Key Insights:

- U.S. spot Bitcoin ETFs saw $471 million in daily inflows on Jan. 2. BTC moved closer to the $90,000 resistance. Traders increased exposure as momentum built.

- Despite the one-day rebound, ETF sentiment remains fragile, with IBIT posting outflows in eight of the past 10 weeks.

- Broader market signals remain bearish, as Glassnode data shows slowing capital inflows and rising loss realization among long-term holders.

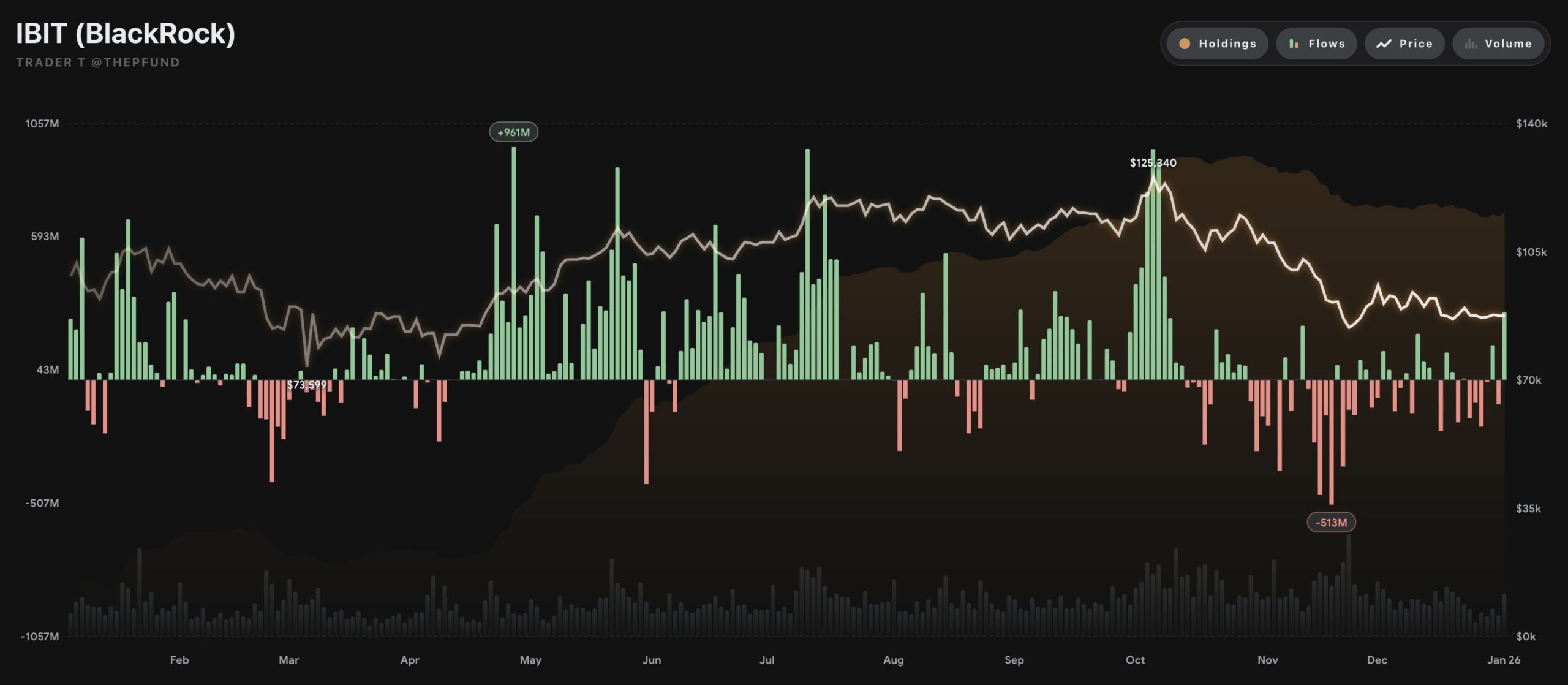

BlackRock’s Bitcoin ETF (IBIT) reversed December’s trend. It recorded relief inflows of $287.4 million on Jan. 2. This marked a sharp shift after major outflows.

This comes as the BTC price shows some strength, moving once again closer to its strong resistance at $90,000. The total inflows across all US ETF issuers stood at $471 million yesterday.

BlackRock Bitcoin ETF Starts 2026 On a Strong Note

BlackRock’s Bitcoin ETF (IBIT) saw strong demand on Jan. 2. It recorded net inflows of 3,199 Bitcoin. The value was about $280.1 million in the first trading session. Furthermore, IBIT’s daily trading volumes have also reached $3.4 billion.

Along with Blackrock, other asset managers also contributed to the inflows on Jan. 2. Fidelity’s FBTC saw inflows at $88.1 million while Bitwise’s BITB saw inflows at $45.7 million. The net inflows across all U.S. ETF issuers totaled $471.3 million.

BlackRock’s iShares Bitcoin Trust had an eventful 2025. With this, the IBIT shares experienced volatile swings in the range of $44 to $72.

However, the stock has corrected more than 30% from its peak in October 2025. Amid yesterday’s inflows, the IBIT share price has once again regained the crucial $50 support level.

Bitcoin ETFs Faced A Tough 2025

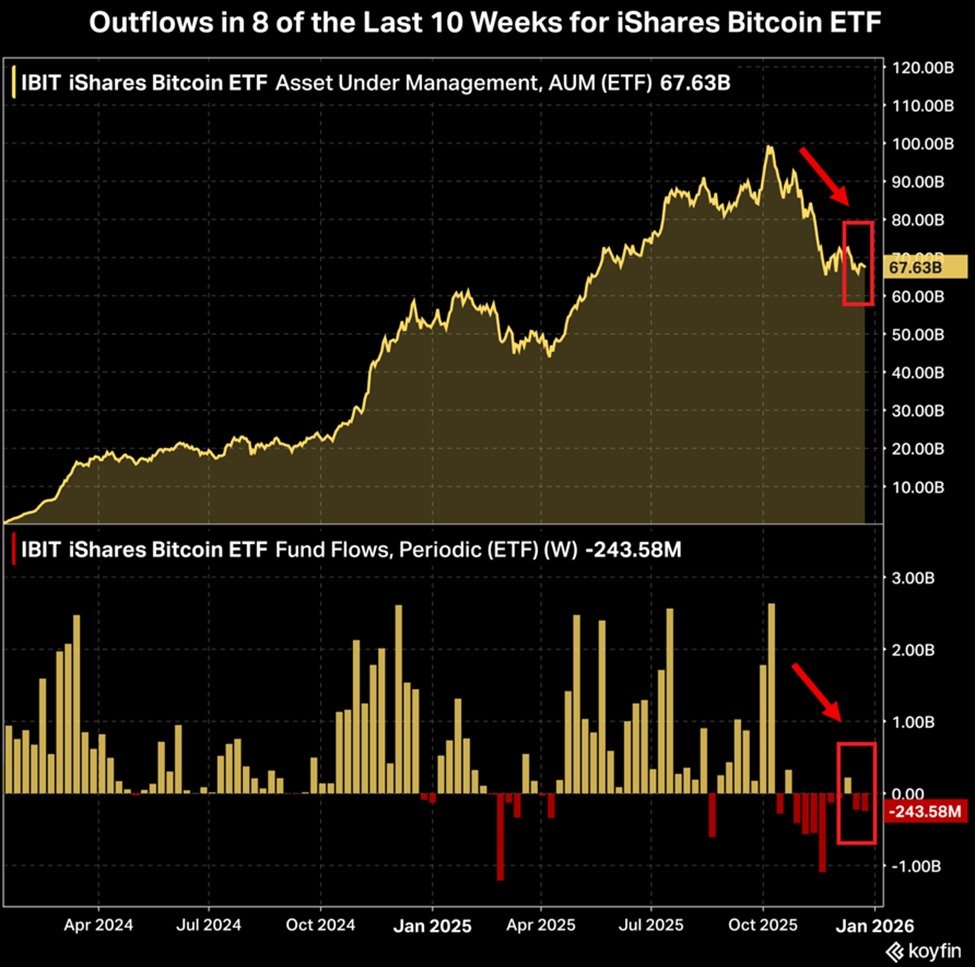

Despite the single-day inflow, recent trends highlight mounting pressure on Bitcoin ETFs. IBIT posted $244 million in net outflows last week, marking its second consecutive week of withdrawals.

The fund has now recorded outflows in eight of the past 10 weeks. This brings its total number of weekly outflow periods to 20 since its launch in January 2024.

As a result, IBIT’s assets under management have fallen to $67.6 billion. It’s close to their lowest level since June 2025. From its October 2025 peak, the fund’s AUM has declined by roughly $32 billion, representing a 32% drawdown. The Kobeissi Letter shared this on X.

However, this weakness isn’t just limited to the BlackRock Bitcoin ETF. Across the broader market, crypto investment funds saw $446 million in net outflows last week. It also marks the sixth weekly withdrawal over the past nine weeks.

The sustained redemptions suggest investors remain cautious. Moreover, investors remain cautious as the BTC price continues to search for the bottom.

BTC Price Faces Extended Bearish Phase

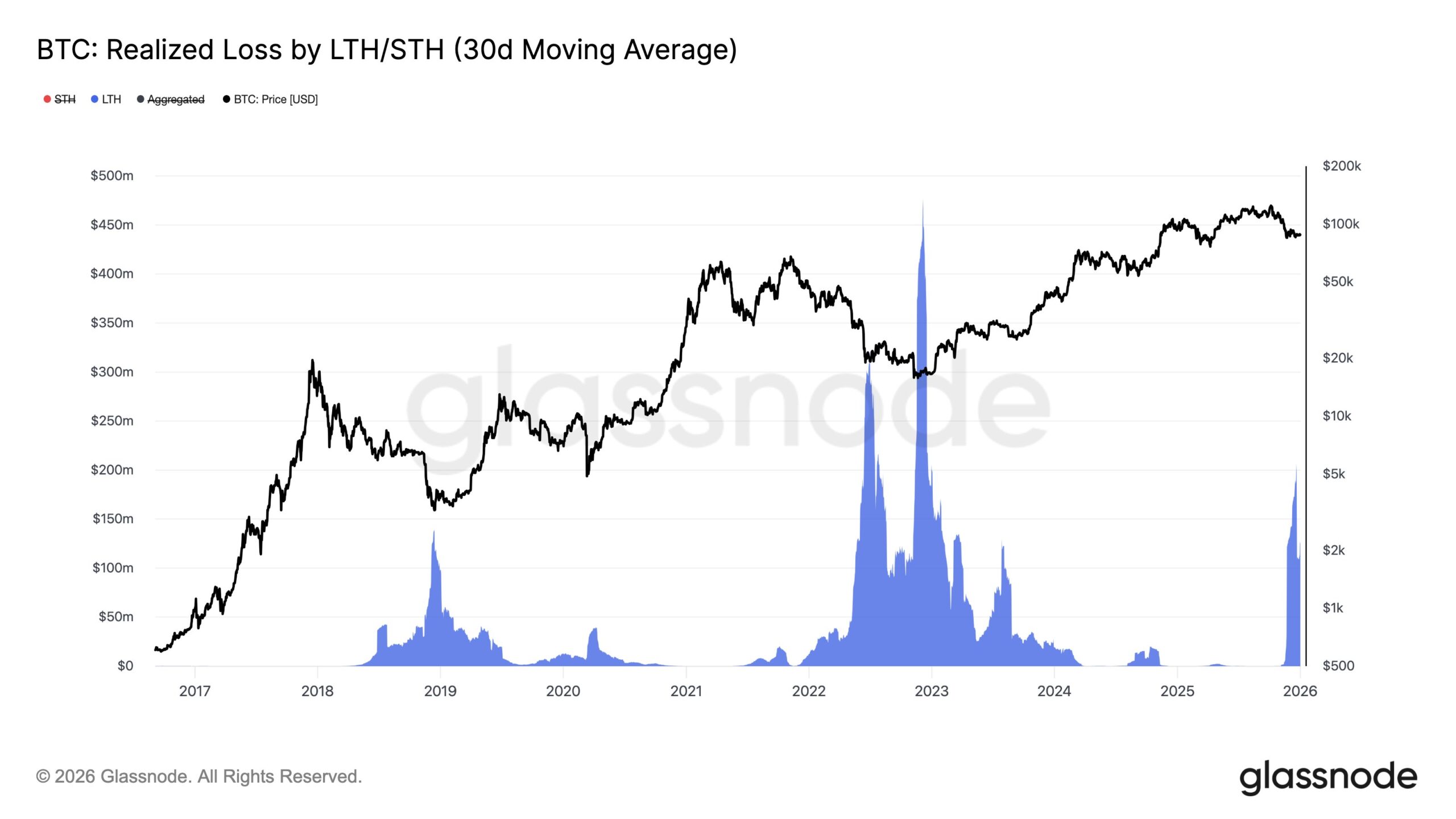

BTC price faced a major bearish Q4, against everyone’s expectations, and ended 2025 in a negative territory. Apart from the ETF outflows, long-term holders and Satoshi-era whales have also been offloading their Bitcoins.

Blockchain analytics firm Glassnode reported that capital inflows into the crypto market have slowed. This happened alongside a rise in loss realization among long-term Bitcoin holders.

According to the firm, this dynamic is developing while prices remain locked in a narrow trading range. This clearly hints at investor fatigue. Glassnode noted that such conditions are typically observed during prolonged bearish phases.

Thus, extended consolidation and limited upside momentum lead long-term investors to gradually capitulate. Weak inflows, rising realized losses, and compressed price action combine to signal bearish sentiment.

Traders see this as a clear indication of market weakness. Momentum remains tilted toward the downside.

The post BlackRock Bitcoin ETF Gains Inflows as BTC Price Stays Bearish appeared first on The Market Periodical.