KuCoin Ventures Weekly Report: MSCI Shelves MSTR Exclusion Proposal & Compliance Concerns; NFP Reshapes Asset Repricing; Analysis of the CEX-TradFi Dual-Track Paths

2026/01/12 11:00:02

1. Weekly Market Highlights

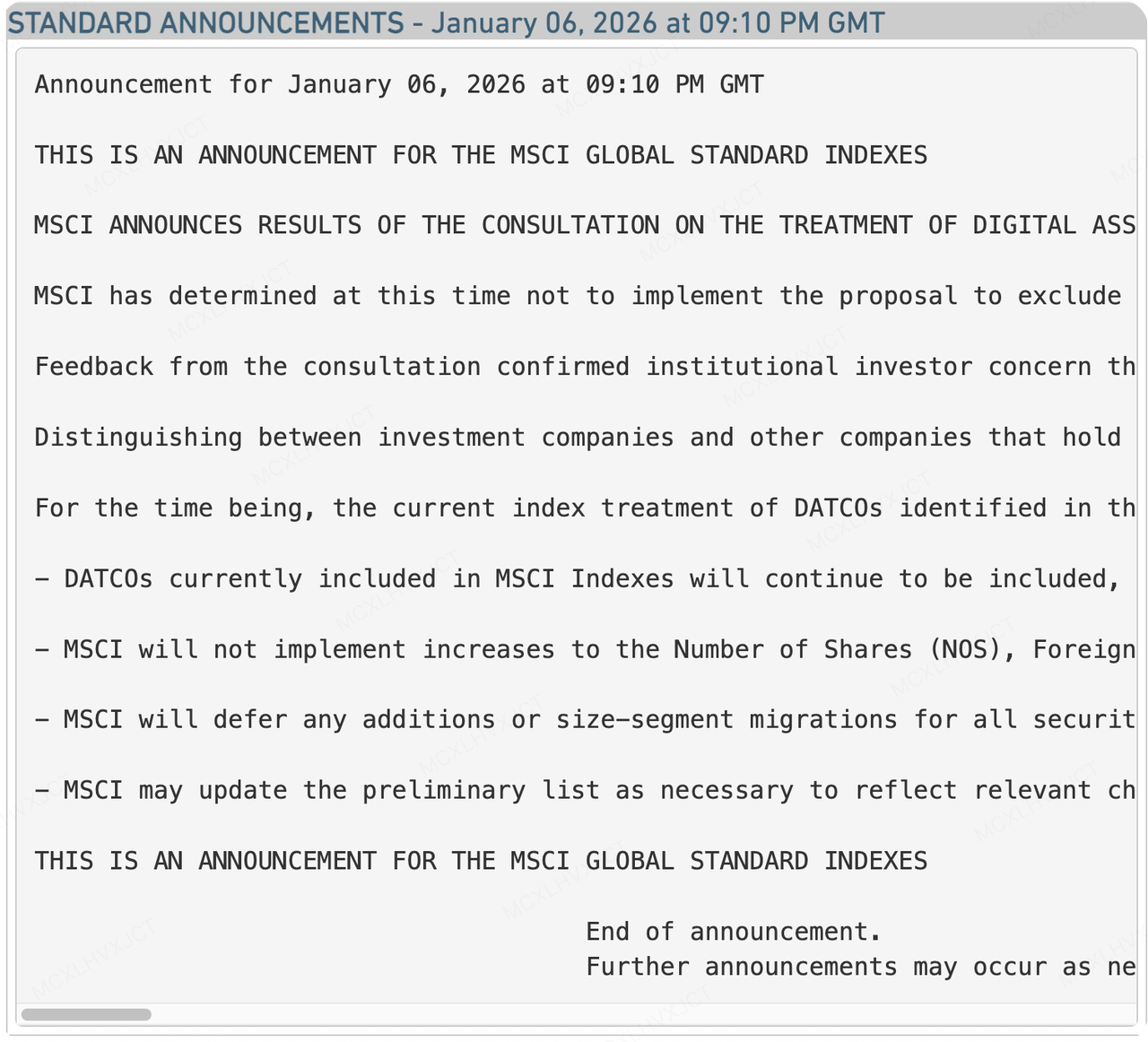

MSCI Shelves Proposal to Exclude MSTR, but the Long-Term Test Is Not Over

Data Source: https://app2.msci.com/webapp/index_ann/DocGet?pub_key=DD3Olh5uInk%3D&lang=en&format=html

Last week, the alarm for the crypto market's most feared "black swan" event—MSCI removing MSTR—was temporarily deactivated. MSCI, the world's most influential index provider, officially announced it would shelve the proposal to exclude "Digital Asset Treasury Companies" (DATCOs) from its global indices. While this appears to be a victory, when viewed alongside MicroStrategy’s (MSTR) simultaneously disclosed financial realities, long-term concerns remain unresolved.

Previously, in October 2025, MSCI proposed that companies with digital asset holdings exceeding 50% of their total assets be classified as non-operating entities (similar to ETFs) and subsequently delisted. The decision to shelve this proposal means Strategy (MSTR) and other companies adopting a Bitcoin treasury strategy have temporarily retained their spots in passive investment indices, averting the forced selling of billions of dollars in passive capital that the market had anticipated. According to MSTR's latest 8-K filing, due to the price correction in Q4 2025, the company recorded a staggering $17.44 billion unrealized loss in a single quarter. Given the severe unrealized losses on its books, the selling pressure from an index exclusion could very well have triggered a liquidity crisis. MSCI’s choice to "defer" the decision likely includes considerations for maintaining market stability.

Why did MSCI choose to grant MSTR a temporary reprieve? This decision is not a full endorsement of the "Bitcoin Treasury Model," but rather a compromise based on operational complexities and market feedback. The main reasons can be summarized in three points:

-

Self-Proof of Active Management: In early January, just as MSCI was about to announce its results, MSTR did not remain passive like a fund. Instead, it continued to raise capital through At-The-Market (ATM) equity offerings and swiftly purchased 1,283 Bitcoins. This high-frequency capital maneuvering, combined with a $2.25 billion USD cash reserve, served as strong evidence that it is an "actively managed operating company" rather than a "passive holding vehicle."

-

The Logic of Classification: MSTR argued that MSCI’s simple "50% asset ratio" threshold was overly mechanical. If Bitcoin prices were to surge, a software company could "passively" transform into a fund solely due to asset appreciation. This would cause frequent additions and deletions of index constituents, resulting in significant tracking errors. In its defense letter to MSCI, MSTR used a compelling analogy: If a company holds massive oil reserves, would you remove it from the index?

-

Lack of Unified Accounting Standards: In its statement, MSCI noted that distinguishing between assets "held for investment" versus those "held as core operating assets" on a global scale requires further research. Current financial statements and accounting standards are insufficient to support such granular, automated screening.

Although MSTR dodged immediate exclusion in February 2026, MSCI's announcement contains hidden caveats, and the path ahead is far from smooth sailing.

The Index Weight "Freeze Order": MSCI explicitly stated that while it will not remove MSTR this time, it will not increase MSTR's Number of Shares (NOS) weight. This move effectively stalls MSTR’s growth flywheel. In the past, under MSTR’s "issue shares to buy Bitcoin" model, passive index funds were required to purchase every new share issued on a pro-rata basis. Now that the weight is locked, passive funds will not absorb any new shares MSTR issues in the future. This directly weakens the momentum for stock price appreciation and increases the difficulty of future financing.

Redefining "Non-Operating Companies": MSCI will launch a broader consultation to redefine "non-operating companies." With current holdings of 673,783 Bitcoins, MSTR is a colossal entity. In the future, MSCI may introduce "revenue sources" or "cash flow structures" as new criteria. If MSTR cannot demonstrate that its software business or other operating cash flows are sufficient to cover debt interest, it still faces the risk of being classified as a "high-risk investment vehicle."

In the days ahead, having lost the "automatic blood transfusion" function of passive capital, MSTR will have to rely more heavily on Bitcoin's market performance, its own operating cash flows, and alternative financing capabilities to pass MSCI's broader upcoming scrutiny of "non-operating companies." The war over the "right of definition" has only just begun.

2. Weekly Selected Market Signals

Re-pricing Assets Amidst Shifted Rate Expectations, Carry Trade Unwinding, and Risk Preference Correction

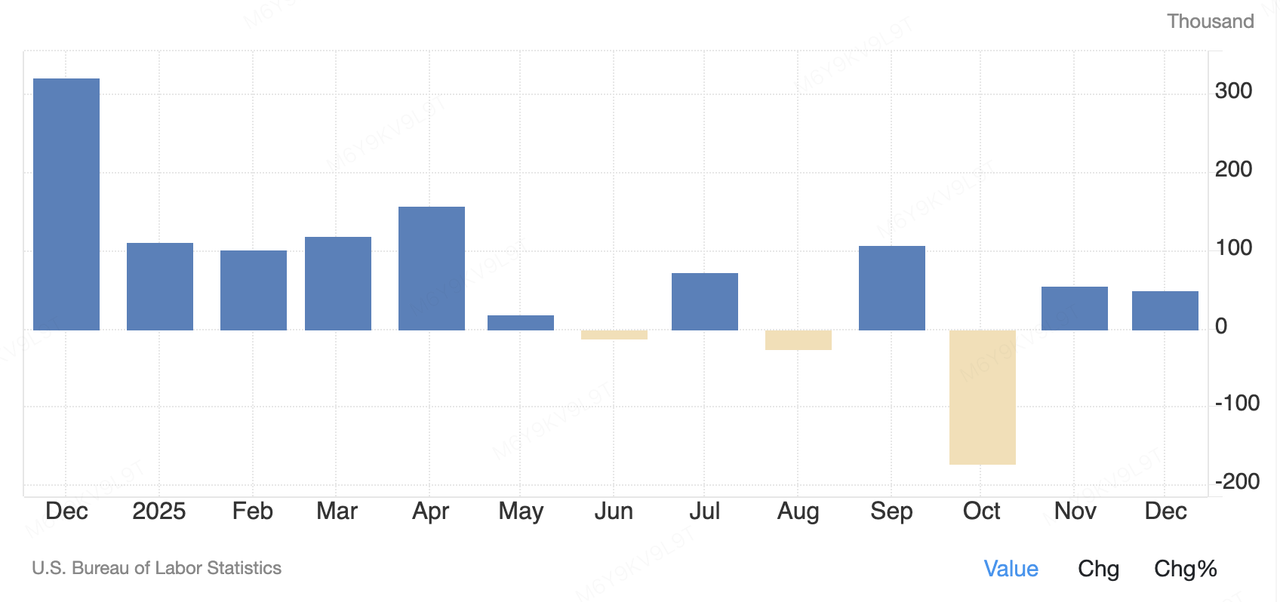

Last week, global risk asset pricing was primarily influenced by two macro themes: one stemming from short-term U.S. data shocks, and the other from medium- to long-term policy signals from the Bank of Japan. On Friday, the U.S. Bureau of Labor Statistics released the December nonfarm payroll report, showing an increase of only around 50,000 jobs—well below the market expectation of approximately 70,000. Meanwhile, the unemployment rate unexpectedly fell to 4.4%, and wage growth remained moderately upward. This combination of “slowing employment growth but no destabilization” continues the trend of a gradually cooling U.S. labor market and weakens market expectations for another rapid rate cut by the Federal Reserve in the short term. Following the data release, the market leaned toward interpreting it as a soft landing rather than a recession signal, with U.S. equity risk appetite largely unaffected.

United States Non Farm Payrolls

Data Source: tradingeconomics.com

In contrast, signals from the Bank of Japan had a more structural impact on global liquidity. In early January, Bank of Japan Governor Kazuo Ueda, in his first public appearance of the year, reiterated that the BOJ would continue its monetary policy normalization as long as inflation and economic performance meet expectations. While this statement did not constitute an immediate policy surprise, it reaffirmed Japan’s systematic exit from a prolonged ultra-loose framework. The deeper implication is that as the last major central bank maintaining long-term ultra-loose policy, Japan’s “normalization” fundamentally reshapes global liquidity distribution. As interest rate differentials between Japan and the U.S. gradually narrow, the attractiveness of global carry trades diminishes, and discussions on the repatriation of Japanese capital from overseas risk assets intensified. In the long run, this will systematically reduce the incentive for domestic Japanese funds to hold U.S. Treasuries, driving capital back home, constraining long-end U.S. Treasury demand, and indirectly raising the discount rate baseline for global risk assets.

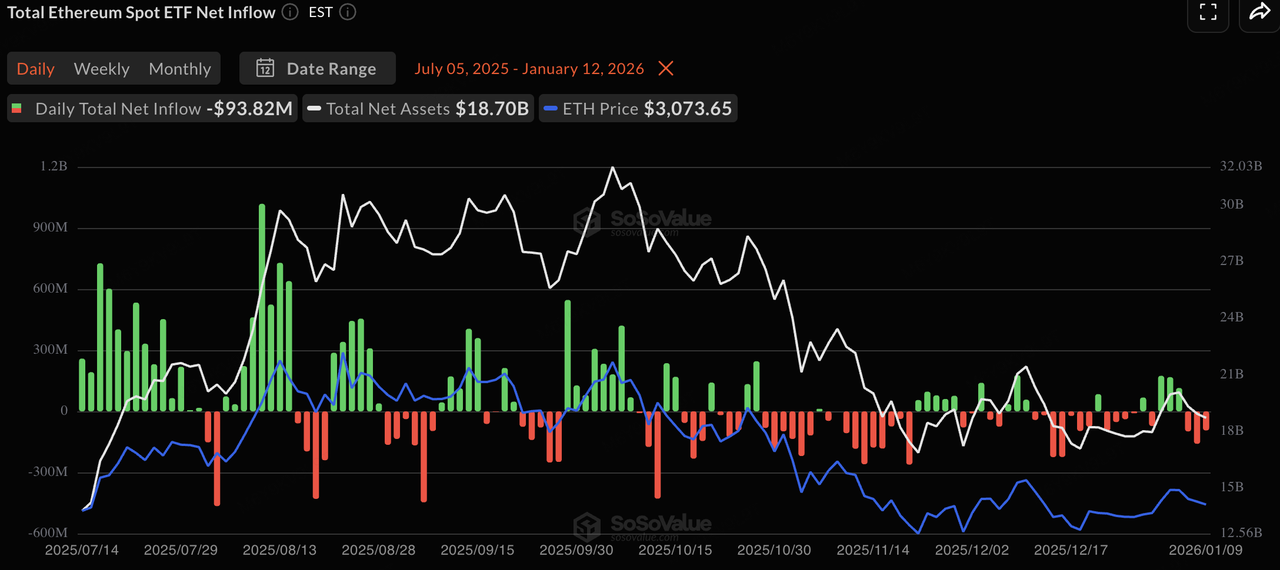

Entering the first trading week of 2026, the crypto secondary market exhibited a typical "bull-trap" volatility pattern—rising early before retreating. At the start of the week, driven by a recovery in risk appetite, BTC reclaimed the $90,000 psychological barrier and repeatedly tested the $94,000 level, hitting a weekly high of approximately $94,700. ETH rose by about 10% during the same period, returning above $3,200 and significantly outperforming BTC, signaling a tactical rotation into high-beta assets. XRP was particularly notable, surging over 25% to approximately $2.20, which buoyed multiple mainstream altcoins and briefly spiked speculative sentiment. However, following Friday's NFP data, interest rate expectations tightened rapidly, causing a sharp reversal in market sentiment. BTC pulled back from its highs to retest the $90,000 level, while ETH fell to approximately $3,085, and other mainstream assets like XRP and SOL also retraced their gains. Overall, while the total crypto market cap briefly surpassed $3 trillion with a weekly gain of roughly 5%, the growth was concentrated in the early days of the week. The single-day retreat triggered by the NFP data nearly erased previous optimism, highlighting the market's extreme sensitivity to macro rate expectations. Once the "delayed rate cut" narrative gains traction, capital swiftly exits high-beta assets. This structure—dominated by macro expectations despite no deterioration in fundamentals—remains the core challenge for the crypto market in early 2026.

Similarly, spot ETF flows mirrored this "first-in, first-out" pattern. Early in the week, amid warming risk appetite, both Bitcoin and Ethereum spot ETFs recorded net inflows. Bitcoin ETFs, in particular, saw single-day inflows reach relative highs not seen in months, indicating a tactical return of short-term allocation capital. However, as macro data landed, sentiment turned cautious, and ETF flows slowed or began to see outflows. Overall, institutional behavior at the ETF level remains highly consistent with price action, reflecting a tactical allocation strategy where traditional capital remains on the sidelines until macro uncertainties clear.

Data Source: SoSoValue

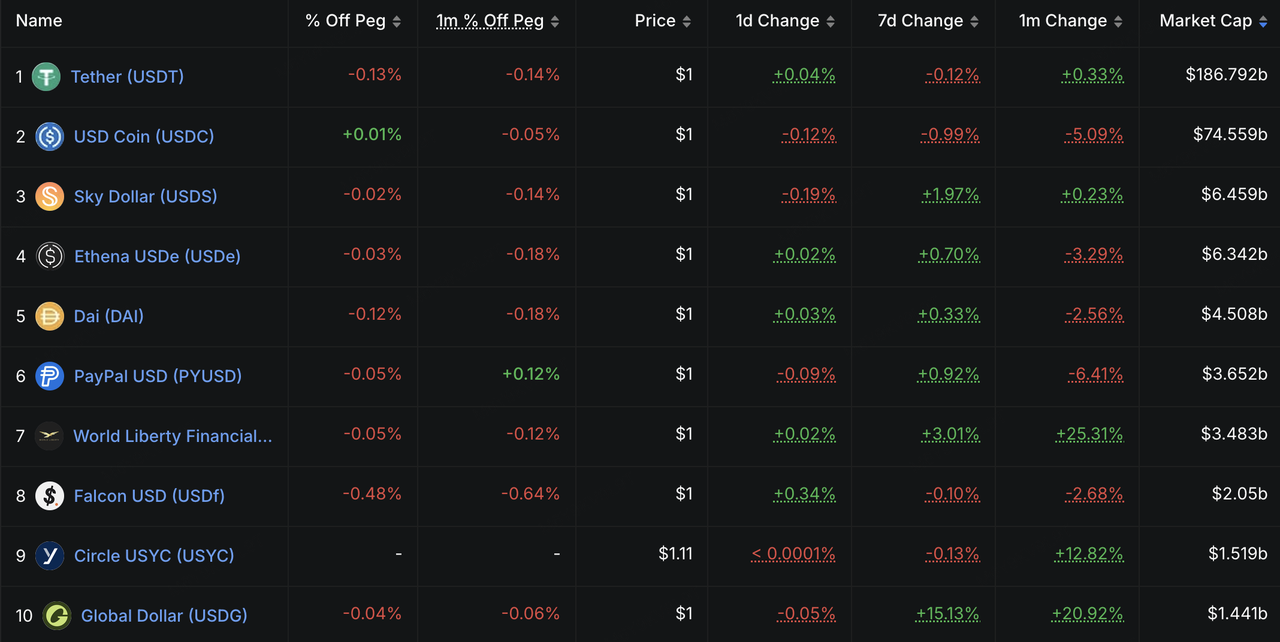

This week, stablecoin total market cap reached approximately $308 billion, up marginally by 0.01% week-over-week, remaining in a high-level bottoming phase. Among them, USDT market cap stood at $186.792 billion, maintaining dominance with a 60.70% share. In comparison, USDC saw a 5.09% monthly market cap contraction, reflecting cautious attitudes among compliant funds amid macro uncertainty. Structurally, funds are flowing toward assets that balance yield and compliance. Global Dollar (USDG) and Circle USYC saw monthly market cap surges of 20.92% and 12.82%, respectively. This indicates that amid fluctuating rate expectations, investors prefer emerging varieties with interest returns or strong backing. Overall on-chain “dry powder” remains ample, with funds largely in a hold-and-wait mode.

Data Source: DeFiLlama

According to the latest CME FedWatch data, market consensus on the Federal Reserve keeping rates unchanged at the January meeting has reached 95.0%. The unexpected decline in the nonfarm unemployment rate, coupled with sticky wages, essentially closes the short-term emergency rate cut window. The market now prices the first substantive rate cut in March, with a 25bp cut probability at 27.9%, while maintaining current rates remains the mainstream expectation at 70.8%.

In the medium to long term, the focus of rate pricing is gradually shifting downward. Rate cut expectations for H1 2026 are relatively restrained, with a pricing midpoint around 325–375bps; by late 2026 to 2027, the market begins to price in a more aggressive easing path, with 300–325bps gradually becoming the new anchor for distant rates. This “tight near-term, loose long-term” structure reflects the Fed’s preference to extend observation periods to counter residual inflation as long as the labor market does not collapse sharply. For crypto assets, the clearance of January rate cut expectations implies that short-term liquidity premiums are unlikely to surge rapidly, and markets may continue wide fluctuations at current high rates while awaiting clearer policy signals in March.

Data Source: CME FedWatch Tool

Key Events to Watch This Week (GMT+8):

-

Jan 13: U.S. December CPI release. If core CPI continues to cool, it could alleviate tightening pressures from nonfarm data and provide momentum for crypto markets to break resistance levels.

-

Jan 14: U.S. December PPI and retail sales data. These will further complement the inflation picture and affect “recession expectations” pricing.

-

Jan 15: Bank of Korea interest rate decision. As one of Asia’s key crypto trading markets, Korea’s policy will directly impact KRW exchange rates and local retail premiums.

Primary Market Financing Observations:

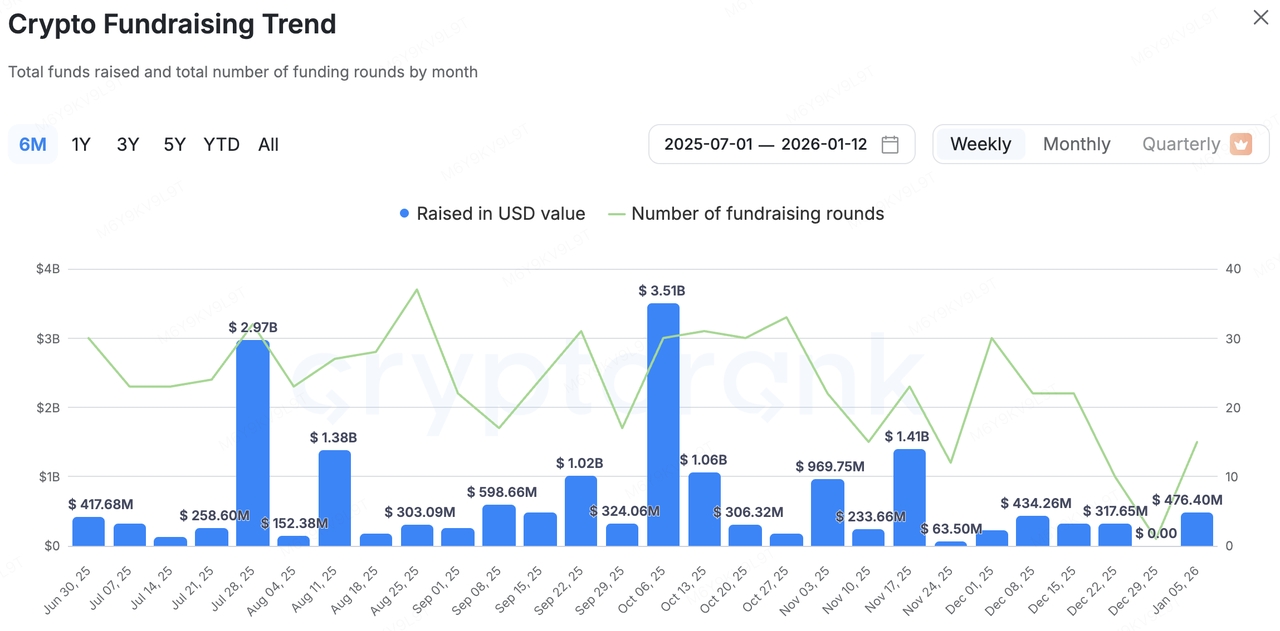

Crypto-native primary market activity rebounded significantly this week. According to CryptoRank, from January 5–12, the market disclosed over 10 financing events totaling $476 million. Compared with the quiet end of December 2025, the capital inflow pace accelerated at the start of the year, and individual financing sizes increased, indicating that institutional investors have begun a new round of asset allocation in early 2026.

Data Source: CryptoRank

-

Tres Finance was acquired by Fireblocks for $130 million, aiming to integrate crypto accounting and reporting tools into Fireblocks’ digital asset operating system.

-

Babylon raised $15 million in a funding round led by a16z Crypto to develop a non-custodial Bitcoin staking and lending protocol, promoting native BTC usage in DeFi.

-

Rain completed a $250 million Series C led by ICONIQ at a $1.95 billion valuation, expanding stablecoin payment infrastructure for enterprise-level global settlement.

Ubyx Receives Strategic Investment from Barclays, Paving the Way for “Banking” Compliant Payment Channels

This week's most strategically significant transaction was Barclays' strategic investment in the full-chain asset management and payment infrastructure provider Ubyx. This is not merely financial capital injection but a clear signal from a top-tier commercial bank incorporating crypto-native infrastructure into the global clearing system.

Ubyx's business model focuses on building a global clearing platform that enables multiple stablecoins (such as USDT, USDC, PYUSD, etc.) to circulate like universal digital cash. Specifically, it adopts a shared rulebook and pre-funded settlement account mechanism to ensure par-value redemption between issuers and institutions, supporting peer-to-peer payments without intermediaries while aligning accounting treatment as cash equivalents. This addresses key pain points in the current stablecoin market: users frequently need to “on/off-ramp” between the crypto world and traditional banks, resulting in high friction costs. Ubyx eliminates this bottleneck by enabling direct redemption into bank or fintech accounts, promoting mass adoption. Through this infrastructure, traditional institutions like Barclays can achieve seamless mapping between fiat accounts and on-chain stablecoin positions, leveraging smart contracts for efficient cross-border settlement and treasury management while retaining compliance audit (KYC/AML) controls.

In the context of gradually landing global stablecoin regulatory frameworks, Ubyx plays the role of a “compliance bridge.” Barclays' entry signals that future payment competition will no longer be merely about channels but deep integration of underlying “accounts + clearing layers.” Going forward, its post-launch penetration rate and depth of cooperation with major issuers will be key to watch, determining the amplification effect on the “stablecoin era.”

3. Project Spotlight

Are Crypto Exchanges Turning to TradFi for Incremental Growth? Two Parallel Paths: MT5 (CFDs) vs. Native Perpetuals

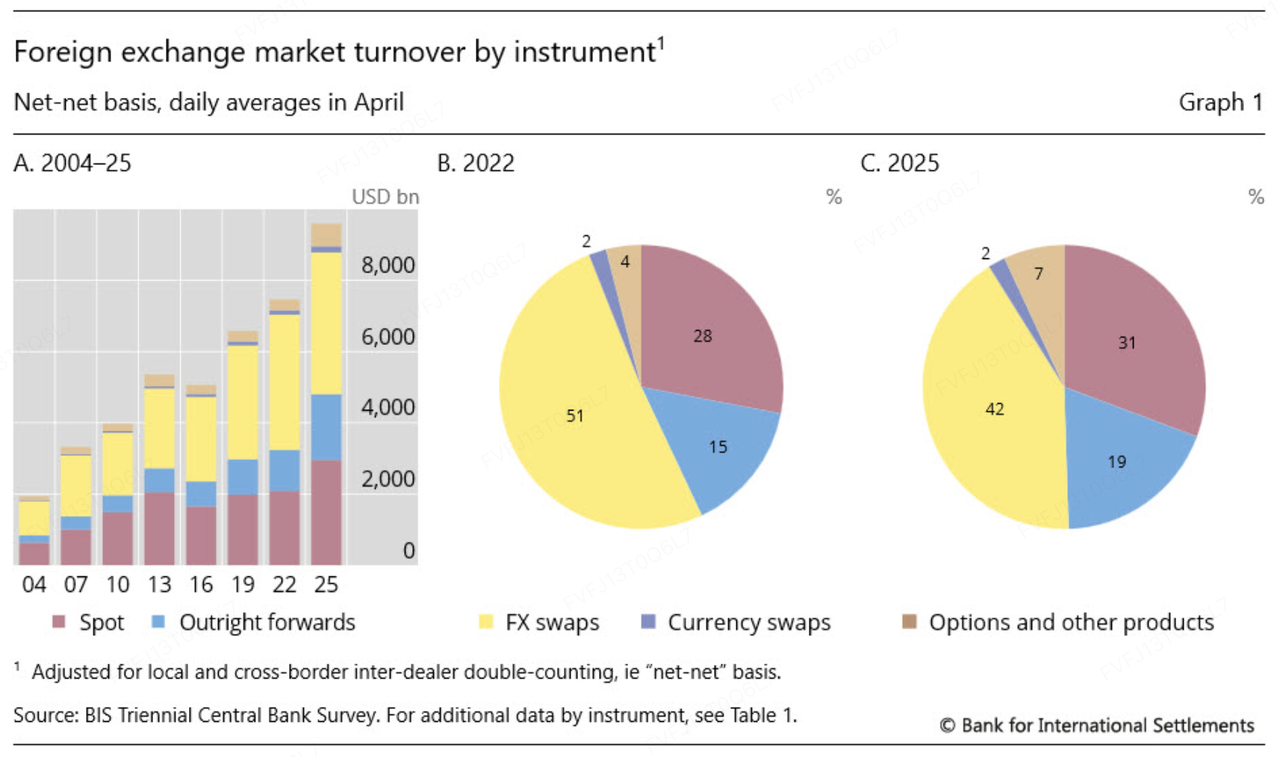

In a market phase characterized by relatively muted crypto volatility and increasingly competitive “zero-sum” liquidity, crypto exchanges expanding into TradFi is, at its core, a search for more stable trading opportunities and access to a larger, addressable liquidity pool. Recent data points support this direction: the BIS 2025 triennial survey reports global OTC FX average daily turnover reached $9.6 trillion in April 2025 (+28% vs. 2022), while the World Gold Council (WGC) shows gold market average daily trading volume rose to $361 billion in 2025 (+56% YoY), and briefly peaked at $561 billion/day in October 2025. In periods with denser macro catalysts, FX and precious metals tend to generate more “tradable volatility,” creating a more practical demand foundation for exchanges to broaden their product shelf.

Data Source: https://www.bis.org/statistics/rpfx25_fx.htm

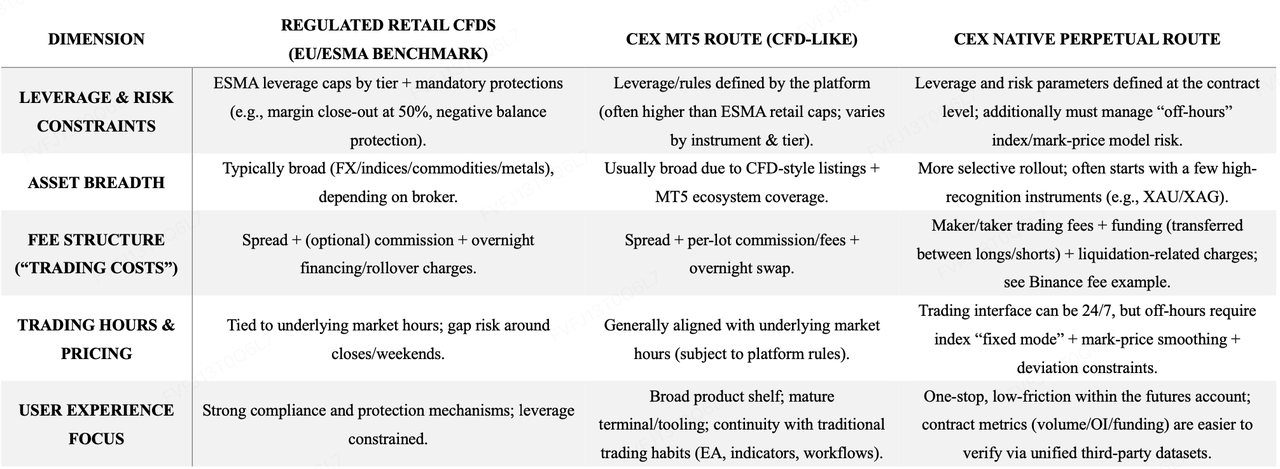

From a product strategy perspective, the market is increasingly observing a “dual-track” approach:

-

MT5 (CFD) route — fast expansion and familiarity for TradFi traders. By adopting a model closer to the traditional CFD/brokerage stack, platforms such as Bybit and Bitget can rapidly cover FX, precious metals, commodities, and indices—while naturally inheriting the existing terminal habits and tooling of traditional traders (e.g., MT5 workflows).

-

Native perpetual route — unified experience and re-use of the crypto derivatives flywheel. This path emphasizes integrating TradFi exposures directly into the exchange’s core derivatives ecosystem. For example, Binance listed TradFi perpetuals quoted in USDT (e.g., XAUUSDT, XAGUSDT) and disclosed its handling logic during non-trading hours (e.g., fixed index mode, mark-price smoothing and deviation constraints) to reduce unnecessary liquidations driven by index/mark-price divergence when the underlying index stops updating.

Early trading activity is inherently tracked through different lenses. For the MT5/CFD route, market visibility often relies on platform disclosures and media reporting (e.g., Bybit reportedly reaching $24B in single-day Gold & FX volume; Bitget recently marketing TradFi daily volume surpassing $2B). By contrast, the native perpetual route is easier for third parties to monitor under a more standardized framework—e.g., Coinglass provides 24h volume and open interest snapshots for XAU contracts for external cross-checking. Importantly, “volume” across different models can reflect different statistical definitions (notional turnover, contract face value, leverage inclusion, cross-product aggregation), which makes it more suitable for capturing momentum and growth, rather than as a strict apples-to-apples metric for ranking.

The most material distinction between the two routes tends to surface in pricing mechanics and trading frictions:

-

MT5/CFD resembles traditional margin trading: Spreads and per-lot commissions form explicit transaction costs, while overnight swaps become the primary holding cost.

-

Native perpetuals rely on exchange-style fees and funding: Maker/taker fees are the main explicit cost, funding rates transfer PnL between longs and shorts, and liquidation-related fees can apply. Using Binance’s disclosed baselines as an example, perpetual fees often anchor around maker 0.02% / taker 0.05%, while XAU funding typically settles on a 4-hour cadence, fluctuating with positioning crowding and basis dynamics. In contrast, Bybit’s MT5 pages often present pricing in a more brokerage-native format (e.g., “from $3 per lot”), and Bitget tends to productize cost disclosure via “per-lot commission + leverage tiers” at the instrument level.

Leverage comparability also requires caution. Traditional regulatory regimes (e.g., ESMA) impose retail CFD leverage caps by category (e.g., 20:1 for gold/major indices; 30:1 for major FX pairs). Crypto exchanges’ MT5 offerings often market higher ceilings (instrument- and tier-dependent), while native perpetuals usually publish a more “exchange-native” cap per contract (e.g., XAGUSDT up to 50x as disclosed).

Data Source: KuCoin Ventures compilation based on public information

From a platform strategy standpoint, native perpetuals look more like an “in-house listed” derivatives category: trading behavior, risk controls, market making, and liquidity flywheels remain within the exchange’s own derivatives ecosystem—making it easier to coordinate with existing margin frameworks and quant/market-maker interfaces. MT5/CFD, by contrast, functions more like a broker-style incremental line: it is faster to launch, broader in coverage, and better suited to capturing traditional FX/CFD users with minimal habit disruption. For retail users, the trade-off is similarly clear: native perpetuals tend to offer one-stop experience, lower friction, and more externally verifiable data, while MT5/CFD tends to offer broader product coverage, mature terminal ecosystems, and continuity of established workflows.

These two approaches are not mutually exclusive. The optimal mix depends on an exchange’s primary objective—whether it prioritizes compounding liquidity within its own derivatives ecosystem, or prioritizes rapid product expansion via an established brokerage framework to address a wider TradFi trader base. Bitget’s latest moves, for example, illustrate how a single venue may push both routes in parallel to serve different user segments and different layers of demand.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.