Key Insights

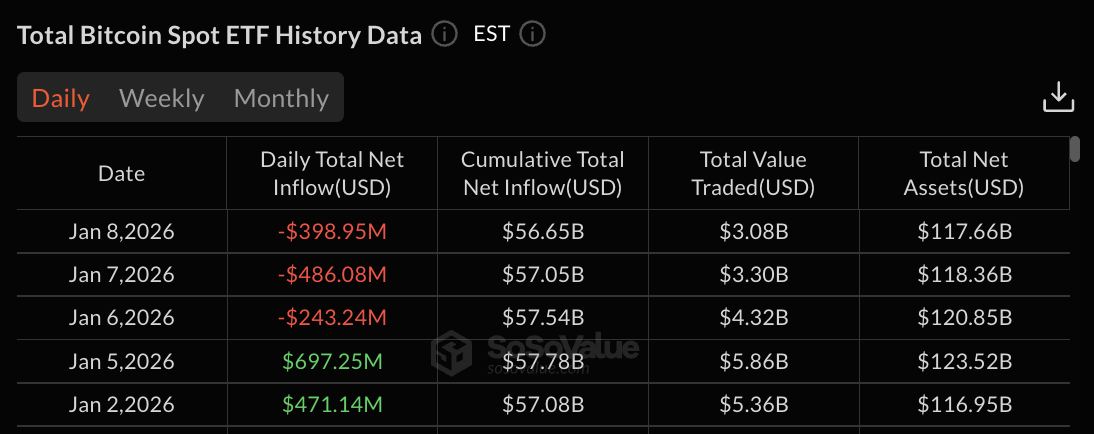

- Bitcoin ETFs recorded $398.95 million in outflows on January 8.

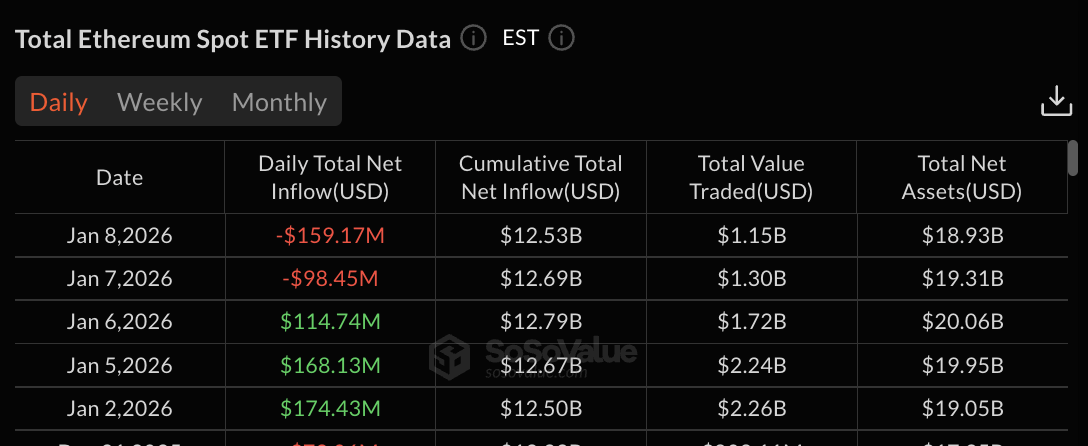

- Ethereum ETFs posted $159.17 million in redemptions on the same day.

- Combined losses of $558 million marked the worst two-day stretch of 2026.

Bitcoin ETFs recorded $398.95 million in net outflows on January 8. Also, it was the third consecutive day of redemptions.

Data from SoSoValue shows cumulative flows declined to $56.65 billion with total net assets at $117.66 billion. Ethereum ETFs posted $159.17 million in outflows, with cumulative flows at $12.53 billion.

Bitcoin ETFs Record $399M Outflow on Third Straight Day

Bitcoin ETFs faced widespread redemptions on January 8, with only two products reporting positive flows. BlackRock’s IBIT led losses, with $193.34 million in outflows, resulting in the shedding of 2,130 BTC.

IBIT maintains $62.66 billion in cumulative inflows despite the major single-day loss. Fidelity’s FBTC posted the second-largest outflow, with $120.52 million, resulting in a loss of 1,330 BTC. FBTC holds $11.71 billion in cumulative inflows. The January 8 outflow extended a pattern of losses from previous sessions.

Grayscale GBTC recorded $73.09 million in redemptions with 806.21 BTC exiting. The legacy trust product maintains -$25.41 billion in cumulative flows.

Grayscale BTC posted $7.24 million in losses with 79.82 BTC redeemed. ARK 21Shares’ ARKB recorded $9.63 million in outflows, shedding 106.24 BTC.

Bitwise’s BITB provided one of two positive flows, generating $2.96 million in gains and adding 32.60 BTC. WisdomTree’s BTCW recorded $1.92 million in inflows, acquiring 21.16 BTC.

Trading volume reached $3.08 billion for the session, down from $3.30 billion on January 7. The declining volume accompanied sustained redemptions.

BlackRock and Fidelity Lead Bitcoin ETF Redemptions

BlackRock’s IBIT and Fidelity’s FBTC produced combined outflows of $313.86 million on January 8. The two products accounted for 78.7% of total Bitcoin ETF losses.

IBIT’s cumulative inflows remain positive at $62.66 billion with total assets at approximately $68 billion.

Fidelity has faced sustained redemption pressure across multiple sessions. The $120.52 million loss marked the second consecutive day of significant outflows.

The pattern suggests large holders are reducing positions. FBTC’s cumulative inflows stand at $11.71 billion despite recent losses.

The three-day Bitcoin ETF outflow period from January 6-8 produced combined losses of $1.13 billion. January 6 saw $243.24 million in redemptions.

January 7 posted $486.08 million in losses. January 8 added $398.95 million in outflows. The consecutive negative sessions erased gains from January 2 and 5.

Bitcoin ETFs recorded $1.17 billion in net inflows on January 2 and 5 combined before the reversal.

The week-to-date result remains marginally positive at $39.95 million despite the three-day sell-off. Total net assets declined from $123.52 billion on January 5 to $117.66 billion on January 8.

Ethereum ETFs Post $159M Loss Ending Brief Recovery

Ethereum ETFs recorded $159.17 million in net outflows on January 8. This marks the second consecutive negative session.

Cumulative flows declined to $12.53 billion with total net assets at $18.93 billion. The losses reversed a three-day inflow streak from January 2-6 that produced $457.30 million in gains.

BlackRock’s ETHA-led Ethereum ETF experienced redemptions with $107.65 million in outflows, resulting in the sale of 34,760 ETH.

The product maintains $12.80 billion in cumulative inflows but faced concentrated selling pressure. ETHA accounted for 67.6% of total Ethereum ETF losses on January 8.

Grayscale products posted combined outflows of $44.62 million. ETHE recorded $31.72 million in redemptions with 10,240 ETH exiting.

Grayscale ETH reported $12.90 million in losses, resulting in the sale of 4,160 ETH. Fidelity’s FETH recorded $4.63 million in outflows, losing 1,500 ETH. VanEck’s ETHV saw $2.27 million exit with 731.50 ETH redeemed.

No Ethereum ETF reported positive flows on January 8. Five products recorded zero activity: Bitwise ETHW, Franklin EZET, 21Shares TETH, and Invesco QETH.

Combined $558M Outflows Mark Worst Two-Day Stretch

Bitcoin ETFs and Ethereum ETFs produced combined outflows of $558.12 million on January 8. The total followed the combined losses of $584.53 million on January 7.

The two-day period recorded $1.14 billion in net redemptions and was the worst consecutive sessions of January 2026.

Bitcoin ETFs contributed 71.5% of January 8 outflows while Ethereum ETFs accounted for 28.5%. The distribution suggests selling pressure concentrated in Bitcoin products.

Solana ETFs reported $13.64 million in net inflows on January 8, continuing their positive momentum. XRP ETFs recorded $8.72 million in gains.

The January 6-8 period produced combined losses of $1.28 billion for Bitcoin and Ethereum ETFs. The sell-off erased most gains from January’s first week.

Total net assets for Bitcoin ETFs declined 4.7% from $123.52 billion to $117.66 billion. Ethereum ETF assets fell 5.6% from $20.06 billion to $18.93 billion.

The post Bitcoin ETFs Lead $558M Crypto Outflows in Worst Two-Day Stretch appeared first on The Market Periodical.