Key Insights

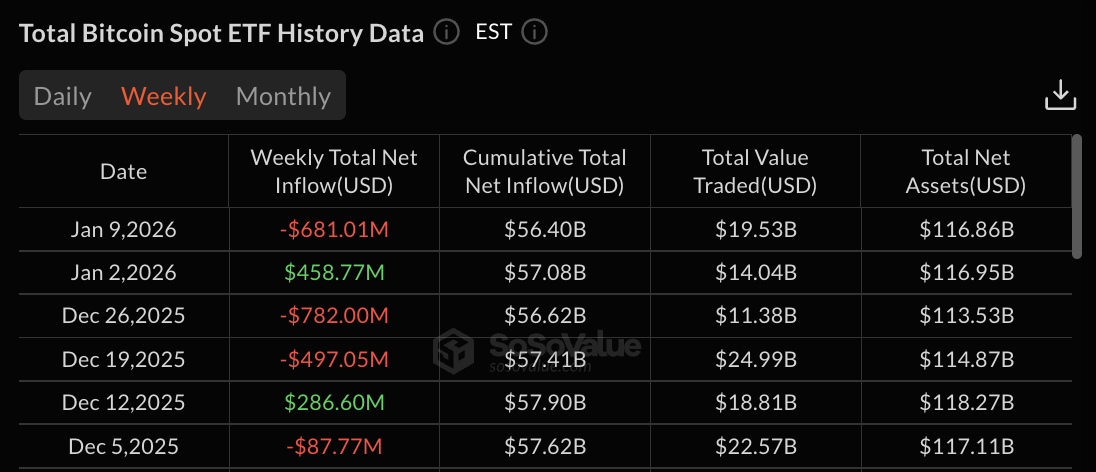

- Bitcoin ETFs recorded $681.01 million in weekly outflows ending January 9.

- Four consecutive negative days erased $1.38B following early week gains.

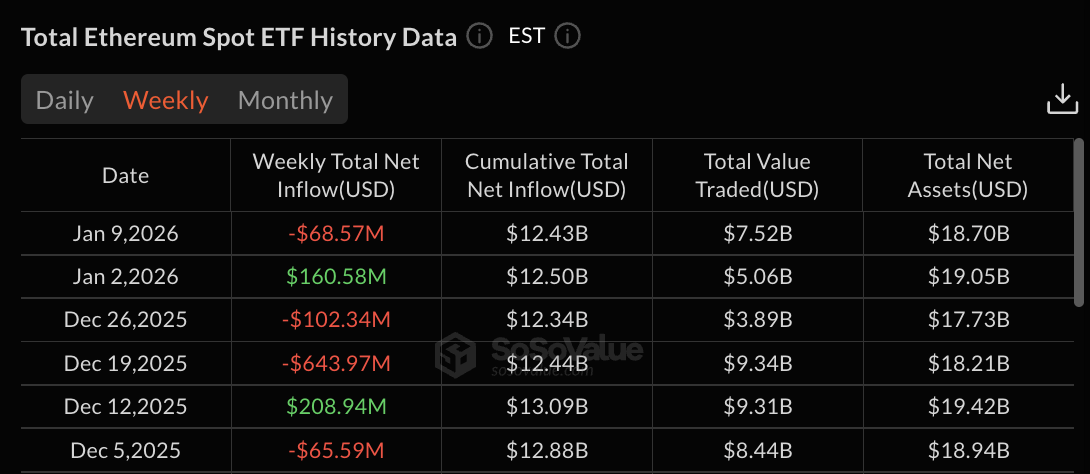

- Ethereum ETFs posted $68.57 million in weekly redemptions.

Bitcoin ETFs recorded $681.01 million in net outflows for the week ending January 9, 2026, according to SoSoValue data.

The losses followed a strong start to the week when products posted $1.17 billion in combined inflows on January 2 and 5.

Bitcoin ETFs Face Four-Day Outflow Streak

Bitcoin ETFs posted positive flows on January 2 and 5 before reversing course. January 2 recorded $471.14 million in inflows with $5.36 billion in trading volume.

On January 5, $697.25 million in gains were recorded, alongside $5.86 billion in volume. The two-day period resulted in cumulative flows of $57.78 billion and total net assets of $123.52 billion.

The outflow streak began January 6 with $243.24 million in redemptions. Trading volume reached $4.32 billion as Bitcoin ETFs faced broad-based selling pressure.

January 7 recorded $486.08 million in outflows with $3.30 billion in volume. January 8 posted $398.95 million in losses with $3.08 billion in volume. January 9 completed the streak with $249.99 million in outflows and $2.97 billion in volume.

The four days from January 6-9 produced combined outflows of $1.38 billion for Bitcoin ETFs. The losses exceeded the $1.17 billion gained on January 2 and 5, resulting in net weekly outflows of $681.01 million.

Total net assets declined $6.66 billion from $123.52 billion on January 5 to $116.86 billion on January 9.

Ethereum ETFs Record $68.57M in Weekly Losses

Ethereum ETFs posted $68.57 million in net outflows for the week ending January 9. The products began the week with strong gains before facing three consecutive days of losses.

January 2 recorded $174.43 million in inflows with $2.26 billion in trading volume. On January 5, $168.13 million in gains were recorded, alongside $2.24 billion in volume.

January 6 brought a brief reversal with $114.74 million in inflows and $1.72 billion in volume. The single positive day interrupted what would become a three-day losing streak.

January 7 recorded $98.45 million in outflows with $1.30 billion in volume. January 8 posted $159.17 million in losses with $1.15 billion in volume. January 9 completed the week with $93.82 million in outflows and $1.11 billion in volume.

The three-day outflow period from January 7-9 produced combined losses of $351.44 million. The redemptions exceeded gains from January 2, 5, and 6, resulting in net weekly outflows of $68.57 million.

Cumulative flows declined from $12.79 billion on January 6 to $12.43 billion on January 9. Total net assets fell from $20.06 billion to $18.70 billion.

The pattern for Ethereum ETFs differed slightly from Bitcoin ETFs. Ethereum products posted positive flows on January 6 while Bitcoin faced redemptions.

Trading volumes for Ethereum ETFs declined throughout the week. The $2.26 billion volume on January 2 fell to $1.11 billion by January 9.

XRP and Solana ETFs Maintain Weekly Inflows

XRP ETFs recorded $38.07 million in net inflows for the week ending January 9, according to available data. The products maintained positive flows despite broader market weakness in Bitcoin and Ethereum ETFs.

Daily data showed consistent gains throughout the period. January 2 posted $13.59 million in inflows. January 5 recorded $46.10 million.

January 6 saw $19.12 million. As of January 7, the fund faced $40.80 million in outflows. January 8 recorded $8.72 million in gains. January 9 posted $4.93 million in inflows.

The weekly total of $38.07 million brought cumulative XRP ETF flows to $1.22 billion with total net assets at $1.47 billion.

Solana ETFs recorded $41.08 million in net inflows for the week. The products maintained consistent positive flows throughout the period.

The post Bitcoin ETFs Lose $681M in a Week as Ethereum Sees $68.6M in Outflows appeared first on The Market Periodical.