Author: 100y.eth

Translated by: Saoirse, Foresight News

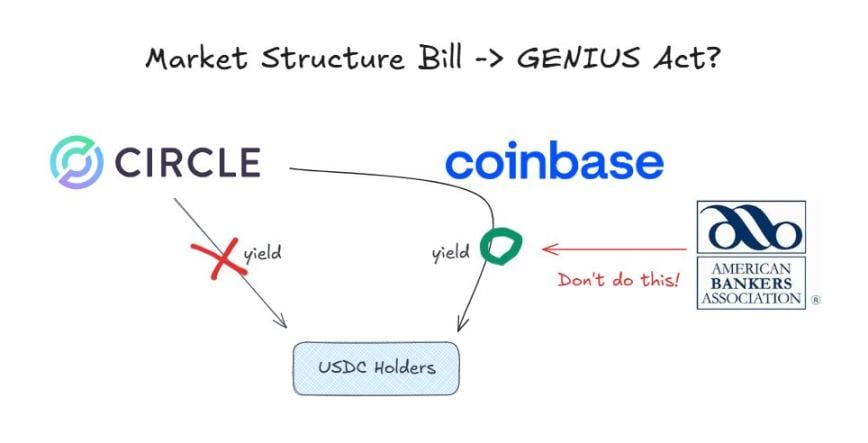

Under the GENIUS Act, stablecoin issuers are prohibited from paying interest to stablecoin holders.

Currently, Coinbase Exchange is offering users a 3.35% reward for holding USDC on the platform. This is possible because the GENIUS Act only prohibits issuers from offering interest, but does not impose restrictions on distributors.

However, before the U.S. Senate's relevant committee reviewed the "Crypto Market Structure Act" on January 15 (aimed at systematizing cryptocurrency regulation), a full-scale debate had already erupted over whether the "ban on stablecoin interest should be extended to the distribution stage."

Strong opposition from the banking industry

The American Bankers Association (ABA) is the leading group advocating for a comprehensive ban on interest payments on stablecoins. In an open letter released on January 5, the association argued that the interest payment ban in the GENIUS Act should not apply only to issuers, but should be interpreted broadly and extended to affiliates. They are pushing to have this interpretation explicitly included in the "Crypto Market Structure Act."

The Underlying Reasons Behind the Banking Sector's Strong Opposition

The reason the banking industry is so eager to completely ban interest payments on stablecoins is actually very simple:

- Concerned about outflow of bank deposits;

- A decrease in deposits means a reduction in the ability to lend;

- Stablecoins are not insured by the Federal Deposit Insurance Corporation (FDIC).

Ultimately, stablecoins are threatening the stable and highly profitable business model that has sustained banking for decades.

The Comeback of the Cryptocurrency Industry

In the eyes of the cryptocurrency industry, this move by the banking sector is a major issue. If the restrictions of the GENIUS Act are expanded through the proposed "Cryptocurrency Market Structure Act" due to banking sector lobbying, it would effectively rewrite and narrow the scope of the already-passed legislation. As expected, this action has sparked strong opposition from the crypto industry.

Coinbase's Position

Faryar Shirzad, Coinbase's Chief Policy Officer, refuted this by citing relevant research indicating that stablecoins have not caused significant outflows from bank deposits. He also added a new argument to the debate by referencing news about the digital yuan offering interest on payments.

Paradigm's Viewpoint

Alexander Grieve, Vice President of Government Affairs at crypto investment firm Paradigm, offered another perspective. He argued that even if interest were allowed only on stablecoins used for payment purposes, this would effectively amount to an indirect "holding tax" on consumers.

How about the situation in China and South Korea?

Although China and South Korea are not as fast as some other Asian countries in advancing policies related to cryptocurrencies, both have recently introduced a series of new initiatives regarding central bank digital currencies (CBDCs) and stablecoin regulations. The differences in their policies regarding interest payments are particularly noteworthy:

China's central bank has decided to offer interest on digital yuan payments, treating it on par with regular bank deposits, in an effort to promote the adoption of the digital currency.

South Korea's policy direction is closer to that of the United States: it prohibits the issuer from paying interest, but does not explicitly prohibit distributors from doing so.

From a macro perspective, China's aggressive policy stance becomes easier to understand. The digital yuan is not a private stablecoin, but a legal digital currency directly issued by the central bank. Promoting the digital yuan can not only counterbalance the dominant positions of private platforms like Alipay and WeChat Pay, but also strengthen a financial system centered around the central bank.

Conclusion

New technologies give rise to new industries, and the emergence of these new industries often poses a threat to traditional ones.

Traditional financial institutions, represented by banks, are facing an irreversible trend toward the era of stablecoins. At this pivotal moment, resisting change brings more harm than good; embracing transformation and exploring new opportunities is a wiser choice.

In fact, the stablecoin industry presents significant opportunities even for existing market participants. Many banks have already begun to proactively position themselves:

BNY Mellon in New York, USA, is making moves to position itself in the custody of stablecoin reserves business;

Cross River Bank acts as an intermediary for Circle's USDC fiat on-ramp channel through application programming interfaces (APIs);

JPMorgan is also testing a tokenized deposit business.

Major card organizations also have a vested interest in this matter. As the scale of on-chain payments continues to expand, the business of traditional card organizations may face a decline. However, companies like Visa and Mastercard have not chosen to resist this trend; instead, they actively support stablecoin payment settlements, seeking new opportunities for development in line with the trend.

Asset management institutions are also entering the field. Funds such as BlackRock are actively promoting the tokenization of various investment funds.

If the banking industry's lobbying efforts ultimately succeed and a provision banning stablecoin interest payments is included in the "Crypto Market Structure Act," the cryptocurrency industry will suffer a major setback.

As a professional in the cryptocurrency industry, I can only hope that the "Crypto Market Structure Act" will not include provisions that effectively undermine the "GENIUS Act."