Author:@intern_ccEncrypted KOL

Translated by: Felix, PANews

Crypto options are poised to become a landmark financial instrument by 2026, driven by the convergence of three major trends: traditional DeFi yields being squeezed by the "yield apocalypse," a new generation of simplified "entry-level" products that abstract options into one-click trading interfaces, and institutional validation through Coinbase's $2.9 billion acquisition of Deribit.

Although on-chain options currently account for only a small portion of crypto derivatives trading volume, perpetual contracts still dominate the market by a large margin. This gap mirrors the situation of TradFi options before they became popular on Robinhood.

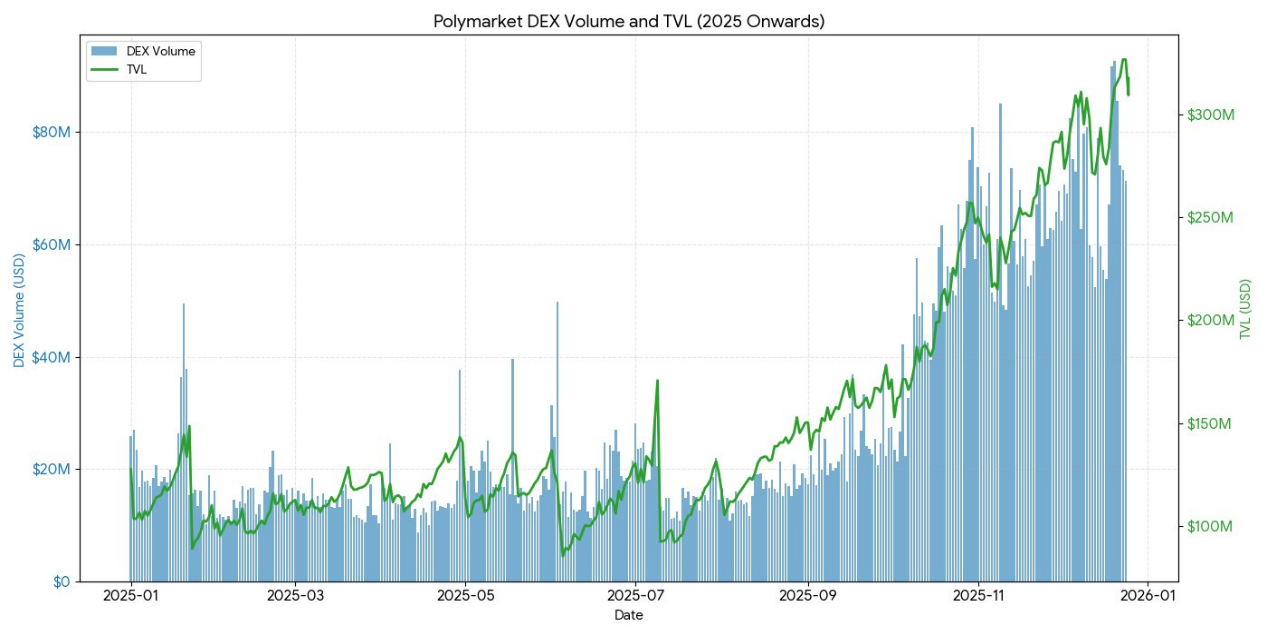

Polymarket repackaged binary options and, with the help of excellent marketing, processed $9 billion in trading volume in 2024. If the retail market's demand for probabilistic betting is validated, can DeFi options achieve a similar structural transformation? As infrastructure and incentive mechanisms finally align, execution will determine whether options break through the bottleneck or remain niche tools.

The End of Passive Income

To understand why crypto options might explode in 2026, you first need to understand: what is dying.

In the past five years, the cryptocurrency ecosystem has flourished rapidly. Market analysts retrospectively refer to this period as the "Golden Age of Lazy Returns," during which participants could achieve significant risk-adjusted high returns with minimal complex operations or active management. Typical examples are not sophisticated options strategies, but rather simple and straightforward arbitrage methods such as token issuance mining, looping strategies, and perpetual contract basis trading.

Basis trading is at the core of generating returns in crypto. Its mechanism appears simple but is actually more complex: due to retail investors' long-term structural long bias, longs must pay costs to shorts through funding rates to maintain positions. By buying spot assets and shorting perpetual futures, sophisticated participants construct delta-neutral positions that are insensitive to price fluctuations, while simultaneously earning annualized returns of 20% to 30%.

However, there's no such thing as a free lunch. With the approval of a Bitcoin spot ETF, the entry of traditional financial institutions has brought industrial-scale efficiency. Authorized participants and hedge funds began executing this trade with billions of dollars, compressing the spread to Treasury bill rates plus a meager risk premium. By the end of 2025, this "bubble" had dissipated.

DeFi refers to "Decentralized Finance," a movement and set of Options Agreement"Hello, how areCemetery"Please enter a valid

- Hegic was launched in 2020 with the innovation of pool-to-pool, but due to code errors and game theory flaws, it was closed twice in its early stage.

- Ribbon's market value dropped from a peak of $300 million, mainly due to the market crash in 2022 and the subsequent strategic migration to Aevo, leaving only about $2.7 million hacked by hackers in 2025.

- Dopex introduced concentrated liquidity options, but due to the lack of competitiveness of the option products generated by the model, inefficient capital utilization, and an unsustainable token economics in the harsh macro bear market, it eventually collapsed.

- After realizing that options trading was still dominated by institutions, Opyn shifted its focus to infrastructure and abandoned the retail market.

Highly consistent failure modes: Ambitious protocols struggle to achieve both liquidity bootstrapping and simplified user experience simultaneously.

The Paradox of Complexity

Ironically, the options that are theoretically safer and more aligned with user intent are less popular than perpetual contracts, which carry higher risks and more complex mechanisms.

Perpetual contracts may seem simple at first glance, but their underlying mechanisms are highly complex. Every time the market plummets, traders are often liquidated or automatically deleveraged, and even large traders may not fully understand how perpetual contracts operate.

By contrast, options do not face these issues at all. When buying a call option, the risk is limited to the premium paid, and the maximum loss is determined before entering the trade. However, perpetual contracts dominate primarily because "sliding to 10 times leverage" is always simpler than "calculating risk exposure adjusted for delta."

Mind Traps of Perpetual Contracts

Perpetual contracts force you to bear the spread and pay fees twice for each trade.

Even hedging positions can wipe out your capital.

They are path-dependent; you can't open a position and then "set it and forget it."

However, even if you believe that short-term retail directional capital flows will still head toward perpetual contracts, options can still dominate the majority of the market share in native on-chain financial products. They are more flexible and powerful tools that can be used for hedging risks and generating returns.

Looking ahead to the next five years, blockchain infrastructure will gradually evolve into the backend infrastructure of the distribution layer, with a broader reach than traditional finance.

Today's innovative protocols, such as Rysk and Derive, represent the initial wave of this transition, offering structured products that go beyond basic leverage or lending pools. Savvy asset allocators will require more sophisticated tools to manage risk, perform volatility trading, and optimize portfolio returns in order to fully leverage the decentralized ecosystem.

Traditional finance proves that retail investors love options.

Robinhood revolution

The surge in retail options trading in traditional finance provides a roadmap. Robinhood launched commission-free options trading in December 2017, sparking an industry transformation that culminated in October 2019, when Charles Schwab, E*TRADE, and Interactive Brokers all eliminated commissions within a few days of each other.

Its impact is significant:

- The volume of retail options trading in the U.S. surged from 34% at the end of 2019 to between 45% and 48% in 2023.

- In 2024, the Office of the Comptroller of the Currency (OCC) cleared a record total of 12.2 billion annual options contracts, setting a record for the fifth consecutive year.

- In 2020, stock options of internet celebrities accounted for 21.4% of the total options trading volume.

Zero-day expiration option (0DTE stands for "0 Days to Expiration," which is aexplosive growth

0DTE (Zero Days To Expiration) options reflect retail investors' interest in short-term, high-convexity bets. The volume of 0DTE options accounted for 5% of S&P 500 index options volume in 2016, but increased to 51% in the fourth quarter of 2024, with an average daily trading volume exceeding 1.5 million contracts.

Its appeal is obvious: lower capital requirements, no overnight risk, built-in leverage exceeding 50 times, and intraday feedback loops—industry insiders call it "dopamine trading."

Convexity and Explicit Risk

The nonlinear profit structure of options attracts directional traders seeking asymmetric returns. A buyer of a call option may only risk a $500 premium, yet potentially gain more than $5,000. Spread strategies allow for more precise strategy adjustments, as both the maximum potential loss and maximum potential profit are clearly defined before entering the trade.

Getting Started with Products and Infrastructure

Abstraction as a Solution

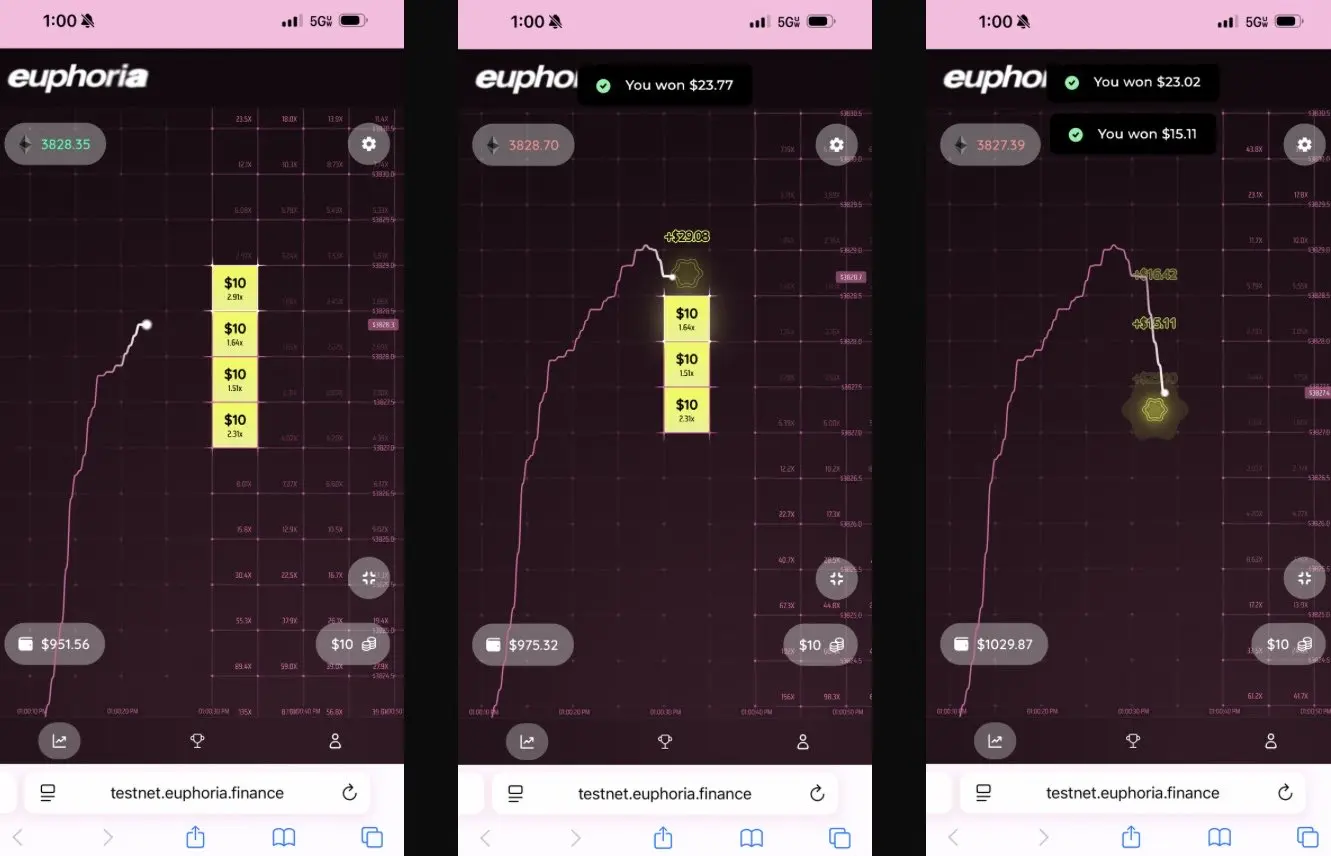

The new generation of protocols solves the complexity issue by completely hiding options through a simple interface, known in the industry as a "dopamine app."

Euphoria has secured a $7.5 million seed round with a radically simplified concept. Its vision is: "You simply look at the chart, observe the price movement, and click the grid squares you believe the price will reach next." There's no need for order types, no need for margin management, no need for Greek letters—just placing the right directional bets on a CLOB.

Building sub-millisecond infrastructure based on MegaETH.

The prediction of a market breakout confirms the concept of a simplified strategy:

- Polymarket processed over $9 billion in trading volume in 2024, with a peak of 314,500 monthly active traders.

- Kalshi's weekly trading volume has consistently exceeded $1 billion.

These two platforms are structurally similar to binary options, but the concept of "prediction" transforms the stigma of gambling into collective intelligence.

As clearly admitted by Interactive Brokers, their prediction contracts are "binary options 'prediction markets'."

The lesson is: retail investors do not want complex financial instruments; they want simple, clear probabilistic bets with transparent outcomes.

2025 Year DeFi Current Status of Options

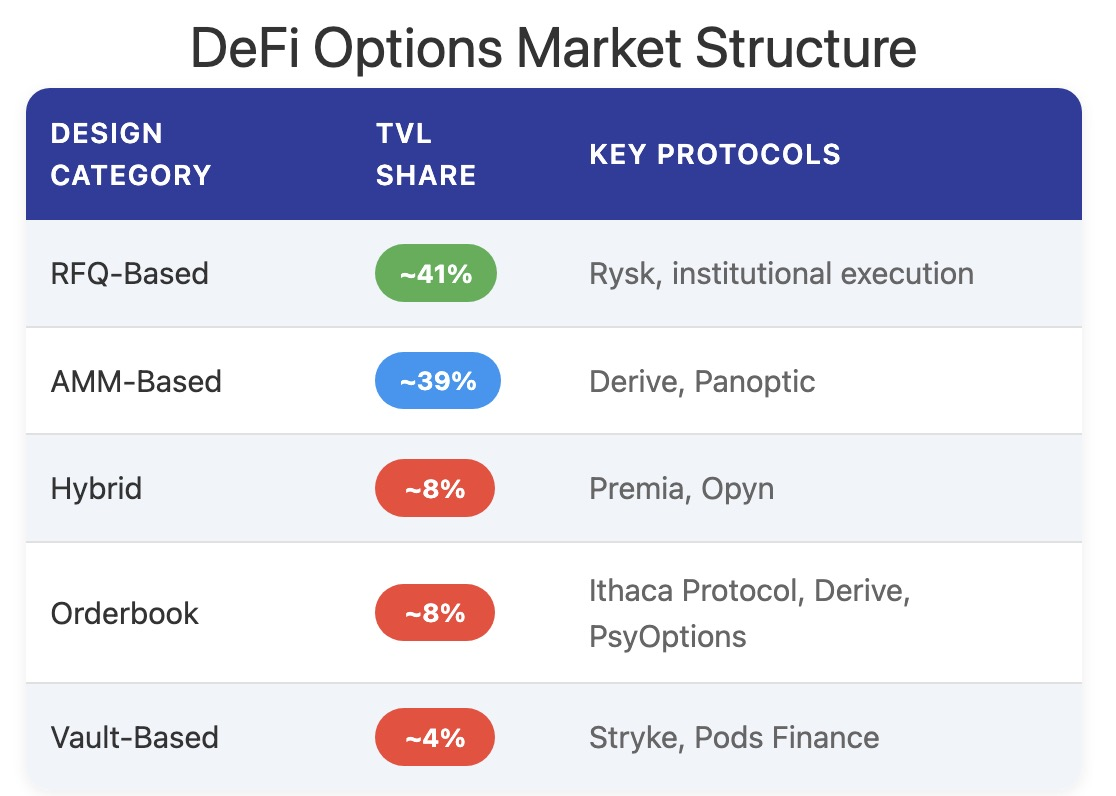

By the end of 2025, the DeFi options ecosystem is transitioning from experimental designs to more mature and composable market structures.

Early frameworks exposed many issues: liquidity was fragmented across different maturities, reliance on oracles for settlement introduced latency and manipulation risks, and fully collateralized vaults limited scalability. This prompted a shift toward liquidity pool models, perpetual option structures, and more efficient margin systems.

Currently, participants in DeFi options are primarily retail investors seeking yield, rather than institutions aiming for hedging. Users view options as a tool for generating passive income, selling covered call options to collect premiums, rather than as a tool for transferring volatility. When market volatility intensifies, treasury holders face adverse selection risks due to the lack of hedging instruments, leading to sustained poor performance and outflows of TVL (Total Value Locked) funds.

The protocol architecture has moved beyond traditional maturity-based models, giving rise to new paradigms in pricing, liquidity, and other aspects.

Russian

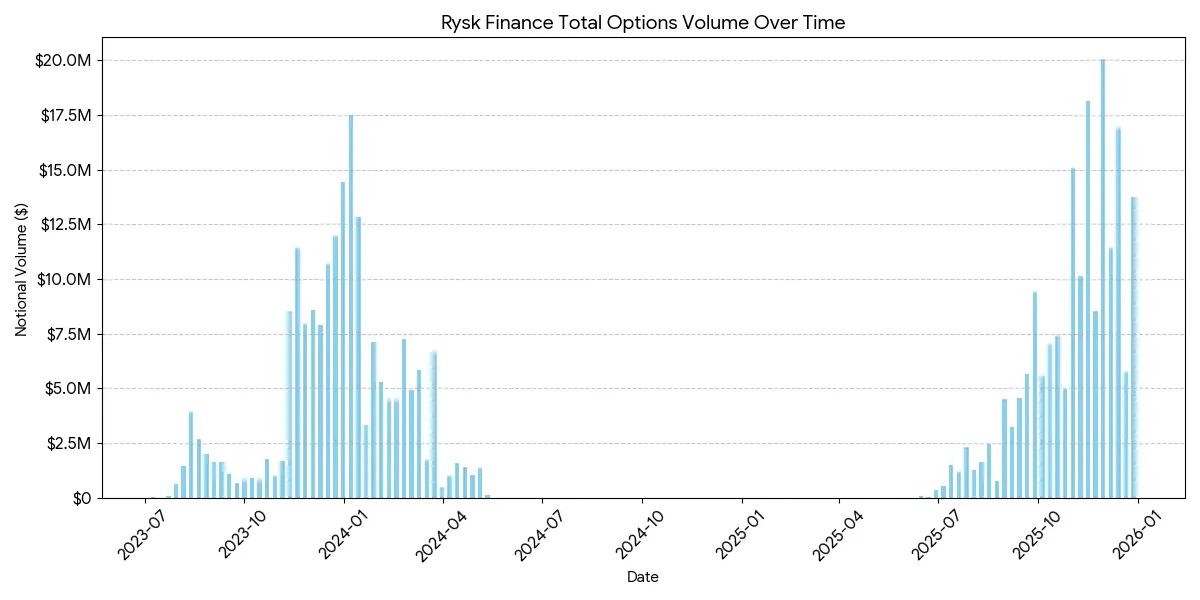

Rysk applies traditional options selling mechanisms to DeFi through on-chain primitives, supporting covered calls and cash-secured puts. Users can directly deposit collateral into smart contracts to establish individual positions and customize strike prices and expiration dates. Trades are executed through a real-time quotation mechanism, with counterparties providing competitive quotes via fast on-chain auctions, enabling instant confirmation and early receipt of option premiums.

The returns follow the standard covered call option structure:

- If the price at expiration < strike price: the option expires worthless, the seller keeps the collateral + option premium

- If the price at expiration ≥ strike price: The collateral is physically settled at the strike price, the seller keeps the option premium but forgoes the upside gains.

A similar structure applies to cash-secured put options, with physical settlement automatically executed on-chain.

Rysk's target users are those seeking sustainable, non-inflationary returns through options premium. Every position is fully collateralized, carries no counterparty risk, and employs deterministic on-chain settlement. It supports multiple collateral assets, such as ETH, BTC, LST, and LRT, making it suitable for DAOs, treasuries, funds, and institutions managing volatile assets.

The average position size on the Rysk platform has reached five digits, indicating institutional-level capital involvement.

Derive.xyz

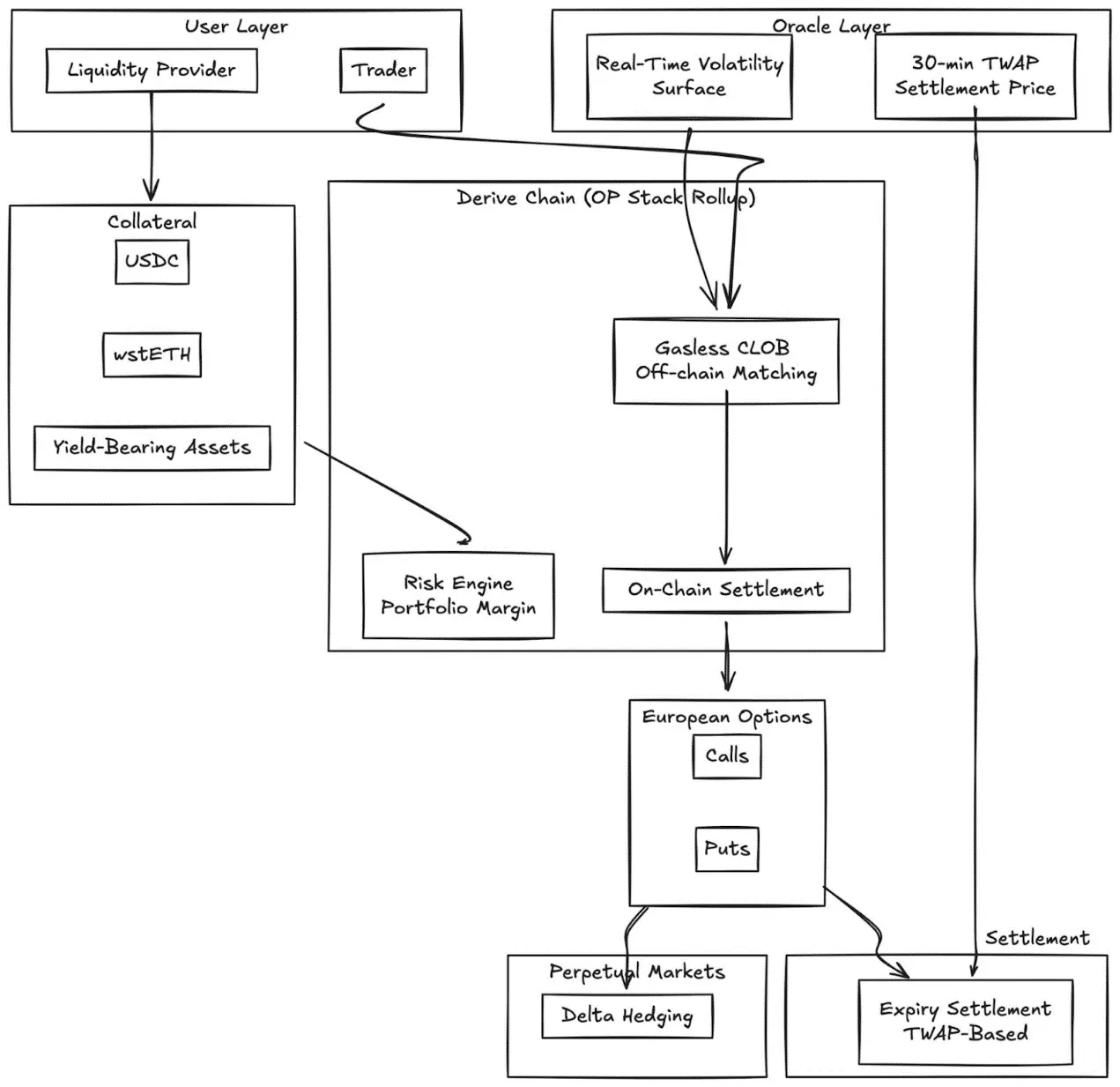

Derive (formerly Lyra) has transitioned from its pioneering AMM architecture to a gas-free central limit order book with on-chain settlement. The protocol offers fully collateralized European options with dynamic volatility surfaces and settlement based on 30-minute TWAPs.

Main Innovations:

- Real-time volatility surface pricing via external feeds

- 30-Minute TWAP Oracle Reduces Expiry Manipulation Risks

- Integrate perpetual markets to enable continuous delta hedging.

- Support collateral of yield-bearing assets (e.g., wstETH) and portfolio collateral to improve capital efficiency

- Execution Quality: Competitive compared to smaller CeFi venues

GammaSwap

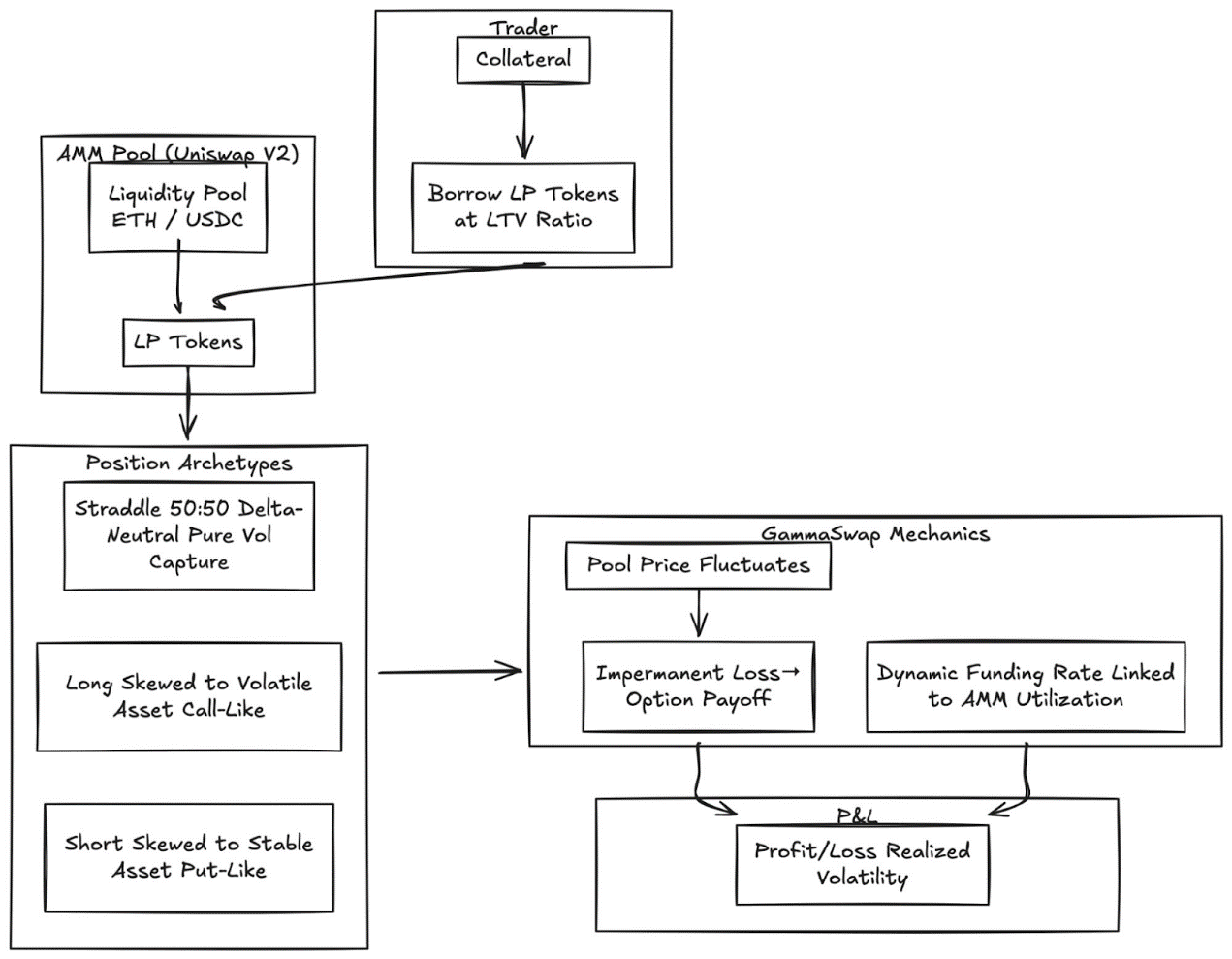

GammaSwap has introduced non-synthetic perpetual options built upon AMM liquidity.

It does not rely on oracles or fixed expiration dates, but instead generates continuous volatility exposure by borrowing liquidity from AMMs like Uniswap V2.

This mechanism converts impermanent loss into tradable option gains:

- Traders borrow LP tokens at a specified loan-to-value ratio.

- As the capital pool experiences price fluctuations, the value of collateral relative to the amount borrowed will also change.

- Profits and losses are proportional to the realized volatility.

- Dynamic funding rates tied to AMM utilization

Position Type:

- Straddle Option: Delta Neutral (50:50), Pure Volatility Capture

- Long volatility options: Collateral biased toward more volatile assets (similar to long call options)

- Short options: Collateral is biased toward assets with higher stability (similar to put options)

This mechanism completely eliminates reliance on oracles by deriving all prices from the endogenous AMM state.

Panoptic is a term that is often used in

Perpetual Options on Uniswap without Oracles.

Panoptic represents a fundamental breakthrough: perpetual, oracle-free options built on concentrated liquidity from Uniswap v3. Any Uniswap LP position can be interpreted as a combination of long and short options, with fees taking the form of a continuous stream of option premiums.

Key Insight: Uniswap v3 positions within specific price ranges behave similarly to a short options portfolio, with delta values changing as prices fluctuate. Panoptic formalizes this concept by allowing traders to deposit collateral and select liquidity ranges to establish perpetual options positions.

Key Features:

- Valuation without oracles: All positions are priced using quote and liquidity data internal to Uniswap.

- Everlasting Exposure: Options held indefinitely, with continuous premium flows rather than discrete expiration dates.

- Composability: Built on Uniswap and integrated with lending, structured yield, and hedging protocols.

and CeFi stands for "Centralized Finance," which refers to financial services and Comparison:

The gap with centralized exchanges remains significant. Deribit dominates globally, with daily open interest exceeding $3 billion.

The following structural factors contribute to this difference:

Depth and liquidity

CeFi centralizes liquidity in standardized contracts with tightly spaced strike prices, supporting tens of millions of order books for each strike price. DeFi liquidity remains fragmented across protocols, strike prices, and expiration dates, with each protocol operating independent liquidity pools that cannot share collateral.

Execution Quality: Deribit and CME offer nearly instant order book execution. AMM-based models like Derive provide smaller spreads for liquid, near-the-money options, but execution quality degrades for large orders and deep out-of-the-money strike prices.

Collateral efficiency: CeFi platforms allow cross-collateralization across instruments; most DeFi protocols still isolate collateral by strategy or capital pool.

However, DeFi options have unique advantages: permissionless access, on-chain transparency, and composability with the broader DeFi tech stack. As capital efficiency improves and protocols eliminate fragmentation by removing expiration dates, this gap will narrow.

Institutional Positioning

Coinbase-Deribit Super Stack:

Coinbase Acquires Deribit for $2.9 Billion, Achieving Strategic Integration Across the Entire Crypto Capital Stack:

- Vertical Integration: Spot bitcoin held by users on Coinbase can be used as collateral for options trading on Deribit.

- Cross-margin: In fragmented DeFi, capital is dispersed across various protocols. On Coinbase/Deribit, funds are centralized in a single pool.

- Full lifecycle control: By acquiring Echo, Coinbase controls token issuance => spot trading => derivatives trading.

For DAOs and crypto-native organizations, options provide an effective mechanism for managing capital and risk:

- Buy put options to hedge against downside risk and lock in the minimum value of the cash assets.

- Sell covered call options to hedge idle assets and generate a systematic income stream.

- Tokenize risk positions by encapsulating options exposure into ERC-20 tokens.

These strategies convert holdings of more volatile tokens into more stable, risk-adjusted reserves, which is critical for institutional adoption of DAO treasury management.

LP Strategy Optimization

The LP Scalable Toolkit: Transforming Passive Liquidity into Active Hedging or Yield-Enhancement Strategies:

- Options as Dynamic Hedging Tools: In Uniswap v3/v4, liquidity providers (LPs) can reduce impermanent loss by purchasing put options or constructing delta-neutral spreads. GammaSwap and Panoptic allow liquidity to be used as collateral for continuous option premiums, thereby offsetting the risk exposure of AMMs.

- Options as yield stacking: Vaults can automatically execute covered call and cash-secured put option strategies against LP or spot positions.

- Delta-targeting strategy: Panoptic's perpetual options allow selecting delta-neutral, short, or long exposures by adjusting the strike price and expiration.

Composable Structured Products

- Vault Integration: Automated vaults package short-term volatility strategies into tokenized yield instruments, similar to structured on-chain notes.

- Multi-leg options: Protocols like Cega have designed path-dependent payoff structures (dual-currency notes, auto-redemption options) with on-chain transparency.

- Cross-protocol composition: Combine options payoffs with lending, restaking, or redemption rights to create hybrid risk instruments.

Outlook

The options market will not develop into a single category. It will evolve into two distinct tiers, each serving different user groups and offering significantly different products.

First Layer: Abstract Options for Retail Investors

Polymarket's success story demonstrates that retail investors are not rejecting options, but rather rejecting complexity. The $9 billion in trading volume did not come from traders who understand implied volatility, but from users who see an issue, choose a position, and click a button.

Euphoria and similar dopamine-driven apps will drive the development of this theory. The options mechanism operates invisibly under the click-trading interface. There are no Greek letters, no expiration dates, no margin calculations—only price targets on a grid. The product is the option itself.

User experience is like a game.

This layer will capture the volume currently dominated by perpetual contracts: short-term, high-frequency, dopamine-driven directional bets. The competitive advantage here is not financial engineering, but UX design, mobile-first interfaces, and sub-second feedback. The winners in this layer will resemble consumer apps more than trading platforms.

Second Layer: As Institutional Infrastructure DeFi Options

Protocols like Derive and Rysk won't compete with retail investors. They will serve a completely different market: DAOs managing eight-figure treasuries, funds seeking non-correlated returns, LPs hedging impermanent loss, and asset allocators building structured products.

This layer requires advanced technical capabilities. Features such as portfolio margining, cross-collateralization, inquiry systems, and dynamic volatility surfaces may not be frequently used by retail investors, but are essential for institutional investors.

Today's vault providers are early-stage infrastructure at the institutional level.

On-chain asset allocators need the full expressiveness of options: explicit hedging strategies, income stacking, delta-neutral strategies, and composable structured products.

Leverage sliders and simple lending markets are insufficient.

Related Reading:Is a prediction market an extended form of binary options?