Industry Report

Muted Trading as Markets Await FOMC Catalyst

Summary

-

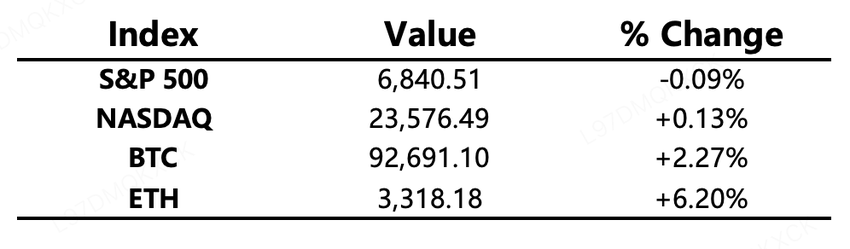

Macro Environment: U.S. ADP employment data unexpectedly improved but did not alter expectations for a December rate cut. “Shadow Chair” Hassett reiterated that the Fed has ample room to lower rates. With markets awaiting clearer forward guidance from the FOMC meeting, U.S. equities saw muted trading, and the three major indexes ended mixed.

-

Crypto Market: Boosted by rate-cut expectations, Bitcoin briefly surged over 5% intraday to $94.6k, lifting total crypto market capitalization by 3.22%. However, overall trading activity declined, signaling strong wait-and-see sentiment. Altcoins saw both market cap and trading-volume share contract, underscoring persistently weak liquidity. Market sentiment improved marginally but remained within the “fear” zone.

Project & Token Developments

-

Trending Tokens: WET, PIPPIN, ZEC

-

WET: Coinbase to list Humidifi (WET), driving a 58% price spike

-

Memecoins broadly higher: PIPPIN, WIF, DEGEN, and PENGU leading gains

-

Do Kwon trial: Scheduled for Thursday in New York; related tokens LUNA and LUNC rose

-

Privacy narrative heating up: Circle’s bank-grade privacy stablecoin initiative, SEC privacy roundtable; ZEC, ZEN, FHE, NIL, DASH rallied

Market Indicators

-

Crypto Fear & Greed Index: 26 (up from 22), still categorized as Fear

Key Events Today

-

U.S. Federal Reserve December rate decision; Chair Powell’s press conference

-

Bank of Canada rate decision

-

Linea (LINEA) to unlock ~1.38B tokens (~$11.1M)

Macro Updates

-

Hassett: Fed has substantial room for aggressive rate cuts

-

Trump to begin final round of Fed Chair candidate interviews; states rate-cut stance is the “litmus test”

-

U.S. October job openings rose to a five-month high as hiring remains subdued

-

BOJ Governor Ueda: rapid acceleration in inflation would warrant policy adjustment

-

RBA Governor: rate hikes may be needed if inflation remains elevated

Regulatory & Policy Trends

-

Bipartisan senators request public hearings before Senate Banking Committee proceeds—Market Structure Bill review may be delayed

-

U.S. OCC confirms banks may engage in riskless principal crypto transactions; no justification for treating banks and crypto institutions differently

-

SEC Chair: many categories of crypto ICOs fall outside SEC jurisdiction

-

EU to launch capital-markets integration reform by 2027; crypto companies to fall under ESMA oversight

Industry Highlights

-

Circle & Aleo to launch bank-grade privacy stablecoin USDCx

-

HashKey reveals IPO details: aiming to raise up to RMB 1.67B, expected to list on December 17

-

Bitwise’s crypto index fund BITW to trade on NYSE Arca

-

U.S. firms file for “AfterDark” Bitcoin ETF—holds BTC only when U.S. equities are closed

-

MetaMask perpetual futures feature goes live, supporting U.S. equities and stock-market trading

-

Stripe to enable stablecoin payments on Ethereum, Base, and Polygon

-

Vitalik: PeerDAS in the Fusaka upgrade marks a “heroic” milestone for the Ethereum Foundation

Industry Highlights Extended Analysis

-

Circle & Aleo to launch bank-grade privacy stablecoin USDCx

Circle's partnership with Aleo, a zero-knowledge proof (ZK)-based blockchain, to launch USDCx marks a significant step towards achieving the critical balance between privacy protection and compliance in the stablecoin sector. Unlike fully anonymous digital currencies, USDCx promises "bank-grade privacy" or "configurable compliance." This means it utilizes Aleo's ZK technology to conceal transaction details on-chain while retaining necessary compliance records (e.g., for authorized regulatory review). This innovation addresses the commercial intelligence leak risk faced by institutional investors and corporations using public transparent blockchains for applications like global payroll or large B2B settlements. It represents a crucial technological breakthrough to facilitate the mass adoption of stablecoins for private settlement by compliant institutions.

-

HashKey reveals IPO details: aiming to raise up to RMB 1.67B, expected to list on December 17

HashKey Group, a leading Asian crypto financial services provider and licensed exchange operator, revealing its IPO details and planning a December 17th listing is not only a major milestone for the group but also a strong affirmation of the regulatory maturity of the Asian crypto market. The scale of the proposed fundraising, up to RMB 1.67 billion, underscores the capital market's recognition of the value and strong demand for compliant, fully licensed crypto enterprises. HashKey's listing will provide traditional investors with a rare, regulated channel for direct exposure to the growth of the crypto industry, likely enhancing the visibility and acceptance of crypto assets within mainstream financial markets, and setting a significant precedent for other crypto-native companies seeking listings.

-

Bitwise’s crypto index fund BITW to trade on NYSE Arca

Bitwise's BITW (Bitwise 10 Crypto Index Fund) successfully upgrading from the OTC market to an Exchange Traded Product (ETP) on the NYSE Arca signifies the further integration of crypto index investing into the US mainstream financial system. As one of the largest crypto index funds, BITW tracks a market-cap-weighted index of the top ten crypto assets, offering investors a diversified, low-management-cost way to gain exposure without selecting specific coins (currently featuring Bitcoin at approx. 74.34%, Ethereum at 15.55%, and XRP at 5.17%). This listing improves the fund's liquidity, transparency, and accessibility, making it easier for a wider range of institutional and retail investors to allocate via traditional brokerage platforms, further confirming crypto assets' acceptance as a distinct asset class on Wall Street.

-

U.S. firms file for “AfterDark” Bitcoin ETF—holds BTC only when U.S. equities are closed

The filing for an "AfterDark" Bitcoin ETF by US firms demonstrates how financial product innovation is attempting to bridge the gap between traditional finance (TradFi) market hours and the 24/7 nature of cryptocurrency trading. The ETF's unique mechanism of only holding Bitcoin during US equity market closures (i.e., after-hours) is theoretically designed to allow investors to hedge or capitalize on significant crypto price movements that occur when the US stock market is closed. This highly specialized and time-constrained financial product reflects asset managers' focus on trading risks during specific time windows, and hints at a future ETF market with more complex structured crypto products based on time, strategy, or volatility.

-

MetaMask perpetual futures feature goes live, supporting U.S. equities and stock-market trading

MetaMask, as a leading self-custodial wallet, launching a perpetual futures feature that supports long/short positions on US equities and stock market indices is a profound DeFi innovation. By integrating with decentralized derivatives protocols like Hyperliquid, MetaMask brings traditional financial assets (such as NVDA, TSLA, AAPL, etc.) into its non-custodial, on-chain trading interface, realizing the convergence of Decentralized Finance (DeFi) and Traditional Finance (TradFi). Although the feature typically excludes users from restricted jurisdictions like the US and UK, it represents a clear trend of DeFi platforms moving towards offering all-asset-class derivatives trading, allowing users to speculate or hedge against global traditional markets 24/7 through a Web3 wallet using leverage.

-

Stripe to enable stablecoin payments on Ethereum, Base, and Polygon

Payment giant Stripe announcing support for stablecoin payments on Ethereum, Coinbase's L2 network Base, and Polygon is a pivotal milestone for mass commercial adoption of Web3 payments. This integration allows merchants to accept stablecoins like USDC for settlement, with Stripe handling the complex crypto infrastructure, liquidity management, and fiat settlement (e.g., settling in the merchant's USD account). The choice of L2 networks like Base and Polygon indicates Stripe’s intent to leverage their high efficiency and low transaction costs for retail and e-commerce scenarios. This move will significantly lower the barrier for merchants to accept crypto payments, pushing stablecoins from being a speculative tool toward becoming a true global commercial settlement currency.

-

Vitalik: PeerDAS in the Fusaka upgrade marks a “heroic” milestone for the Ethereum Foundation

Ethereum co-founder Vitalik Buterin calling PeerDAS (Peer Data Availability Sampling), implemented in the Fusaka upgrade, a "heroic" milestone emphasizes the technology's importance in solving Ethereum's core scalability challenge. PeerDAS is a sampling mechanism that allows nodes to verify data availability without a full node having to download all data, essentially forming a critical piece in realizing the sharding vision. By significantly increasing the data space (Blob Capacity) available for L2 Rollups (like Arbitrum, Optimism), PeerDAS greatly reduces L2 transaction fees (estimated to be reduced by 40-60%), thereby indirectly boosting the throughput and usability of the entire Ethereum ecosystem. This marks a solid step in Ethereum's transition from the theoretical sharding roadmap to practical engineering implementation.