21Shares has expanded its European product lineup with a Jito-staked Solana exchange-traded product, providing listed exposure to the SOL token while embedding staking incentives. The JSOL ETP, priced in USD and EUR, is now trading on Euronext Amsterdam and Euronext Paris, and is promoted as the first Europe-listed ETP backed by JitoSOL. The vehicle holds JitoSOL directly and incorporates staking rewards into its net asset value, offering institutions a regulated, liquid avenue to participate in Solana’s liquid staking framework.

Issued by the Jito Network, JitoSOL represents SOL deposited into a liquid staking program on the Solana network, where staked tokens remain transferable rather than locked. Holding JitoSOL enables investors to earn staking yield through a liquid token without directly delegating to validators or managing on-chain staking operations.

In a series of posts on X on Thursday, Jito said the product offers institutional investors regulated access to JitoSOL while capturing staking and MEV-related rewards.

The European launch extends the prior US-facing initiative, building on last year’s JitoSOL ETF filing from VanEck in the United States and reflecting a broader push to broaden institutional access to liquid staking infrastructure. 21Shares notes that it already operates more than 55 crypto ETPs across European venues and manages roughly $8 billion in assets under management, underscoring its role as a long-standing bridge between traditional markets and digital-asset products. The issuer, which began with a physically backed crypto ETP in 2018, has since become a cornerstone for regulated crypto exposure in Europe.

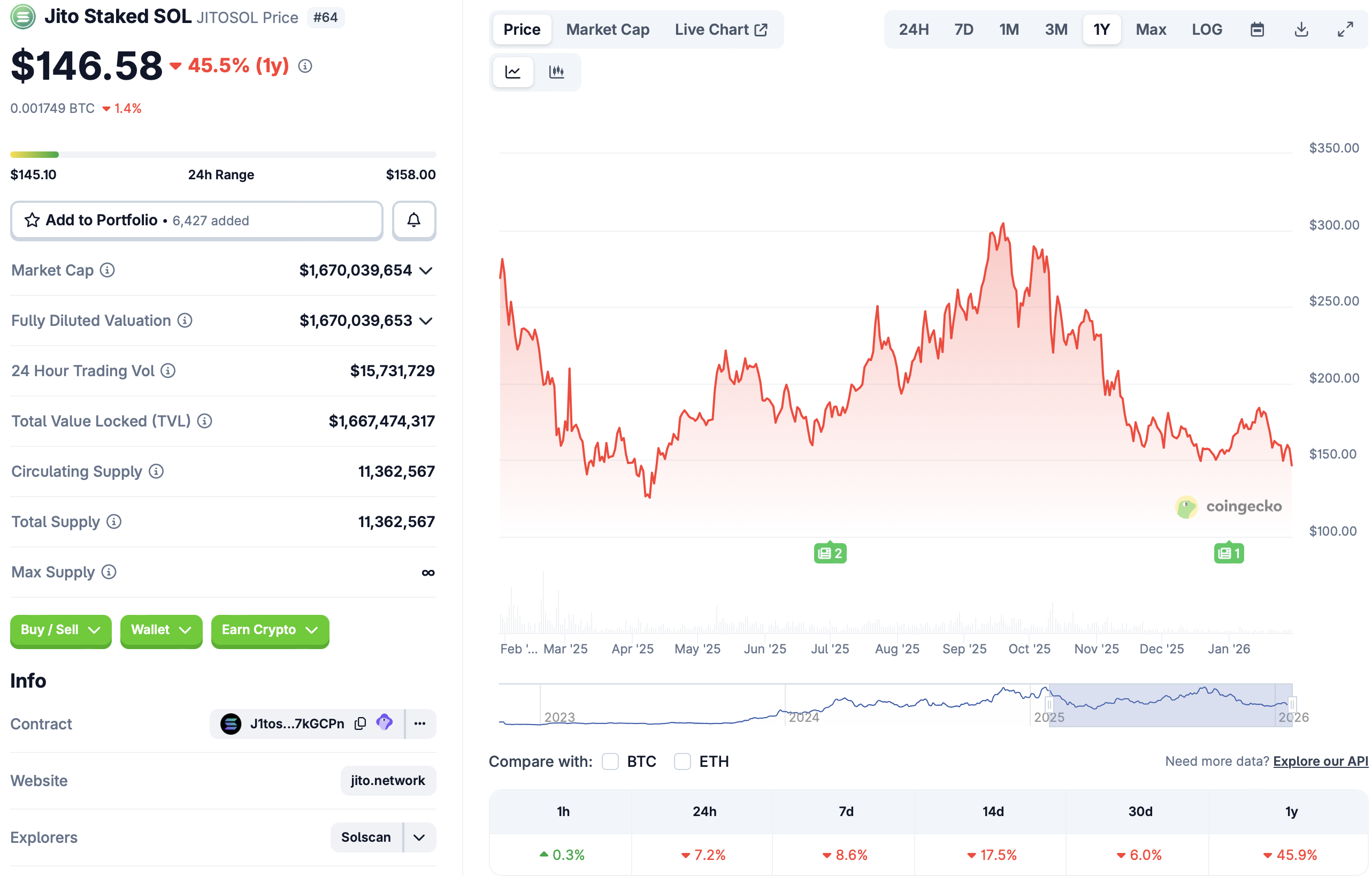

Jito Network, which started in 2021, has carved out a niche around liquid staking and validator infrastructure on Solana. At the time of writing, its JitoSOL token carried a market capitalization around $1.67 billion, per CoinGecko data, illustrating the liquidity and scale of the liquid-staking ecosystem connected to Solana.

Related: Solana validator count drops 68% as node costs squeeze small operators

Solana staking ETFs launch in US, but liquid staking still up for debate

In the United States, regulators have approved several Solana staking ETFs, though liquid staking products remain barred from the domestic market. The launch activity has included notable first-day inflows and growing asset bases for staking-focused vehicles. In July, the first Solana staking ETF listed in the country attracted about $12 million in net inflows on its debut trading day, while in October Bitwise’s Solana staking ETF opened with more than $220 million in assets. Grayscale subsequently debuted a staking-enabled Solana spot ETF in the US.

Industry participants have argued that liquid staking could improve capital efficiency and reduce rebalancing frictions for funds, prompting calls in July for regulators to permit Solana-backed liquid-staking ETPs. In the months that followed, VanEck filed for a US-listed ETF designed to hold JitoSOL, a move that signaled continued interest in bridging Jito’s liquid-staking framework with traditional financial markets.

Lucas Bruder, CEO of Jito Labs, said the company expects JitoSOL-based products to receive approval in the US and noted growing interest from markets in Asia and the Middle East. He emphasized that broader education around digital assets and proof-of-stake mechanics remains essential to unlocking broader adoption of Solana’s infrastructure advantages.

This European development sits within a broader pattern of crypto ETP growth and market access expansion across the continent. 21Shares has leveraged its European footprint to bring regulated exposure to a wide range of digital assets, and the JitoSOL-backed ETP is positioned as a test case for how liquid staking assets might be integrated into regulated product wrappers for institutional investors.

Why it matters

For investors seeking regulated access to Solana’s liquidity-enhanced staking, JSOL represents a concrete option that combines price exposure to SOL with ongoing staking yields. By holding JitoSOL directly, the ETP aims to reflect staking rewards in its NAV, potentially delivering yield dynamics that are closer to on-chain staking economics than traditional spot exposure alone. The European listing on Euronext Amsterdam and Paris broadens the geographical reach of regulated crypto products, reinforcing Europe’s position as a center for crypto-asset wrappers and exchange-traded products.

From the issuer’s vantage point, the launch demonstrates how institutional-grade vehicles can package innovative on-chain mechanics—such as liquid staking and MEV capture—into familiar investment formats. 21Shares has built a diversified catalog of ETPs since its 2018 inception, underscoring a strategic emphasis on scalable, compliant access to digital assets for traditional finance counterparties. The collaboration with Jito Network also signals an ongoing push to connect liquid staking infrastructure to traditional market infrastructure, a bridge that could accelerate institutional participation in Solana’s ecosystem.

For Solana and the broader crypto ecosystem, the move signals continued demand for regulated exposure to high-yield staking models. While the US debate over liquid staking continues, Europe’s adoption of JitoSOL-based products could help unlock cross-border liquidity and diversify funding sources for validators and network operators, potentially contributing to capital efficiency in the Solana ecosystem.

What to watch next

- Regulatory progress on liquid staking ETPs in the United States, including potential changes to SEC policy and any pending filings for JitoSOL-based funds.

- Whether additional European exchanges will list further JitoSOL-backed products or similar liquid-staking instruments from other issuers.

- Performance and NAV tracking of JSOL relative to actual SOL staking yields and MEV-related rewards, particularly during periods of network activity spikes.

- Any new filings or approvals for US-listed funds that hold JitoSOL or other liquid-staking assets, signaling broader institutional appetite in North America.

Sources & verification

- GlobeNewswire: 21Shares launches Jito Staked SOL ETP (JSOL) offering enhanced yield exposure to Solana

- Jito Network posts on X detailing the regulatory-access claims for JitoSOL

- CoinGecko data for JitoSOL market capitalization

- Solana price index and related coverage

This article was originally published as 21Shares Lists JitoSOL-Backed Solana ETP Across Europe on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.