Author: 𝗰𝘆𝗰𝗹𝗼𝗽

Compile: DeepTide TechFlow

The Tides of Depth: In the cryptocurrency market, the myth of 100x growth still exists, but the rules have been completely rewritten. Seasoned trader Cyclop points out that with the explosive growth in token supply (per capita token holdings have increased 24 times), the traditional "buy and hold" strategy has become a graveyard for wealth.

This article thoroughly examines the evolution of market paradigms from 2017 to the present, revealing how liquidity has rapidly shifted among airdrops, Solana memecoins, real-income protocols (such as HYPE), and "casino-style" platforms.

Standing at the threshold of 2026, the author provides us with a brand-new practical framework: instead of trying to find that one coin with a ten-thousand-fold return, investors should capture the cyclical interplay of "value, casino, and structural extraction," and use compounding to achieve a leap into bourgeois wealth. For investors trapped in a "bear market mindset" yet eager to reclaim their former glory, this is not just a guide—it is a complete transformation of their cognitive framework.

The full text is as follows:

In the past two years, I turned $8,000 into a seven-figure amount in cryptocurrency.

Most people believe such achievements cannot be replicated again—I disagree. I think now is the best time to make the leap from $10,000 to $1,000,000 (even though it may sound crazy).

(Important warning: This article is long. Bookmark it now so you don't miss it, but be sure to read it all the way through—it might change the way you look at this market.)

Even though the term "altseason" is no longer commonly mentioned nowadays, most people still hold the same mindset:

They are waiting for a huge wave, when all the cryptocurrencies will rise together. You just need to buy a bag of coins, and it will lead you to wealth.

- Hold Forever

- Looking for "the one true coin (the one coin)"

- Ignore Sector Rotation

- Pray that the market will reward patience.

This kind of thinking can indeed make money when the token supply is limited and the narrative can last for months.

In 2024, this is usually a mistake. For most of 2025, it will still be a mistake. And by 2026, it will definitely be a mistake. Not because it's no longer a 100x possibility.

But because the way to get 100 times has changed.

Part 1: 2017–2021, What Has Changed?

The market has been diluted into a machine for printing tokens.

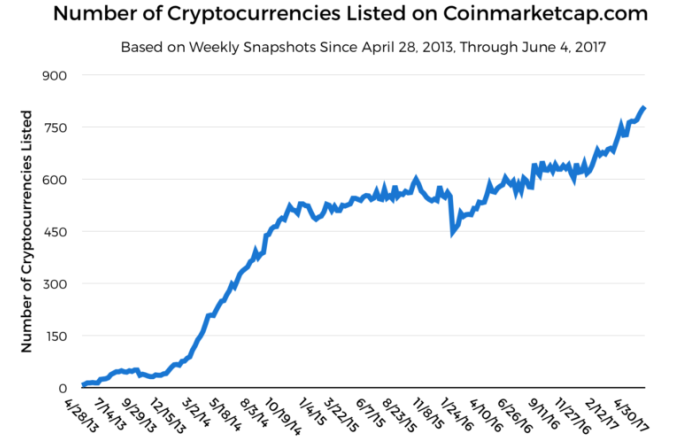

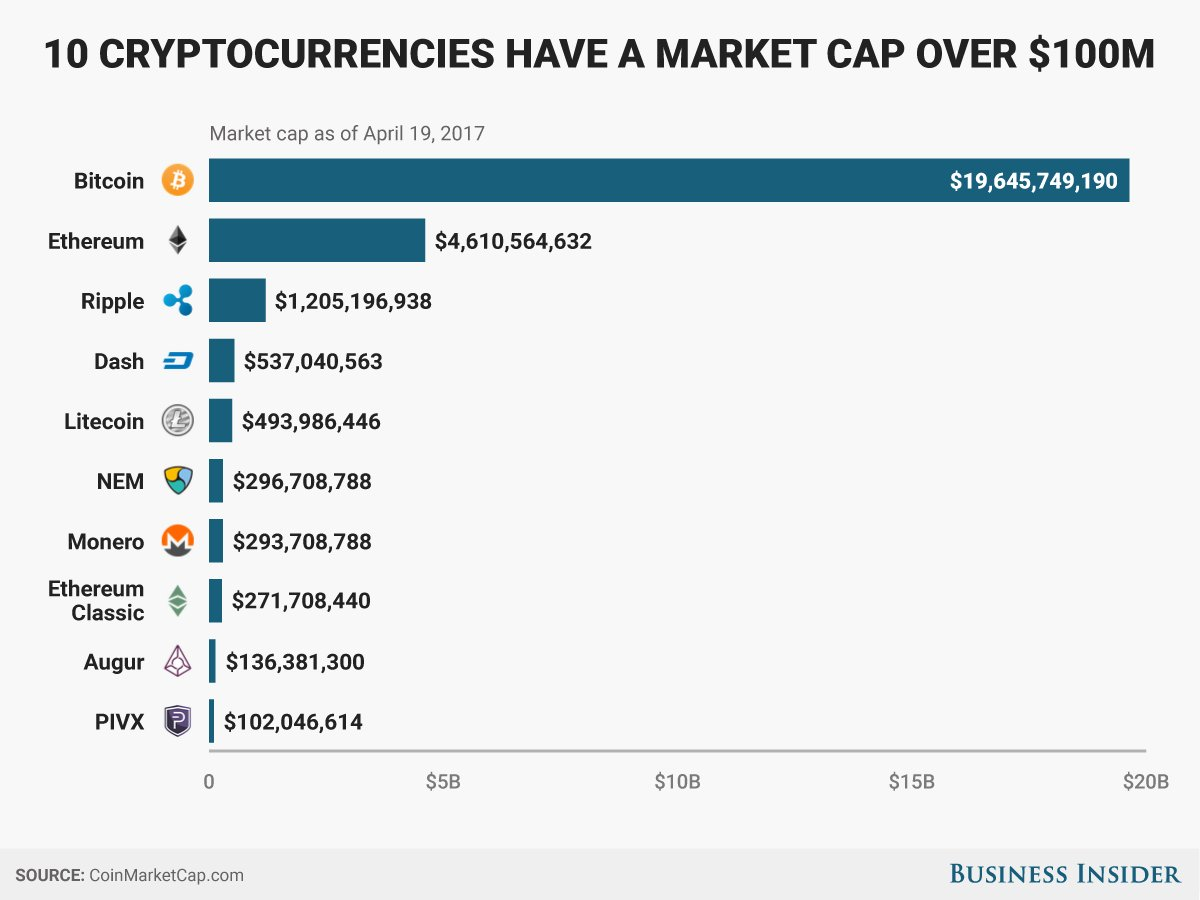

At the beginning of 2017, CoinMarketCap was tracking about 796 cryptocurrencies. This is not a typo—less than 1,000. At that time, around 800 cryptocurrencies already felt like a "lot." Today? According to CoinGecko's statistics, about 5,300 new tokens are created every day in 2024.

In practice, this means:

- "Discovery" is real. There weren't endless alternatives back then.

- If you gain exposure (appearing on CMC, being listed on exchanges, having a basic narrative + some promotion), and there are limited liquidity outlets, then it will really flood toward you.

- People buy random things because the selection is limited, and everyone is learning in sync.

This is why "just appearing on CMC + gaining attention" could be an advantage from 2017 to 2021. Everyone had room to survive.

The attention-to-supply ratio has collapsed.

The most important change since 2021 is:

Attention has not scaled. But token supply has exploded.

The number of encrypted users has indeed increased.

However, the number of tokens has exploded even more dramatically, causing the attention value allocated to each token to decrease continuously.

Crypto.com Estimate:

- There were 106 million cryptocurrency holders in January 2021.

- 295 million holders in December 2021

- 580 million holders in December 2023

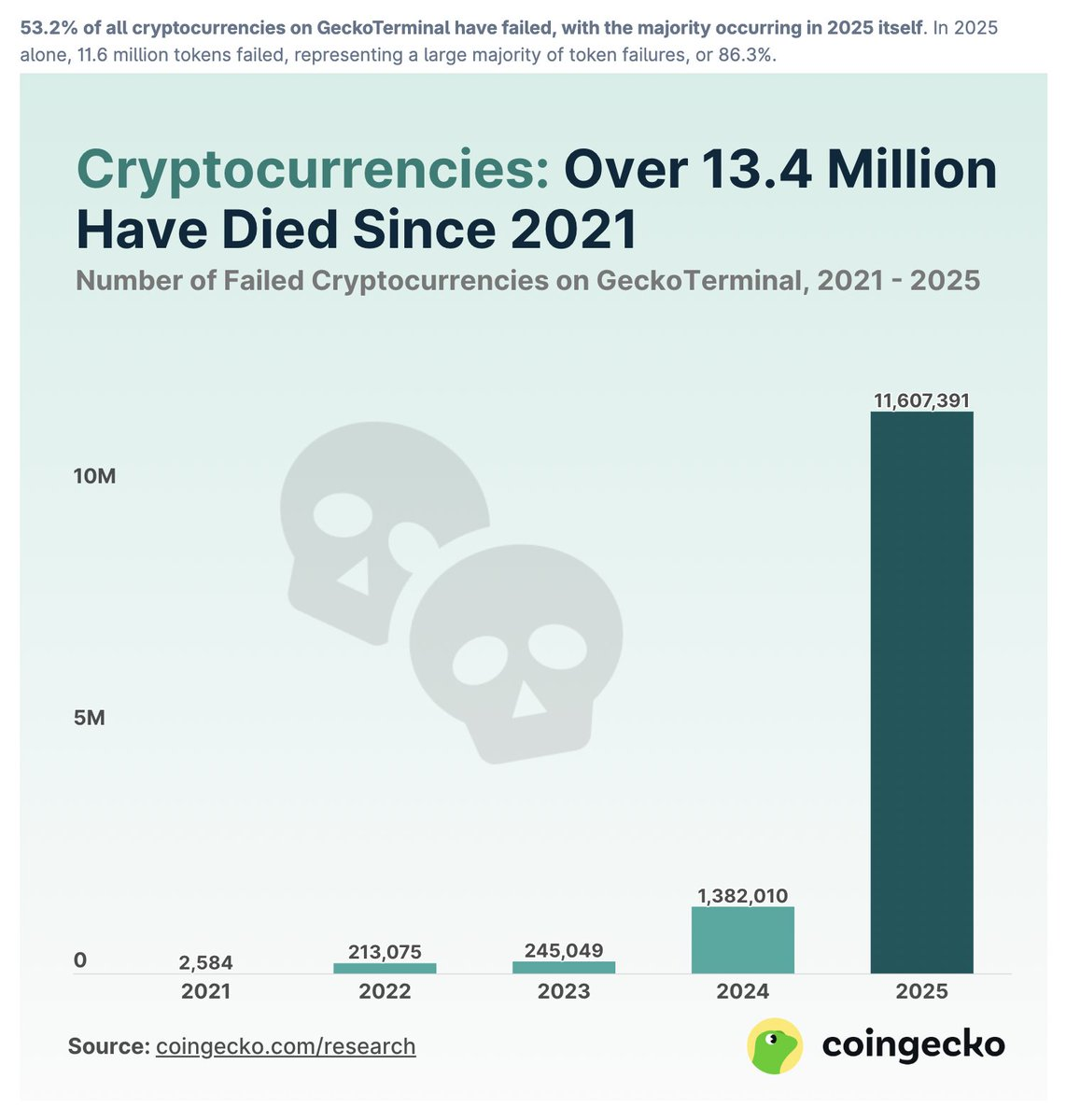

Supply Side (Currency/Project): Data from CoinGecko's GeckoTerminal shows:

- There were 428,383 projects in 2021.

- There are 20,170,928 items by 2025.

Now let's look at the most crucial part: to what extent has the market actually been diluted?

In 2021, there were approximately 689 holders per token. By 2025, there will be approximately 29 holders per token.

Within just a few years, the per capita supply increased by about 24 times.

This means: previously, there weren't many places where attention could go, so even random coins could be noticed.

Now, you're competing against an ocean of new tokens every day—so "holding a bag of coins and waiting" is no longer a viable strategy.

Massive new launches are designed to perform poorly.

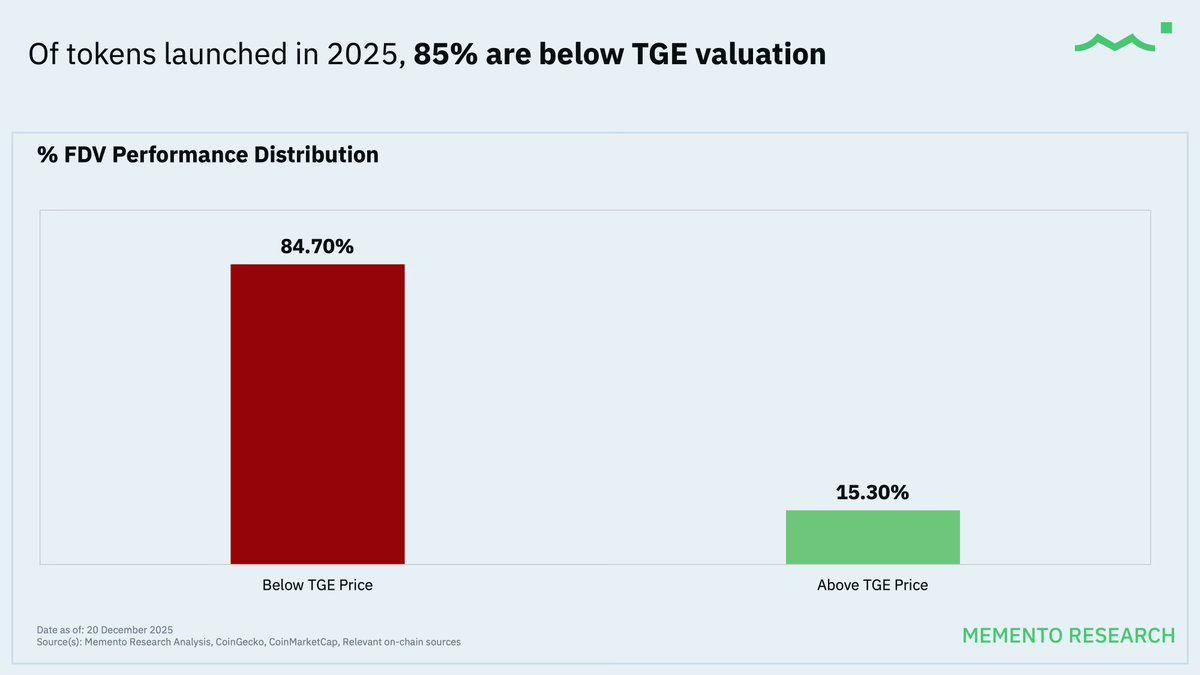

There were many tokens issued at low prices in previous cycles, and there is still real room for growth in the market. The current general pattern is:

- High fully diluted valuation (FDV) at launch

- Low float

- Heavy token unlocks

- Early holders seeking exit liquidity

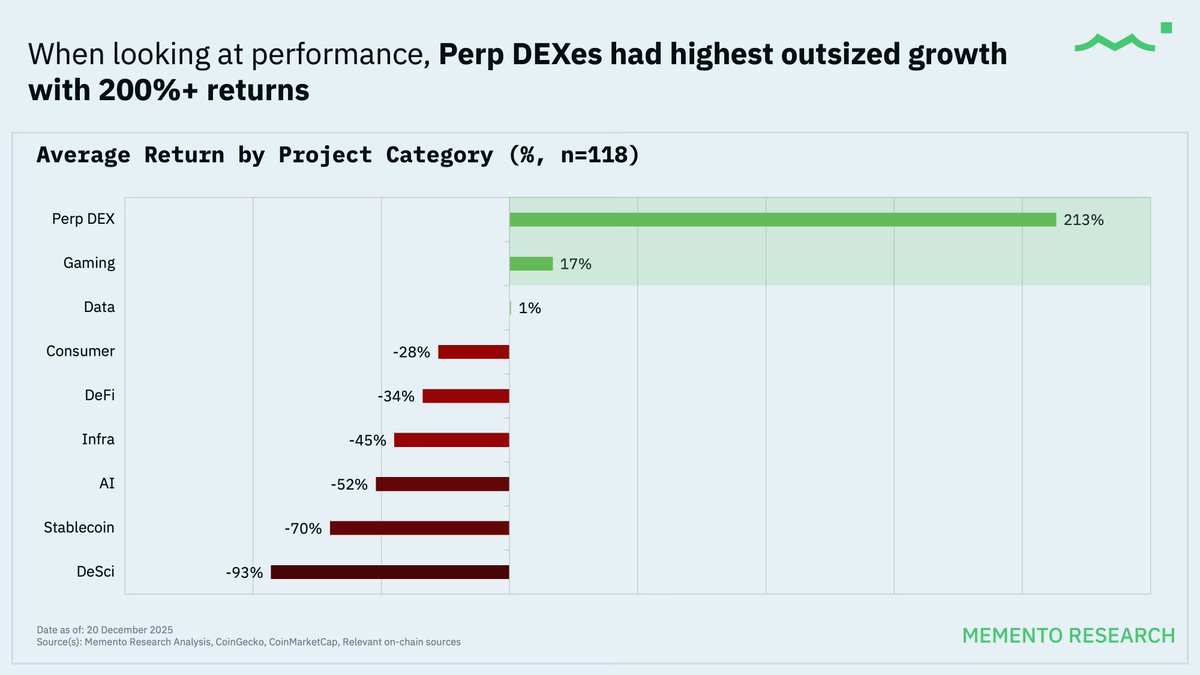

Memento Research tracked 118 major token launches in 2025:

- 84.7% of the prices are lower than their valuation at the token generation event (TGE).

- Median performance: FDV decreased by 71.1% and market cap decreased by 66.8% compared to launch.

This is why the strategy of "only buying new listings" has become a death trap. But here's the twist:

Even in this diluted, ruthless market—you can still make money if you identify the right narrative early on. (More details later)

Part 2: Why Small Players Are Exploited by Default Paths

The Illusion of a "Fair Start"

Retail investors no longer trust VCs and are unwilling to buy overvalued altcoins after a Token Generation Event (TGE), so the market has created a new product: a casino where anyone can "get in early." There are no VCs, and there are no high valuations at the TGE.

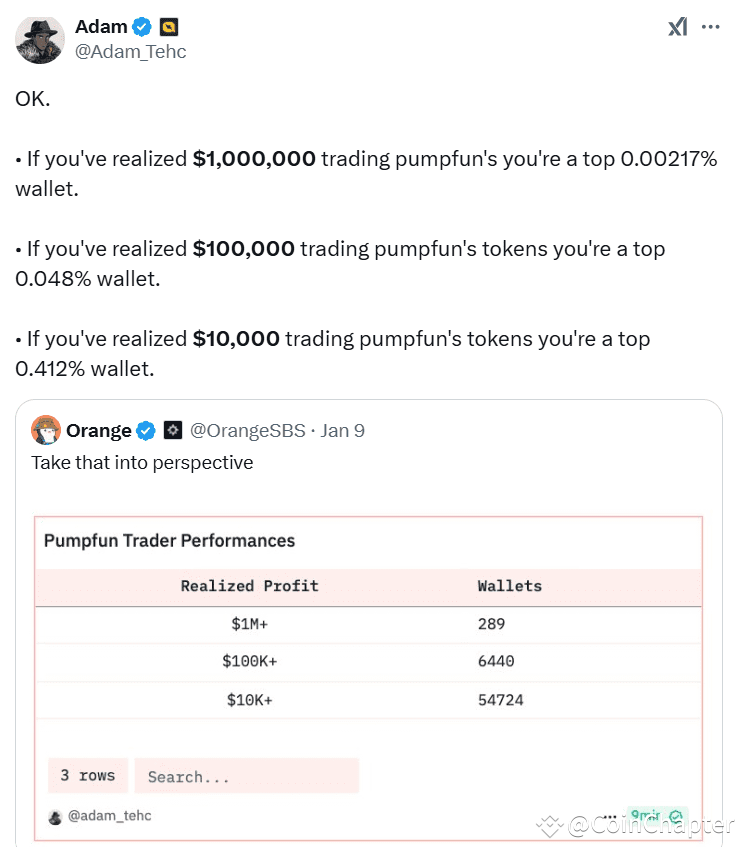

The Era of Pump.fun Has Arrived. Some data is as follows:

- 1,355,000 Pump.fun wallet addresses

- Only 55,296 (0.4%) wallets achieved a profit of over $10,000.

- This means that 99.6% of people did not meet the standard, and more than 90% are experiencing losses.

So, indeed, a very small group of people achieved a huge victory.

But the median outcome is that liquidity is given to token developers, their insider friends, paid KOLs (Key Opinion Leaders), Pump.fun developers, or simply to faster players and trading bots. While users are fighting over the scraps, the big players are printing money wildly.

- Pump.fun has collected over $935 million in fees since its launch.

The same dynamic exists in prediction markets: an analysis cited by Finance Magnates found that among Polymarket's 1.7 million trading addresses, over 70% incurred losses.

If your plan is "I want to be the exception," you need a real advantage (edge). Otherwise, you're just a random variable in a negative distribution.

Part III: The theme for 2026 is sector rotation rather than a altcoin season.

In a diluted market where most new coins perform poorly, the behavior of liquidity has changed:

- Highly concentrated liquidity

- Liquidity moves quickly.

- Liquidity needs a story.

- The speed of liquidity withdrawal is faster than you can imagine.

Therefore, the way to win is not "picking shillcoins." Instead, it's:

- Identify the next rotation as early as possible.

- Go with the flow.

- Take profits before the next move begins.

This is why a 100x return is still possible in 2026: not relying on a single coin, but on the combination of overlapping momentum + position management + exiting like a professional player.

Part Four: From 2023 to 2025, rotation is the only truly winning approach.

If you look back at the past 2-3 years, the pattern is very clear: you don't win by simply "holding onto one coin" and waiting. You win by catching the right momentum early on—and then winning again by riding the next wave of momentum.

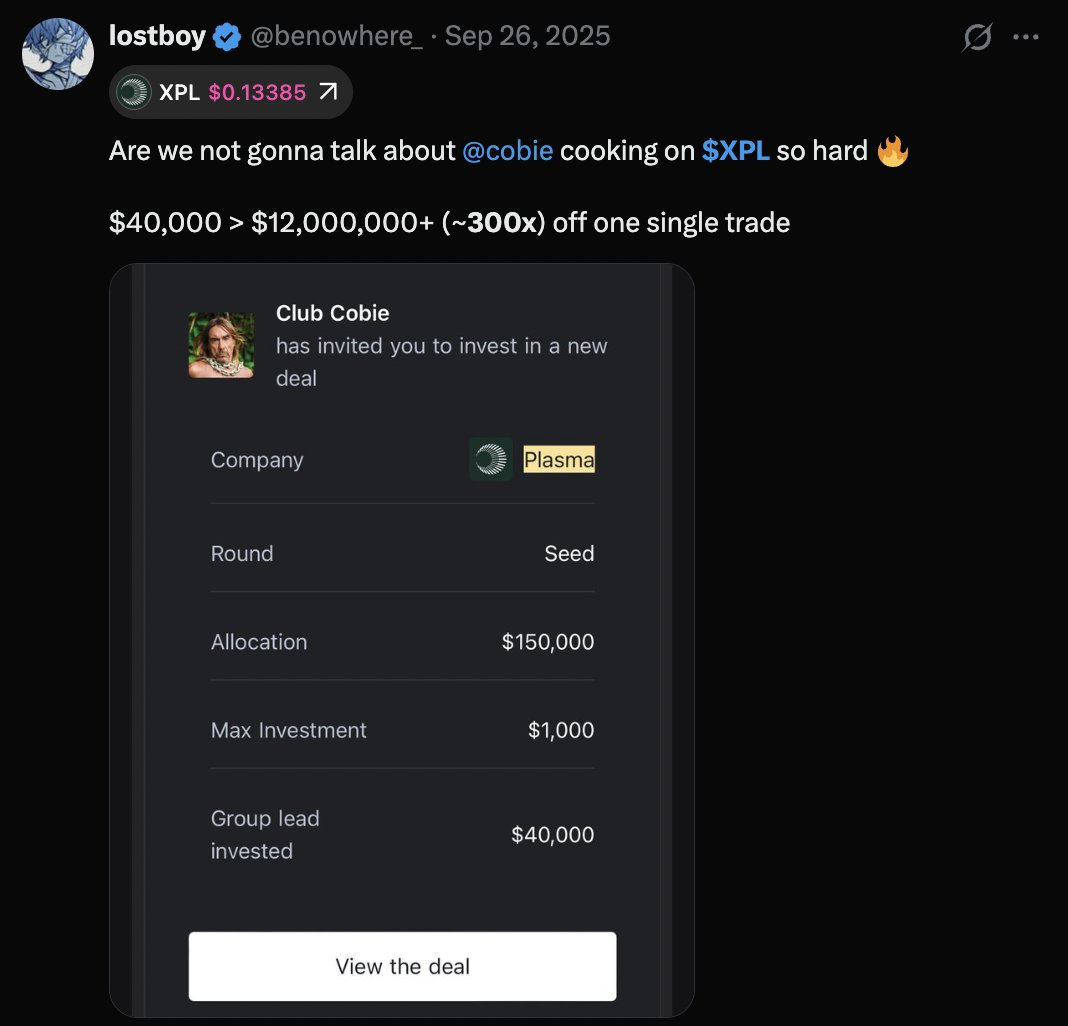

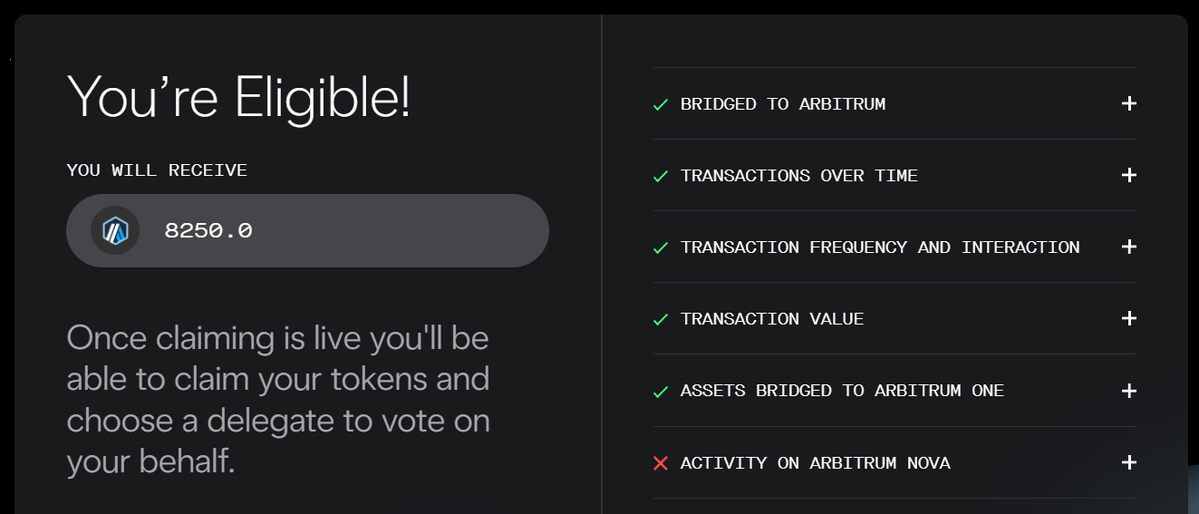

Cycle 1 - Airdrops (where I earned my first six figures)

When my capital was still small, I didn't intend to win simply by making more skillful trades. I was seeking asymmetry—opportunities where the potential returns are not dependent on the size of the capital.

Airdrops are exactly like that. They reward time rather than capital, so in that area, I am equal to someone who has six-figure assets.

When the market was dead and no one cared (at that time BTC was at the bottom), I was doing boring work—staying active and using the protocol. Then the market recovered, and everyone started "farming." By then, the advantage had already disappeared. This is why early efforts are rewarded.

Arbitrum ($ARB) launched on March 23, 2023. Optimism has conducted multiple airdrop rounds over time—following the same logic: early participation + persistence = substantial rewards.

This is how I earned my first significant amount of capital—not through a miraculous 100x position, but by getting in early before this meta-narrative became crowded. I started with $8,000, spent only about $400 to claim a few airdrops, and eventually made a six-figure profit.

Rally 2 - Early Solana Memecoins (Where I Made My First Seven Figures)

After the airdrop (helicopter money), liquidity flowed into the "casino." Money came quickly and also vanished quickly. The market began craving something new—Solana Meme became the simplest answer.

I discovered POPCAT when its market cap was around $2.5 million, and WIF when its market cap was $30 million (a few months later, their market caps reached $2 billion and $4 billion respectively): increases of 100 to 1,000 times.

My success wasn't because I'm a trading genius. It was because I was immersed in the market 24/7. At that time, the market was very quiet, and these "shiny new Solana coins" were basically the only real momentum-driven meta-narrative at the time. There were fewer than five coins with a market cap exceeding $1 million, so if you entered early, the winners were easy to identify.

Rotation 3 - "Real Income" Becomes the New Display (Based on the HYPE Template)

After the dopamine rush from memes, the market began to crave something else. Not "utility in two years," nor "vibes." But something you can explain clearly in one sentence, that sounds like a real business.

This is why Hyperliquid ($HYPE) has such a significant impact. It's not just a "new token." Its story is:

- Real trading activities

- Actual cost and revenue

- Token Direct Benefits (Buyback)

Whether you love it or hate it, this is where the market, tired of "casino" dynamics and "extraction," turns: visible value capture. Even if you're not that "smart," you can see it: when everyone gets tired of memes, they start paying for narratives that appear mature.

Cycle 4 - The Metanarrative Advances: "Don't play in the casino, own the casino."

This is the most interesting part of the crypto space. People will bet on 5,000 memes... ...and then suddenly realize that the only ones who consistently win are the platforms that charge fees.

This is the moment when "house tokens" and "platform games" start to shine. Pump.fun is a perfect example of this era: users fight each other for scraps, bots reap everything, and the house quietly prints money every day. This is not a moral judgment, but simply how the market operates.

The rotation is always the same:

- First, you trade tokens.

- Then you trade on the platforms that pump money from these tokens.

Cycle 5 - When the market becomes excessively decadent, it will swing back to the "real world" narrative.

After some time, people get tired. They begin to crave narratives that can survive without pure hype:

- Stablecoin

- Payment

- Settlement Track

- The real things used by ordinary humans.

This was deliberately designed to be boring. Boring narratives often prevail in the later stages because they are the only things that can be sustained without constantly requiring new fools to buy in at higher prices. This is why you later see more attention flowing toward stories like PayFi or stablecoin infrastructure.

So, what's the next step?

First, let's honestly face the current situation. BTC is now around $91,000 to $93,000, which looks "bullish" on paper, but the actual feeling is quite the opposite. We are still about 25% below the all-time high expected in October 2025 (around $124,700), and the market sentiment remains in "bear market mode."

Why? Because we have just experienced the largest liquidation event most people have ever seen—around 24 hours before and after October 10-11, 2025, approximately $19 billion vanished into thin air.

In such a market, capital will concentrate in 1-2 directions that are currently working, while everything else is bleeding. This is similar to the airdrop logic before the big rally in the previous cycle: the market is half-dead — but if you act early enough, a single meta-narrative can still make you a lot of money.

So the current task isn't "finding 50 potential coins." Instead, it's about identifying a few momentum cycles that can function without retail investors, and then digging deeper into them harder than others.

The current sentiment is: most tokens are useless, especially L1/L2.

This is the prevailing market sentiment at present: the majority of tokens are meaningless and will eventually become worthless because they:

- No practical utility

- Does not generate real income

- Primarily exists as an exit liquidity.

This hits L1/L2 the hardest. Because you can't keep playing this game forever: raising funds at absurd valuations, launching with an absurd fully diluted valuation (FDV), having only 8 users, making $20 per month, yet pretending you're worth $15 billion. (Starknet, zkSync, Aptos—you know which kind I'm talking about.)

Will this sentiment reverse? Perhaps. But I don't even need to predict it, as the implication is obvious...

What the market wants next is a new model: real earnings + buybacks

After 3 years of "extraction," people have finally come to understand the class structure: Creator -> VC -> KOL -> Bot/Trader -> Finally, every late buyer

For most retail investors, this game has a negative expected value: you buy tokens and pray that you're not the last one to exit liquidity. This is why the market is now extremely eager for tokens that behave more like "businesses."

A simple model: If a token has a market cap of $1 billion, the protocol generates $80 million in real annual revenue, and 50% of that is used for token buybacks... then this asset has a valuation floor. Unless the revenue collapses, it won't suddenly drop to zero.

This is exactly the logic behind value investing in the stock market: when market sentiment is poor and everyone is fearful, people stop buying "dreams" and start buying "cash flows." Cash flow becomes the best narrative in a fearful market.

Then the money helicopter returns—so does the casino.

This is the part that everyone will eventually forget. The "value phase" won't last forever. At some point, the market will start printing money wildly again: something surges dramatically, people get lucky, airdrops start hitting, and a new wave brings money back into people's hands.

Once people feel wealthy, the market instantly shifts from "show me income" to "show me the fastest 10x opportunities." That's when the casino phase returns. Memes, NFTs, no matter what new foolish things are invented. It doesn't matter. The pattern is always the same: it has no real value, but it can offer crazy multiples, and everyone wants quick money.

Then it will crash. After the crash...

The market enters the next "pump narrative" (ICO, utility tokens, structured issuance)

After being "rugged" by a casino, the market does not immediately become "fundamental-driven." It often shifts into a more structured pump-and-dump model, allowing people to spend money again, for example:

- ICO / "Public Round"

- Points Metanarrative

- "Utility Token"

- You pay for access, and others later sell it to you through a publishing mechanism.

Therefore, the cycle proceeds as follows: Value (revenue) -> Helicopter Money -> Casino -> Crash -> Structured Water Extraction -> Repeat

Nothing in the crypto space can grow forever. What grows is what the market is emotionally craving at that moment. So the winning strategy in 2026 is not "hold and hope." Instead, it is:Identify the early signs of momentum -> Go with the flow -> Exit before it becomes obvious.

Part V: How to Achieve a 100x Growth by 2026

A 100x return by 2026 isn't achieved through a single trade. It's achieved through compounding momentum. You win by stacking "correct phases," not by hoping you've found your golden goose.

This is the system I am using:

Select up to 2 rotations.

A conservative rotation (income/infrastructure) + an aggressive rotation (casino/structured). If you track 10 macro narratives, you'll be late on every one.

Buy "triggers," not "vibes."

Before I put in a heavy position, I need to define clear triggers. For example:

- The trend of expenses/revenue has been rising for consecutive weeks.

- User return without unreasonable incentives

- Distribution channels activated (Integration, large platforms, genuine attention)

- The narrative has started to spread but has not yet entered the mainstream.

No trigger, no entry.

Define "invalidation (失效)" before entering. Most people lose money not because they are wrong, but because they don't know when to exit. No one goes bankrupt from taking profits (even if it's just $1). Remember this. Your exit list should be boring:

- Usage collapse

- The income is fabricated.

- The liquidity rotation has left.

- Tokenomics/unlocking starts dumping

If the failure conditions are met, you leave immediately. No arguments.

Position Management - Three-Tier Stacking

This is how you achieve significant gains without resetting:

- Beta (Leading Liquidity in Rotation)

- Water Seller (Infrastructure That Wins Regardless)

- Only small-cap coins with perfect narrative fit are "bo bei zhe" (gambling odds). Only Beta (β) = capped returns.

Profit-taking is the true core advantage.

The speed at which the rotation ends is faster than you imagine. So:

- Reduce positions during a strong upward trend.

- Don't fall in love with mid-cap coins.

- Always know where you will move to next.

If you don't have the next target for the rotation, you'll ride the "rollercoaster" back the way you came.

Part Six: Traps That Trap Most People

The trap is thinking, "As long as I hold it long enough, it will definitely go up." This worked when the market size was still small, but it doesn't work anymore now.

Because now:

- The supply is unlimited.

- New coins are listed just to dump the price.

- The existence of most tokens is just to take your money.

So, if your plan is still:

- Buy new random coins

- Holding mid-cap coins for the so-called "grand cycle"

- Chasing an already popular trend

...You are participating in a "harvesting" game specifically tailored for you.

The rotation is a vulnerability. Because rotation is the current mode of liquidity.

Every week I observe:

- Which cost items are actually increasing?

- Which apps' active users are returning?

- Where are the trading volume and open interest (Open Interest) shifting toward?

- Where is the liquidity incentive being deployed?

- Is the narrative still in its early stages, or has it already become a topic of discussion among the top ten cryptocurrencies?

Most people don't miss the narrative. They arrive only after the narrative has become obvious.

Therefore, in 2026, just as in previous years, the winners won't be the "right people." They will be the "early people"—and they will keep changing.