prediction market on the Base ecosystem, its contract betting volume has already exceeded $270 million. In preparation for its upcoming TGE, the team launched a points program on July 1st, rewarding users for product usage, liquidity provision, and referrals. This positions Limitless to potentially become the first major prediction market platform to launch a token and airdrop to its early users.

Coinbase Acquires Liquifi to Build an End-to-End Service Ecosystem

Coinbase announced the acquisition of token management platform Liquifi, its fourth acquisition of 2025. This follows recent deals for on-chain advertising platform Spindl, the core team of Iron Fish, and the landmark $2.9 billion acquisition of derivatives exchange Deribit.

Often described as "Carta for crypto," Liquifi provides token distribution, vesting management, and ownership tracking services for project teams. It previously raised a $5 million seed round led by Dragonfly with participation from Y Combinator and Coinbase Ventures, serving clients like Uniswap Foundation, OP Labs, and Zora.

This acquisition will complete Coinbase's end-to-end service capabilities, from token creation to public trading, allowing it to capture value earlier in the token lifecycle and better compete with rivals like Binance. This series of acquisitions also reflects a broader strategy by leading institutions to expand their service ecosystems through strategic M&A amidst a clarifying US regulatory environment.

3. Project Spotlight

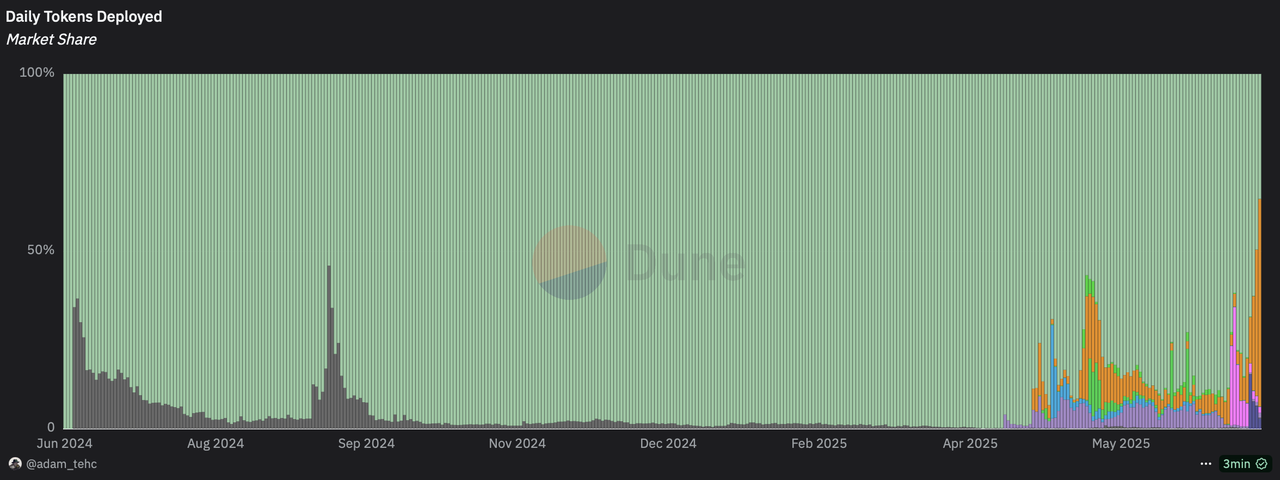

Pump Fun's Strongest Challenger: LetsBONK Captures Over 50% of Solana Memecoins Launchpad Market Share

On July 6, 2025, driven by the USELESS and Solana OG meme BONK communities, LetsBONK captured a 58.5% market share of the Solana Memecoins Launchpad, surpassing Pump Fun’s 35.2%—marking the first time Pump Fun’s daily market share fell below 50%. Despite creating fewer tokens daily than Pump Fun, LetsBONK achieved a higher number of “graduated” tokens successfully launched to DEXs, indicating superior token quality. Over the past seven days, 15 tokens created on Solana reached a market capitalization exceeding $1 million, with 10 originating from LetsBONK. However, LetsBONK still lags significantly behind Pump Fun in active address counts.

Launched in late April 2025 by the established Solana BONK community, LetsBONK peaked on May 12, 2025, with a record-breaking 12,000 daily token creations, though it later experienced a slowdown in June.

The resurgence of LetsBONK was sparked by the success of its memecoin USELESS, which reached a $300 million market cap, making it one of the top-performing memecoins in recent months. Unlike other tokens that rapidly hit high valuations, USELESS grew steadily from a $30 million market cap in mid-June, offering ample entry opportunities for investors. Its “useless” branding resonates as a satirical nod to memecoin culture, drawing significant attention to LetsBONK. The key figure behind this momentum is Unipcs, a prominent BONK community member.

Similar to influential figures like Ansem for WIF or Muard for SPX, Unipcs, self-styled as “BONK GUY,” has been pivotal in promoting USELESS and LetsBONK. Holding 2.8% of USELESS—equating to over $7.5 million in unrealized gains—Unipcs has never sold, reinforcing trust in the project. As a BONK ecosystem advocate, Unipcs leverages his KOL status and transparent wallet address to boost engagement, maintaining an approachable and controversy-free social media presence. Notably, Unipcs actively engages the Chinese-speaking community, earning widespread goodwill through frequent Mandarin-language posts praising meme community participants.

The rapid growth of LetsBONK can, to some extent, be attributed to the current community sentiment surrounding Pump Fun. Pump Fun’s high-valuation token launches and repeated delays have somewhat impacted its reputation within the community. Although Pump Fun has introduced a creator revenue-sharing model, this step followed its accumulation of over $600 million in SOL revenue, and some community members perceive its commitment to the Solana ecosystem as limited, leading to certain reservations among users.

In contrast, LetsBONK’s commitment to the Solana community is clearly reflected in its revenue allocation model. Fifty percent of its revenue is used to buy back and burn BONK, 15% is allocated to purchasing BONKsol to support the security of the Solana network, 7.6% is directed toward acquiring GP for reserves to fund technical operations and development, and 4% is dedicated to SBR to contribute to the broader ecosystem. This thoughtfully designed revenue model has earned LetsBONK widespread support from the Solana community.

While LetsBONK has emerged as a formidable rival to Pump Fun, its ability to sustain user and developer loyalty remains uncertain, especially with dozens of competing Solana memecoin launchpads challenging the market. Additionally, as USELESS continues its upward trajectory, Unipcs’ management of their significant unrealized gains will be critical to monitor.

Tether Launches Stable: A Dedicated Layer 1 Blockchain for USDT Transactions

Stable, introduced by Tether, is a Layer 1 blockchain leveraging USDT and other native stablecoins for network gas fees and settlements. Stable offers EVM compatibility, low-cost and instant settlements, regulatory-compliant confidential transactions for enterprise use, built-in compliance solutions, and integration with debit and credit cards directly tied to USDT for everyday consumer spending and merchant payment terminals (peer-to-peer USDT0 transfers incur no gas fees).

Both Stable and Plasma are integral to Tether’s ecosystem, aimed at enhancing USDT’s on-chain and off-chain use cases. They differ primarily in technical architecture: Stable operates as an independent PoS Layer 1 blockchain, offering broader functionality suitable for DeFi and enterprise applications; Plasma, a Bitcoin sidechain, partially inherits Bitcoin’s mainnet security and aims to drive more transactions to the Bitcoin network through USDT payments. Comparatively, Stable provides more versatile features, while Plasma focuses on fee optimization within the Bitcoin ecosystem, catering to scenarios prioritizing heightened security.

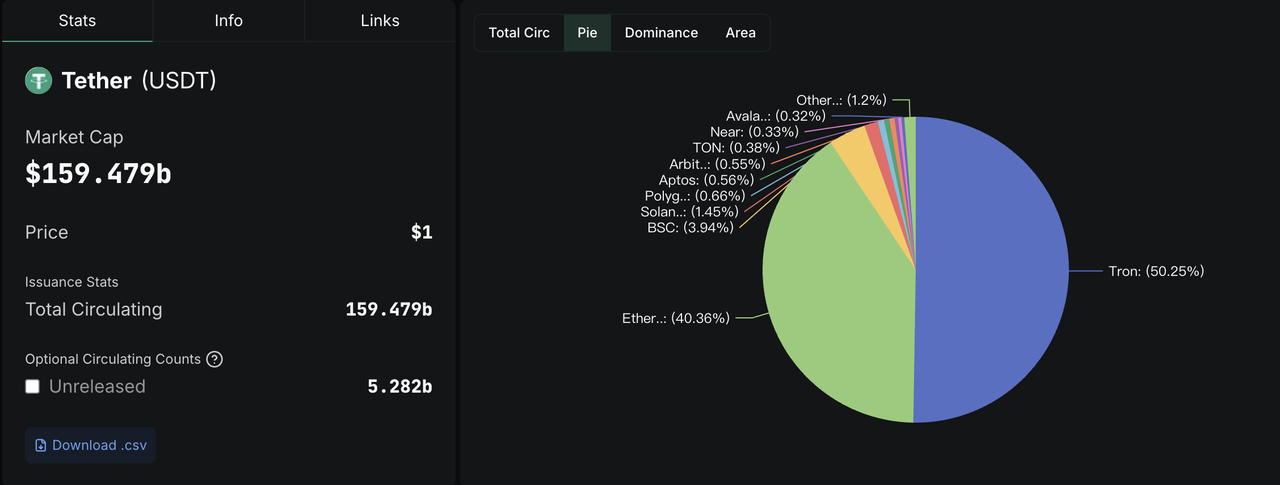

Stable and Plasma are Tether’s strategic responses to enhancing stablecoin transaction efficiency. According to DeFiLlama, USDT’s total supply exceeds $159 billion, with Tron accounting for 50.25% and Ethereum 40.36% of the market share. On Ethereum, USDT is widely used for DeFi activities like trading and lending, while Tron primarily facilitates transfer transactions. The introduction of Stable and Plasma, directly operated by Tether or Bitfinex with stronger institutional backing, may impact Tron’s dominance in routine USDT transfers. However, Tron’s unique “energy” system for gas fees, which operates off-chain and provides a degree of anonymity, has created a niche moat, particularly for illicit activities. ZachXBT has reported that funds linked to the Lazarus Group have been laundered through small-scale OTC brokers on Tron, with estimates suggesting $5–10 billion in “dark pool” USDT on Tron, much of which is untraceable.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer: This content is provided for general informational purposes only, without any representation or warranty of any kind, nor shall it be construed as financial or investment advice. KuCoin Ventures shall not be liable for any errors or omissions, or for any outcomes resulting from the use of this information. Investments in digital assets can be risky.