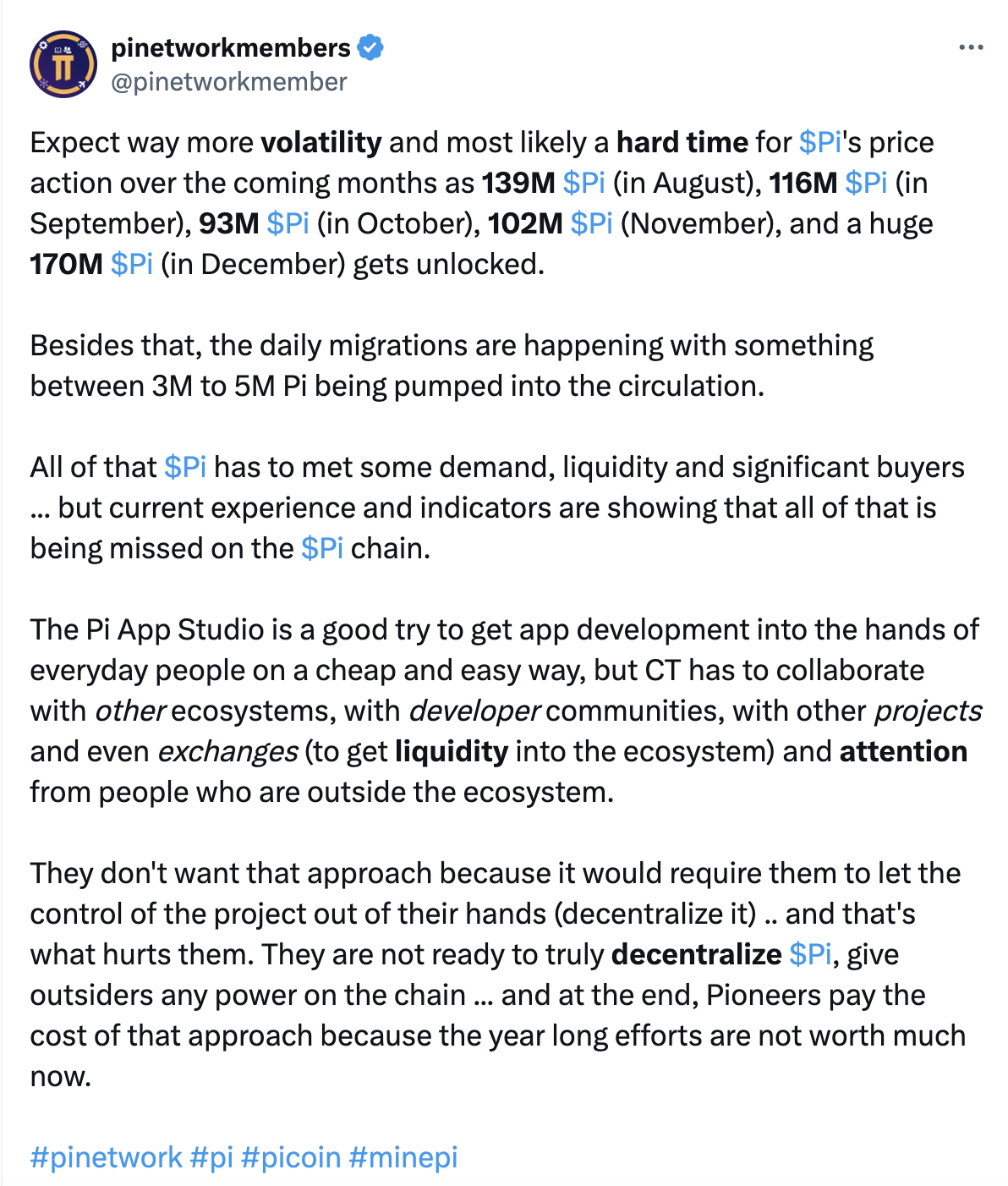

As reported by Coinpedia, Pi Network is facing significant challenges as over 620 million Pi tokens are set to unlock by December 2025. This surge in supply is raising concerns about price pressure and liquidity within the ecosystem. Analysts suggest that Pi Network needs to focus on decentralization, partnerships, and exchange listings to avoid long-term decline. The community is anxiously awaiting the impact of these token unlocks, with 139 million Pi entering circulation in August, followed by 116 million in September, 93 million in October, 102 million in November, and 170 million in December. A previous single-day unlock of 337 million Pi on July 15 led to a sharp 25% price decline, highlighting the immediate impact of supply surges. Despite the launch of Pi App Studio, the project struggles to attract external interest, and critics argue that the network's lack of decentralization is hindering growth.

The Looming Supply Shock

The sheer volume of tokens entering circulation in the coming months presents a formidable hurdle for Pi Network. The 620 million Pi tokens slated for unlock by December represent a substantial increase in the circulating supply, which could significantly dilute the value of existing tokens. This isn't mere speculation; the July 15 unlock of 337 million Pi, which triggered a 25% price drop, serves as a stark warning. As we move closer to the end of the year, the consecutive monthly unlocks—139 million in August, 116 million in September, 93 million in October, 102 million in November, and a staggering 170 million in December—create a sustained downward pressure that could prove challenging to mitigate.

Source: @pinetworkmember on X

At the heart of the issue lies a fundamental supply-demand imbalance. While Pi boasts a reported 47 million users and an expansive mining community, the question is no longer whether users exist—it’s whether the ecosystem can absorb the tokens they are earning. Critics argue that the Pi economy remains largely internal and illiquid, with limited real-world utility or integration with the broader crypto markets.

The dilemma is compounded by the fact that token migration from mining balances to the open market continues daily—estimated between 3 to 5 million tokens per day—even before the monthly unlocks are accounted for. With each wave of supply, pressure builds on the network to either generate organic demand or secure liquidity support through strategic listings and partnerships.

Centralization Shadows Long-Term Growth

A parallel concern revolves around Pi Network's governance model, which critics describe as too centralized for a protocol. Key decisions—including unlock scheduling, ecosystem funding, and roadmap priorities—are still largely handled by the core team, with no formal decentralized governance structure in place. This raises questions about the long-term sustainability and true "cryptocurrency" nature of Pi.

While the network has made early moves toward expanding validator participation, including the use of community-run nodes, there is still no DAO (Decentralized Autonomous Organization) or transparent voting mechanism that would give users real influence over protocol development. In the current environment, where investors increasingly prize transparency and autonomy, Pi’s centralized model may be a significant deterrent for both institutional interest and developer participation.

This governance bottleneck also casts a long shadow over the potential for major exchange listings. Platforms such as KuCoin and Binance typically require not only technical readiness but also compliance assurance and sufficient decentralization before onboarding a token. Until Pi’s mainnet opens fully and key infrastructure is decentralized, listings on top-tier exchanges may remain out of reach—further delaying crucial liquidity access for the growing user base.

Exchange Listings and Liquidity

The lack of official exchange support is arguably the single greatest friction point in Pi Network’s current trajectory. With no verified trading pairs on major platforms, token holders are left in a precarious position. Pi Network's current reliance on informal P2P transactions makes price discovery opaque and creates significant barriers to entry for external investors. The absence of a reliable market not only hampers liquidity but also distorts price discovery, fueling speculation and confusion among miners and investors alike.

The community widely agrees that establishing strategic partnerships with leading cryptocurrency exchanges like KuCoin or Binance could be a turning point. Not only would it provide users with a legitimate avenue to trade, but it would also validate Pi as a serious crypto project on a global stage. However, these listings are contingent on a number of yet-unmet milestones: full mainnet access, a completed KYC process for token holders, credible documentation, and ideally, clearer governance. Without these, the large volumes of tokens scheduled for release risk becoming “trapped value”—liquid in name, but inaccessible in practice.

The Struggle for External Interest and Utility

Despite its massive user base, Pi Network has struggled to translate its user engagement into tangible external interest and practical utility. The Pi App Studio, launched with the aim of fostering a developer ecosystem and DApp development, has yet to gain significant traction. For cryptocurrency to thrive, it needs more than just a large number of users; it needs compelling use cases, a vibrant developer community building innovative applications, and active participation from businesses and merchants.

The absence of widespread utility outside of the Pi ecosystem is a critical weakness. Users are accumulating tokens, but the avenues for spending, trading, or integrating Pi into everyday transactions are severely limited. This creates a supply-demand imbalance, where an increasing supply meets a stagnant or slow-growing demand for actual utility. To counter the impending supply flood, Pi Network urgently needs to stimulate demand by facilitating real-world applications, fostering partnerships with e-commerce platforms, and encouraging the development of genuinely useful DApps that incentivize token usage.

Community Sentiment and Investor Psychology

Source: CCN

Despite mounting pressure, Pi Network continues to command significant attention from its global community. Supporters point to its grassroots origins, mobile-first mining model, and inclusive vision as reasons to stay hopeful. Many early adopters still believe in the long-term potential of Pi becoming a widely used digital currency, especially in regions underserved by traditional financial infrastructure.

However, optimism is increasingly tempered by anxiety. Across social platforms like Reddit and X (formerly Twitter), a growing number of users express doubts about the team’s pace, transparency, and ability to execute on promised milestones. Some community leaders have called for more frequent updates and clearer communication regarding the mainnet roadmap, tokenomics revisions, and the long-delayed exchange integrations. Others have openly questioned whether Pi Network’s long beta-phase mining approach is sustainable—or simply diluting user expectations in the absence of tangible utility.

Investor sentiment, too, is split. While many Pi holders are passive miners hoping for a major listing event, more seasoned participants are beginning to weigh opportunity costs. As the broader crypto market gradually recovers, capital is flowing into projects with clear governance, liquidity, and interoperability—factors that Pi has yet to fully deliver.

What Comes Next?

To mitigate the impending price pressure and secure its long-term viability, Pi Network must undertake a multi-pronged approach focusing on:

-

Accelerated Decentralization: The core team needs to articulate a clear, transparent roadmap for progressive decentralization. This should include concrete steps towards open-sourcing more of the codebase, implementing a robust on-chain governance model, and empowering a diverse set of independent validators. Building trust through genuine decentralization is essential for attracting external capital and developer talent.

-

Bolstering Utility and Ecosystem Development: Pi Network must aggressively pursue partnerships with businesses and developers to create compelling use cases for Pi. This could involve integrating Pi as a payment method in e-commerce, incentivizing DApp development that addresses real-world problems, and fostering a robust ecosystem of services that leverage the Pi token. The focus should shift from simply accumulating users to creating a vibrant, functional economy within the network.

-

Prioritizing Exchange Listings: Engaging with major cryptocurrency exchanges for listing is no longer an option but a necessity. While the "Open Mainnet" remains elusive, strategic discussions and preparations for exchange listings should be a top priority. A phased approach, potentially starting with smaller, reputable exchanges and gradually moving towards larger ones, could provide much-needed liquidity and price discovery.

-

Transparent Communication: The Pi Network core team needs to enhance its communication with the community regarding the token unlock schedule, its strategies for managing supply, and the progress towards decentralization and utility. Clear, proactive, and transparent communication can help alleviate community anxiety and foster a sense of shared purpose.

Conclusion

As 2025 enters its final stretch, Pi Network finds itself in a delicate balancing act: managing token inflation while defending long-term viability. The numbers are daunting—over 620 million tokens entering circulation by year-end, in an ecosystem still grappling with liquidity, decentralization, and functional dApp engagement.

Yet the project is not without strengths. Its massive user base, inclusive ethos, and first-mover advantage in mobile crypto remain significant assets. Whether these can be leveraged in time—before sentiment turns decisively—will depend on the team’s responsiveness and the network’s ability to evolve beyond its current limitations.

For users, investors, and observers alike, the next five months will offer a telling glimpse into whether Pi Network can mature into the decentralized utility network it promises to be—or fade under the weight of its own scale.