Key Insights

- Bitcoin ETFs recorded $458.77 million in weekly inflows ending January 2.

- BlackRock’s IBIT led Bitcoin ETF gains with $324 million weekly inflow.

- Ethereum ETFs posted $160.58M in weekly inflows but lagged Bitcoin performance.

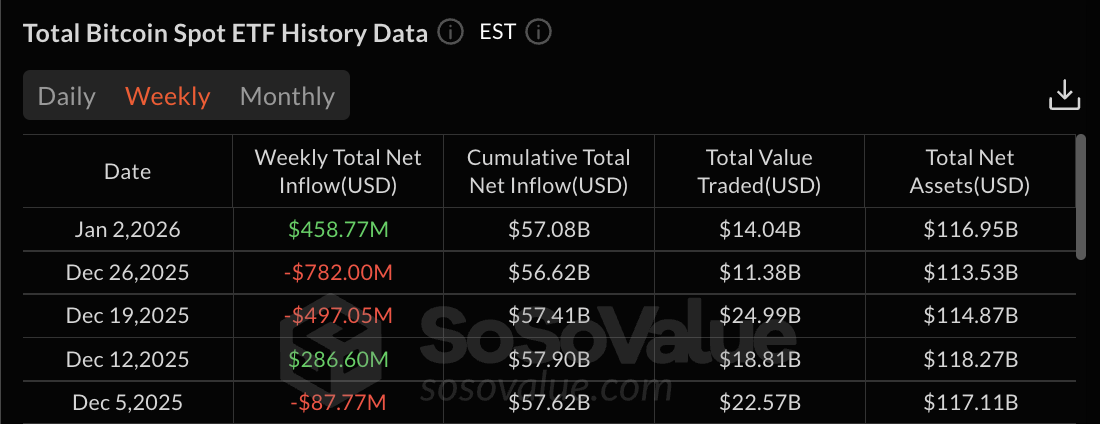

Bitcoin ETFs started 2026 with strong momentum, recording $458.77 million in net weekly inflows for the period ending January 2.

The gains show a recovery from the previous week’s $782 million outflow. Data from SoSoValue shows cumulative inflows reached $57.08 billion, while weekly trading volume hit $14.04 billion.

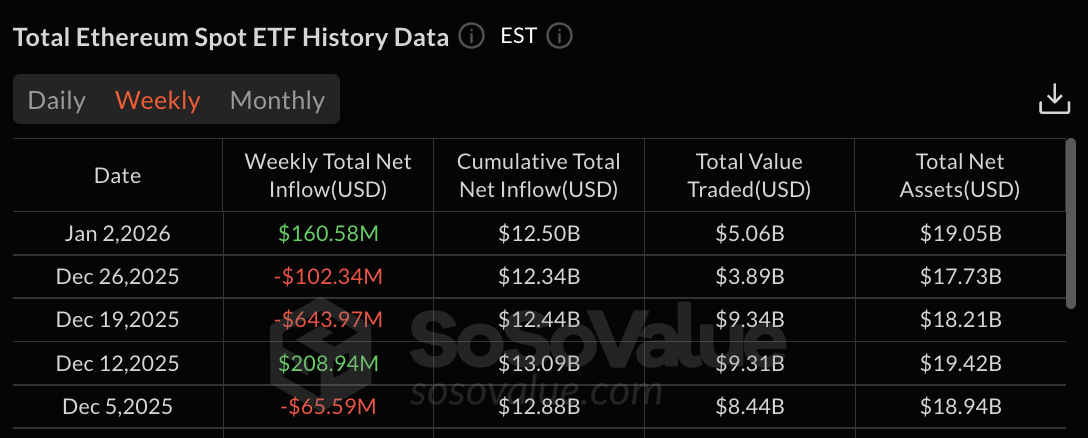

Ethereum ETFs posted $160.58 million in weekly inflows but significantly lagged Bitcoin’s performance.

BlackRock and Fidelity Drive Bitcoin ETF Gains

Bitcoin ETFs saw broad-based inflows across the final week of 2025 and first trading days of 2026. BlackRock’s IBIT led the recovery with $324 million in weekly inflows.

The product maintains $62.19 billion in cumulative inflows and total net assets exceeding $67 billion, preserving its position as the largest Bitcoin ETF.

The weekly performance included strong gains on key trading days. January 2 saw $471.14 million in daily inflows, the strongest single day during the period.

December 30 recorded $355.02 million in gains. The positive sessions offset the $348.10 million outflow on December 31 and the $19.29 million loss on December 29.

Fidelity’s FBTC posted the second-largest weekly gains among Bitcoin ETFs. The product attracted consistent inflows throughout the period.

Grayscale Bitcoin Mini Trust (BTC) recorded positive weekly flows. The product maintains $1.95 billion in cumulative inflows with total assets at $4.26 billion.

Several other products posted positive contributions, including Bitwise’s BITB, ARK 21Shares’ ARKB, and VanEck’s HODL.

Grayscale’s GBTC showed zero flows for the week. Invesco’s BTCO, Franklin’s EZBC, Valkyrie’s BRRR, WisdomTree’s BTCW, and Hashdex’s DEFI all reported no activity.

Previous Week Saw One of the Largest Bitcoin ETF Outflows

The weekly gains reversed the previous period’s performance when Bitcoin ETFs recorded $782 million in net outflows.

The week ending December 26 marked one of the worst weekly performances in recent months. All Bitcoin ETF products posted negative or zero flows during that period.

Total net assets declined from $118.27 billion on December 12 to $113.53 billion on December 26 before recovering to $116.95 billion on January 2.

The three-week period showed significant volatility with cumulative flows decreasing from $57.90 billion to $56.62 billion, then recovering to $57.08 billion.

The December 26 week included multiple days of heavy redemptions. On December 24, $175.29 million in outflows were recorded, on December 23, $188.64 million in losses were reported, and on December 22, $142.19 million in exits were posted.

Ethereum ETFs Post $160.58M Weekly Inflows

Ethereum ETFs recorded $160.58 million in weekly net inflows for the period ending January 2, bringing cumulative flows to $12.50 billion.

The performance lagged behind Bitcoin ETFs, which posted nearly three times larger weekly gains. Weekly trading volume reached $5.06 billion, while total net assets stood at $19.05 billion.

The weekly performance included January 2’s strong $174.43 million daily inflow. December 30 added $67.84 million in gains.

These positive sessions offset the $72.06 million outflow on December 31 and the $9.63 million loss on December 29. The mixed daily performance produced modest net weekly gains.

The week ending December 26 saw Ethereum ETFs post $102.34 million in outflows. The previous week recorded $643.97 million in losses, marking one of the worst weekly performances for the products.

Total assets recovered from $17.73 billion on December 26 to $19.05 billion on January 2. Cumulative inflows increased from $12.34 billion to $12.50 billion during the same period.

Solana and XRP ETFs Maintain Consistent Performance

Solana spot ETFs posted $10.43 million in weekly net inflows for the period ending December 31. Cumulative flows reached $766.20 million with total assets at $950.82 million.

XRP spot ETFs recorded weekly gains during the same period. The products have not posted a negative week since launch, maintaining an unbroken streak of positive or zero weekly flows.

The post Bitcoin ETFs Open the Year Strong With $459M Inflows; Ethereum ETFs Lag appeared first on The Market Periodical.