Key Insights

- XRP price has crashed into a technical bear market in the past few months.

- Technicals suggest that the token has started to bottom.

- XRP ETF inflows have accelerated in the past few months and may hit $5 billion soon.

XRP price has sunk. It has erased nearly 50% of its value since July last year, mirroring the performance of other tokens. However, there are signs that the Ripple price has bottomed.

This may trigger a bullish breakout in the near term. Its potential catalysts are the rising ETF inflows and the falling supply in exchanges.

XRP Price Technicals Suggest That It Is Bottoming

The three-day chart shows that XRP price has been in a strong freefall as the broader crypto market crash accelerated. It dropped from a record high of $3.6695 in July and bottomed at $1.7845.

A closer look shows that the coin may be bottoming. Also, it will eventually rebound as long as it holds strong above the key support level at $1.7843.

It has formed a triple-bottom pattern, a common bullish reversal sign in technical analysis. This pattern normally forms when an asset fails to drop below a key support level three times. It also sends a signal that bears are reluctant to short below it.

Additionally, the token has slowly formed a falling wedge pattern, which is made up of two descending and converging trendlines. A rebound normally happens when the two lines are about to converge, which is happening now

There are signs that the coin is also forming a bullish divergence pattern. This happens when oscillators are rising during a downward trend.

The two lines of the Percentage Price Oscillator (PPO) have formed a bullish crossover pattern. At the same time, the Relative Strength Index (RSI) has started moving upwards.

The most likely XRP price prediction is bullish. The immediate target is $2.42 at the 38.2% Fibonacci Retracement level. This target is about 30% above the current level. A move above that price will see it jump to the all-time high of $3.6695.

On the flip side, a drop below the triple-bottom at $1.7843 will invalidate the bullish XRP price forecast and point to more downside.

XRP ETF Inflows to Hit $5 Billion if the Trend Continues

American investors have continued to accumulate XRP in recent months. This steady buying is seen as a potential catalyst for the token’s price.

Data shows that these investors added $5.1 million in assets on Wednesday. This brought the cumulative inflows to over $1.17 billion. As a result, the funds have now attracted over $1.24 billion in net assets.

Analysts believe these funds may attract over $5 billion in inflows in the first half of the year. They say this will solidify their status as the third crypto ETF.

Bitcoin has already attracted $56 billion in inflows since its inception. Ethereum has drawn $12 billion in inflows over the same period.

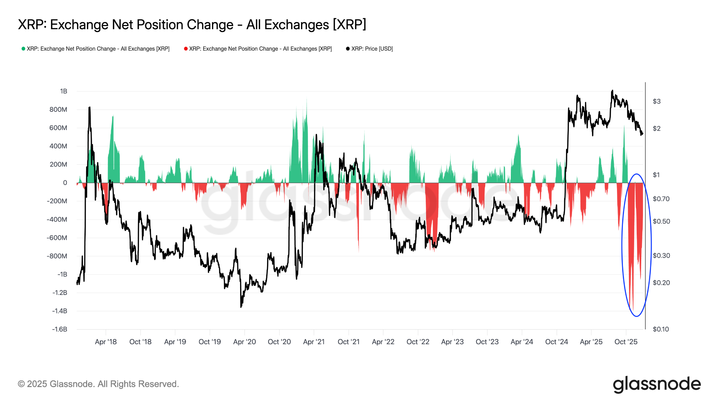

Falling Exchange Supply and XRP Price Signal Strong Accumulation

Another sign of potential accumulation is the fact that the supply in exchanges has continued falling in the past few months.

Data shows the supply in top exchanges plunged by 58% in 2025. XRP price now sits at the lowest level in eight years. The supply moved from 3.76 billion in October to the current 3.76 billion.

The supply crashed as investors bought amid some notable XRP news, including the start of ETF trading. Also, Ripple Labs revealed a $500 million investment at a $40 billion valuation from Wall Street giants like Fortress and Citadel. It made this announcement at the Ripple Swell event.

XRP accumulation increased as the company received a Federal banking charter. The charter came from the Office of the Comptroller of the Currency (OCC). It allows the company to offer custodial services.

Ripple also completed the acquisition of four companies, including: GTreasury, Hidden Road, Rail, and Palisade.

Most importantly, the Ripple USD (RLUSD) stablecoin gained momentum. Its cumulative supply rose to over $1.4 billion. Monthly trading volume jumped to more than $3 billion. These catalysts mean that the XRP price may rebound in the coming weeks.

The post XRP Price Eyes Rebound as ETF Inflows Hit $5B, Supply Falls appeared first on The Market Periodical.