Weekly Crypto Analysis: Top 5 Things to Know This Week, Ether and ApeCoin Outlook

Global cryptocurrencies are trading bullish on Monday, as the market continues to offer plenty of positive fundamentals. The global crypto market cap is $1.94 trillion, down 2.75% from the previous day. Over the last 24 hours, the total crypto market volume has increased by 17.79% to $68.79 billion.

The total volume in DeFi is currently $8.52 billion, accounting for 13.26% of the total 24-hour volume in the crypto market. The total volume of all stablecoins is now $52.39 billion, accounting for 81.55% of the total 24-hour volume of the crypto market.

Let's take a quick look at the top 5 latest cryptocurrency market news and the technical outlook for the leading crypto coins, Ether (ETH) and ApeCoin (APE).

Crypto Market Overview

Bitcoin’s market dominance has surged from 40.70% to 41.24%, as the largest cryptocurrency in the market consolidates at $42,268. During the past week, Bitcoin has plunged 8.55% to trade near $42,268. On Monday, Bitcoin was down around 1.43%. However, the fundamental outlook seems good. On the other hand, Ether, the second-largest cryptocurrency by market cap, fell by 9.38% in the past seven days. On Monday, ETH/USD was trading at $3,174, down about 2.50% in 24 hours.

Cryptocurrency Heat Map | Source: Coin360

Between March 28 and April 11, the ApeCoin price fell roughly 28% and shattered the $12.28 support level. This downtrend was broken when APE rallied 15% on April 10, indicating the start of an uptrend. However, the APE token seems to be gaining some traction on Monday, as it has already gained over 3% in the last 24 hours.

Later in this update, we will have a detailed technical outlook for Ether and ApeCoin.

Top Altcoin Movers This Week

Altcoins such as Kyber Network Crystal v2 (KNC), Monero (XMR), and Neutrino USD (USDN) remained the top performers from the previous week. KNC increased by more than 30.44% to trade at $4.17, while XMR surged by 10.81% in the last seven days to $5.43.

Waves (WAVES) is down 51.18% to $22,54, Axie Infinity (AXS) is down 14.6%, and Aave (AAVE) is down 27.5% to trade at $172.98.

Top Altcoin Gainers:

➢ Kyber Network Crystal v2 (KNC) ➠ 30.44%

➢ Monero (XMR) ➠ 10.81%

➢ Neutrino USD (USDN) ➠ 6.04%

Top Altcoin Losers:

➢ Waves (WAVES) ➠ 51.18%

➢ Axie Infinity (AXS) ➠ 28.02%

➢ Aave (AAVE) ➠ 27.57%

Crypto Fundamentals & News Highlights This Week

Here are some of the events that made the previous week's crypto news section stand out:

Crypto Fear & Greed Index Shifts to Fear - Crypto Market Under Pressure

The cryptocurrency fear and greed index collects and condenses emotions and sentiments from various sources into a single number. The Fear & Greed Index for Bitcoin and other major cryptocurrencies is calculated on a daily basis. The crypto fear and greed index score was 52 (Neutral) over the last week, indicating that some investors were feeling a little more optimistic. However, the index seems to shift market sentiment.

Fear & Greed Index | Source: Alternative

On Monday, the fear and greed index shifted from Neutral to Fear, indicating a bearish bias among cryptocurrency traders. According to the index, extreme fear can indicate that investors are overly concerned. That could be an excellent time to buy. Bulls typically wait for the index to move from fear to extreme fear before placing any bets.

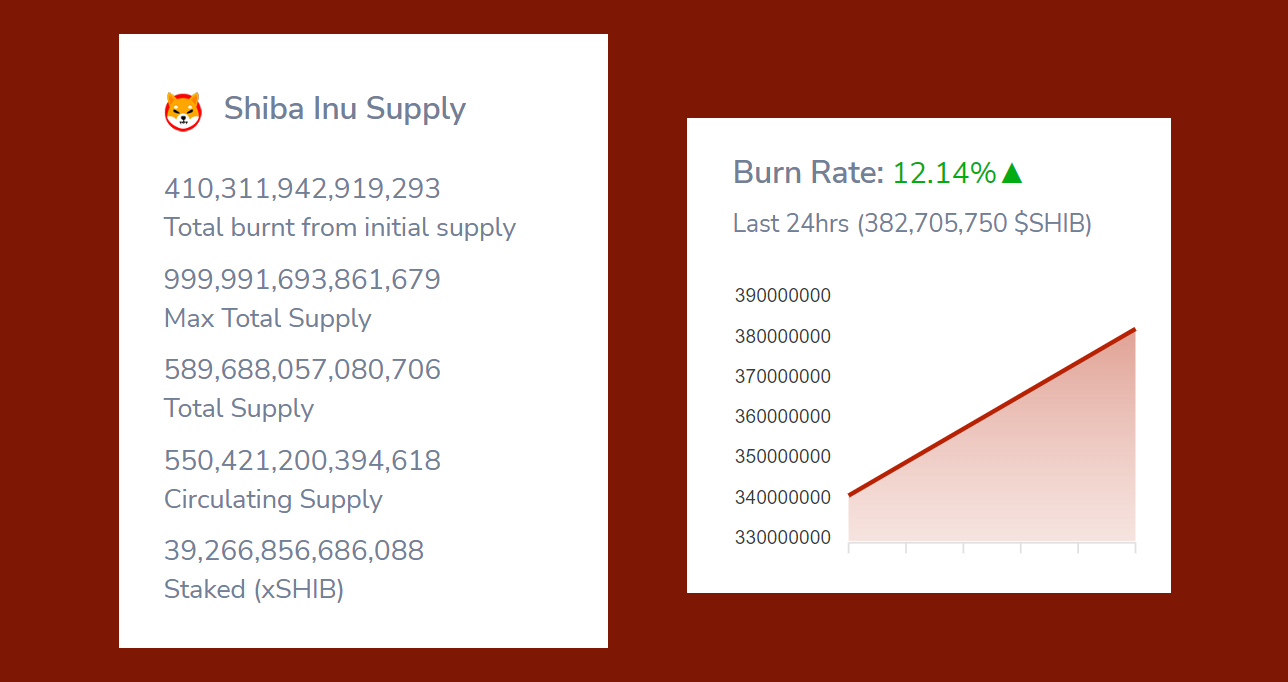

Shiba Inu Burn Rate Hits 26,000%

On Saturday, the second-largest meme-based cryptocurrency, Shiba Inu, burned a large number of tokens in the last 24 hours. Statistics say that the network's burn rate has increased by 26,592%, which has led to the destruction of 1.4 billion SHIB.

Shiba Inu Burn Rate on April 09, 2022 Source: shibburn.com

According to shibburn.com, 1.4 billion SHIB were burned in the last day at a rate of 26,592%. On March 14, the burn rate for SHIB was 6,700%, resulting in the destruction of 745 million SHIB in a single day. In comparison, during the last 24 hours, the Ethereum blockchain destroyed 4,098 ether.

The 24-hour value burned by Ethereum is far more valuable, with $13.2 million burned in the last day. The value of SHIB's 1.4 billion tokens burned, on the other hand, is only $34,554. Despite this, the Shiba Inu coin failed to gain support and fell around 1.63% to trade at $0.00002436.

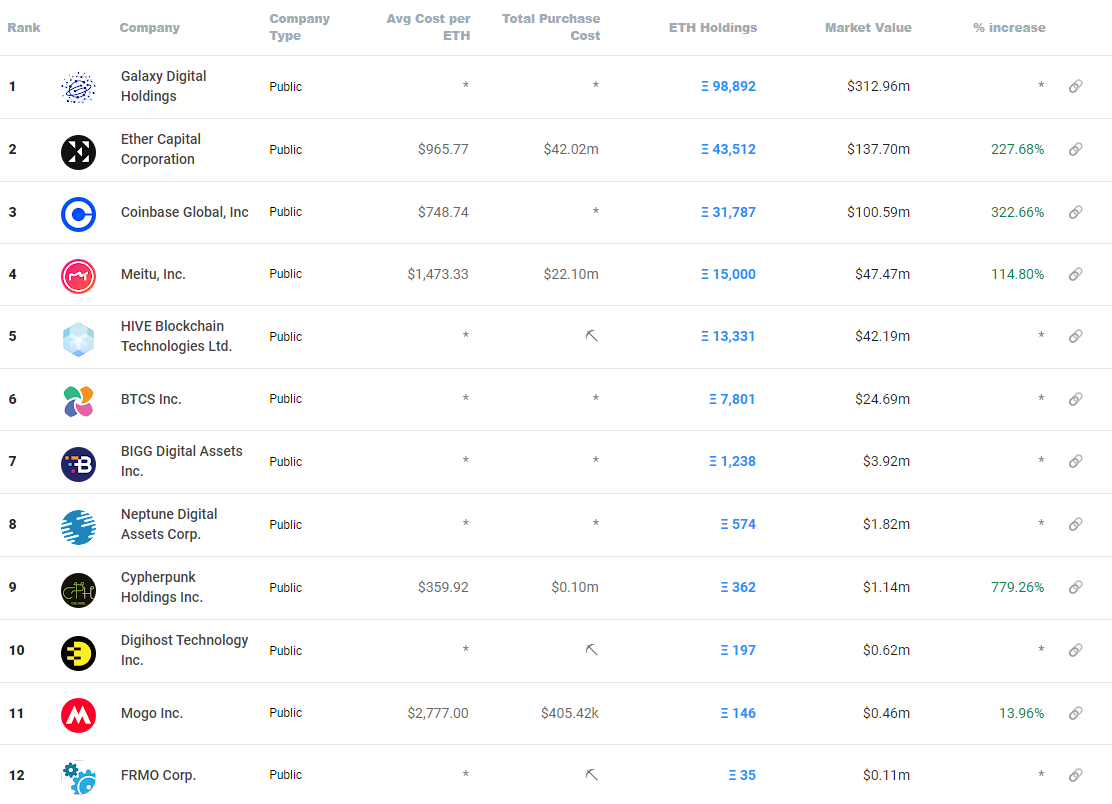

Ethereum Treasuries Have Grown Close to $700 Million

There has been a lot of talk in the last year about bitcoin treasuries or public companies putting bitcoin on their balance sheets. However, the most valuable crypto asset in terms of market capitalization is not the only digital currency held by treasuries. Ethereum has emerged as a prominent treasury asset, with a number of companies known to hold the second-largest cryptocurrency in their reserves.

Cryptocurrency Treasuries | Source: cryptotreasuries.org

According to the list maintained by cryptotreasuries.org, 212,875 Ether is held by 12 distinct entities. The website cryptotreasuries.org displays information about 12 different funds and companies that hold Ethereum.

According to the data, the entities currently hold 212,875 ether worth nearly $700 million. Galaxy Digital Holdings is the largest holder on that list, with 98,892 ether held at the time of writing, according to cryptotreasuries.org. Galaxy Digital Holdings controls 46.45 percent of the 212,875 ether distributed among the 12 entities. Typically, this should underpin Ether’s demand, and keep its prices bullish.

Ethereum's Hashrate Taps an All-Time High Before The Merge

While the Ethereum community prepares for The Merge and the protocol's transition to full proof-of-stake (PoS), the network's hashrate reached an all-time high (ATH) on April 7, 2022. Ethereum's hashrate peaked at 1.131 petahash per second (PH/s), a 13 percent increase in 89 days.

Since March 21, 2016, the hashrate of Ethereum has grown at an exponential rate. On that particular day, the hashrate was Ethereum approximately 1.51 terahash per second (TH/s), or 1,510,000,000,000 hashes per second (H/s). Currently, the Ethereum hashrate is 1.131 PH/s, or 1,131,000,000,000,000 H/s, which is 74,800% higher than it was six years ago.

Ethereum Hashrate | Source: Coinwarz

Ethereum's daily mining rewards have surpassed Bitcoin's 24-hour mining rewards in recent times. On April 11, 2022, Ethereum's daily mining income of $88.8 million is 16 percent greater than Bitcoin's daily rewards of $76.4 million.

How does it impact Ether?

Cryptocurrency miners place a high value on the hashrate. They want their machines to solve puzzles as quickly as possible because they are constantly competing with other miners to be the first to generate a valid hash. If they use equipment with a slower hashrate than their competitors, they will not win the race to be the first as frequently. Instead, they compete with many other miners if they work in a network with a high hash rate. Both have an impact on the profitability of miners.

Investors consider the hashrate to be a measure of network security. Because more computers validate transactions, the higher the hash rate, the more difficult it is for a bad actor to launch an attack on a network. Hence, the higher hash rate can result in a surge in Ether’s demand.

Negative Crypto Funding Rates Weight on Cryptocurrencies

Despite a drop in the leading cryptocurrency prices, the funding rate remains above zero, indicating market optimization. Bitcoin's price has recently dropped from $47,106.14 (April 5, 2022, High) to $42,268.98.

BTC Funding Rates History | Source: Coinglass

The positive BTC funding rate demonstrates investor confidence in the crypto market's uptrend, which may help support cryptocurrency prices.

Finally, we're going to look at how the crypto market works on the technical side.

Crypto Technical Analysis

That concludes the crypto news and fundamental outlook; let us now turn our attention to the market's technical side.

Ether (ETH/USDT) Analysis on KuCoin Chart

On a daily basis, the ETH/USDT pair is trading at $3,070 with a bearish bias.Ether has reached the 38.2 percent Fibonacci retracement level of $3,167, and sellers continue to dominate the market. The RSI (relative strength index) and MACD (moving average convergence divergence) indicators are both in the sell zone, indicating a strong sell bias in the market.

The ETH/USDT pair is now heading south to complete the 50% Fibonacci retracement at $3,050. Ether’s next support level is $2,906 (61.8% Fib) and $2,728 (78.6% Fib).

ETH/USDT Chart on the Daily Timeframe | Source: KuCoin

Alternatively, a surge in the buying trend and a bullish breakout exposes the Ether price towards further highs. The next resistance level for Ether is $3,160, which is extended by the previously violated 38.2% Fib level.

ApeCoin (APE/USDT) Analysis on KuCoin Chart

The APE/USDT coin is trading choppy on the daily timeframe, in a narrow trading range of $12.57 to $10.60. Because the coin is still relatively new and no long-term historical data is available, it is difficult for investors to make accurate predictions.

For the time being, APE/USDT has completed a 61.8 percent Fibonacci retracement at $10.60. A surge in the selling trend could result in a bearish breakout, exposing ApeCoin's price to the $7.71 support zone.

APE/USDT Chart on the Daily Timeframe | Source: KuCoin

Alternatively, ApeCoin's resistance remains between $12.57 and $14.60. In addition, increased demand may sever APE and expose it to the $18.65 resistance zone.

Sign up on KuCoin, and start trading today!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange

Download KuCoin App >>> https://www.kucoin.com/download

Also, Subscribe to our Youtube Channel >>>Listen to 60s Podcast