KuCoin Ventures Weekly Report: ETH Treasury Narrative Heats Up Amid Intertwined Macro & AI Signals, Reshaping the Foundational Blockchain Ecosystem

2025/08/18 09:42:02

1. Weekly Market Highlights

ETH Breaks Record Highs, Fueling a High-Stakes Capital Game of Opportunity and Scrutiny in the Treasury Narrative

Early last week, on August 12, ETH broke through $4,700 USD, reaching a four-year high, while its spot ETF also hit a record weekly trading volume of $17 billion. Fueled by the "corporate treasury" narrative, synchronized promotion from top Eastern and Western KOLs, and continued pursuit by institutional capital, Ethereum's momentum continues to build strongly. This narrative has rapidly expanded from its origins with BTC and ETH to include a wider range of altcoins, opening a new chapter for the strategic reserves of publicly listed companies.

Data Source: TradingView

Data Source: https://www.strategicethreserve.xyz/

According to data from strategicethreserve.xyz, on August 15, SharpLink announced an accumulation of 206,500 ETH, its largest single purchase to date. Although specific details were not disclosed, BitMine's associated wallets also showed signs of continued accumulation last week. The competition among leading public companies in the treasury narrative is in full swing, with other players eager to join. Last week, ETH Zilla (formerly 180 Life Sciences) successfully entered the list of the top 10 largest ETH-holding entities with a single purchase of 82,200 ETH. With the backing of the Story Foundation and a16z, Heritage Distilling (NASDAQ: CASK) transformed itself from a craft distillery into the world's first public company to launch a treasury strategy focused on the Story ($IP) token.

The corporate treasury has become the most compelling narrative and sector in the current market, as it not only generates widespread discussion but also attracts significant real capital inflows. However, unlike previous crypto narratives driven primarily by code and community, the "treasury narrative" has an extremely high barrier to entry. It is deeply intertwined with publicly traded entities, backing from traditional capital, and complex financial structuring. This means it cannot be replicated by copycat projects through simple technical "copy-pasting," making it an exclusive "game" for top-tier crypto assets. Yet, shadows loom beneath the market's fervor. Allegations of potential related-party transactions, self-dealing, and even insider trading based on information asymmetry are growing louder, and the operational models of some treasury companies do indeed involve controversial grey areas.

Therefore, barring any definitive regulatory intervention or major negative events (such as a financial or debt crisis at a treasury company), this narrative is likely to continue dominating market sentiment for some time. But its limitations are also apparent: this capital-intensive narrative is difficult to extend indefinitely to smaller, more speculative crypto assets. For other leading crypto projects, the question of how to find a suitable public "shell company" and structure a compliant and attractive deal to get on this "treasury strategy" bandwagon has become the most pressing and difficult strategic challenge they currently face.

2. Weekly Selected Market Signals

Inflation Re-Accelerates, Cooling September Cut Bets; Risk Assets Pause as ETH ETFs Set a New Record

U.S. July PPI rose sharply on the back of services, coming in well above expectations and signaling stronger-than-anticipated wholesale inflation. The print tempered markets’ earlier enthusiasm for a September Fed rate cut that had firmed after the softer CPI. Risk assets—fresh off recent highs—saw a brief pullback: Bitcoin fell more than $7,000 intraday, slipping below $117,000. Following consumer sentiment data, the 10-year U.S. Treasury yield hit a two-week high; the dollar weakened to a two-week low; and gold posted its first weekly decline in three weeks, with Comex gold down over 3%—the largest weekly drop in three months. Overall, markets remain in a fragile balance between rate-cut hopes and the reality of persistent inflation pressures.

Data Source: TradingView

Last week, spot ETH ETFs extended their strong momentum with $2.85B in weekly net inflows—an all-time high—far outpacing spot BTC ETFs’ $54.78M. Persistent institutional demand provided notable support for ETH at elevated levels. That said, after Thursday’s macro data, both ETH and BTC ETF flows turned lower on Friday, underscoring that near-term price action remains tied to the macro path and incoming Fed signals.

Data Source: SoSoValue

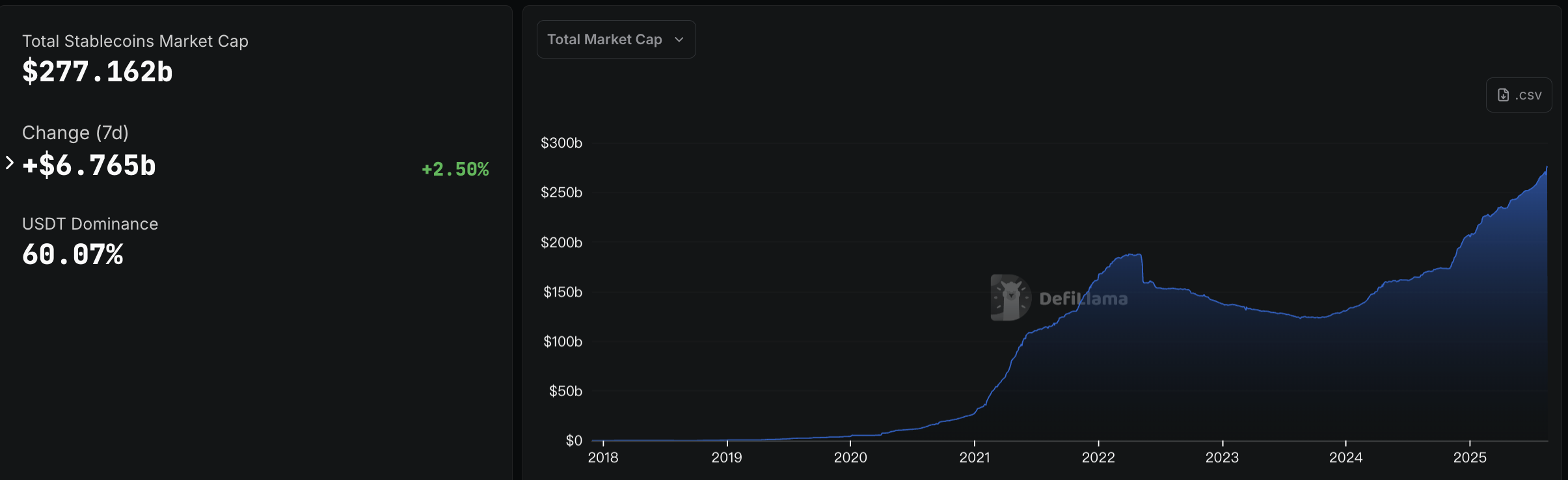

Stablecoin supply expanded by $6.765B over the past week (+2.5% WoW). USDT increased by $2.27B, USDC by $2.95B, and yield-bearing USDe by $1.0B. The “dual engine” of traditional and yield-based stablecoins suggests capital is still entering crypto via stablecoin rails, laying groundwork for a potential recovery in risk appetite and broader market expansion.

Data Source: DeFiLlama

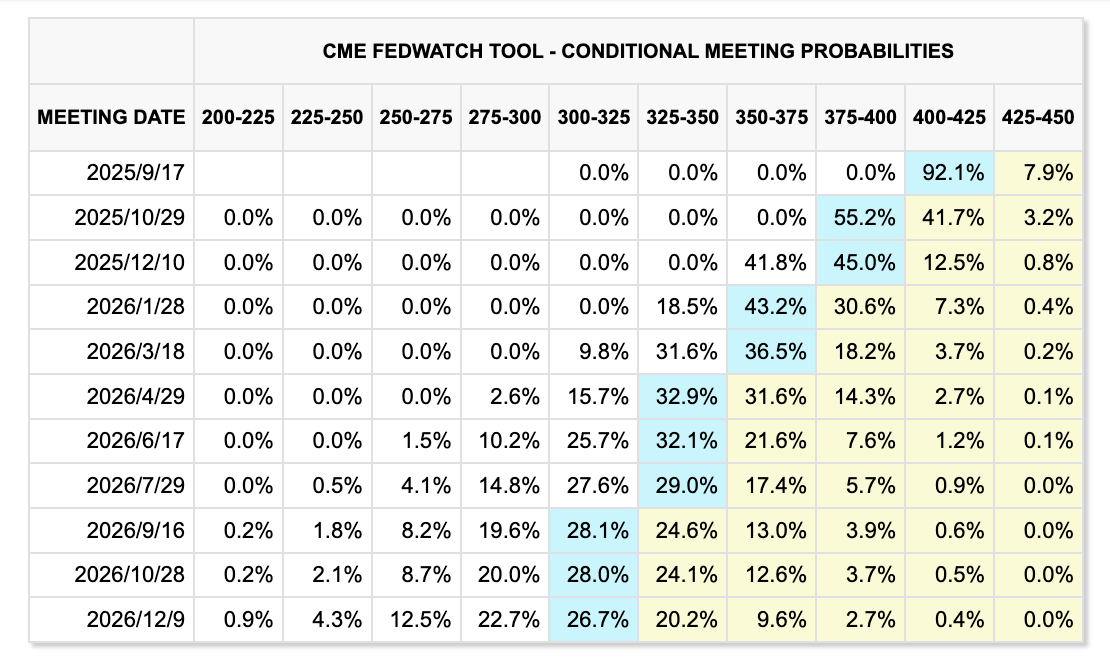

Despite some back-and-forth in expectations, market pricing still assigns >92% odds to a 25bp cut in September, with most traders anticipating two cuts this year. The upcoming Jackson Hole symposium is the key watch: Chair Powell’s remarks could shape expectations on timing and magnitude. With equities already buoyed by easing bets, any hawkish surprise could trigger another bout of volatility across risk assets.

Data Source: FED Watch Tool

Key Macro Events This Week

-

Aug 18: President Trump to meet Ukrainian President Zelensky at the White House; a U.S.–Russia–Ukraine trilateral meeting is possible if conditions allow

-

Aug 20: FOMC releases minutes of the July policy meeting

-

Aug 21–23: Jackson Hole Economic Policy Symposium; Powell to speak on Aug 22

Primary Market Financing Watch:

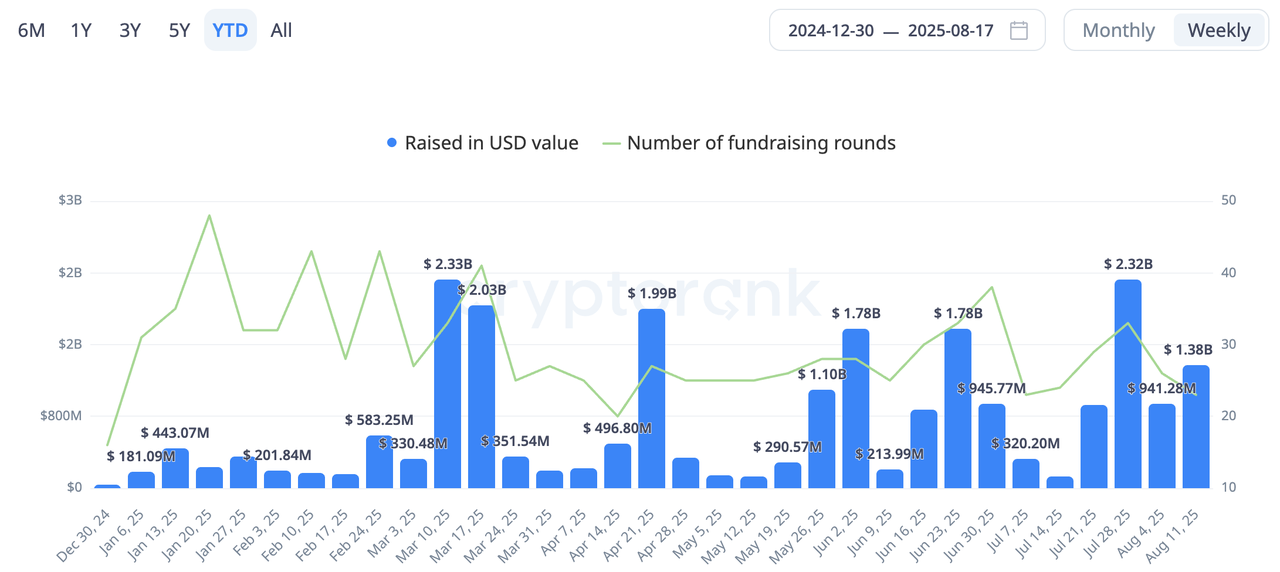

Crypto venture funding totaled ~$1.38B last week, remaining at the higher end of this year’s range. The largest ticket came from Bullish, which raised $1.11B in its IPO at a $5.4B valuation. Broadly, listed companies’ DAT (Digital Asset Treasury) strategies and the AI vertical continue to dominate attention, with investor interest in “crypto treasuries” and “AI+Crypto” narratives still robust.

Data Source: https://cryptorank.io/funding-analytics

AI Still Anchors the Funding Narrative; New Use Cases Emerge in Crypto

The much-anticipated GPT-5 delivered only middling benchmark results, while competition from Google and xAI intensifies—challenging OpenAI’s once-dominant position and prompting talk of a potential “AI plateau.” Even so, capital and enterprise demand remain resilient, with focus shifting from frontier breakthroughs to extracting commercial value from existing tech stacks. Bain & Company and Crunchbase estimate that AI accounts for roughly one-third of global VC this year. In crypto, AI+Crypto remains in favor, with RICE AI, Sola AI, USD.ai and others announcing fresh rounds last week.

USD.ai, a synthetic stablecoin protocol for AI-infrastructure financing, raised $13M (Series A) led by Framework Ventures with participation from Dragonfly. The project targets financing pain points for AI startups by collateralizing GPUs, AI hardware and node infrastructure. Its CALIBER on-chain collateral standard enables title, insurance and redemption of compute assets, allowing AI companies to access credit directly on-chain. On the user side, deposits into USDai (a low-risk synthetic dollar backed by Treasuries) can be staked to sUSDai to earn both compute-loan yields (GPU, energy, telecom infra) and underlying Treasury returns. The team claims up to 90% faster loan approvals; deposits reportedly reached ~$50M in private beta, with a current APR around 6.76%.

Meanwhile, Sola AI, an AI voice assistant in the Solana ecosystem, closed a $17.5M Series A led by a16z. By combining GPT-based models with the Tavily search engine and real-time Solana on-chain data, Sola AI supports contextual web aggregation, general Q&A, calendar/task management, and gaming interactions (e.g., via Solana Blinks).

Takeaway: As the AGI narrative hits a near-term plateau, capital is gravitating toward solutions that create tangible value with today’s technology. USD.ai’s synthesis of compute-asset liquidity, DeFi instruments and stablecoins provides a credible template for deeper AI–finance integration, while Sola AI highlights how AI agents can be productively embedded within crypto ecosystems.

3. Project Spotlight

Circle launches Arc, a USDC-dedicated chain to compete with Tether’s Plasma/Stable

Last week, Circle announced the upcoming launch of Arc, an EVM-compatible L1 blockchain specifically built for the USDC stablecoin. Arc aims to provide efficient and compliant foundational infrastructure for stablecoin-driven financial services such as global payments, currency exchange, and capital markets.

According to the litepaper, Arc can be summarized as a four-layer architecture with modular expansion:

-

Consensus and Settlement Layer The consensus engine, Malachite, is an improved version of Tendermint BFT, allowing existing Ethereum developers to migrate contracts directly. In terms of performance: – 4 nodes → over 10,000 TPS, confirmation time ~100ms – 20 nodes → ~3,000 TPS, confirmation time ~350ms

-

Fees Gas fees are paid in the USDC stablecoin instead of ETH, addressing the accounting complexity and risk caused by using volatile assets for gas. Additionally, Arc introduces a fee-smoothing mechanism on top of the base fee and minor dynamic adjustments to avoid sharp fluctuations in transaction fees.

-

Privacy and Compliance Module Transactions are public by default, but users can opt for confidential transfers and hidden amounts (Opt-in Confidential Transactions); addresses remain public for regulatory purposes. Arc also features view key permissions, allowing enterprises to authorize third-party auditors or regulators to access transaction details. Modules like TEE, MPC, FHE, and ZKP can also be gradually integrated as needed for compliance.

-

Application Layer Arc integrates many primitives at the L1 level tailored for financial services, such as: – A native FX engine: An on-chain foreign exchange market supporting both P2P and RFQ matching – Cross-chain module: Integration with Circle CCTP, Gateway, and Mint services to facilitate on-chain and off-chain fund transfers – Enterprise-grade features: Invoicing, refunds, revenue splitting, proxy payments, etc., can be directly executed through smart contract calls by applications

-

Network and Governance In its early stage, Arc will adopt PoA (Proof of Authority), run by a few permissioned nodes including Circle. As the network stabilizes, it will gradually transition to PoS (Proof of Stake) to increase decentralization. Arc's roadmap also includes features such as MEV mitigation, encrypted mempool, and batch transaction processing.

Overall, Circle’s Arc and Tether’s Plasma/Stable are similar in that they both place their own stablecoins at the core of the system—serving as the cornerstone for payments, gas, and financial transactions—and emphasize “low cost, high performance, and compliant or compliance-ready” use cases in cross-border settlement and financial markets. The difference lies in their public chain focus: Circle Arc leans toward compliant financial infrastructure with regulatory-optimized and controllable privacy; Tether Plasma uses a Bitcoin sidechain architecture and emphasizes BTC nativeness; Tether Stable is more like a “payment channel-style” native USDT network.

OKB Large-Scale Burn May Signal Focus on Network Token Role in X Layer

Crypto exchange OKX announced last week a one-time large-scale burn of OKB, fixing its total supply at 21 million tokens. The OKB smart contract was also upgraded, removing both minting and manual burning functions. At the same time, OKTChain is being gradually phased out, with OKT being swapped 1:1 for OKB. Meanwhile, X Layer is undergoing a strategic upgrade aimed at establishing itself as a public blockchain serving DeFi, payments, and RWA scenarios, with OKB positioned as the native token and gas token of X Layer.

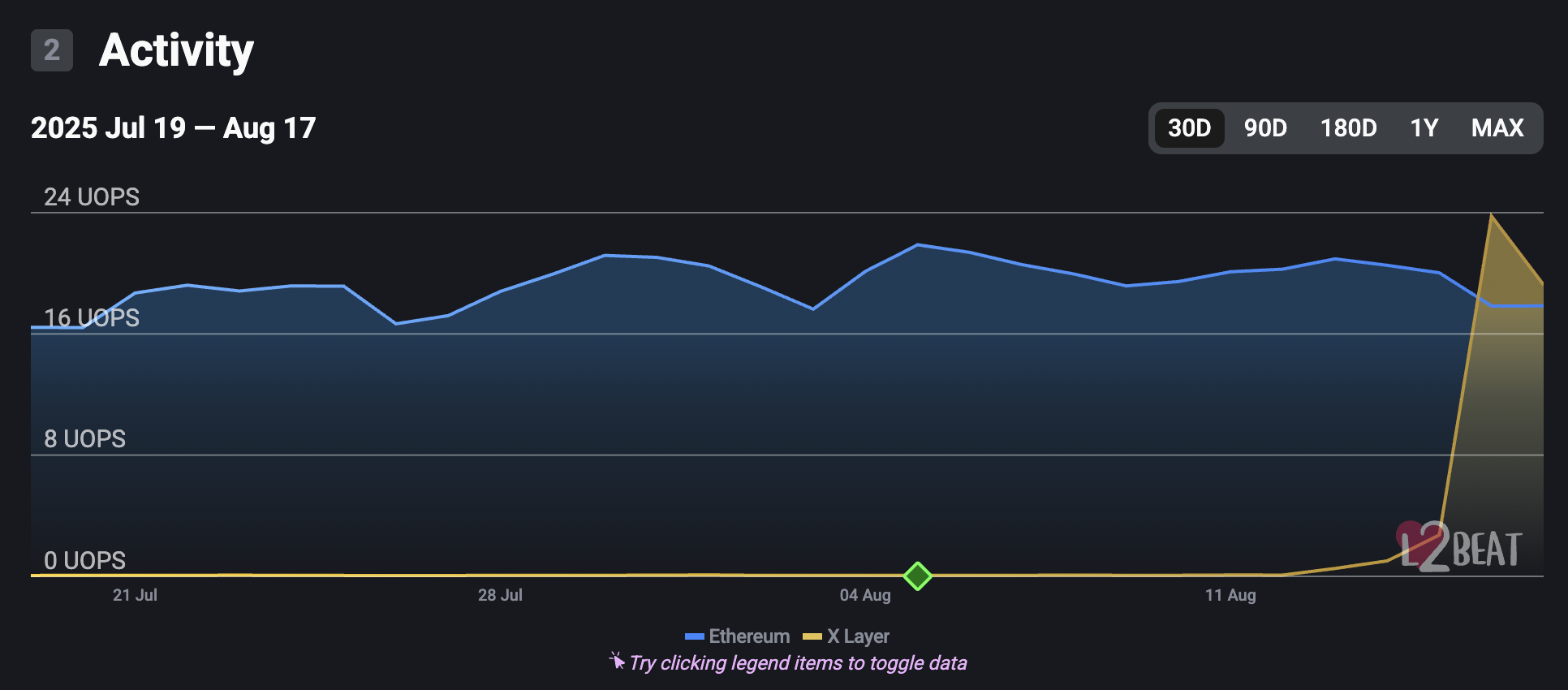

X Layer is an Ethereum L2 built by OKX and Polygon using Polygon CDK, specifically as a zkEVM Validium (not a Rollup). Transactions are guaranteed correct via ZK proofs, but the transaction data itself is not posted to Ethereum; instead, data availability is managed by a DAC (Data Availability Committee), resulting in lower fees and higher throughput. According to L2Beat data, following the large-scale OKB burn, X Layer's TVL grew by 103% over the past 7 days to approximately $85 million. On August 16 alone, the number of user transactions exceeded 2 million, temporarily surpassing Ethereum.

Source: L2Beat

From a community perception standpoint, X Layer’s current network activity remains largely focused on the issuance of new assets, primarily represented by Memecoins. Trading terminals like Aveai quickly integrated X Layer, further fueling this trend. However, networks like Solana, which are also Memecoin-driven, have struggled to significantly grow in market cap due to listing restrictions from top CEXs, leaving them in a PvP trading phase. Whether Memecoins on X Layer will receive listing support from OKX remains uncertain. According to DeFiLlama data, most of the current applications on X Layer are still integrations of existing applications from other blockchains, indicating the ecosystem is still in a relatively primitive early stage

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.