Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhang_web3)

Recently, the cryptocurrency community has been discussing..."California, USA Officially Seizes Assets from Dormant Accounts at Exchanges"The discussion is becoming increasingly heated. Don't panic just yet. Upon closer examination, you'll find that this is actually a delayed fermentation of an "old news" story.

This is called SB 822 refers to a specific bill or piece of legislation. However, without additional context (such as the state or country, and the The bill was signed by California Governor Gavin Newsom as early as October 2025 and will officially take effect in 2026. Its essence is to formally extend the "dormant account management system"—a practice that has been in place in the traditional banking system for decades (officially known as the "Unclaimed Property Law," or UPL)—into the world of cryptocurrency.

However, there is a great deal of misunderstanding and panic within the community. Many people mistakenly believe that simply "holding onto their coins" will result in confiscation. Odaily Planet Daily will clarify this issue for our readers in this article:Who exactly does this bill regulate, and who does it not? What exactly is the so-called "regulatory takeover"—is it a trap or a form of protection? As ordinary investors, how can we simply and effectively protect our cryptocurrency assets?

Core Mechanism: When "HODL" Turns into "Out of Contact," How Does the Three-Year Rule Work?

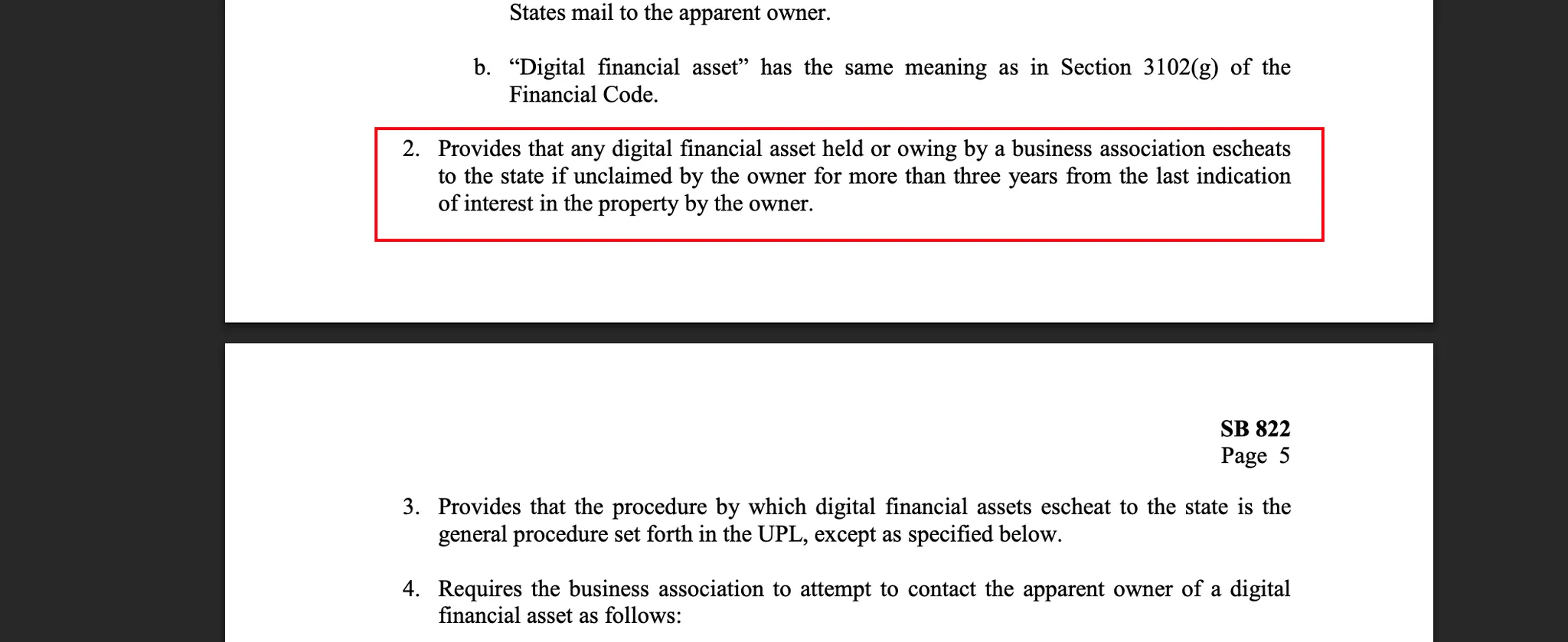

According to the provisions of Senate Bill 822,If a digital asset account has no "ownership activity" for three years, and communications from the exchange are returned undelivered or cannot be delivered, the assets will be considered "unclaimed" and trigger a transfer process.

This sounds terrifying, as if merely being a long-term holder with "diamond hands" would result in asset confiscation. However, this is not the case. The bill defines "ownership behavior" extremely broadly, which in fact constitutes the first line of protection for active users.

The original text of the SB822 bill

The so-called "acts of ownership" refer to more than just on-chain transfers or token swaps. According to the bill's text, the following actions are all considered proof that you still control the account and can directly interrupt.A three-year countdown:

- Log in account: Even if you just open the app to check your balance or log in once through the web version, it counts as an "electronic access," which is enough to reset the timer.

- One-time or recurring transaction: Whether you are buying, selling, depositing or withdrawing fiat currency, or even if an automatic deduction occurs for a scheduled investment plan you set up several years ago, all of these are considered active transactions.

- Cross-account activities: If you have multiple accounts at the same exchange (for example, a spot account and an investment account), as long as there is activity in one of the accounts, the other linked accounts will also be considered active.

- Simple communication: Sending a customer service email, or clicking the confirmation link when receiving an inquiry email from the exchange, both are considered "acts of ownership."

This means that, unless you are completely out of contact—neither logging in nor making transactions, and ignoring all emails and notifications—your assets will never be transferred without prior warning.

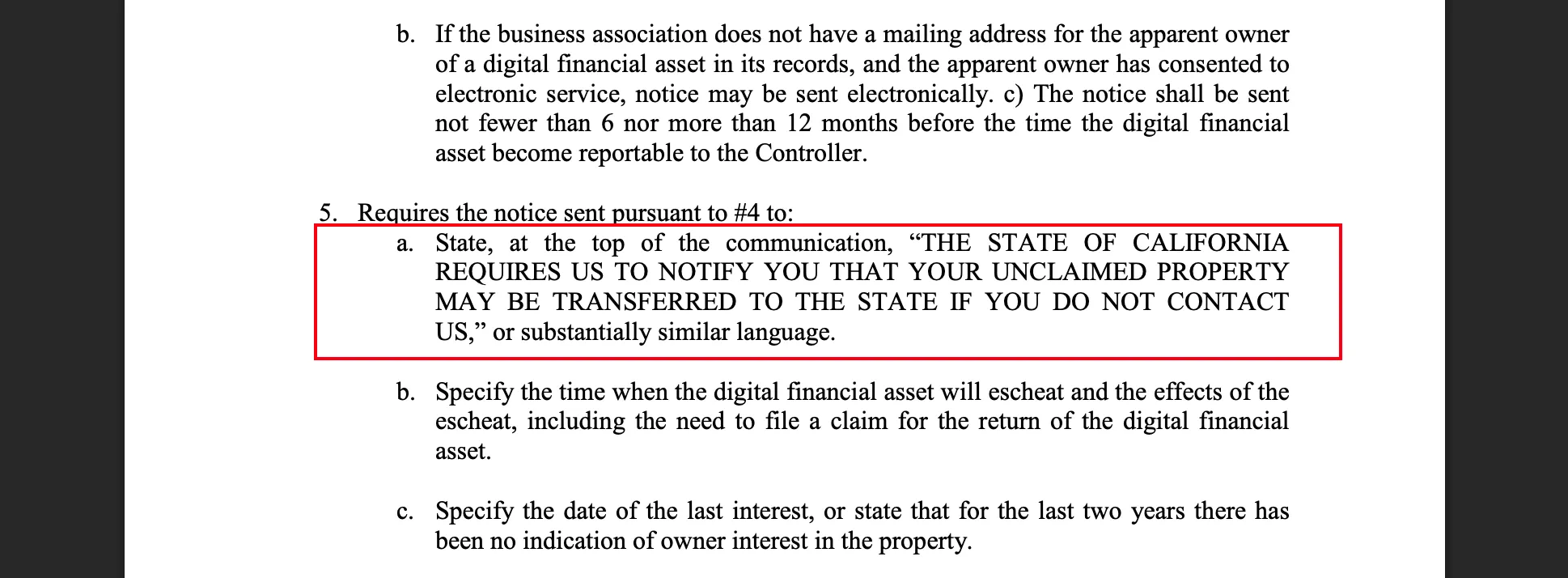

Was there a warning before it was confiscated?

To prevent users from having their assets passively confiscated due to forgetfulness, SB 822 establishes clearMandatory Notification Procedure.

According to the regulations, the exchange, as the asset holder, must report the assets to the state government prior to... 6 to 12 monthsSend a notice to the internal users. This notice is not a routine update to the user agreement; it must follow strict legal formatting requirements. At the top of the notice, it must be clearly stated in prominent bold font: "The state of California requires us to notify you that your unclaimed property may be transferred to the state government if you do not contact us."。" translates to

The original text of the SB822 bill

In addition, the notice must also include a form prescribed by the Office of the State Comptroller. The user simply needs toFill out and return this form.or through telephone, online customer service, etc.Contact the exchange to verify your identity., the account's dormant status will be immediately lifted, so-called three yearsThe countdown will also reset to zero..

The biggest misconception: Does being transferred mean being "liquidated"?

Before the implementation of SB 822, the community's biggest concern was that assets would be forcibly sold after being transferred, just like traditional securities. However, SB 822 clearly specifies that...Immediate compulsory liquidation is prohibited.making California the first state in the U.S. to legislatively protect unclaimed cryptocurrency assets to be transferred "as-is," where "as-is" includes the assets themselves and the associated private keys.

To achieve this operation, the bill even specifies handling at the level of "private keys." If an exchange holds only part of the private keys (e.g., in a multi-signature wallet), the bill requires it to attempt to obtain the remaining keys within 60 days. If it ultimately cannot obtain them, the exchange must continue to maintain the assets until transfer conditions are met, thereby technically preventing asset loss.

Furthermore, after assets are transferred into the state-regulated account, they will be entitled to 18 to 20 months protection period. During this period, the state government usually does not sell the assets, and the original owner may still apply to reclaim them.Original Quota Quantitytokens. The state government is only entitled to liquidate them after the protection period ends.

Who will be in charge of keeping it?

In response to the large demand for custodial services for digital assets, Senate Bill 822 (SB 822) authorizes the State Controller to select one or more "qualified custodians" to manage these assets. These custodians must hold a valid license issued by the California Department of Financial Protection and Innovation (DFPI) and must meet a series of strict standards, including:

- Security Level: Top-tier cybersecurity measures and private key management capabilities are required.

- Compliance Identity: It must qualify as a "financial institution" under the Bank Secrecy Act and assume anti-money laundering obligations.

- Industry Experience: Proven experience in handling digital assets (e.g., institutional-level service providers such as Coinbase Custody or Anchorage Digital).

Are cold wallets affected?

In community discussions, many experienced players are most concerned about these questions: Am I affected if I have a cold wallet where I control the private keys myself? Are my LP tokens on Uniswap affected?

The answer is clear:Unaffected.

The regulatory targets of the bill are defined as"Holder"That is, a third-party centralized institution that has control over the assets. Since self-custody wallets allow users to directly hold their private keys, there is no third party that can report to the government or transfer the assets. As long as the private key remains in the user's possession, the assets fall outside the jurisdiction of this bill.

In addition, the bill provides a precise definition of "digital financial assets,"Explicitly excludedGame virtual currencies, commercial points rewards (such as airline miles), and tokens registered with the SEC as securities are exempted from broad regulatory oversight.

Practical Guide:How to reclaim transferred assets?

As previously mentioned, even if the assets have been transferred to the state government's name, the original owner and their legal heirs still have the right to claim them.Property rights do not disappear.and the right to file a claim with the California State Controller's Office.No time limitThe specific claim outcome depends on the timing of the application: if applied for before the assets are liquidated (i.e., 18-20 months after government seizure), the owner can recover the assets.Original amount of cryptocurrency; if applied for after liquidation, only the proceeds from the asset sale can be claimed.Net cash income.

What needs to be cautious about is that, as the bill takes effect, there may be fraudulent intermediaries offering to apply on behalf of others in the market. California State Controller's Office official website (sco.ca.gov) is the only official channel for inquiries and applications, and the processNo fees are charged.Any request for advance payment of handling fees to unfreeze assets carries the risk of fraud.

How to avoid custody risks?

The key to mitigating the risks of SB 822 lies in regularly breaking an account's dormant status. Since the law is triggered by "three consecutive years of inactivity," long-term holders only need to periodically perform simple actions to avoid this.Ownership ConductThat's it. For example, every other year.Log in to the exchange account once.Click to check the balance, or make a very small transaction. These actions will be recorded by the system as active status, thereby resetting the three-yearThe countdown restarts..

For users with large assets, the most thorough solution isWithdraw assets to a non-custodial walletOnce assets leave the exchange and enter a cold wallet under private key control, they no longer fall under the "custodied assets" as defined by the bill, thereby addressing the issue at its root.Exempt from the jurisdiction of escheat lawsThis not only helps avoid policy-driven transfers but also protects against the risk of exchange misappropriation or collapse (just think of the lessons from FTX).

In addition, there is another often-overlooked aspect: estate planning. In many cases, assets become "unclaimed" because the asset holder passes away unexpectedly, and their family is completely unaware of the existence of this digital wealth. SB 822 objectively provides an administrative safeguard for these accidentally lost digital assets. Therefore, with the purpose of being responsible for family wealth, it is advisable to create a memorandum detailing the location of assets and properly inform family members, ensuring that in extreme situations, family members can retrieve them through official channels.Recover these digital inheritances.

Conclusion: The Double-Edged Sword of Compliance

The enactment of Senate Bill 822 is undoubtedly another milestone in the mainstream adoption of crypto assets. It grants digital assets the same legal status as bank deposits and stocks, particularly offering special protections against forced liquidation. This move also marks that regulators are genuinely recognizing the unique characteristics of crypto assets and striving to find a balance between protecting consumer rights and adapting to the nature of the technology.

At first glance, the state government's action seems to be "meddling unnecessarily," but upon deeper examination of its underlying logic, it is actually a response to...Strong constraints on the power of third-party custodians.Without a mature legal mechanism for establishing ownership, huge sums of wealth that remain dormant due to forgetfulness, accidents, or users becoming unreachable could ultimately become the "private property" of the exchanges.

Bill SB 822 leveragesAdministrative guaranteeThis approach has established a permanent "lost and found" system for digital assets, successfully bringing personal wealth that might otherwise have been lost due to platform closures back within the boundaries of legal protection.