The release of the People's Bank of China's "Action Plan for Further Strengthening the Management Service System and Related Financial Infrastructure for Digital Currency" by the end of 2025 marks the official transition of digital yuan from the "Digital Cash 1.0" era into the "Digital Deposit Money 2.0" era.

The core change is that, starting from January 1, 2026, the balance in digital RMB wallets will begin to earn interest. Its legal nature will also shift from being a direct liability of the central bank to becoming one that is characterized by...Commercial Bank LiabilitiesThe legal currency of the property.

Common Challenges of Global CBDCs and the Breakthrough of Digital RMB

More than 130 monetary authorities around the world are exploring.CBDC stands for Central Bank Digital Currency.The practice has generally fallen into a difficult-to-reconcile paradox: how to introduce digital currency while preventing it from undermining the foundation of the traditional banking system? The root of this issue lies in concerns about financial disintermediation—the fear that if central banks directly offer the public safe and convenient digital legal tender, it could lead to a loss of deposits for commercial banks and disrupt their credit-creation function.

Therefore, whether it is the European Central Bank's discussion on imposing holding limits on the digital euro or the Bank of Japan's clear warnings, the underlying logic is essentially defensive. By strictly defining retail CBDC as non-interest-bearing digital cash (M0), they aim to reduce its appeal compared to bank deposits, thereby ensuring financial stability. However, this approach often leads to weak adoption of CBDC due to the lack of incentives for both users and banks, resulting in a divergence between the functionality and objectives of CBDC.

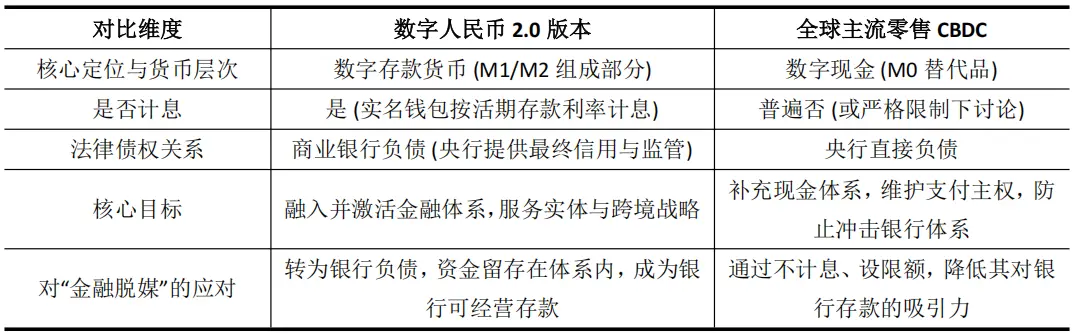

Based on this, the digital yuan will become the world's first CBDC that pays interest on the balances in ordinary users' digital wallets. Digital Yuan 2.0 redefines the monetary creditor-debtor relationship through institutional innovation, aiming to resolve risks and generate new momentum within the banking system. Its differences from other retail CBDCs globally include:

This model transforms digital RMB from a "circulation outside the banking system" that could potentially impact banks, into "blood within the body," deeply integrated into banks' balance sheets.

Commercial banks have management rights and revenue rights over deposits of digital RMB, shifting their motivation for promotion from "passive responsibility fulfillment" to "active operation," thus forming a sustainable market-driven promotion mechanism. At the same time, clear deposit insurance protection eliminates users' concerns about credit risk.

This not only addresses the issue of incentives, but also signifies that digital RMB has officially been incorporated into the traditional framework of monetary creation and regulation. It provides the central bank with a new policy variable (digital RMB interest rate) that can be directly applied. Additionally, the traceability of digital RMB transactions creates conditions for implementing precise and structural monetary policies.

Defining a New Form: The "Hybrid" of CDBC and Tokenized Deposits

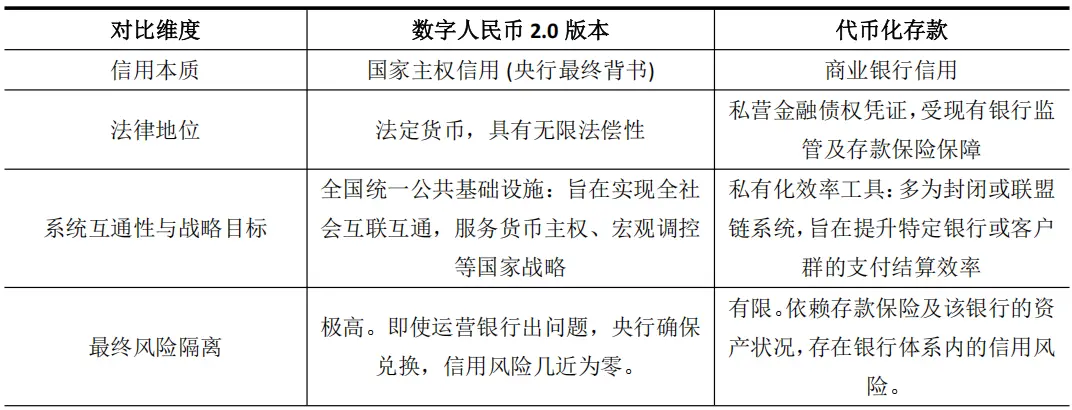

The e-CNY 2.0, due to its interest-bearing and banking operational features, is somewhat similar to tokenized deposits promoted by commercial banks. The latter refers to digital representations of bank deposits on a blockchain (such as JPM Coin by JPMorgan), designed to enhance settlement efficiency between institutions. However, this similarity is only superficial; the two differ fundamentally in terms of credit foundation and strategic significance.

Digital RMB 2.0 actually creates a new hybrid form: it adopts the efficiency characteristics of tokenized deposits, but its core is the full national sovereign currency credit.

This distinction is crucial. The creditworthiness of tokenized deposits is closely tied to the balance sheet of the issuing bank, and their essence lies in optimizing the efficiency of existing financial intermediaries. In contrast, the credit foundation of Digital Currency 2.0 remains national sovereignty, with the goal of building fundamental financial infrastructure to support the future digital economy.

The report from the Institute of Fintech at Tsinghua University also points out that this state-backed, programmable digital currency provides a core pivot for building a dual-platform model of "blockchain + digital assets."

Therefore, the upgrade to Digital RMB 2.0 goes far beyond the evolution of a payment tool; it also pre-establishes a "settlement track" with the highest credit rating for the upcoming era of large-scale asset tokenization.

Empowering Hong Kong's Digital Financial Ecosystem with Interest-Bearing Digital Currency

The strategic elevation of digital RMB has the most direct and profound impact on Hong Kong, which is unique in terms of geopolitics and institutional framework.

The key variable of interest-bearing has fundamentally changed the nature of digital RMB in cross-border and financial scenarios, transforming it from a "payment channel" into a "strategic asset." This evolution provides substantial support at multiple levels for Hong Kong's development as an "international digital asset hub."

First, interest payments address the motivation for cross-border capital retention, directly enhancing Hong Kong's function as an offshore RMB funding pool.

In the cross-border payment network based on the multilateral central bank digital currency bridge (mBridge), interest-free digital currencies serve merely as a medium of exchange, and businesses are motivated to settle transactions quickly to reduce capital occupation costs. Once interest is applied, the digital yuan gains attributes that enable it to compete with offshore RMB deposits in Hong Kong. Treasury centers of multinational corporations can then use it as an interest-earning liquidity management tool, allowing funds to remain longer within Hong Kong's compliance framework.

Currently, the share of digital yuan in mBridge transactions has exceeded 95%. The interest-bearing policy is expected to convert this traffic advantage into a stock advantage, helping to expand and deepen Hong Kong's offshore RMB funding pool and consolidate its hub status.

Second, the interest-bearing feature enhances the credit appeal of digital RMB as a currency for tokenized asset issuance and settlement in Hong Kong.

Hong Kong is actively promoting the tokenization of assets such as bonds. In such delivery versus payment (DvP) settlements, the credit rating of the settlement currency directly affects the product's risk pricing and market acceptance. Digital RMB that pays interest and is backed by national credit has a much higher credit rating than tokenized deposits from any single bank.

The Hong Kong Monetary Authority's Ensemble project has explored the interoperability of tokenized deposits, and the digital yuan 2.0 could serve as a higher-level settlement asset integrated into this ecosystem. By leveraging the programmability of the digital yuan, processes such as bond interest distribution or trade finance conditions can be automated, significantly improving efficiency and reducing operational risks.

This provides a potentially superior underlying financial infrastructure option for Hong Kong to issue high-end products such as tokenized government green bonds.

Third, the interest-bearing feature activates the innovation potential of financial services around digital RMB, bringing synergistic opportunities for Hong Kong's fintech industry.

When digital RMB becomes a bankable and interest-bearing liability, deposit, wealth management, financing, and smart contract management services around it will naturally emerge.

Hong Kong, with its common law system aligned with international standards and a vibrant financial market, serves as an ideal "sandbox" for testing such innovative services. For instance, one could develop a compliant gateway linking the digital RMB wallet with virtual asset platforms, or design structured wealth management products based on its interest-bearing characteristics.

This innovative synergy will enable Hong Kong to take the lead in the product design and rule-making of digital finance.

Fourth, interest payments deepen the differentiated and collaborative strategy between the digital yuan and Hong Kong's "e-HKD."

Hong Kong has clearly prioritized the development of a wholesale "e-HKD," focusing on large-value transactions between financial institutions and capital market applications. The interest-bearing digital RMB 2.0, on the other hand, can primarily serve cross-border retail payments, trade settlements, and related derivative financial services closely linked to the mainland's real economy.

The two are not substitutes but rather form a clear complementary structure: the digital HKD optimizes the efficiency of local wholesale financial systems, while the digital RMB deepens cross-border economic connectivity. This synergy enables Hong Kong to simultaneously strengthen its local financial infrastructure and its role as a cross-border bridge.