Original | Odaily Planet Daily (@OdailyChina)

Author | Golem (@golemweb3)

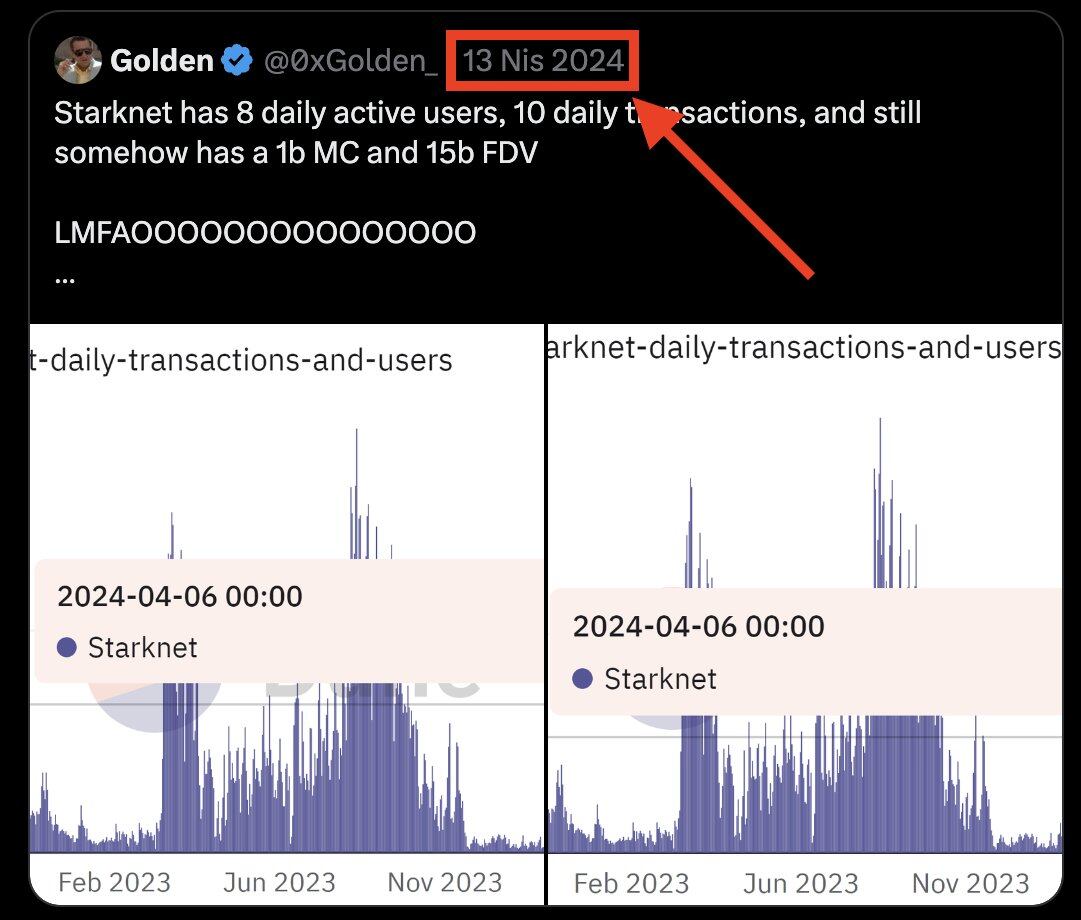

On the evening of January 14th, the official Solana account posted a message without prior warning.Taunt"Starknet has only 8 daily active users and only 10 daily transactions, yet it supports a circulating market cap of $1 billion and a maximum valuation of $15 billion," and directly stated that Starknet should drop to zero.

An hour after the post was published, Starknet's official account quickly responded by posting an image of an ugly chimpanzee and retorted, "Who told this little Solana guy all this data?" StarkWare's CEO even resorted to personal attacks, commenting under Eli Ben-Sasson's mocking post.Call"Solana has 8 marketing interns (all bald), who post 10 tweets every day." Solana co-founder Toly alsoPost an articlesaid, "This post has received a great response; the marketing staff in charge should be promoted."

As tensions escalated, some people in the crypto community began to call for reconciliation. He Yi posted a message.Call"Take a deep breath and relax. We're all friends, and harmony is most important," but at the same time, he also added, "peanuts, melon seeds, and mineral water," to show a passive, onlooker attitude. Near official.Post an articleSolana and Starknet should reconcile and become friends again.

However, some believe this was a deliberately planned publicity campaign by the official side, aiming to generate buzz and build anticipation for the upcoming collaboration. Meanwhile, netizens have uncovered that Solana's post was not original; an identical tweet had already been posted by a user as early as April 2024.

Solana Mocks Starknet for Copy-Pasting a 2024 User's Tweet

Regardless of the true reason behind Solana's editor mocking Starknet with a "sudden illness" joke, from a data perspective, Starknet is no longer the "ghost town on-chain" it once was.

A thunderclap in silence.

The L2 market in 2024 is highly competitive, with a strong dominance effect from leading players. Arbitrum and OP Mainnet have already covered a large number of common use cases. As a result, after Starknet's airdrop ended, users rapidly left the platform, making it a subject of criticism and mockery.

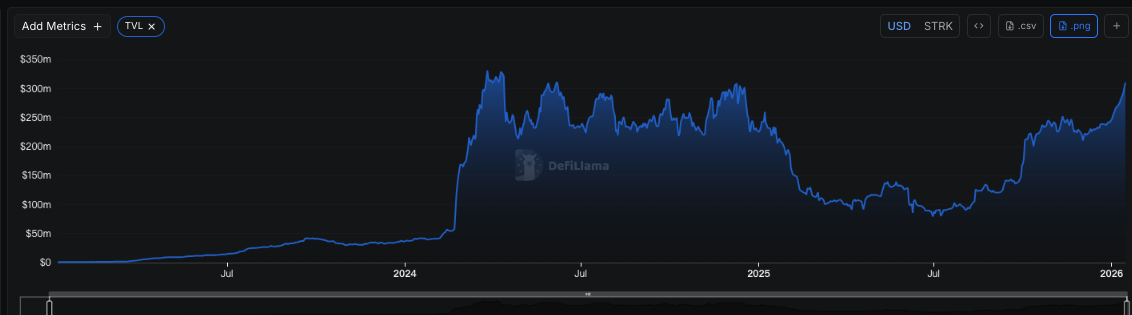

After more than a year of hard work and determination, Starknet is now capable of competing with most L1s. According to DeFiLlama data, Starknet's TVL began to recover in September 2025 and has now exceeded $300 million, returning to the levels seen in 2024.Ranked 22nd in blockchain rankings, surpassing a number of L1 and L2 blockchains such as Monad, Scroll, Linea, and Sei.

At the same time, the stablecoin market capitalization, transaction fee revenue, and DEX trading volume within its ecosystem began to recover after September 2025. Over the past four months, Starknet's daily transaction fee revenue has remained between $5,000 and $10,000. Although this is lower than the daily transaction fee revenue during 2023–2024 (which averaged over $150,000 per day), it still ranks among the top in the blockchain industry.

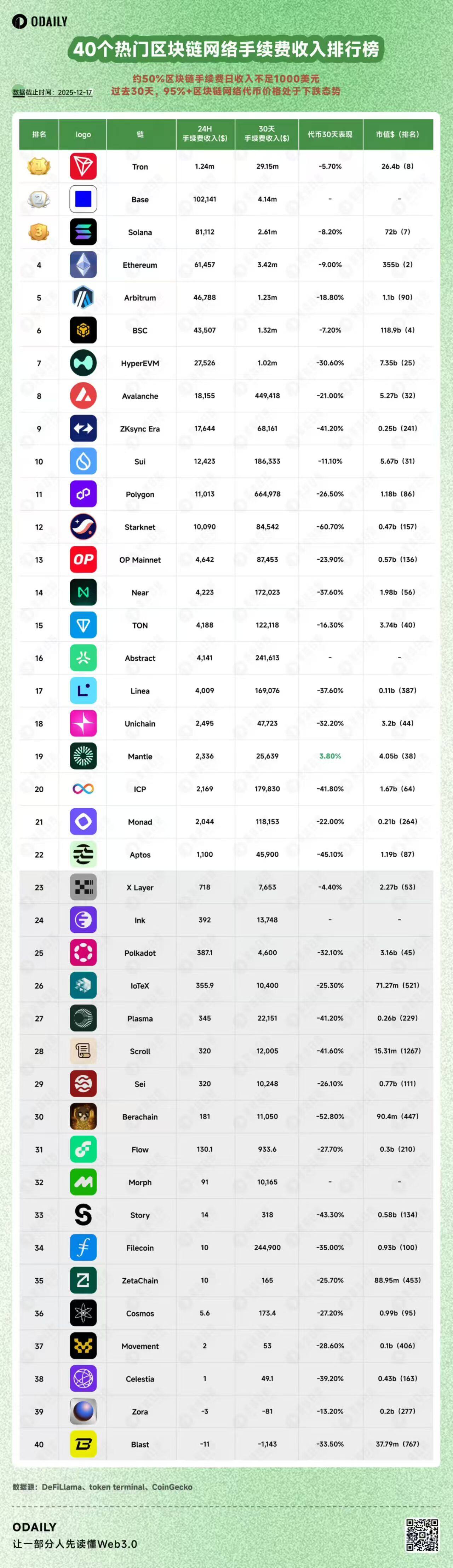

Odaily Planet Daily reported in mid-December on the transaction fee revenue rankings of 40 major blockchains. Starknet ranked within the top 15, with daily transaction fee revenue surpassing blockchains like Monad and TON.

In terms of on-chain activity, Starknet has finally cultivated a group of genuine loyal users (rather than just people chasing airdrops). According to the Starknet Foundation's official data:Dune Data PanelCurrently, Starknet maintains a daily active user count of 2,000 to 4,000 (unique addresses), with daily transaction volume exceeding 240,000.

Compared to its peak in 2023, when Starknet's daily active users exceeded 100,000, the current daily active user count is still negligible. However, in terms of transaction volume, the current number of transactions—generated by addresses that are less than 2% of the previous year's—has already reached about one-third of the 2023 level (which saw over 600,000 daily transactions).This data proves that the users currently remaining on Starknet are high-quality users with real transaction needs, who contribute the majority of the network's fee revenue.

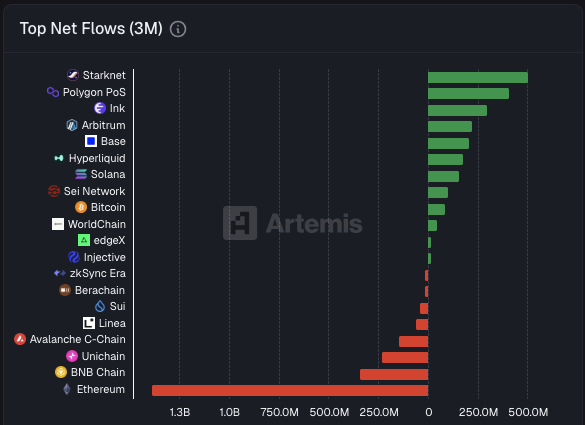

Don't simply view Starknet as a gathering place for niche enthusiasts in the blockchain space. In fact, Starknet has already gained favor from external capital and demonstrates strong user retention. According to Artemis data, Starknet recorded a net inflow of $504.2 million over three months, ranking first among all blockchains. The second-place blockchain, Polygon, is $100 million behind, while Starknet significantly outpaces other blockchains like Solana and BSC.

Move Beyond Ethereum L2, Go All-in on BTCFi

The reason Starknet was able to make a comeback is actually very simple: instead of competing with blockchains like Solana, BSC, and Base on Meme trends or popular narratives, it directly committed to BTCFi.

Starknet is now moving beyond the label of an Ethereum Layer 2 solution, and its official account has added a note (BTCFi arc) after the Starknet name. In March 2025, Starknet's parent company, StarkWare, announced the establishment of a "strategic Bitcoin reserve." Initially, the move was seen by many as mere hype, and few expected Starknet to take it seriously. By late September 2025, after more than six months of development, Starknet officially launched BTC staking, along with a 100 million STRK incentive program. Users who stake BTC on Starknet can now earn staking rewards and receive STRK incentives.

So far, BTCFi has been live on Starknet for over three months, and its launch is highly positively correlated with the warming on-chain data on Starknet.

According toDune DataCurrently, the value of staked Bitcoin on Starknet exceeds $214 million, accounting for approximately 70% of Starknet's total TVL ($300 million). About 50% of the assets deposited on the platform are native BTC, while the remaining are various wrapped versions of BTC, mainly SolvBTC and WBTC.

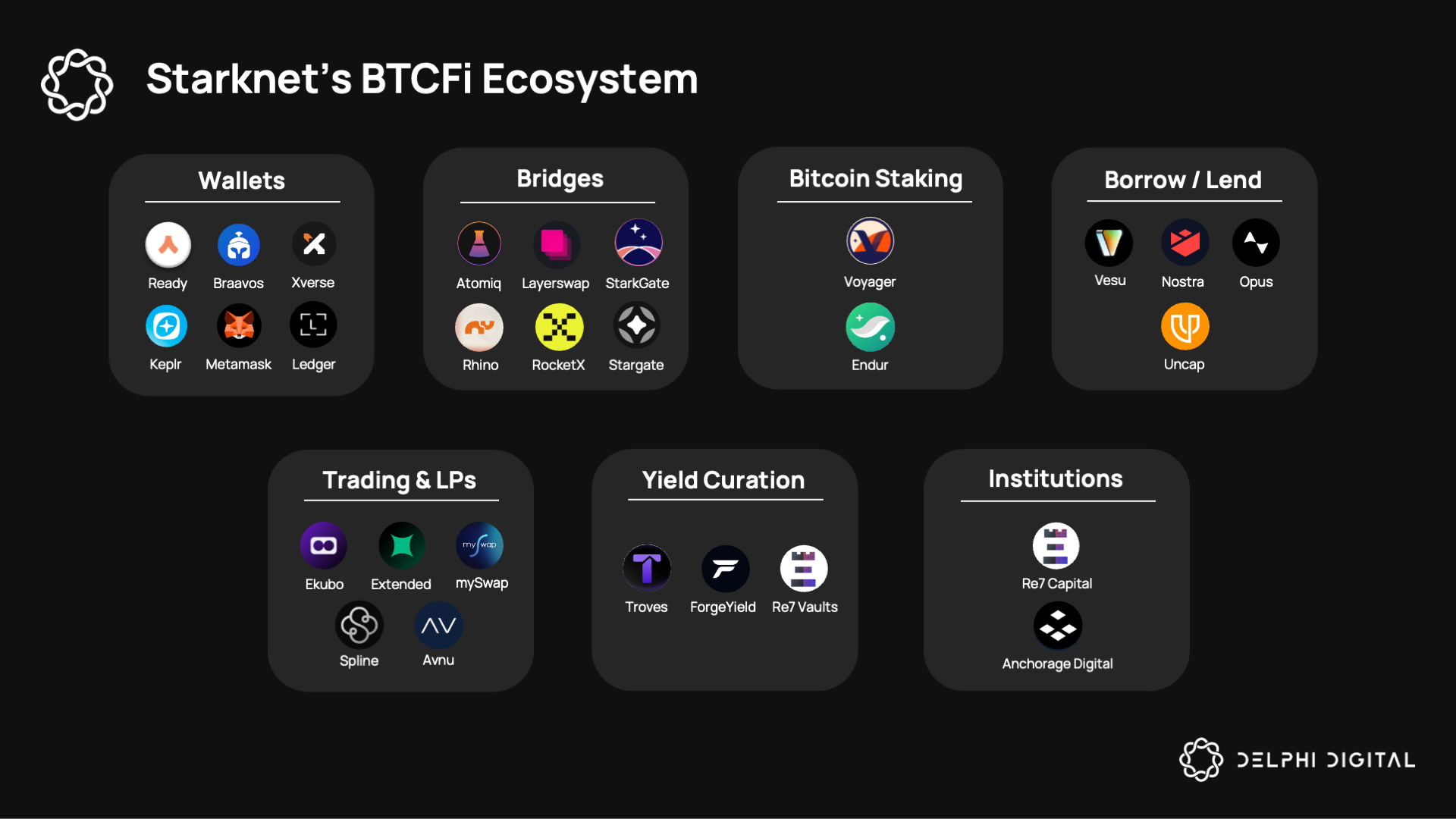

The Bitcoin ecosystem on Starknet has also gradually become more complete, offering everything from wallets and cross-chain bridges, to staking, lending, and yield protocols, with all the use cases already proven viable.

Starknet BTCFi Ecosystem Map

Users can stake Bitcoin on the Endur and Voyager platforms and delegate it to validators. In return, stakers receive STRK tokens (currently, the APY for STRK on Endur is approximately 2.09%). The resulting LST tokens can then be deposited again into lending protocols like Vesu to generate additional yield. For institutional investors, Re7 Capital can also design customized yield strategies.

As for why Starknet dares to fully commit to BTCFi, it might be related to the founder's personal background. As early as 2013, before the birth of Starknet, Eli Ben-Sasson was already researching how to use zero-knowledge proofs to improve Bitcoin. This research eventually became one of Starknet's core technologies (STARK cryptography). Therefore, now fully embracing BTCFi, in a way, can be seen as returning to its original mission.

Although the blockchain world does not always reward idealists and those who work quietly, Starknet's steps have become lighter and more stable after being freed from the "hostage" situation of airdrops.