XRP emerged as the only top asset to record positive ETF flows last week despite the bloodbath that ravaged the market.

The crypto market witnessed one of its worst performances last week, with Feb. 5 particularly standing out. Specifically, the market lost $310 billion in valuation that day, representing its worst day since Oct. 10, 2025, when it lost $383 billion during a steep crash that resulted in over $19 billion worth of liquidations.

XRP was one of the hardest hit during the Feb. 5 decline, but institutional adoption continued to trickle upward despite the price struggles. Specifically, last week, XRP emerged as the only top asset to record positive ETF flows, pulling in nearly $45 million while BTC, SOL, and ETH saw outflows.

Key Points

- XRP collapsed by more than 19% on Feb. 5 amid the market crash that wiped out $310 billion worth of capital from the crypto market.

- While prices struggled, XRP saw increased institutional interest, as XRP ETF products recorded $45 million worth of inflows last week.

- This bullish institutional standing was unique to XRP alone, with Bitcoin, Ethereum, and Solana ETFs seeing outflows instead.

- The latest performance represents XRP’s first positive weekly ETF record in the past three weeks, after losing $92 million two weeks back.

- The Franklin Templeton XRP ETF contributed the most to the $45 million inflow last week, raking in over $20 million alone.

XRP ETFs Record Inflows Despite Price Struggles

This is according to market data provided by Coinglass, as the market eyes a recovery from last week’s turbulence.Specifically, on Feb. 5, XRP collapsed 19.6% before falling deeper to a 15-month low of $1.11 the next day. While a rebound followed on Feb. 6, XRP remained in bearish territory, closing last week with a 10% decline.

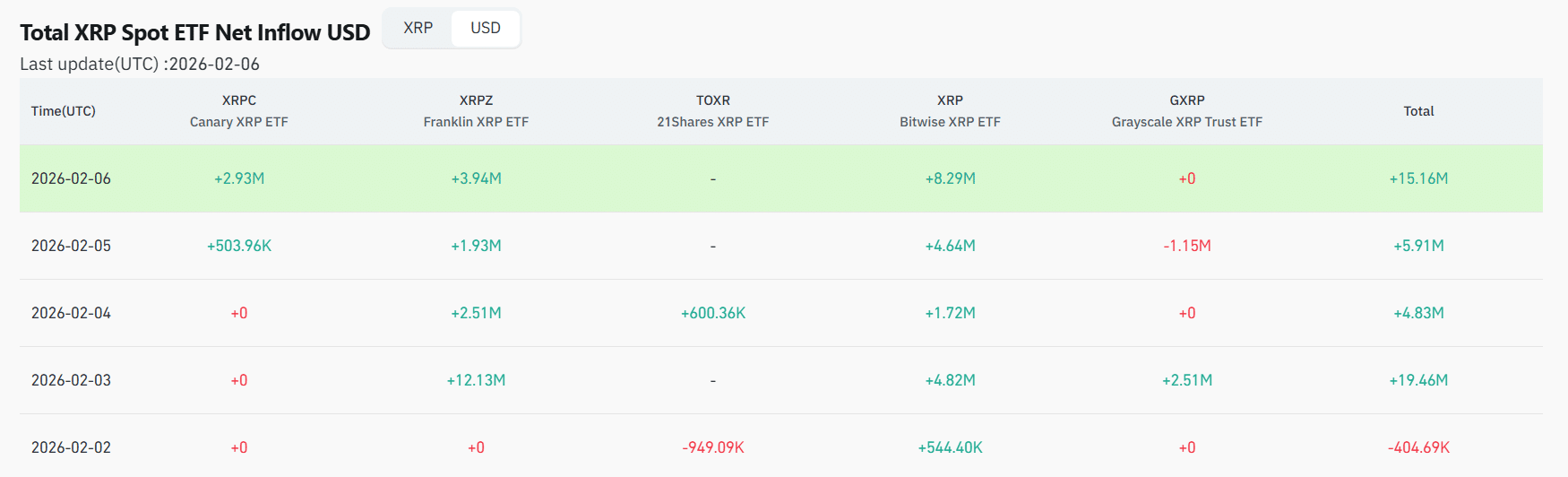

Despite this, XRP ETFs saw intraday capital inflows four times out of five last week. Notably, the only outflow involved –$404K on Feb. 2. As the week progressed, the products only witnessed inflows, including $19.46 million on Feb. 3, $4.83 million on Feb. 4, and even $5.91 million on Feb. 5, the day XRP’s price collapsed 19%. On Feb. 6, the products saw $15.16 million in inflows.

Together, these flows translate to $44.956 million worth of net capital inflows last week, representing XRP’s first positive weekly ETF performance in the past three weeks. In the week ending Jan. 23, XRP ETFs recorded $40.64 million in net outflows. The next week, outflows hit $52.26 million, triggered by the $92 million outflow on Jan. 29. Within these two weeks, XRP ETFs lost $92.9 million.

Which XRP ETF Contributed the Most?

Notably, the recent recovery mostly comes from the contributions of two XRP ETF products: the Franklin XRP ETF (XRPZ) and the Bitwise XRP ETF (XRP). These products pulled in a combined $40.5 million, representing over 90% of the total ETF flows from last week.

Of the $40.5 million combined flow, XRPZ saw $20.51 million in net inflows, marking the largest for any XRP ETF last week. Meanwhile, Bitwise’s XRP recorded $20.014 million worth of inflows.

While Canary Capital’s XRPC did not record any intraday outflows, it only saw $3.43 million in net inflows, seeing no flows on most days. Grayscale’s GXRP witnessed $1.36 million in net inflows. The 21Shares XRP ETF was the only product that saw outflows last week, recording $348K worth of capital exit.

BTC, ETH, SOL ETFs Seeing Losses

While XRP moved to recover the ETF losses of the past few weeks, products tied to Bitcoin, Ethereum, and Solana have continued to see outflows.

Specifically, Bitcoin ETFs recorded $358 million worth of outflows last week, while Ethereum ETFs saw $170.4 million in capital exit. Meanwhile, Solana ETFs witnessed outflows worth $9.3 million, with most of these losses coming on Feb. 6, which introduced $11.9 million in capital exit to the Solana products.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.