Compiled by DeepTide TechFlow

Yes and no.

Although there were some sporadic layoffs in December last year, overall, the hiring momentum remained strong in the fourth quarter of 2025.

To understand the situation, I decided to examine data from major cryptocurrency industry job boards for the first two weeks of January 2026 (excluding company-specific job pages such as Lever, Ashby, etc.). The result showed there were only 85–90 unique new job postings.

We have a quiet start.

By comparison, the data for January 2025 is an outlier, with 1,192 job postings released that month, marking the highest monthly total for the entire year of 2025.

And data up to January 12, 2026, indicates that:

- The average number of job postings per day during the first two weeks of January 2025 is approximately 38.

- The average number of job postings per day during the first two weeks of January 2026 was only 6.5.

Conclusion: The start of the hiring season in January 2026 declined by approximately 80% compared to the same period last year. This confirms that the market's start is significantly slower than it was last year.

Job Details

- Job Type: 60% are technical/engineering positions, and 40% are non-technical/market expansion positions (GTM).

- Position Level: Positions at the "senior/lead/director" level account for approximately 65%, indicating that the company prioritizes hiring experienced employees to drive key product and business growth initiatives.

- Experience Requirements: Most positions require more than 5 years of experience, and leadership positions require more than 7 years of experience.

When conducting screening interviews with candidates, I usually ask them what interests them most about the crypto industry. Common answers are often "prediction markets" or "stablecoins." Therefore, it's no surprise that data shows about 60% of hiring is focused on infrastructure teams, stablecoin projects, and payment/financial technology track startups. In addition,@Kalshi and @Polymarket The "talent war" is expected to remain fiercely contested until 2026.

Most active phase of recruitment: Growth-stage companies (Series A and beyond) are currently the most active in hiring. Some hiring pages and Ashby data also support this argument:

Series A company:

- @lifiprotocol13 Open Positions

- @privy_io(Acquired): 10 Open Positions

- @crossmint10 Open Positions

- @CoinflowLabs14 Open Positions

Series B company:

- @turnkeyhq12 Open Positions

Series C company:

- @raincards49 Open Positions

Series D company:

- @Anchorage66 Open Positions

But perhaps more interestingly,The flow of talent is changing...

Solana Challenges Ethereum's Talent Moat

I've been working in full-time recruitment within the crypto industry for 5 years. Looking back, I can't help but wonder: "Has any other alternative chain ecosystem challenged Ethereum's dominance in recruitment and developer growth, as Solana has?"

The simple answer is: No, not at least to such an extent.

Historically, other chains such as Polkadot and Cosmos, to a lesser extent Avalanche, have experienced periods of rapid developer growth, but none have managed to challenge Ethereum in terms of market share and sustained hiring volume as Solana has.

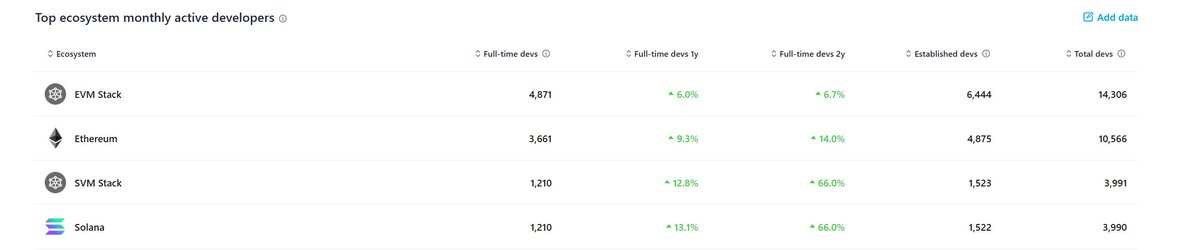

Solana is the first ecosystem that truly competes with Ethereum's appeal. In 2024, it became the first ecosystem since 2016 to attract a higher proportion of new contributing developers than Ethereum (Solana attracted over 22% of new crypto developers, while Ethereum attracted about 16%).[1] This is a historic anomaly. Typically, Ethereum has consistently attracted most of the new talent.

Source:@ElectricCapital Developer Report (Real-time Dashboard Data, January 14, 2026)

In the third quarter of 2025 alone, 23 projects within the Solana ecosystem raised a total of $211 million in funding, representing a 70% year-over-year increase.

For example, when a project raises $13.5 million in Q3 2025 (like @raikucom), the next step is typically to immediately hire 5–10 core engineers or founding engineers to build the core engineering, growth-to-market (GTM), and business teams. These positions are often not listed on public job platforms but are filled through investors/angel networks, hackathons, and direct headhunting.

By 2026, the Solana ecosystem appears to be well-prepared for further expansion. Community-driven talent networks like @SuperteamTalent, along with the $60 million funding pool provided by @colosseum, aim to drive an innovative "hackathon -> accelerator -> funding" model, all of which will contribute to the growth of the Solana ecosystem. This approach to building a sustainable, high-speed talent engine is definitely worth watching.

What will happen next?

As the cryptocurrency industry continues to evolve, the hiring landscape is also changing. Through token sales and token generation events (TGEs), the crypto industry has maximized the potential of internet capital markets. However, the reality is that most tokens launched in the past two years (or even longer) have continued to decline in value.

I believe that by 2026, we will start to see the consequences of this situation, which will impact how teams raise venture capital, enter the market, and, of course, how they recruit talent.

The winning projects this year (and in the future) will be those with strong business fundamentals, real users, solutions to real problems, and, most importantly, the ability to generate revenue.

My position remains basically unchanged... I stay optimistic about the long-term outlook.

Relevant materials

[1] Electric Capital Developer Report 2024—Solana Developers Surpass Ethereum in New Developer Share. Blockworks, 2024.