Macro Risk Appetite Tightens as Technical Factors Drive Bitcoin’s Pullback

Summary

-

Macro Economy: U.S. economic data delivered mixed signals. Ahead of the release of nonfarm payrolls, investor risk appetite converged, leading to a mild pullback across major U.S. equity indices. The previously strong rally in metals cooled on a near-term basis, with silver and platinum seeing sharp corrections. In contrast, gold remained relatively resilient, holding around USD 4,450, indicating that safe-haven demand continues to provide underlying support.

-

Crypto Market: Bitcoin extended its pullback, filling the CME gap at USD 90,600 formed over the weekend. This price action suggests that short-term market dynamics are currently dominated by technical factors. The USD 94,500 level remains the key near-term resistance.

-

Project Updates

-

Hot Tokens: BREV, PAAL, CC

-

BREV: Fully listed on major global exchanges and key South Korean platforms, with KRW trading volume accounting for over 30%. The token rose by 20%.

-

BABY: a16z invested USD 15 million in Babylon, driving BABY up by 18%.

-

WLFI: An affiliated WLFI entity applied to the OCC for a national trust bank charter, aiming to directly issue and custody USD1 and expand institutional custody and stablecoin conversion services.

-

PAAL: Launched its AI-powered quantitative trading product, Quant X.

-

CC: JPMorgan plans to issue JPM Coin directly on the privacy-focused Canton Network, advancing interoperability for “regulated digital cash.”

-

Binance Life / ZKP: Binance listed spot trading pairs for Binance Life and ZKP. Price performance diverged—Binance Life saw a brief spike followed by a pullback, while ZKP surged by 90%.

-

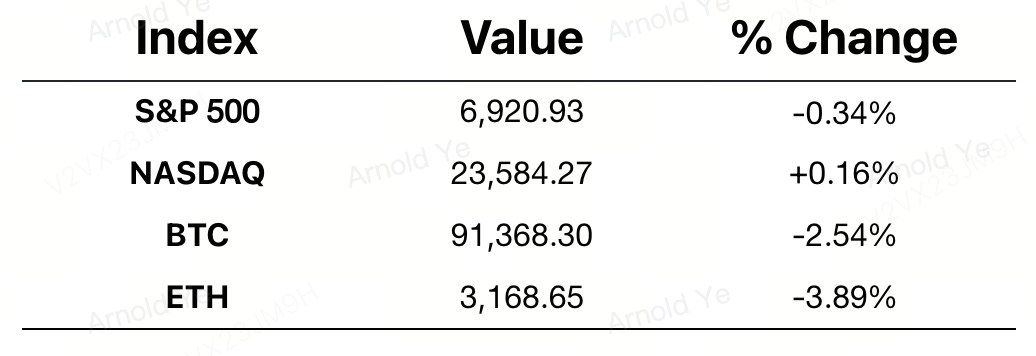

Major Asset Indicators

Crypto Fear & Greed Index: 28 (vs. 42 24 hours earlier), signaling Fear

Today’s Focus

-

CES 2026 (“Tech Super Bowl”), Jan 6–9, Las Vegas

-

Bloomberg Commodity Index (BCOM) rebalancing

-

U.S. initial jobless claims for the week ending Jan 3

-

Web3 robotics project XMAQUINA to conduct the final public sale of $DEUS in collaboration with Virtuals

Macro Economy

-

U.S. December ADP employment: 41k (vs. 47k expected)

-

U.S. November job openings: 7.146 million (vs. 7.6 million expected)

Policy Developments

-

The U.S. Senate Banking Committee will review the CLARITY crypto market structure bill on Jan 15, with ongoing disagreements around DeFi, official ethics, and stablecoin yield treatment.

-

The final Democratic SEC commissioner has stepped down, leaving three Republican commissioners in full control, fueling expectations of a more crypto-friendly regulatory stance.

-

RAKBank received in-principle approval from the UAE central bank to issue a dirham-pegged stablecoin.

Industry Highlights

-

KuCoin released its Australia market report based on user surveys conducted during the ACC Australia Crypto Conference, showing that over half of local users fund crypto accounts via traditional bank transfers—underscoring strong reliance on compliant and stable fiat on-ramps.

-

Polymarket entered its first media partnership with Dow Jones Media, enabling distribution of prediction data to The Wall Street Journal, Barron’s, and Investor’s Business Daily, while exploring new formats such as earnings calendar integrations.

-

Tempo introduced the TIP-20 token standard, designed specifically for stablecoin and payment use cases.

-

Morgan Stanley filed an Ethereum ETF application with the U.S. SEC.

-

JPMorgan will issue JPM Coin directly on the privacy-oriented Canton Network to advance interoperability of regulated digital cash.

-

Solana Mobile: SKR will launch on Jan 21, with an airdrop to Seeker users and developers; 20% of total supply is reserved for eligible participants.

Industry Highlights Extended Analysis

-

KuCoin Australia Report: The "Must-Have" Nature of Fiat Gateways

The heavy reliance of Australian users on traditional bank transfers (52.4%) reflects a broader transition of the crypto market from a "geek experiment" to mainstream adoption. In an environment of tightening global regulations, users are moving away from complex intermediary funding methods in favor of seamless integration with existing banking systems. For exchanges, the ability to secure local compliance licenses (such as AUSTRAC) and establish direct ties with domestic banking networks has become a core competitive moat—far more critical than simply offering a high number of trading pairs.

-

Polymarket & Dow Jones: Prediction Markets Enter the Mainstream News Cycle

The partnership between Polymarket and prestigious outlets like The Wall Street Journal marks the formal elevation of "prediction data" to a decision-making metric alongside earnings reports and economic indicators. This collaboration is a win-win: traditional media gains forward-looking, real-time sentiment indicators, while prediction markets shed the "gambling" label by gaining institutional backing. Specifically, the integration into earnings calendars suggests that crypto-native data is now deeply influencing and reshaping traditional financial research logic.

-

Tempo’s TIP-20: Evolution of the Payment Track Underlying Paradigm

The introduction of the TIP-20 standard signals a shift in payment-focused blockchains from "general compatibility" toward "deep customization." By embedding features like transfer memos, compliance controls, and reward distributions directly into the token layer, Tempo addresses the friction points of traditional ERC-20 tokens in payment scenarios. Backed by resources from Stripe and Paradigm, TIP-20 is poised to become a bridge connecting Web2 payment habits (such as ISO 20022 standards) with the clearing efficiency of Web3.

-

Morgan Stanley’s ETH ETF Filing: The Multi-Asset Institutional Trend

Following the success of Bitcoin ETFs, Morgan Stanley’s move (including potential exploration of Solana ETFs) sends a clear signal: top-tier Wall Street firms now view crypto as a diversified "asset class" rather than a single-asset anomaly. This expansion from BTC to smart contract platforms not only brings massive liquidity to Ethereum but also forces mainstream investors to recognize the value of "programmable finance." As ETF trading volumes are projected to hit new milestones in 2026, crypto is rapidly evolving from a fringe asset into a staple for pensions and mutual funds.

-

JPM Coin on Canton Network: Balancing Privacy and Compliance

JPMorgan’s deployment of JPM Coin on the Canton Network is a landmark step toward "regulated public ledgers." Canton’s privacy-centric architecture satisfies the strict confidentiality requirements of financial institutions, while the cross-chain issuance of JPM Coin breaks the limitations of the "siloed" private chains previously used by banks. This "controlled interoperability" is a prerequisite for the large-scale tokenization of Real-World Assets (RWA), signaling that digital fiat is moving from the lab into the real global settlement infrastructure.

-

Solana Mobile’s SKR: A Hardware-Driven Web3 Incentive Loop

The launch of the SKR token and its substantial 20% airdrop represents Solana’s attempt to restructure the mobile ecosystem through a "hardware empowerment + token incentive" model. SKR is more than just a reward; it carries governance functions (such as electing Guardian nodes) and ecological identity, aiming to challenge the "app store tax" monopoly of Apple and Google. If SKR successfully incentivizes developers to create exclusive apps for the Seeker, Solana will complete its transformation from "just a blockchain" to a mobile operating system, achieving true physical-world penetration for Web3.