Key Insights:

- Monero’s market cap has moved past $10.5 billion amid recent rally, making it the 12th largest crypto by market cap.

- Veteran trader Peter Brandt highlighted a long-term breakout pattern in XMR similar to silver’s historic move.

- Other privacy coins, such as Zcash (ZEC) and Canton (CC), posted notable gains.

Amid the broader market consolidation, privacy coin Monero (XMR) has been leading the sector with 20% upside. Earlier on Jan. 12, the XMR price touched a new all-time high of $596, with its market cap soaring to $10.5 billion. Other privacy tokens like ZCash (ZEC) and Canton (CC) have gained by a similar magnitude amid overall market optimism.

Monero (XMR) Leads Privacy Coin Sector Upside

Privacy coin Monero (XMR) has emerged as a very strong performer, with price hitting an all-time high earlier today. A market capitalization of $10.5 billion makes XMR the 12th-largest cryptocurrency. The daily trading volume for XMR is up by 200% to nearly $400 million.

On the weekly and monthly charts, the Monero price is already up by more than 32%. Veteran trader Peter Brandt spotted a major chart setup while comparing it to Silver breakout. In his analysis, Brandt compared XMR on a monthly timeframe with silver on a quarterly chart.

He noted that both assets previously formed two significant peaks that created a long-term descending resistance trendline. In silver’s case, the price eventually broke above this level and was followed by a powerful breakout move, often referred to as a “god candle.”

Brandt did not outline a specific price target for Monero. However, the comparison implies that XMR could see a similar high-momentum breakout.

Furthermore, the bullish sentiment around Monero has increased considerably following the report of governance issues by ZCash.

At the same time, market analysts noted that Monero has gained support from a renewed market focus on privacy, along with growing anticipation surrounding upcoming protocol upgrades. In a research note, the firm added that these factors have helped revive demand for XMR. This comes despite the regulatory uncertainty over the privacy coin sector.

ZCash Attempts A Bounce Amid Sector-Wide Rally

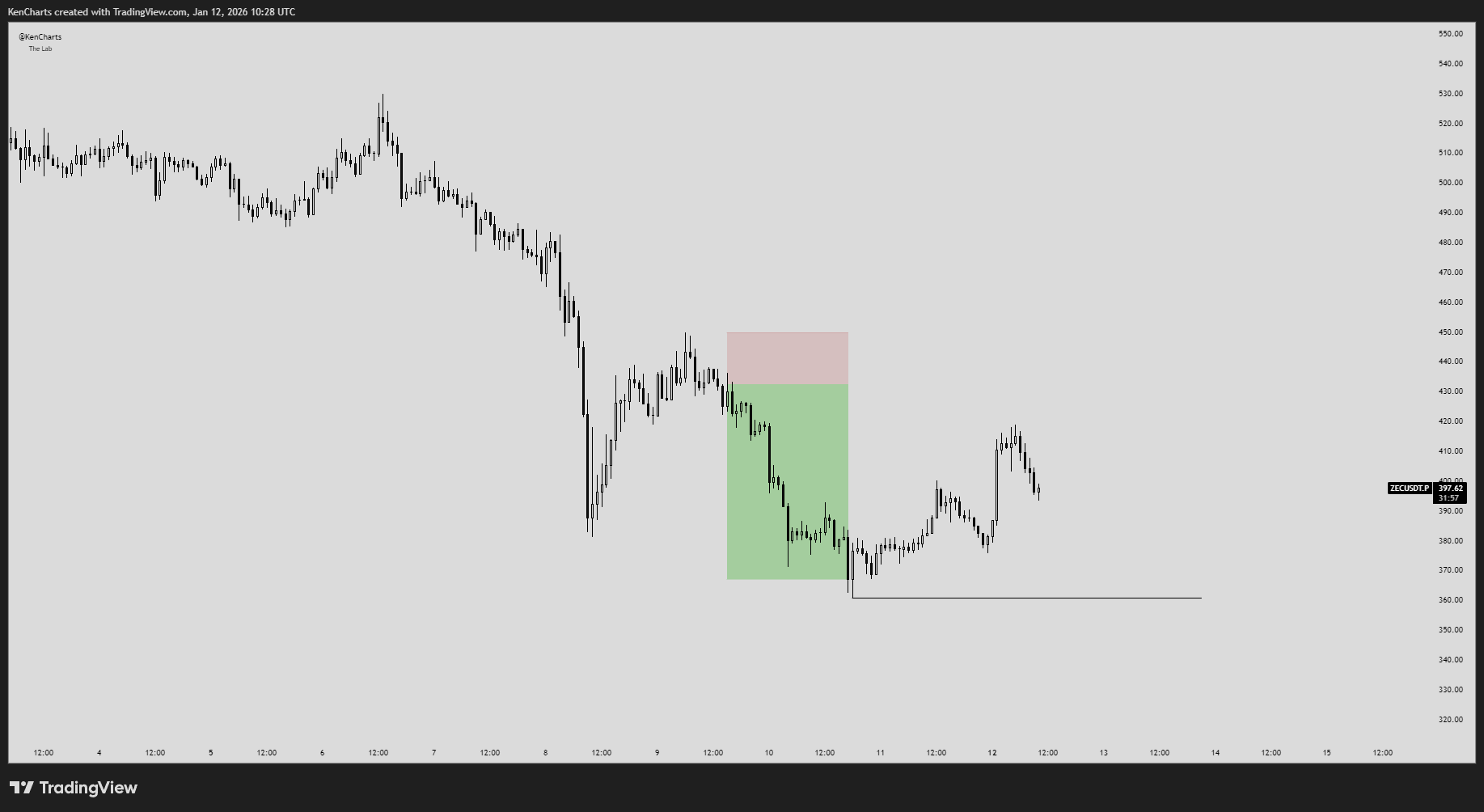

Another privacy coin, ZCash (ZEC), attempted an upside move past $410 levels earlier. After a very strong performance in Q4 2025, the ZEC price has been moving sideways and is currently finding support at $400.

Amid the rally across the privacy coin sector, ZCash is showing decent performance as of now. Crypto analyst Ken Charts said Zcash (ZEC) is showing early signs of stabilization after recent downside pressure.

In a commentary shared this week, the analyst said the $360 level had long been a critical support zone where buyers needed to step in. According to Ken Charts, that level remains a key “line in the sand” for bullish market structure.

At the same time, Layer-1 privacy coin Canton Network (CC) has also shown strength. The CC price surged to $0.151, with its daily trading volume increasing by 140% to $27.4 million, and its market cap reaching $5.21 billion.

Privacy Coins Face Major Blow from UAE Regulator

Dubai’s financial regulator has banned the use of privacy-focused cryptocurrencies within the Dubai International Financial Centre (DIFC). The regulator cited concerns related to anti-money laundering and sanctions compliance.

The move is part of a broader overhaul of the emirate’s crypto regulations. This regulatory action will transfer greater responsibility for token approvals to firms and tightens the regulatory definition of stablecoins.

Under the updated Crypto Token Regulatory Framework, which takes effect on January 12, the Dubai Financial Services Authority (DFSA) is shifting its approach. This includes moving away from approving individual crypto assets and toward stricter enforcement of international compliance and risk management standards.

The post Privacy Coins Monero (XMR), ZCash (ZEC), Canton CC Rally 8-20% Amid Rising Demand appeared first on The Market Periodical.