The Ethereum price aims to avoid a pullback by holding crucial support levels and breaking resistance.

Notably, as the new year begins, Ethereum (ETH) starts the year with a 0.0% change over the last 24 hours, trading at $2,974. The price has remained confined within the range of $2,959 to $3,012, signaling some consolidation as Ethereum struggles to break through resistance near $3,000.

In the broader context, Ethereum has posted a 1.0% increase over the past 7 days and a more encouraging 4.8% gain in the last 14 days. However, the 1-day performance shows a flat trend, reflecting a lack of strong momentum in the short term.

While Ethereum’s price has seen positive movement in the past week, it still faces challenges to break out of its recent price range. As the market begins the new year, Ethereum’s ability to overcome key resistance and build on its recent gains will be critical. Will ETH make a strong start to 2026, or will it continue to struggle within its current range?

Can Ethereum Make a Strong Start?

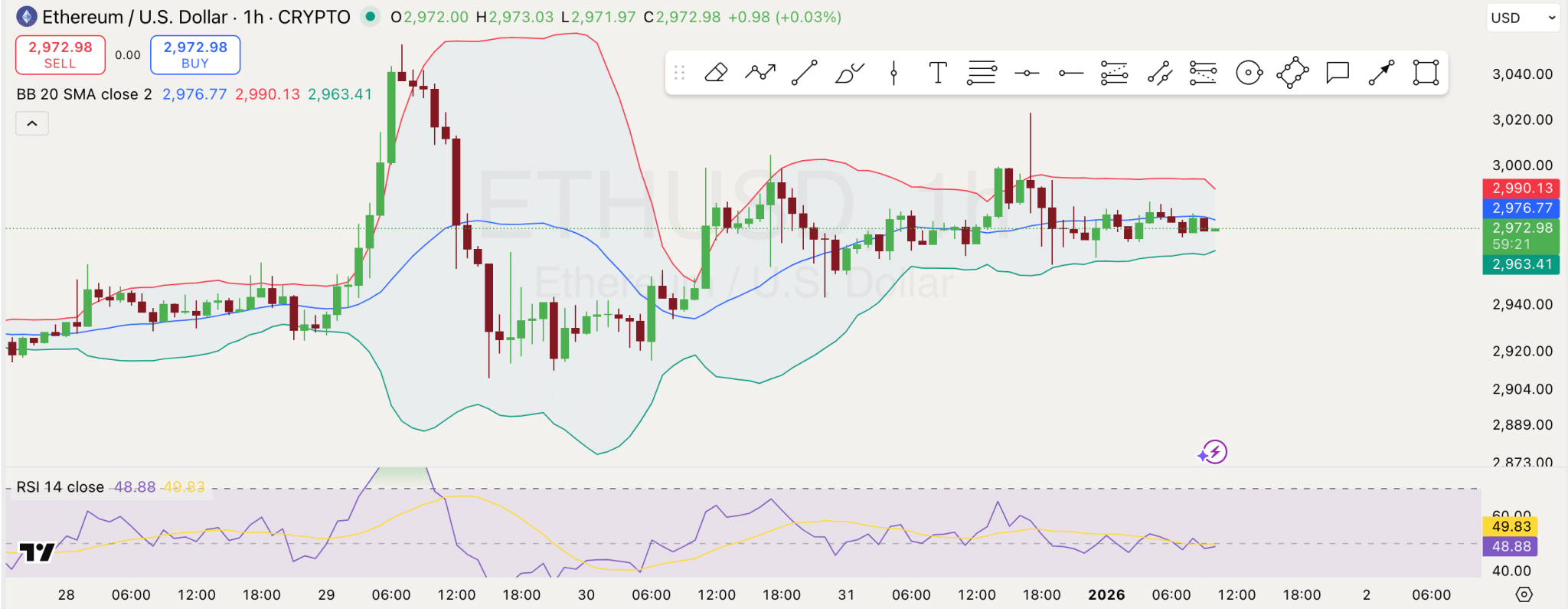

Looking at the technical charts, Ethereum’s price is moving within a narrow range between the lower and upper Bollinger Bands, sitting at $2,963 and $2,990, respectively.

The price action suggests that ETH is consolidating near the middle of this range, indicating indecision in the market. The immediate resistance is at the upper Bollinger Band around $2,990, which could cap any potential upside in the short term.

On the downside, key support sits at the lower Bollinger Band near $2,963. If Ethereum fails to hold above this level, further downside pressure could bring the price towards $2,940 or even lower.

The RSI is currently hovering around 49.83, indicating neutral market sentiment albeit with more positive momentum. However, for a bullish breakout, ETH needs to sustain a move above $2,990, while holding the support at $2,963 is crucial to avoid a deeper pullback.

Ethereum Achieves Record Contract Deployment

Elsewhere, amid Ethereum’s recent performance, analyst Joseph Young highlights a significant milestone for the network. He stated in an X post that Ethereum has just reached an all-time high of 8.7 million contracts deployed in a single quarter.

This sustained multi-quarter growth in contract deployment signals organic expansion. Key factors driving this include the growth of roll-ups and Layer 2 solutions (L2), the issuance of real-world assets (RWA), increased use of stablecoins, and the expansion of wallets and intents.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.