Industry Report

U.S. labor market signals are mixed, putting pressure on Bitcoin and leading to a pullback.

Summary

-

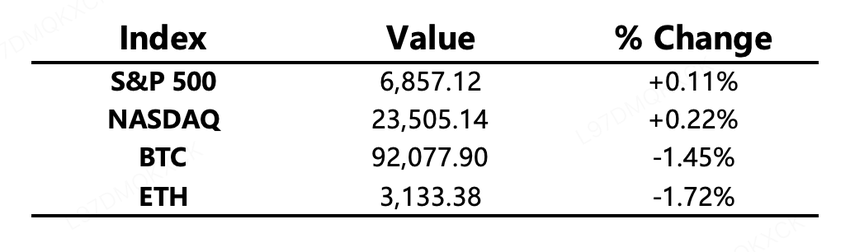

Macro Environment: U.S. labor market signals were mixed. Corporate layoffs hit their highest level since 2022, while initial jobless claims fell to a more-than-three-year low. Investors’ expectations for a December FOMC rate cut remained intact. U.S. equities were mixed, with small-cap and rate-sensitive sectors continuing to rise. Among major indices, only the Dow ended lower as markets await Friday’s PCE release.

-

Crypto Market: Bitcoin remained capped by resistance at 94k and continued its pullback, stabilizing around 91k. As the broader market steadied, altcoin activity picked up. Although prices retraced alongside BTC, both market cap share and trading volume share of altcoins rebounded, with the meme sector showing a notable resurgence in interest.

-

Project Developments

-

Trending Tokens: FARTCOIN, ZEC, SXP

-

SXP: Upbit resumed SXP trading following its latest security audit, driving a 26% rally. Upbit accounted for over 80% of SXP’s trading volume.

-

The privacy sector rallied alongside ZEC, with DCR, ZEC, DASH, XVG all posting broad gains.

-

AERO: Robinhood listed AERO.

-

SUI: 21Shares launched the 2x leveraged SUI ETF (TXXS) on Nasdaq.

-

Major Asset Movements

Crypto Fear & Greed Index: 28 (vs. 26 24 hours ago), categorized as Fear.

What to Watch Today

-

U.S. September PCE revised to be released on Dec. 5; Q3 GDP initial reading cancelled.

Macro Updates

-

U.S. Treasury debt surpassed $30 trillion, doubling from 2018 levels.

-

Corporate layoff announcements declined from October’s spike but still marked the highest November level in three years.

-

Sources indicate the Bank of Japan is almost certain to raise rates in December, with no government intervention expected.

Regulatory & Policy Developments

-

U.S. SEC discussed tokenization regulation; traditional finance and crypto industry remain divided on decentralization issues.

-

IMF warns that widespread stablecoin adoption could weaken central banks’ monetary control.

-

CFTC Acting Chair: Spot crypto can now be traded on CFTC-registered exchanges.

Industry Highlights

-

KuCoin launched “KuCoin Lite Mode”, offering a simpler, safer entry experience for new users.

-

BlackRock, managing $13.5 trillion, revealed that its Bitcoin ETF has become one of its top revenue drivers.

-

Kalshi signed an exclusive agreement with CNBC to integrate real-time prediction data into the media platform.

-

Decentralized perpetuals DEX volume surpassed $1 trillion in November.

-

Russia’s second-largest bank, VTB, plans to launch Bitcoin and crypto trading services in 2026.

-

21Shares listed the 2x leveraged SUI ETF (TXXS) on Nasdaq.

Expanded Analysis of Industry Highlights

KuCoin Launches “KuCoin Lite Mode,” Offering a Simpler, Safer Entry Experience for New Users

The introduction of KuCoin Lite Mode is a strategic move by the cryptocurrency exchange to capture the mainstream user base and lower the barrier to entry. By offering a minimalist interface and simplified operations (such as one-click trading and instant swaps), it hides complex trading tools, allowing novice users unfamiliar with the crypto market to focus on core functions like buying and holding (HODL). This significantly improves user experience and adoption rates. It signals that competition among exchanges is shifting from offering more high-risk, high-leverage products to providing safer and more user-friendly options to attract a wider demographic of retail and traditional investors who are not interested in complex trading.

BlackRock, Managing $13.5 Trillion, Revealed That Its Bitcoin ETF Has Become One of Its Top Revenue Drivers

This statement from BlackRock, an asset manager with $13.5 trillion AUM, is a landmark proof of cryptocurrency's acceptance by the traditional financial system. It implies that the fee revenue generated by the Bitcoin ETF has surpassed many of its long-established, mainstream products (such as the S&P 500 ETF). This achievement not only reflects the immense retail and institutional investment demand for cryptocurrency but also confirms that compliant channels within traditional finance (like ETFs) are currently the most efficient and profitable way to bring capital into the crypto space. This will accelerate the launch and marketing of digital asset products by other traditional asset managers, further solidifying Bitcoin's status as a legitimate investment asset.

Kalshi Signed an Exclusive Agreement with CNBC to Integrate Real-Time Prediction Data into the Media Platform

The partnership between prediction market platform Kalshi and CNBC to integrate its real-time market prediction data into mainstream financial media signifies the legitimization and mainstreaming of prediction markets as a news and analysis tool. Prediction markets are essentially a form of real-time crowdsourced polling that aggregates the views of many participants, often proving faster and more accurate than traditional polls or expert analysis. This move will provide CNBC viewers with analyses of events (such as economic data, political events) based on market probabilities, enhancing data-driven news reporting. This not only expands Kalshi's brand influence but may also prompt other major news organizations to incorporate market mechanisms into their news production process.

Decentralized Perpetuals DEX Volume Surpassed $1 Trillion in November

Decentralized Perpetual Futures Exchange (Perp DEX) volume surpassing $1 trillion in a single month is a key indicator that DeFi's competitiveness against Centralized Exchanges (CEXs) has reached new heights. This milestone reflects the strong market demand for high-leverage, highly liquid on-chain derivatives trading. Perp DEXs continue to capture market share from CEXs by eliminating custody risk, offering greater transparency, and demonstrating stronger system resilience during high-volatility events. This trend will accelerate the development of Layer 2 and emerging app-chains specifically designed for derivatives to meet the demand for high throughput and low latency, further validating the maturity of the DeFi infrastructure.

Russia’s Second-Largest Bank, VTB, Plans to Launch Bitcoin and Crypto Trading Services in 2026

The plan by VTB, Russia's second-largest bank, to offer cryptocurrency trading services reflects how geopolitical and macroeconomic pressures are driving a regulatory shift and the adoption of cryptocurrency by traditional financial institutions in Russia. Amidst Western sanctions, Russia is seeking alternative financial infrastructure, and cryptocurrencies offer a potential pathway to bypass the traditional Swift system. The entry of a major bank suggests that the country's regulators may be creating a controlled, institution-friendly framework for crypto assets. This is significant for unlocking Russia's massive domestic capital and facilitating cross-border digital transactions, though the 2026 timeline depends on final regulatory certainty.

21Shares Listed the 2x Leveraged SUI ETF (TXXS) on Nasdaq

The launch of the 2x Long SUI ETF (TXXS) by 21Shares on Nasdaq is a signal of the expanding asset class and increasing product complexity in the crypto Exchange-Traded Product (ETP) space. As an emerging Layer 1 blockchain, the listing of a leveraged ETF for SUI indicates that institutional and professional investor interest and confidence are growing rapidly in "altcoins" beyond the mainstream. While riskier, leveraged products meet the needs of short-term traders to amplify daily returns, while also offering a convenient channel through the regulated exchange structure, further introducing cryptocurrency market depth into the traditional financial world.