Original Title: Bitcoin is now less volatile than Nvidia, a statistical anomaly that completely changes your risk calculation

Original Author: Gino Matos, CryptoSlate

Original Translation: Saoirse, Foresight News

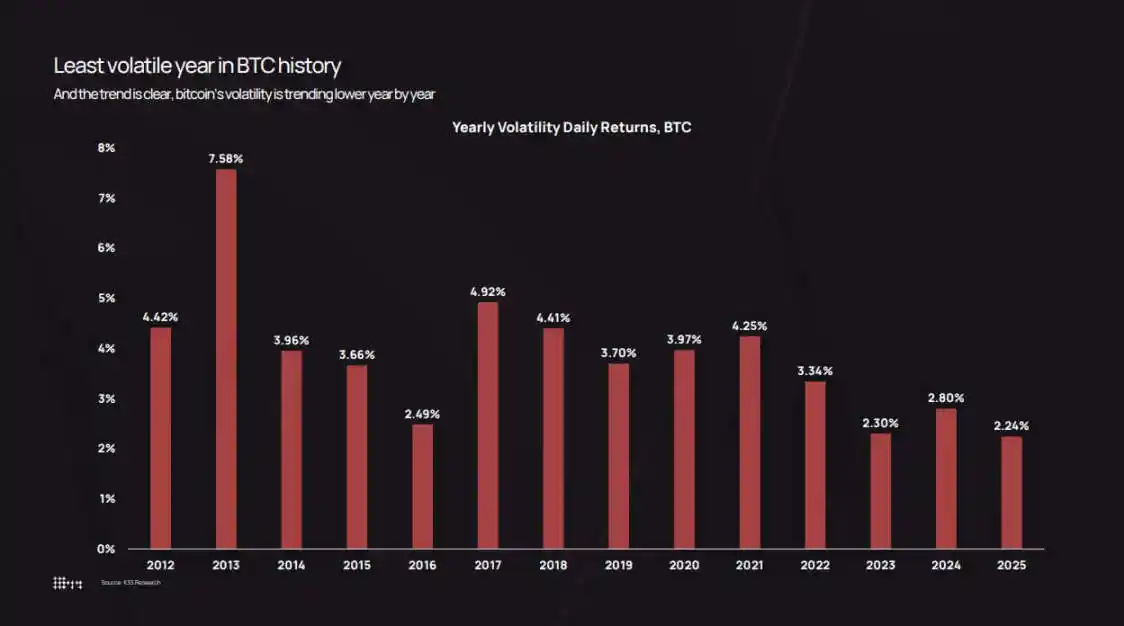

Bitcoin's actual daily volatility dropped to 2.24% by the end of 2025, setting the lowest annual record since the asset was first tracked.

K33 Research's volatility chart dates back to 2012, when Bitcoin's daily volatility was 7.58%. The data shows that Bitcoin's volatility has been steadily decreasing in each cycle: it was 3.34% in 2022, 2.80% in 2024, and further dropped to 2.24% in 2025.

However, market sentiment often deviates from the data. In October 2025, the price of Bitcoin plummeted from $126,000 to $80,500, a distressing decline. On October 10th, a liquidation wave triggered by tariff policy changes erased $19 billion in leveraged long positions in a single day.

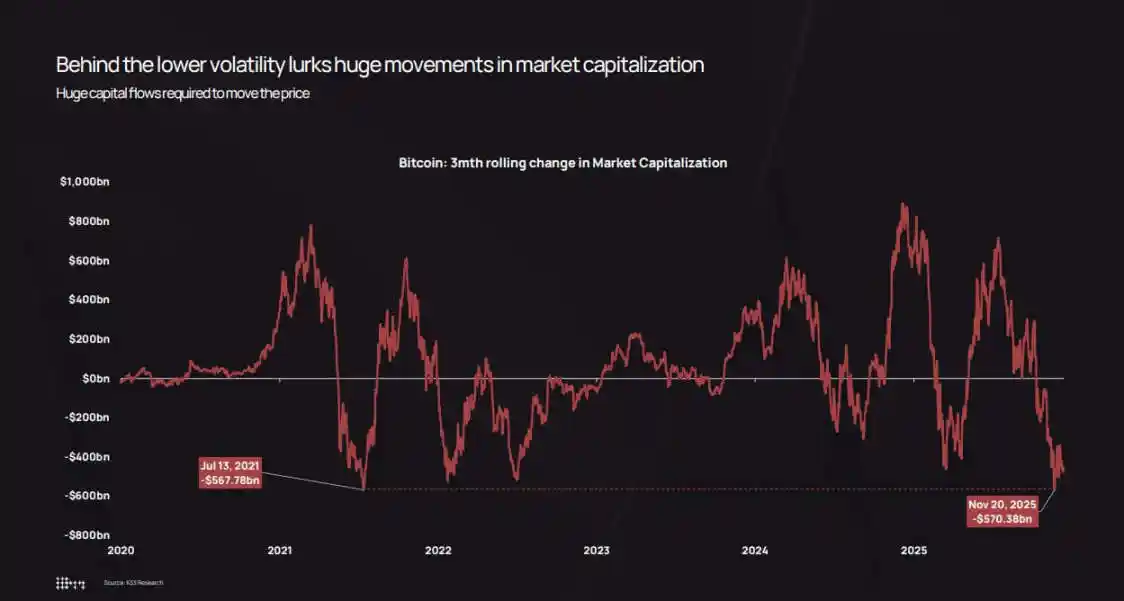

The contradiction lies in the fact that, by traditional standards, Bitcoin's volatility has indeed decreased. However, compared to previous cycles, it is attracting larger inflows of capital and experiencing higher absolute price fluctuations.

Low volatility does not mean that "the market has fallen silent," but rather indicates that the market has become sufficiently mature to accommodate institutional-level capital flows without triggering the kind of "chain reaction" feedback loops seen in earlier stages of the cycle.

Today, ETFs, corporate treasuries, and regulated custodians have become the "ballast" of market liquidity, while long-term holders continue to reallocate assets into this infrastructure.

The end result is that Bitcoin's daily returns have become more stable, but market capitalization fluctuations still amount to tens of billions of dollars—fluctuations that in 2018 or 2021 would have been sufficient to trigger an 80% crash.

According to data from K33 Research, Bitcoin's annual volatility has dropped from a peak of 7.58% in 2013 to a historical low of 2.24% in 2025.

Volatility continues to decline.

The annual volatility data of K33 records this transition process.

In 2013, the average daily return rate for Bitcoin was 7.58%, reflecting the thin order books and speculative frenzy of the market at that time. By 2017, this figure had dropped to 4.81%; in 2020, it was 3.98%; and during the pandemic-driven bull market of 2021, it slightly rebounded to 4.13%. In 2022, the collapse of the Luna project, Three Arrows Capital, and the FTX exchange in succession pushed the volatility rate up to 3.34%.

After that, volatility continued to decline: 2.94% in 2023, 2.80% in 2024, and further dropped to 2.24% in 2025.

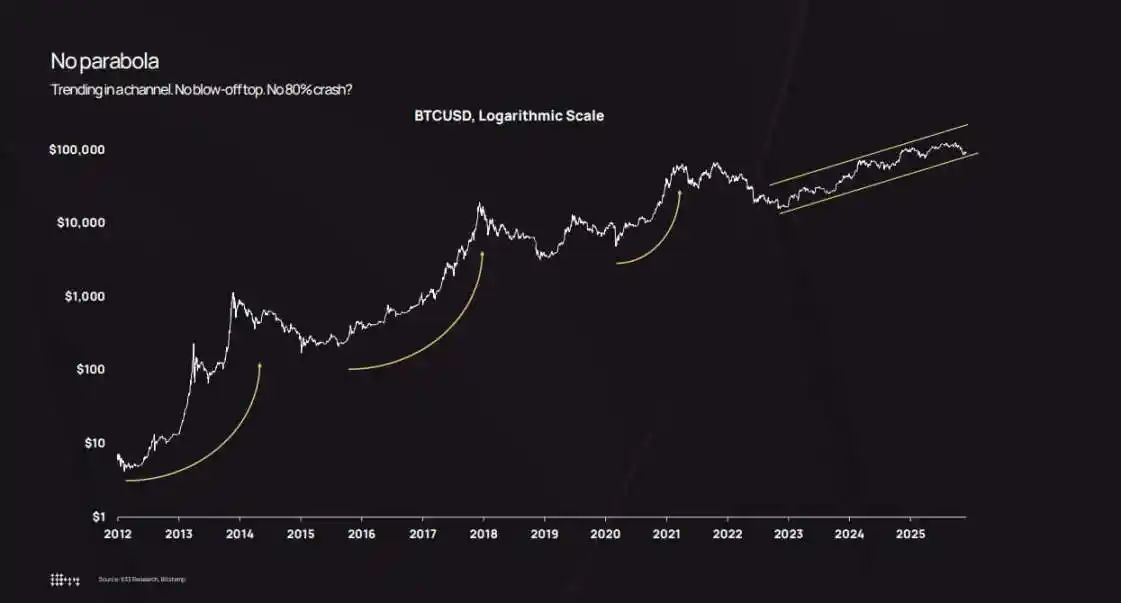

The logarithmic price chart further confirms this trend. From 2022 to 2025, Bitcoin did not experience extreme "sharp rise followed by a crash" movements, but instead steadily climbed within an upward channel.

Although there were pullbacks during this period—the price fell below $50,000 in August 2024 and dropped to $80,500 in October 2025—none of these events led to a "systemic collapse following a parabolic surge."

The analysis points out that the approximately 36% decline in October 2025 still falls within the normal historical correction range for Bitcoin. The difference lies in the context: in the past, a 36% pullback typically occurred at the end of high-volatility periods with volatility levels around 7%, whereas this time it is happening during a low-volatility period with levels at 2.2%.

This creates a "cognitive gap": a 36% drop within six weeks feels intuitively dramatic; however, compared to the early cycle (when daily fluctuations of 10% were already common), the market volatility in 2025 is already relatively calm.

Asset management company Bitwise noted that Bitcoin's realized volatility has now fallen below that of NVIDIA. This shift repositions Bitcoin from a "pure speculative instrument" to a "high-beta macro asset."

The logarithmic price chart of Bitcoin shows that since 2022, its price has slowly risen within an upward channel, avoiding the parabolic surges and subsequent 80% crashes seen in earlier cycles.

Market Capitalization Expansion, Institutional Participation, and Asset Reallocation

K33's core argument is that the decline in actual volatility is not due to a reduction in capital inflows, but rather because a much larger amount of capital is now required to drive price movements.

The institution's "Bitcoin Market Cap Three-Month Change Chart" shows that even during periods of low volatility, the market cap can still fluctuate by tens of billions of dollars.

In the drawdown from October to November 2025, Bitcoin's market value declined by approximately $570 billion, nearly matching the $568 billion drawdown in July 2021.

The magnitude of fluctuations has not changed; what has changed is the "depth" with which the market absorbs these fluctuations.

In November 2025, the market capitalization fluctuation of Bitcoin over three months reached $570 billion, which, despite lower volatility, was comparable to the $568 billion decline in July 2021.

Three major structural factors are driving the decline in volatility:

First is the "accumulation of shares" effect of ETFs and institutional investors.According to K33 statistics, ETFs are expected to net purchase approximately 160,000 Bitcoin in 2025 (although this is lower than the 630,000+ Bitcoin in 2024, the amount is still substantial). Combined with corporate treasury purchases, ETFs and institutional investors are expected to accumulate about 650,000 Bitcoin, representing over 3% of the circulating supply. These funds enter the market through "programmatic rebalancing," rather than being driven by retail FOMO (fear of missing out) sentiment.

K33 specifically noted that even if the price of Bitcoin fell by about 30%, the holdings of ETFs only declined by a single-digit percentage, with no panic redemptions or forced liquidations occurring.

Secondly, corporate treasuries and structured issuance.As of the end of 2025, corporate treasuries have accumulated approximately 473,000 bitcoins in total (with a slower pace of accumulation in the second half of the year). New demand has primarily come from preferred stock and convertible bond issuances, rather than direct cash purchases—because financial teams typically execute capital structure strategies on a quarterly basis, rather than chasing short-term market trends like traders do.

Third is the redistribution of assets from early holders to a broader group.K33's "Asset Holding Duration Analysis" shows that since the beginning of 2023, bitcoins that had been idle for over two years have begun to steadily "reactivate." Over the past two years, approximately 1.6 million bitcoins that were held long-term have entered circulation.

2024 and 2025 are the two years with the largest activation of "dormant assets." The report mentioned that in July 2025, Galaxy Digital sold 80,000 bitcoins, and Fidelity sold 2,040 bitcoins.

These sell-offs coincidentally align with the "structural demand" from ETFs, corporate treasuries, and regulated custodians, which gradually build positions over several months.

This redistribution is crucial: early adopters accumulated Bitcoin at prices ranging from $100 to $10,000, with assets concentrated in a small number of wallets; when they sell, the assets flow to ETF shareholders, corporate balance sheets, and high-net-worth clients making smaller purchases as part of diversified portfolios.

The final outcome is: reduced Bitcoin holding concentration, increased order book thickness, and a weakened "chain reaction feedback loop." In the early cycle, selling 10,000 Bitcoins in a market with thin liquidity could cause a price drop of 5% to 10%, triggering stop-losses and liquidations. However, by 2025, such a sale would attract buy orders from multiple institutional channels and could even push the price up by 2% to 3%. The feedback loop weakens, and daily volatility decreases accordingly.

Portfolio Construction, Leverage Shock, and the End of the "Parabolic Cycle"

The decline in actual volatility has changed institutions' approach to calculating "Bitcoin position size."

Modern portfolio theory suggests that asset allocation weights should be based on "risk contribution" rather than "return potential." For example, a 4% allocation to Bitcoin will contribute significantly more to portfolio risk if its daily volatility is 7% compared to if its volatility is 2.2%.

This mathematical fact forces asset allocators to make a choice: either increase their Bitcoin allocation or use options and structured products (assuming the underlying asset exhibits smoother volatility).

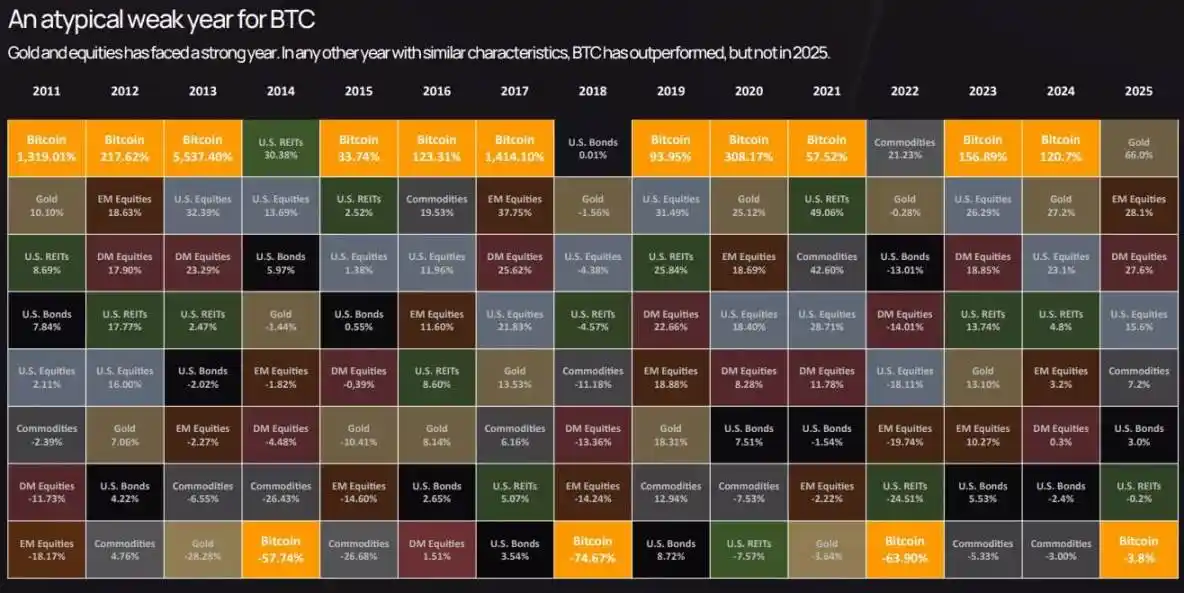

K33's cross-asset performance table shows that in 2025, Bitcoin approached the bottom of the asset return rankings—despite outperforming for multiple years in previous cycles, it underperformed both gold and equities in 2025.

Bitcoin's asset performance in 2025 ranked near the bottom, with a decline of 3.8%. In this atypical year for Bitcoin, it underperformed both gold and stocks.

This "underperformance" combined with low volatility has shifted Bitcoin's positioning from a "speculative satellite asset" to a "core macro asset"—with risk profiles similar to stocks, but return drivers uncorrelated with other assets.

The options market also reflects this shift: recently, the implied volatility of Bitcoin options has declined in line with realized volatility, reducing hedging costs and making synthetic structured products more attractive.

Previously, the compliance department often restricted financial advisors from allocating Bitcoin due to its "excessive volatility." Now, advisors have quantitative evidence: Bitcoin's volatility in 2025 will be lower than that of NVIDIA, lower than many tech stocks, and comparable to high-beta stock sectors.

This opens new investment channels for Bitcoin: inclusion in 401(k) retirement plans, allocation by registered investment advisors (RIAs), and incorporation into insurance company portfolios subject to strict volatility constraints.

K33's forward-looking data forecasts that, as these channels open, net inflows into ETFs in 2026 will surpass those in 2025, creating a "self-reinforcing cycle": more institutional capital inflows → reduced volatility → unlocking more institutional mandates → further capital inflows.

However, the market's "calm" is conditional. Derivative analysis of K33 shows that throughout 2025, Bitcoin perpetual contract open interest steadily increased in an environment characterized by "low volatility and strong upward movement," eventually triggering a liquidation event on October 10th—a single day that wiped out $19 billion in leveraged long positions.

This sell-off is related to President Trump's tariff statements and widespread "risk-off sentiment," but the core mechanism remains issues with derivatives: excessive leveraged long positions, thin liquidity over the weekend, and margin calls for leveraged certificates.

Even with an actual annualized volatility of 2.2%, there may still be "extreme volatility days" caused by leveraged liquidations. The difference is that such events are now resolved within hours rather than lasting for weeks. Moreover, due to the "price floor" provided by ETFs and corporate treasury spot demand, the market can recover quickly.

The structural background in 2026 supports the view that "volatility will remain low or further decline": K33 anticipates that as the two-year Bitcoin supply stabilizes, selling pressure from early holders will decrease. Additionally, there are positive regulatory signals—such as the U.S. CLARITY Act and the full implementation of the EU's MiCA, as well as Morgan Stanley and Bank of America opening 401(k) and wealth management channels for Bitcoin.

K33's "Golden Opportunity" data forecast predicts that Bitcoin will outperform stock indices and gold in 2026—because the impact of regulatory breakthroughs and new capital inflows will outweigh selling pressure from existing holders.

Whether this forecast can be realized remains uncertain, but the mechanisms driving the prediction—deepening liquidity, improved institutional infrastructure, and clear regulation—do provide support for low volatility.

Ultimately, the Bitcoin market will move away from the "speculative frontier" characteristics of 2013 or 2017 and become closer to a "high-liquidity, institution-anchored macro asset."

This does not mean that Bitcoin has become "boring" (such as having low returns or lacking a narrative), but rather that "the game rules have changed": the price path has become smoother, the options market and ETF flows are more important than retail sentiment, and the core transformation of the market is reflected in its structure, leverage levels, and the composition of market participants.

In 2025, despite experiencing the largest regulatory and structural changes in its history, Bitcoin has become an "institutionalized stable asset" in terms of volatility.

Understanding the value of this transition lies in recognizing that low actual volatility is not a sign that "assets have lost vitality," but rather an indicator that "the market has matured sufficiently to accommodate institutional-level capital without collapsing."

The cycle has not ended; it's just that the "cost" driving market fluctuations has become higher.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia