Original Title: "Housing Price 'Shorting Tool' Emerges, Polymarket Launches Real Estate Prediction Market"

Original Author: Asher, Odaily Planet Daily

The value of "everything can be predicted" is still on the rise.

On the evening of January 5th, the on-chain real estate platform Parcl announced via a post that it has partnered with the prediction market Polymarket,A New Real Estate Prediction Market Aiming to Introduce Parcl's Daily Price Index to PolymarketAffected by this news, the Parcl platform's token PRCL surged more than 150% in a short time, but the price has since retreated somewhat. The current price is temporarily reported at $0.042, with a market capitalization of $19 million.

PRCL K-line Chart

Polymarket Real Estate Prediction Market Segment Operating Rules 1. **Market Creation** - Market creators must submit a detailed proposal for real estate-related events, including but not not limited to housing price indices, policy changes, and transaction volumes. - Market topics

Collaboration Details:

· Parcl provides daily housing price indices, serving as independent and transparent reference data for market settlements;

· Polymarket is responsible for listing and operating the market, where users can trade on the Polygon chain using USDC;

Market settlements are based on Parcl's publicly verifiable index, avoiding the delays (typically monthly) and subjectivity of traditional real estate data.

Market Type:

· Predict whether housing prices will rise or fall on a monthly, quarterly, or annual basis;

Threshold-based markets: For example, whether housing prices exceed a certain level; each market is linked to a dedicated settlement page on Parcl, displaying the final value, historical data, and index calculation methodology.

Coverage:

· Start initially from high-mobility U.S. cities.such as New York, Miami, San Francisco, Austin, etc.

More cities and market types will be expanded according to user needs.

Example demonstration:

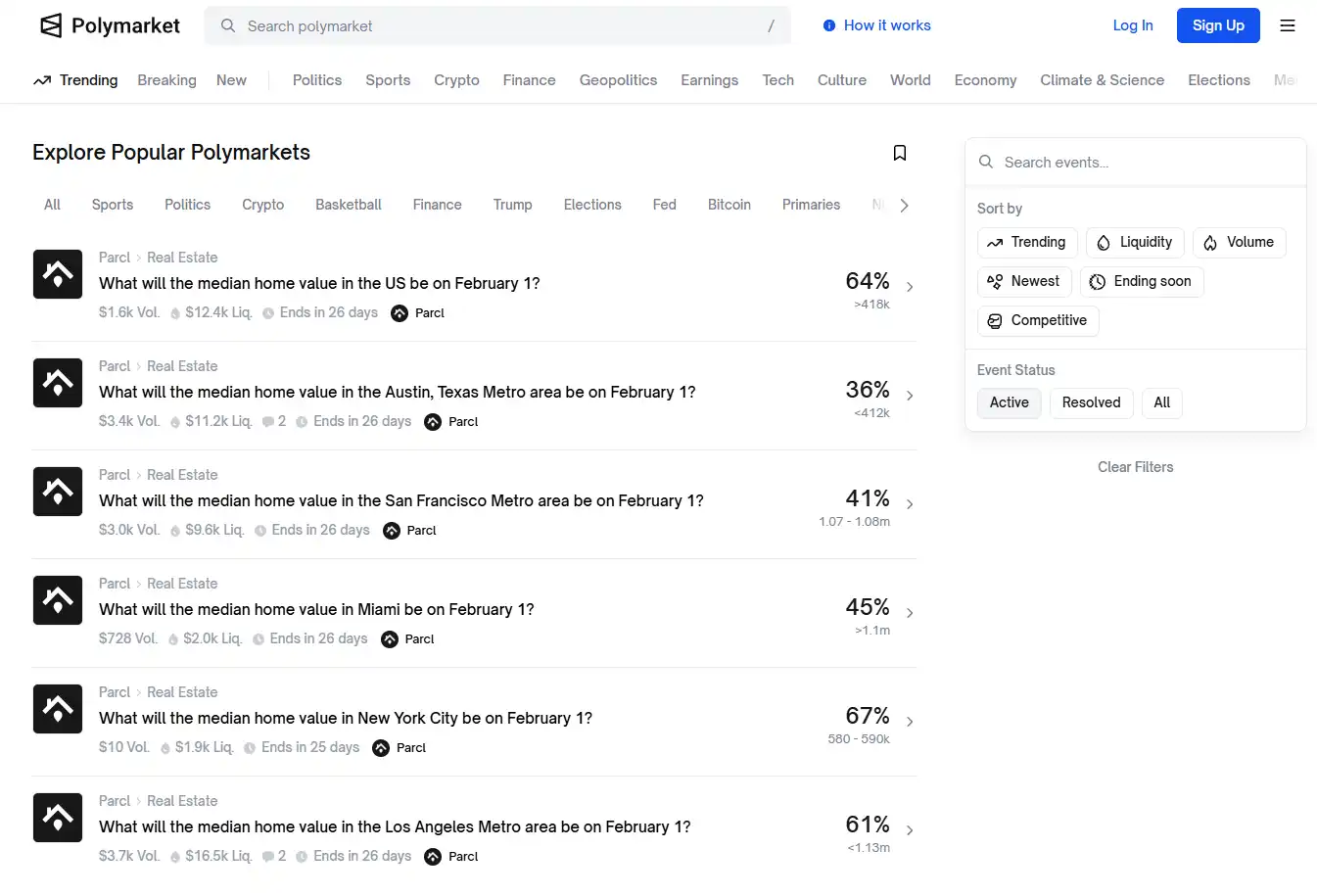

Currently, this section has only launched seven monthly real estate forecast events, and they have poor liquidity. The event with the highest trading volume, "U.S. Los Angeles Home Median Price on February 1," has only reached $3,700 in trading volume.

New Real Estate Prediction Market Segment on Polymarket

In traditional real estate markets, whether bullish or bearish, such expectations are difficult to express directly, let alone form continuous market signals. The introduction of Polymarket essentially decouples "judgments about housing prices" from asset transactions. As long as there is a clear settlement criterion, expectations themselves can be priced independently.

The real estate market has finally introduced a "short-selling tool."

An often-overlooked fact is that the potential demand in real estate-related markets does not come solely from native speculators within the crypto world.

In the traditional financial system, "a decline in housing prices" is almost a risk that cannot be directly hedged.Whether one owns real estate or has an asset structure and income sources heavily dependent on the real estate cycle of a particular city, the typical real-world responses are often limited to either holding on or directly selling the physical assets—both of which involve high transaction costs, long timeframes, and a lack of flexible intermediate options. As KOL 0xMarioNawfal (@RoundtableSpace) put it: "This is much more than just placing a bet; it's about bringing liquidity to one of the most illiquid markets globally. Imagine housing prices at historic highs, you anticipate a crash but can't sell your house—now you can hedge, and short the market."

The introduction of prediction markets abstracts the decline in housing prices into a tradable risk assessment.When housing prices are high and market expectations begin to weaken, the price trend of real estate itself can be priced independently, without the need to manage risks by liquidating underlying assets.

Through Polymarket, the downside risk of real estate prices is abstracted into tradable judgments, rather than requiring the disposal of physical assets. From this perspective, real estate prediction markets on Polymarket are closer to a simplified macro-hedging mechanism, rather than a mere speculative game centered on price fluctuations. It does not alter the liquidity structure of real estate assets themselves, but provides a trading layer for a market with traditionally low liquidity, which can reflect expectations in real time.

Polymarket's CMO, Matthew Modabber, said, "Prediction markets are best suited for events with clear, verifiable data. Parcl's daily housing price index provides us with a transparent and consistent settlement basis. Real estate should be a first-class category in prediction markets."

This collaboration between Polymarket and Parcl brings traditional real estate price signals into the crypto ecosystem:Originally low-frequency, closed, and highly transaction-cost assets are being decomposed into index results that are settleable, verifiable, and tradable. Their form is beginning to resemble stock indices or crypto derivatives.This might precisely be a more practical and realistic implementation path within the RWA narrative, one that is closer to actual needs.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia