Key Insights:

- Coinbase now allows U.S. users to borrow up to $100,000 in USDC using ADA as collateral through Morpho integration.

- Whale wallets accumulated 240 million ADA in one week, signaling sustained large holder confidence during recent price weakness.

- ADA trades between $0.27 support and $0.30 resistance as technical indicators show short-term pressure but steady accumulation trends.

Cardano traded near $0.28 after Coinbase added ADA as eligible collateral under its on-chain lending product. The exchange integrated the DeFi protocol Morpho, allowing U.S. customers to borrow up to $100,000 in USDC using ADA, excluding residents of New York. Consequently, Cardano holders can access liquidity without selling tokens and without triggering taxable events tied to asset disposal.

Coinbase launched its on-chain lending service last year with Bitcoin and Ether and reported more than $1.9 billion in loan originations. Besides expanding collateral options, the company now includes XRP, Dogecoin, Litecoin, and Cardano to widen borrower access. Moreover, the broader collateral base reflects rising demand for decentralized borrowing solutions among retail and institutional users.

Arizona Bill Gains Momentum

Meanwhile, digital asset adoption continues to attract policy attention in Arizona. SB1649, introduced by Mark Finchem, proposes the creation of a Digital Assets Strategic Reserve Fund. Significantly, the bill passed the Senate Finance Committee by a 4 to 2 vote and now moves to the Senate Rules Committee for further review.

The proposed reserve would allow the state to manage appropriated Bitcoin, XRP, and other digital assets to generate returns. Additionally, the draft includes provisions covering stablecoins, NFTs, and DigiByte. Hence, lawmakers aim to position Arizona within the broader digital asset framework that continues to develop across U.S. states.

Whales Increase ADA Holdings

On-chain data from Santiment shows notable accumulation among large holders. Wallets holding between 1 million and 10 million ADA, alongside those holding 10 million to 100 million ADA, acquired a combined 240 million tokens over the past week. Consequently, whale participation increased even as ADA traded below key resistance levels.

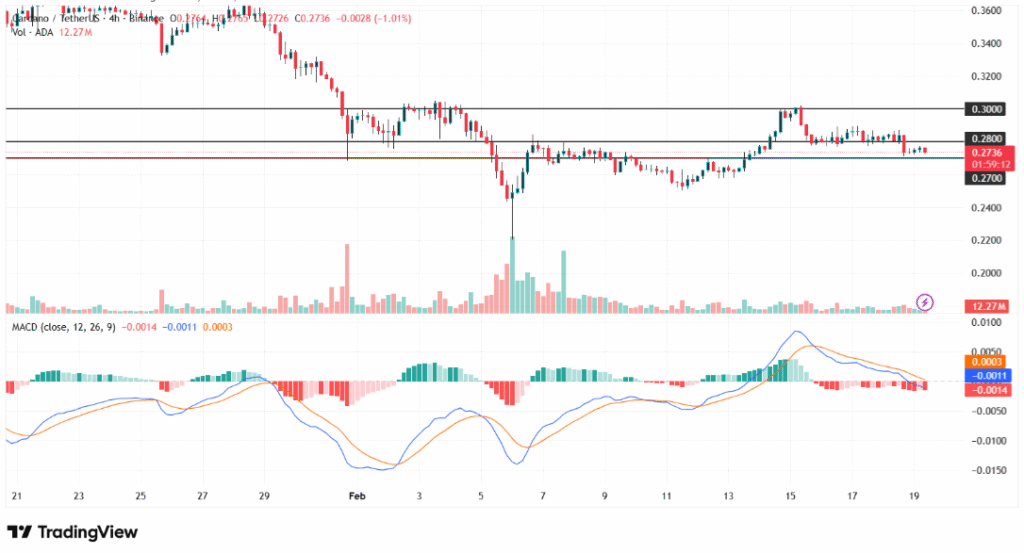

At the time of writing, ADA traded around $0.275, reflecting a mild intraday decline. However, the token continues to move between support at $0.27 and resistance near $0.30. Technical indicators such as the MACD show the signal line above the MACD line, pointing to short-term bearish pressure.

Resistance and Support in Focus

If ADA sustains strength above $0.28, price action could extend toward $0.29 and possibly test the $0.30 resistance zone. However, failure to hold the $0.27 support may open the path toward $0.26 or $0.25, depending on broader market momentum. Moreover, the combination of whale accumulation and expanded lending access keeps ADA positioned within a closely watched consolidation phase.