S&P 500 Hits Record High, Bitcoin Extends Range-Bound Consolidation

Summary

-

Macro Environment: U.S. Q3 GDP grew at an annualized rate of 4.3%, the fastest pace in two years, while ADP private employment recorded positive growth for three consecutive weeks. Strong economic and labor data dampened expectations for rate cuts next year but did not derail the “Santa rally.” Supported by tech stocks, the three major U.S. equity indices reversed from early losses to close higher, with the S&P 500 reaching a new all-time high. U.S.–Venezuela geopolitical tensions further escalated, pushing gold, silver, and copper to fresh record highs, while crude oil posted a five-day winning streak.

-

Crypto Market: The Santa rally failed to lift the crypto market, with total market capitalization down 2.27%. Bitcoin moved higher alongside U.S. equities but pulled back again after testing 88.4k late in the session, as prior support levels showed signs of turning into resistance. Liquidity continued to concentrate in major assets, with altcoin trading volume share declining to 58%. Market sentiment was unchanged from the previous day, remaining in the Extreme Fear zone.

-

Project Updates:

-

Trending Tokens: XAUT, AVNT

-

XAUT: Gold prices broke above USD 4,500 amid heightened geopolitical tensions and continued to set new highs.

-

On-chain perpetuals: The transfer of 250 million tokens from the Lighter token contract address signaled an imminent TGE. Derivatives DEX tokens AVNT, DRIFT, APEX, and AEVO broadly rallied.

-

S: Sonic Labs updated its airdrop tokenomics, with approximately 92,200,000 S tokens remaining unallocated and earmarked for targeted incentive programs.

-

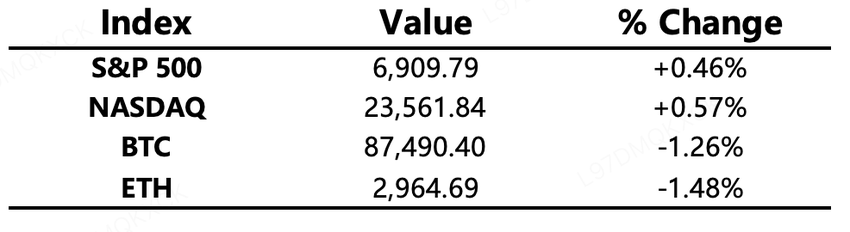

Major Asset Performance

Crypto Fear & Greed Index: 24 (unchanged from 24 hours ago), Extreme Fear

Today’s Outlook

-

Early close for the New York Stock Exchange

-

U.S. initial jobless claims for the week ending December 20

Macroeconomy

-

U.S. Q3 economic growth accelerated to 4.3%, exceeding expectations of 3.3% and marking the fastest pace in two years.

-

Bessent noted there is room for the Federal Reserve to adjust its 2% inflation target in the future.

-

Hassett stated that the U.S. is far behind the global trend in terms of the pace of rate cuts.

-

Trump criticized the “market not rising on good news” phenomenon and warned dissenters against attempting to take control of the Federal Reserve.

Policy Direction

-

Russia plans to liberalize domestic crypto trading, allowing limited participation by retail investors.

-

Russia will begin distributing the digital ruble to government departments starting January 2026.

Industry Highlights

-

Addresses linked to BitMine purchased another 29,463 ETH, worth approximately USD 88.2 million.

-

Sonic Labs released an updated airdrop tokenomics report, confirming around 92,200,000 unallocated S tokens for targeted incentives.

-

South Korean payments giant BC Card completed a stablecoin payment pilot.

Industry Highlights Extended Analysis

BitMine Accelerates Ethereum Accumulation to Solidify Its "Institutional Treasury" Dominance

-

By investing approximately $88.2 million to acquire another 29,463 ETH, BitMine has reached a historic milestone with total holdings surpassing 4 million ETH, now controlling about 3.37% of the global supply. This move reinforces Chairman Tom Lee’s "Alchemy of 5%" objective, aimed at establishing BitMine as the primary liquidity bridge between Wall Street and the Ethereum ecosystem. With the upcoming 2026 deployment of its proprietary staking infrastructure, MAVAN, BitMine is evolving from a passive asset holder into a cornerstone institution deeply involved in network governance and yield capture, a concentration of holdings that will significantly impact Ethereum’s long-term supply efficiency.

Sonic Labs Refines Incentive Structure to Fuel Long-Term Ecosystem Growth

-

The updated airdrop tokenomics report from Sonic Labs confirms the allocation of approximately 92.2 million unallocated S tokens as a strategic lever for targeted developer and high-value user incentives. By clarifying the distribution of these unallocated funds, Sonic Labs aims to alleviate market fears regarding "low circulation, high unlock" dilution while building confidence in the network's ability to monetize its 10,000 TPS performance. This precision-targeted incentive structure is designed to rapidly build Total Value Locked (TVL) during the early stages of the mainnet launch and provide the necessary momentum for the value migration from Fantom to the Sonic brand.

BC Card’s Stablecoin Pilot Signals the Accelerated "On-Chain Migration" of Traditional Payment Networks

-

South Korean payments giant BC Card has successfully completed a stablecoin payment pilot that bridges global digital wallets with South Korea’s massive domestic merchant network, allowing foreign tourists to spend stablecoins via digital prepaid cards. The strategic significance of this pilot lies in its "middle-layer" approach, which enables seamless Web3 payments without requiring merchants to change their existing POS hardware or settlement habits. As South Korea advances its stablecoin legislation, BC Card’s initiative serves as a blueprint for improving cross-border payment efficiency and heralds a broader shift in the payments industry from integrating information flows to achieving instant, blockchain-based settlement of value flows.