Key Insights

- Bitcoin ETFs record $272.02 million in outflows on February 3, 2026.

- Fidelity’s FBTC leads withdrawals with $148.70 million, the day after strong inflows.

- Ethereum ETFs attract $14.06 million as BlackRock’s ETHA contributes $42.85 million.

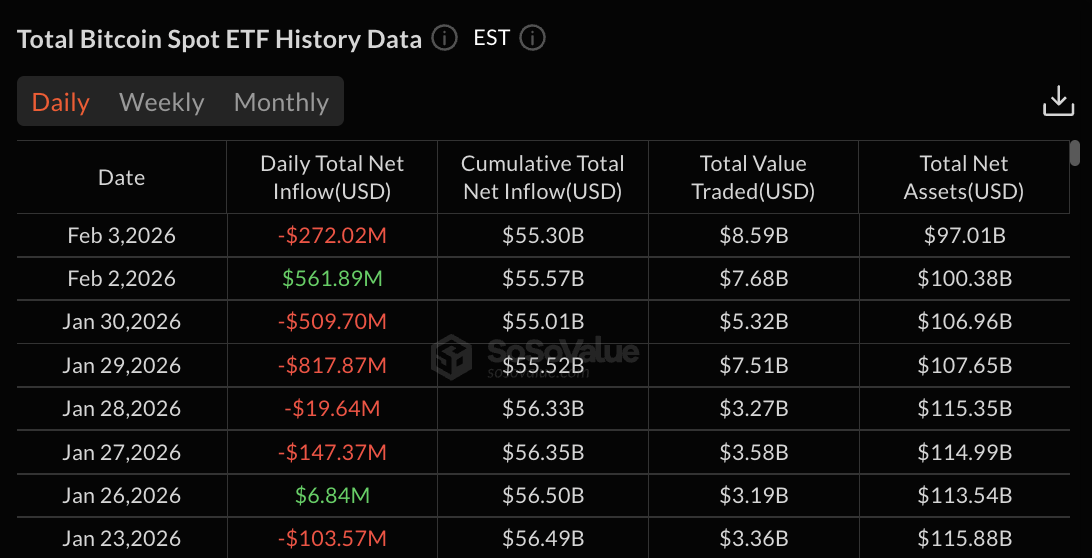

Bitcoin ETFs saw outflows of $272.02 million on February 3, 2026. This ended the brief one-day recovery from the prior trading session, according to SoSoValue data.

Fidelity’s FBTC led withdrawals with $148.70 million, reversing the $153.35 million inflow recorded on February 2. Ethereum ETFs recorded $14.06 million in inflows during the same session, the second consecutive day of positive flows.

Solana spot ETFs attracted $1.24 million, while XRP spot ETFs saw $19.46 million in inflows.

Fidelity Leads Bitcoin ETF Outflows After Prior Day’s Gains

Fidelity’s FBTC recorded $148.70 million in outflows on February 3, reversing the $153.35 million inflow from February 2.

Grayscale products experienced combined outflows of $90.43 million. GBTC saw $56.63 million exit, while the company’s BTC product recorded $33.80 million in withdrawals.

Ark & 21Shares’ ARKB experienced $62.50 million in outflows, and Bitwise’s BITB recorded $23.42 million in withdrawals.

BlackRock’s IBIT recorded $60.03 million in inflows on February 3. It was the only major Bitcoin ETF to post positive flows that day.

VanEck’s HODL recorded $4.81 million in outflows, while Franklin’s EZBC saw $2.19 million exit. Several products reported zero activity, including Invesco’s BTCO, Valkyrie’s BRRR, WisdomTree’s BTCW, and Hashdex’s DEFI.

Total value traded across Bitcoin ETFs reached $8.59 billion on February 3. Cumulative total net inflows declined to $55.30 billion from $55.57 billion on February 2.

One-Day Bitcoin ETF Recovery Proves Short-Lived

The February 3 outflows came one day after Bitcoin ETFs recorded $561.89 million in inflows. The brief recovery had ended a four-day outflow streak totaling $1.49 billion from January 27 through January 30.

Weekly data shows Bitcoin ETFs recorded $289.87 million in inflows for the period ending February 3.

The positive weekly performance came from the large $561.89 million inflow on February 2. This offset the $272.02 million outflow on February 3. The total value traded weekly reached $16.26 billion.

The week ending January 30 had recorded $1.49 billion in Bitcoin ETF outflows, following the prior week’s $1.33 billion in withdrawals through January 23.

Asset Base Continues Decline for Bitcoin ETFs

Total net assets for Bitcoin ETFs stood at $97.01 billion on February 3. They had briefly recovered to $100.38 billion on February 2. The asset base has declined $31.03 billion from the January 14 peak of $128.04 billion.

Cumulative total net inflows of $55.30 billion compare to the $57.82 billion peak reached on January 16. The $2.52 billion decrease over the period came from the extended January outflows and the February 3 withdrawal.

BlackRock Leads Ethereum ETF Inflows

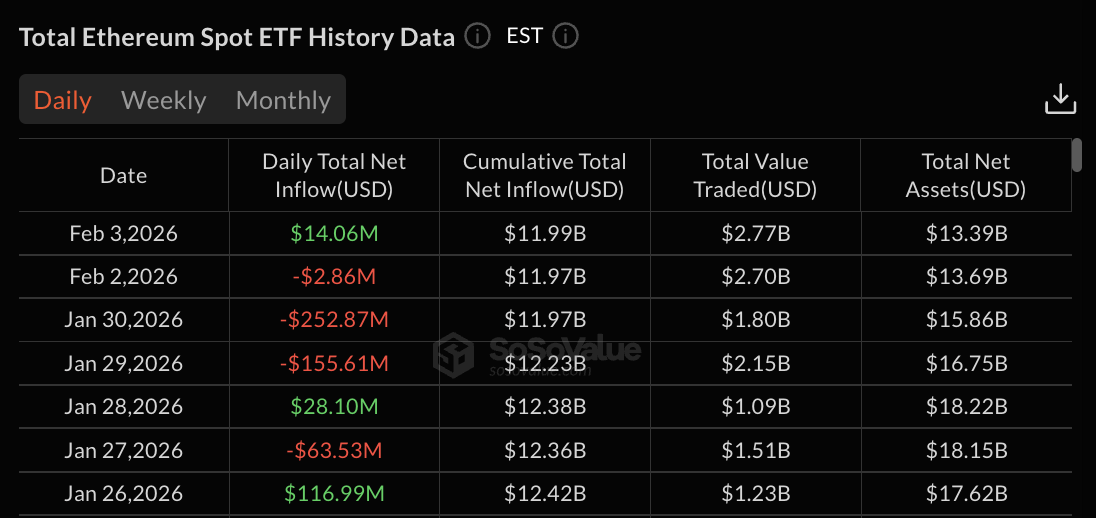

Ethereum ETFs recorded $14.06 million in net inflows on February 3, with BlackRock’s ETHA contributing $42.85 million.

Grayscale’s ETHE added $8.25 million, while the company’s ETH product recorded $19.12 million in inflows. Invesco’s QETH attracted $1.14 million during the session.

Fidelity’s FETH experienced outflows of $54.84 million, partially offsetting the gains from other sponsors.

VanEck’s ETHV recorded $2.47 million in withdrawals. Several Ethereum ETF products reported zero activity. This includes Bitwise’s ETHW, Franklin’s EZET, and 21Shares’ TETH.

Cumulative total net inflows for Ethereum ETFs reached $11.99 billion, up from $11.97 billion on February 2.

Total net assets declined to $13.39 billion from $13.69 billion. Total value traded across Ethereum ETFs reached $2.77 billion during the session.

The February 3 inflows came after Ethereum ETFs recorded $2.86 million in outflows on February 2.

Before that, the products had experienced heavy selling on January 30 at $252.87 million and January 29 at $155.61 million.

Altcoin ETFs Maintain Positive Flows

XRP spot ETFs recorded $19.46 million in inflows on February 3, the largest daily inflow among alternative cryptocurrency products.

Solana spot ETFs attracted $1.24 million during the same session. The combined $20.70 million in inflows came as both products maintained institutional interest. The positive flows across Ethereum, Solana, and XRP ETFs totaled $35.30 million on February 3.

This partially offset the $272.02 million in Bitcoin ETF outflows. This brought the net daily flow across all cryptocurrency ETF categories to $236.72 million in withdrawals. Investors pulled funds broadly, reflecting cautious sentiment across the market.

The post Bitcoin ETFs Bleed $272M Led by Fidelity, Altcoin ETFs Post Inflows appeared first on The Market Periodical.