Key Insights

- BitMine staked $604.5 million in Ethereum on January 6.

- The company deployed 779,488 ETH worth $2.52 billion over 10 days.

- Total Ethereum holdings reached 4.14 million ETH worth $13.2 billion.

BitMine Immersion Technologies staked 186,336 ETH worth $604.5 million on January 6, 2026. The company made its largest single staking deposit. This milestone marked a historic achievement in BitMine’s staking operations.

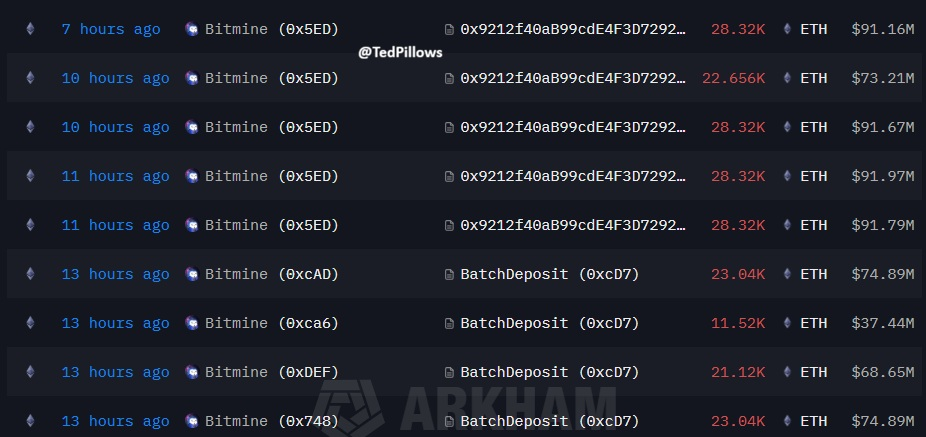

The transaction was completed 10 days from December 27 through January 6. During this, BitMine deployed 779,488 ETH valued at $2.52 billion into Ethereum’s staking contracts.

BitMine Stakes $604.5M in Largest Single Deposit

BitMine executed its largest staking transaction on January 6. The company deposited 186,336 ETH worth $604.5 million. Each coin was valued at $3,243. The single-day stake exceeded all previous deposits by the company.

Initial deposits in late December averaged approximately $200-350 million daily before climbing to the peak $604.5 million deposit. The January 6 transaction alone accounted for 24% of the total 10-day staking volume.

Previous daily stakes included smaller amounts as the company ramped activity. December 27 saw the first deposits as BitMine initiated its staking program.

The staking infrastructure supporting this activity uses three institutional partners. At the same time, BitMine prepares its proprietary Made in America Validator Network (MAVAN). MAVAN is scheduled for commercial launch in Q1 2026.

Ten-Day Staking Spree Totals 779,488 ETH

BitMine deployed 779,488 ETH worth $2.52 billion into staking contracts between December 27, 2025, and January 6, 2026. The 10-day accumulation accounts for 19.9% of BitMine’s total Ethereum holdings.

Most corporate holders stake gradually over months or quarters. BitMine compressed this timeline into 10 days.

The company started conservatively with smaller deposits before escalating to the $604.5 million final transaction.

Staking these tokens generates yield at Ethereum’s composite rate of approximately 2.81%. The 779,488 ETH committed produces estimated annual rewards of $21.9 million based on current rates.

BitMine Holds 3.43% of Ethereum Circulating Supply

BitMine’s total Ethereum holdings reached 4.14 million ETH as of January 6. The position represents 3.43% of Ethereum’s circulating supply, making BitMine the largest corporate holder.

The company accumulated the entire position since launching its Ethereum program on June 30, 2025.

Chairman Tom Lee pursues a goal denominated the “Alchemy of 5%” to acquire 5% of all Ethereum in circulation. Reaching this target requires approximately 1.5-2 million additional ETH.

BitMine began with zero Ethereum holdings in June 2025. The company scaled to 1.523 million ETH worth $6.6 billion by mid-August.

Holdings reached 3.73 million ETH in early November, 3.86 million in early December, and 4.11 million by late December.

Recent December acquisitions included major purchases timed to market dips. December 8 saw 138,452 ETH acquired for $429 million, the largest non-staking purchase since October 19. December 15 added 102,259 ETH for $320 million.

December 16 brought 48,049 ETH for $140 million. December 30 added 32,938 ETH for $97.6 million. January 4 completed the most recent weekly acquisition of 32,977 ETH.

Staking Yields Project $374M Annual Revenue

BitMine’s staking activity changes its balance sheet from static treasury to a yield-generating operation.

The company held 4.14 million ETH in its position. This stake could generate $374 million in annual revenue. The projection assumed Ethereum’s current 2.81% composite staking rate.

Staking returns provide a material income stream within BitMine’s financial profile. The $374 million annual projection exceeds many traditional corporate treasury returns.

Cash equivalents earn approximately 4-5% currently, but apply only to dollar-denominated reserves. Ethereum staking yields apply to the full crypto treasury value.

The post BitMine Locks $2.5 Billion in Ethereum Staking Within 10 Days appeared first on The Market Periodical.