Tariff Risks Intensify Risk-Off Sentiment as Bitcoin Retests Key Support

Summary

-

Macro Economy: Tariff threats continued to weigh on markets, dealing a heavy blow to European equities. Although U.S. equity markets were closed, index futures traded lower, signaling sustained pressure on risk appetite. Safe-haven flows accelerated into commodities, with the metals complex rebounding across the board as gold and silver extended gains and set fresh all-time highs.

-

Crypto Market: Against the backdrop of persistent macro risk, Bitcoin fell for a fifth consecutive session, retesting key support around USD 92,000. Market sentiment slid back into the “fear” zone. Bitcoin’s market dominance remained relatively stable, with fear not materially spreading into altcoins; instead, altcoins broadly retreated in tandem with the broader market, underscoring continued structural weakness.

-

Project Updates

-

Hot tokens: DUSK, STRK, ROSE

-

Privacy sector: Tokens including KEEP, ROSE, FHE, and SCRT rotated higher

-

Magic Eden: Starting February 1, 15% of revenue will be allocated to ME token buybacks and ecosystem development. Based on current revenue, monthly buybacks are estimated at around USD 20,000 worth of ME tokens

-

PUMP: PumpFun launched the Pump Fund and announced a USD 3 million “Build in Public” hackathon

-

CAKE: PancakeSwap passed a proposal to reduce CAKE’s maximum supply from 450 million to 400 million

-

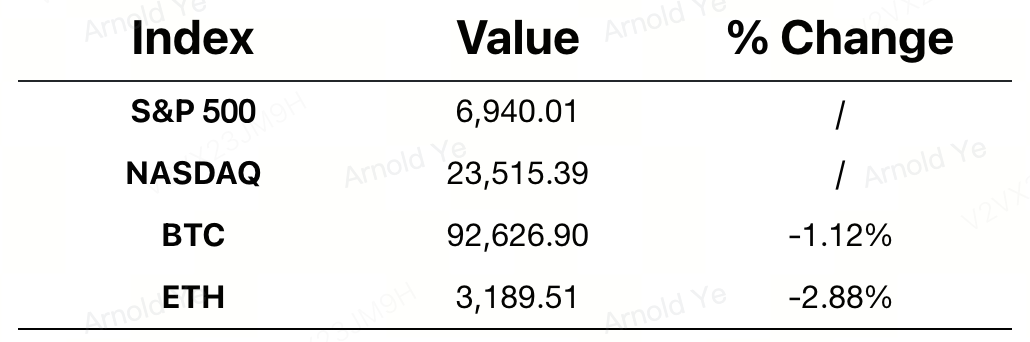

Major Asset Performance

Crypto Fear & Greed Index: 32 (vs. 44 24 hours ago), Fear

Today’s Agenda

-

The U.S. Supreme Court has designated January 20 as the next date to issue an opinion on tariffs, potentially ruling on Trump-era tariff cases

-

ZRO: Token unlock of 6.36% of circulating supply, valued at approximately USD 44.5 million

-

World Economic Forum — Winter Davos (Jan 19–23)

Macro Economy

-

Powell is set to appear at a U.S. Supreme Court hearing and is expected to publicly support Fed Governor Lisa Cook on Wednesday

Policy Outlook

-

White House: Establishing a “Strategic Bitcoin Reserve” remains a priority; seized BTC will not be sold, and frameworks for balance-sheet inclusion are under study

-

Bermuda: Partnering with Coinbase and Circle to advance a fully on-chain national economy pilot

Industry Highlights

-

NYSE: Developing a tokenized U.S. equities trading and settlement platform supporting 24/7 operations, instant settlement, dollar-denominated order sizing, and stablecoin-based fund transfers

-

X: Updated creator revenue-sharing rules—reply posts no longer generate income; only homepage timeline impressions count

-

ETHGas: GWEI airdrop eligibility checks open January 20, with the community airdrop scheduled for January 21

-

CoinShares: Digital asset investment products recorded net inflows of USD 2.17 billion last week

-

Ethereum: Daily transaction count hit a record 2.89 million

Deep Dive into Industry Highlights

-

NYSE Advances into Tokenized Equities: The Dawn of "Hybrid Finance"

The New York Stock Exchange’s move marks a profound convergence between traditional capital markets and blockchain technology. By supporting 24/7 trading and instant settlement (T+0), the NYSE aims to eliminate the multi-day settlement cycles and high back-office clearing costs inherent in traditional markets. The introduction of dollar-denominated orders and stablecoin-based fund transfers means that traditional stocks will soon possess the liquidity and flexibility of cryptocurrencies. This is not merely an infrastructure upgrade; it is a global reshuffling of capital efficiency, signaling the arrival of a "Hybrid Finance" era where the boundaries between physical and digital assets disappear.

-

X Platform Revenue Update: Shifting Incentives from "Interactions" to "Reach"

X (formerly Twitter) has refined its creator revenue-sharing model by excluding replies and focusing solely on Home Timeline impressions. This represents a strategic reclaim of algorithmic power. Previously, many creators gamed the system by "reply-guying" viral posts or sparking controversy in comments to farm engagement. This new rule shifts the incentive toward high-quality, original content that holds a place in a user's primary feed. While this may be a death blow to "engagement-bait" accounts, it is a necessary step toward purifying the social environment and rewarding genuine audience loyalty.

-

ETHGas Airdrop: A "Reverse Incentive" for Ethereum’s Power Users

The logic behind the ETHGas (GWEI) airdrop is particularly innovative: it rewards users based on their historical Gas consumption via "Gas IDs." By essentially "refunding" those who have endured high Ethereum mainnet fees over the years, the project has garnered massive community support. With eligibility checks opening on January 20, the hype has reached a fever pitch. Beyond being a simple distribution of funds, this event serves as a stress test for the "Gasless Future" vision, seeking to turn transaction friction into a platform for decentralized governance and user rebates.

-

CoinShares Data: A Resilient Surge in Institutional Appetite

Recording USD 2.17 billion in net inflows within a single week is a significant milestone, representing the highest weekly total since October 2025. Despite macro-geopolitical headwinds—such as trade tariff discussions and diplomatic shifts—global institutional confidence in digital assets remains unshaken. Notably, U.S.-based spot ETFs continue to be the primary engine of this growth. The diversification of these inflows into assets like Ethereum, Sui, and Lido suggests that institutional capital is moving beyond "Bitcoin-only" strategies and is now betting on the growth of broader smart-contract ecosystems.

-

Ethereum’s Record Transactions: Reaping the Rewards of the "Fusaka" Upgrade

Ethereum’s daily transaction count hitting 2.89 million is a direct validation of the "Fusaka" upgrade and the successful optimization of data blobs (PeerDAS). For the first time, the network is handling record-breaking volume while maintaining average gas fees below $0.15. In the past, such activity would have driven fees to unusable levels, forcing users to other chains. Today, with stablecoins accounting for nearly 40% of this traffic, Ethereum is cementing its role as the "Global Settlement Layer." This "high volume, low cost" paradigm proves that Ethereum’s scaling roadmap is effectively delivering the infrastructure needed for mass-market dApps.