KuCoin Ventures Weekly Report: Three Key Narratives Amid Market Volatility: Base's Distribution Revolution, the Macro Rate Cut Gambit, and the Battle for Stablecoin Infrastructure

2025/08/04 09:57:02

1. Weekly Market Highlights

Base APP Emerges as a Key Distribution Channel for the Base Ecosystem, Zora Coins Surges as the Largest Launchpad Network-Wide

Recently, Coinbase Wallet underwent a major upgrade and rebranded to Base APP, evolving from a simple wallet into a Super APP integrating applications, social features, trading, communication, and wallet functionalities. Key Base network apps like Farcaster, Uniswap, Zora Coins, and XMTP are natively embedded, corresponding to the app’s bottom navigation tabs. Additionally, users can explore various mini-apps and curated applications through the homepage, with trending and featured apps gaining more visibility and usage.

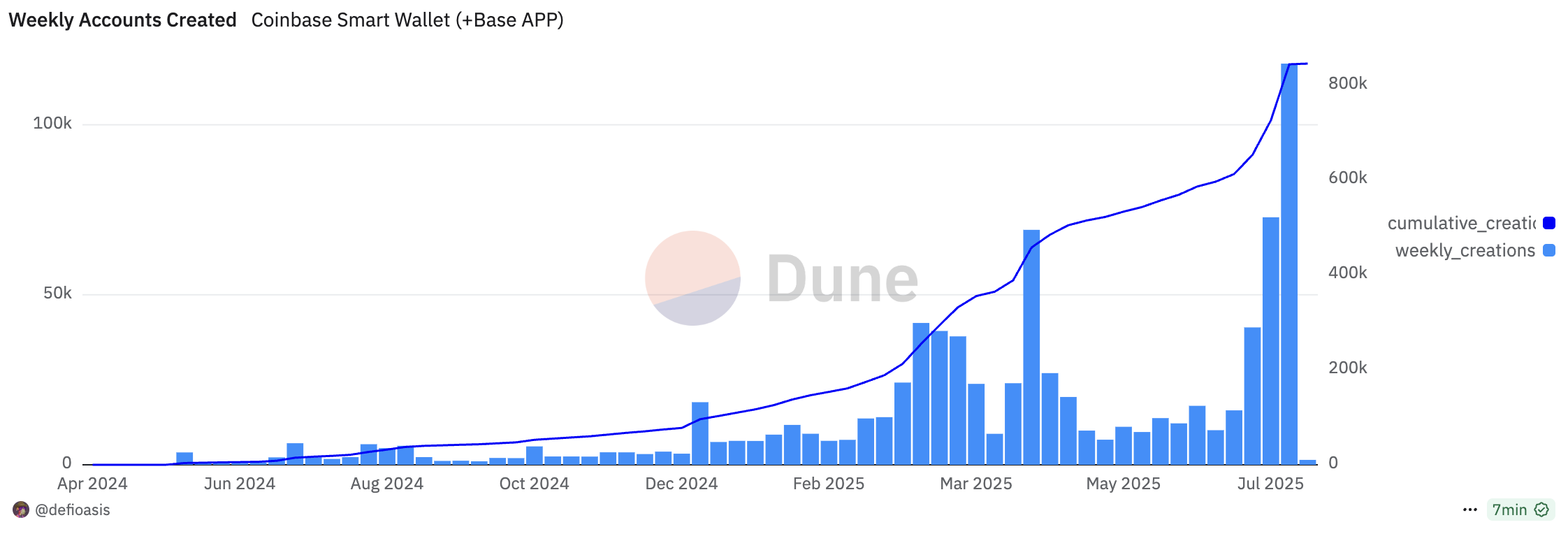

USDC serves as the universal currency within Base APP, usable for all transactions. Users don’t need to switch networks or pay gas fees, as Coinbase Smart Wallet handles everything seamlessly in the background—users may not even realize they’ve completed an on-chain transaction. As an app backed by Coinbase, the largest U.S. exchange, Base APP has become the most direct distribution channel for Base network ecosystem. Currently, Coinbase Smart Wallet has over 840k deployments, with new deployments hitting all-time highs in the past two weeks, including 118k new accounts added between July 28 and August 3 alone. Since Base APP is still invite-only, it’s estimated that hundreds of thousands, if not millions, of users are still waiting for invite codes.

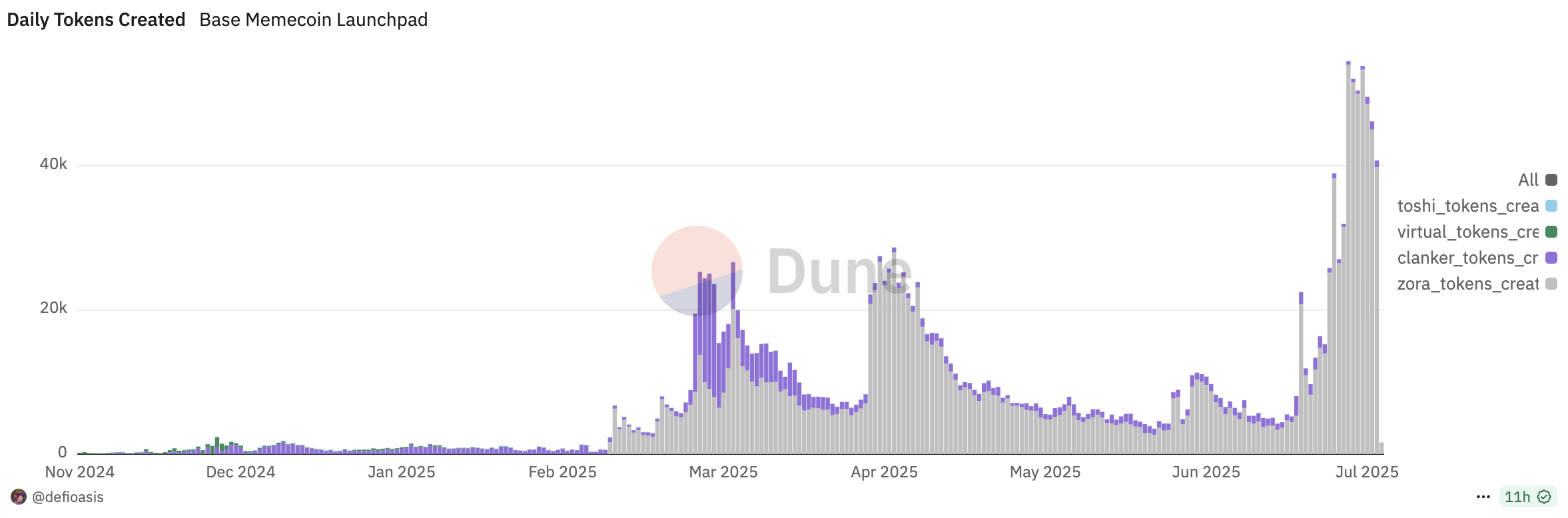

Zora Coins stands out as a prime example of Base APP’s power as a distribution channel. Following its deep integration with Base APP, Zora Coins has become the largest Launchpad on the Base network and across all networks, propelling Base to surpass Solana as the network with the highest daily token creation volume. In the past week, Zora Coins recorded 40k–50k daily token creations, nearly double that of Solana’s largest launchpad, LetsBONK.

Creators on Base APP can use Zora Coins to issue tokens for themselves or any content on the Base network. Zora Coins has established a mechanism for creator tokens, content tokens, and ZORA. Creator tokens serve as the parent token for content tokens, meaning content tokens are paired with creator tokens for trading. Similarly, ZORA is the parent token for creator tokens, with creator tokens paired against ZORA. Posting contentessentially means issuing a token, with content tokens accounting for 70%-80% of total token creations. However, trading volume tells a different story: 70%-80% of trading volume is concentrated in creator tokens, as a single creator can have countless content tokens under their umbrella. The rise in creator token trading also boosts demand for the parent token, ZORA, which is a key reason for ZORA’s significant recent price surge.

However, Zora’s fees are steep, with revenue shared among multiple stakeholders. Whether trading on the Zora Coins platform or Uniswap, both content tokens and creator tokens incur a 3% fee per transaction (6% for a buy-sell cycle). For content tokens, the 3% fee is split as follows: 1% to LP, 1% to the content creator, 0.3% to Zora, and the remainder to trading rebates, platform rebates, and the underlying Doppler protocol. For creator tokens, the 3% fee is simpler: 1% to LP, 1% to Zora, and 1% to the creator.

Notably, while Zora Coins generates a massive number of tokens, accounting for nearly 99% of token creations on the Base network, most lack sustained trading demand or momentum. Content tokens are often too cheap and easily replaceable, with truly valuable content still scarce. Additionally, the 3% transaction tax on Zora Coins tokens is considered expensive, leading to most meme trading volume on Base concentrating on Virtuals and Clanker. At the user level, Zora Coins, Virtuals, and Clanker form a tripod, each shining in its own way. This suggests that while Zora Coins attracts a sizable number of users for token trading, the transaction amounts are generally modest.

Regardless, Zora Coins is currently on an upward trajectory, bolstered by Base APP and the Base network. Some KOLs are even framing ZORA as "the token of the Base network" in their narratives. However, for the ZORA parent token flywheel to gain stronger momentum, it needs high-value child tokens to support a higher market cap, similar to how AIXBT supports VIRTUAL. Moving forward, keep an eye on top creators on Zora Coins and content with meme potential. We might soon see headlines like, "Shock! A Single Piece of Content Worth $100M—Tech Innovation or Internet Bubble?"

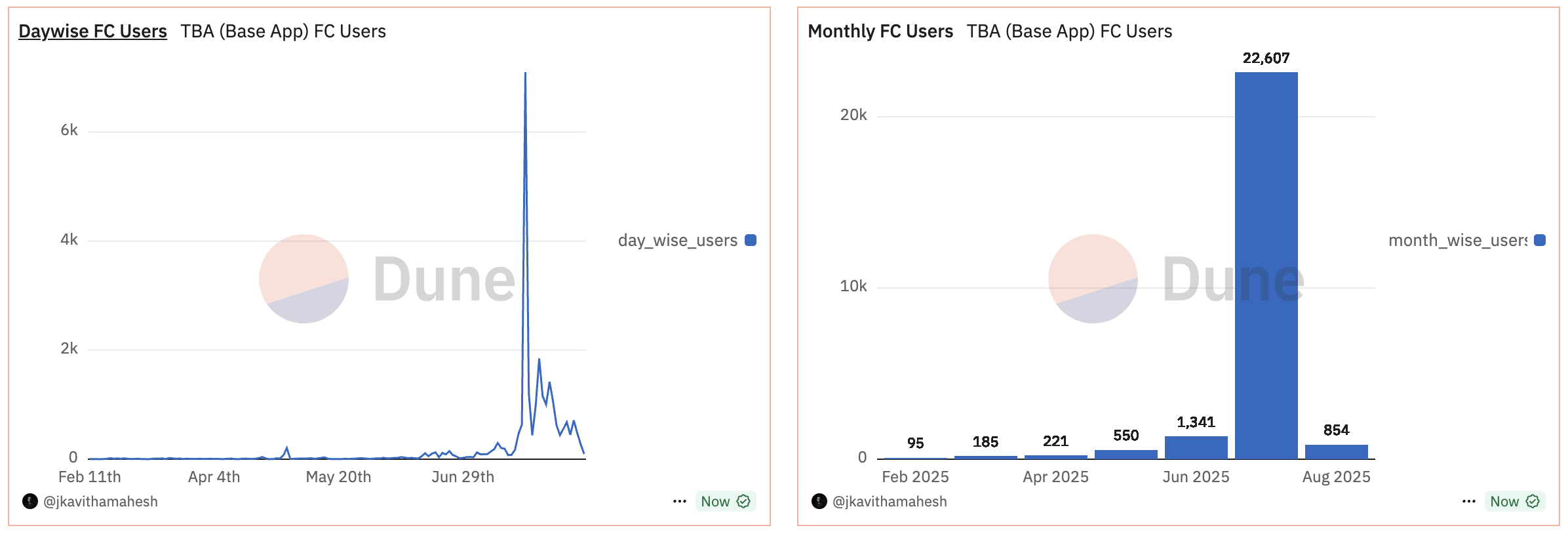

Beyond Zora Coins, numerous integrated applications have also reaped benefits, underscoring Base APP’s critical role as a driving force for ecosystem expansion. PredictBase, a prediction market under PrediBot, an AI Agent assistant launched by Virtuals Protocol, became a trending app after integrating with Base APP, with both its prediction market trading volume and native token price seeing significant growth. Farcaster is another prime beneficiary. Following deep integration, Base APP drove over 22k new users to Farcaster in July alone. Users can leverage Basename to seamlessly communicate with friends, make transfers, or send tips across both Base APP and Farcaster.

2. Weekly Selected Market Signals

Non-Farm Payrolls 'Black Swan' Sparks Risk Market Sell-off: Crises and Opportunities Amid Renewed Rate Cut Expectations

Last week, a surprisingly sharp downward revision of the U.S. Non-Farm Payrolls report became the fuse that ignited global financial markets. Risk-off sentiment surged, leading to a heavy blow for U.S. stocks and a spike in the VIX fear index. The S&P 500 recorded its largest drop since May, with small-cap stocks being hit the hardest, and over $1 trillion in U.S. stock market value was wiped out. The decline in risk assets spurred a bond-buying spree, with the 10-year U.S. Treasury yield falling to 4.24% and the Dollar Index breaking below 99.

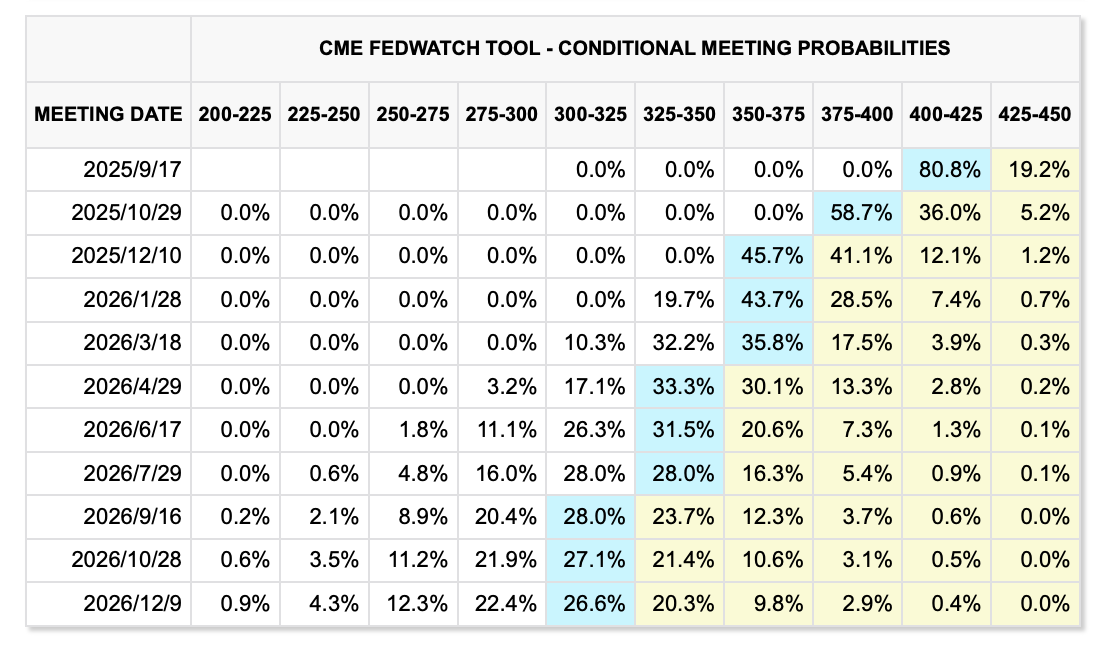

According to the latest data, the June Non-Farm Payrolls figure was revised down from an initial 147,000 to just 14,000, a downward revision of 133,000. Excluding the impact of the COVID-19 pandemic, this marks the largest revision in 46 years. This is a significant signal of an increased probability of future rate cuts. Data from the interest rate futures market shows that the probability of a rate cut in September soared from less than 40% before the data release to 80.8%, with the market even beginning to price in the possibility of two rate cuts before the end of the year.

Source: FedWatchTool

BTC fell to around $112,000, wiping out nearly three weeks of gains. The CMC Crypto Fear & Greed Index fell back to the neutral zone around 52, and the "Altcoin Season" fervor also cooled significantly, with the Altcoin Season Index once dropping to 34.

Source: TradingView

BTC spot ETFs saw a net outflow of $643 million for the week, with a single-day net outflow of $812 million on August 1st, marking the largest weekly net outflow since March and the second-largest single-day net outflow in nearly six months. ETH spot ETFs, on the other hand, had a single-day net outflow of $152 million but still maintained a slight net inflow on a weekly basis. From a data perspective, ETH's performance was relatively strong last week.

Source: SoSoValue

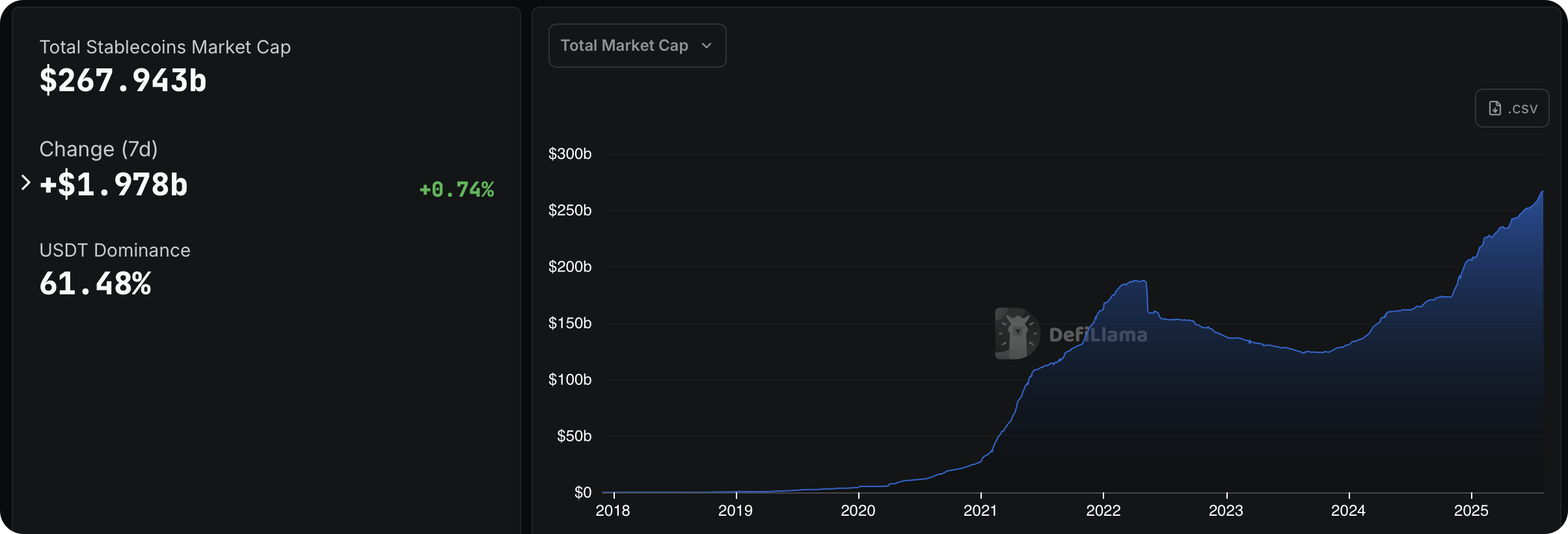

The stablecoin supply continued to record a slight increase over the past week, with the main growth coming from USDe, which saw a 7-day increase of $1.78 billion.

Source: DeFiLlama

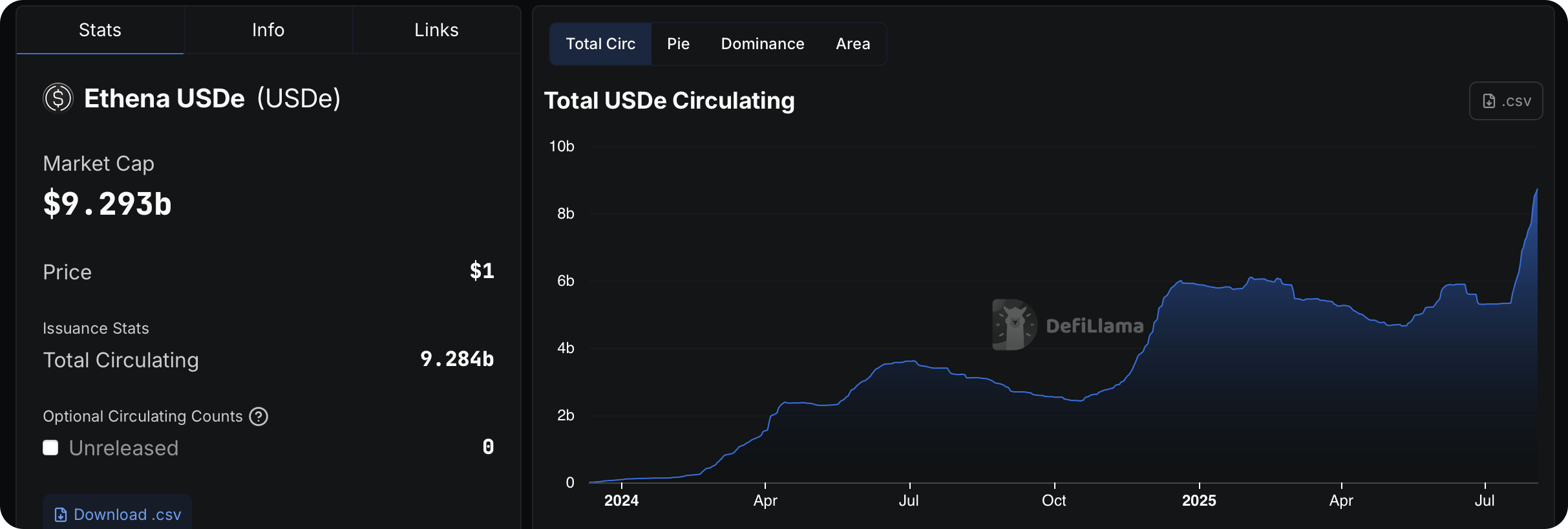

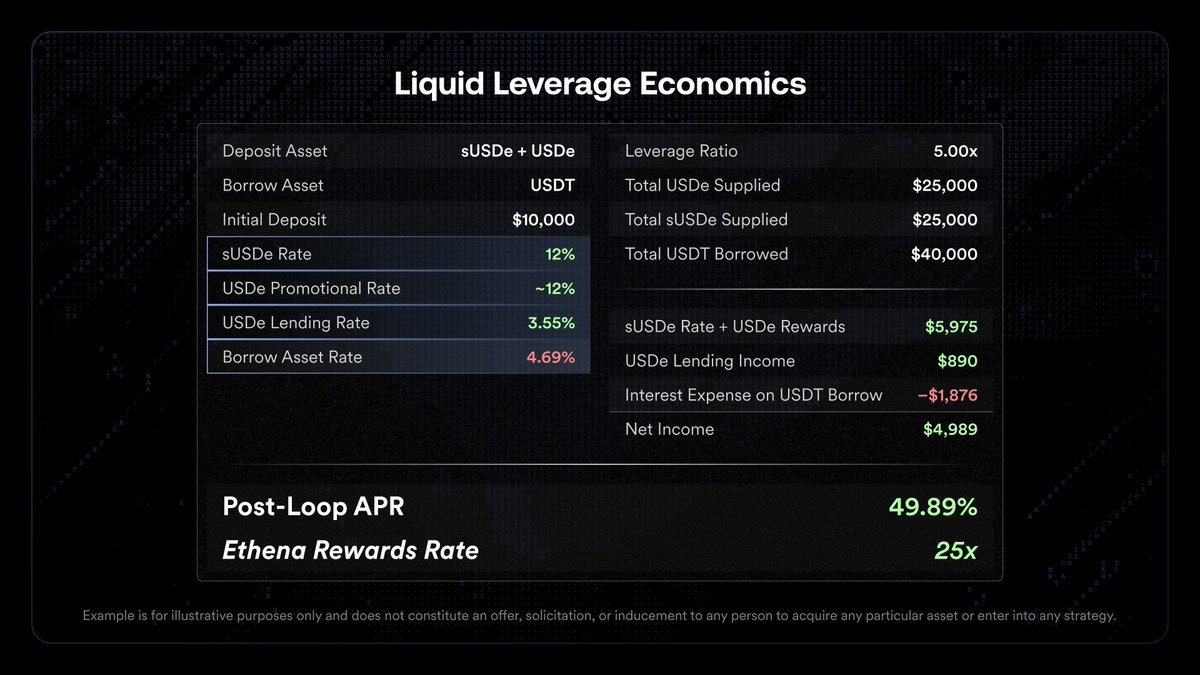

The supply of USDe has grown astonishingly since late July, now reaching a total supply of $9.293 billion. The recent growth is mainly due to the launch of new products. Last week, Ethena Labs launched the Liquid Leverage feature on the Aave platform, where users can deposit 50% sUSDe and 50% USDe to receive promotional rewards and standard lending rates. After engaging in leveraged looping, a 5x leverage state can yield extremely high annualized returns and high multiples of Ethena points rewards. Although leveraged looping itself carries significant risks, it has still attracted considerable market capital.

Major Macro Events to Watch This Week:

-

Geopolitical Risks: Pay close attention to the latest developments in the Russia-Ukraine conflict. Last week, Trump pressured both sides to reach a peace agreement by August 8th. Any unexpected escalation could further exacerbate volatility in financial markets.

-

U.S. Economic Data: A series of manufacturing data and speeches from FOMC voting members will be released this week. This information will provide more clues for judging the U.S. economic fundamentals and may affect the Federal Reserve's subsequent policy path (such as the timing of rate cuts and the pace of ending QT), thereby influencing market expectations for liquidity.

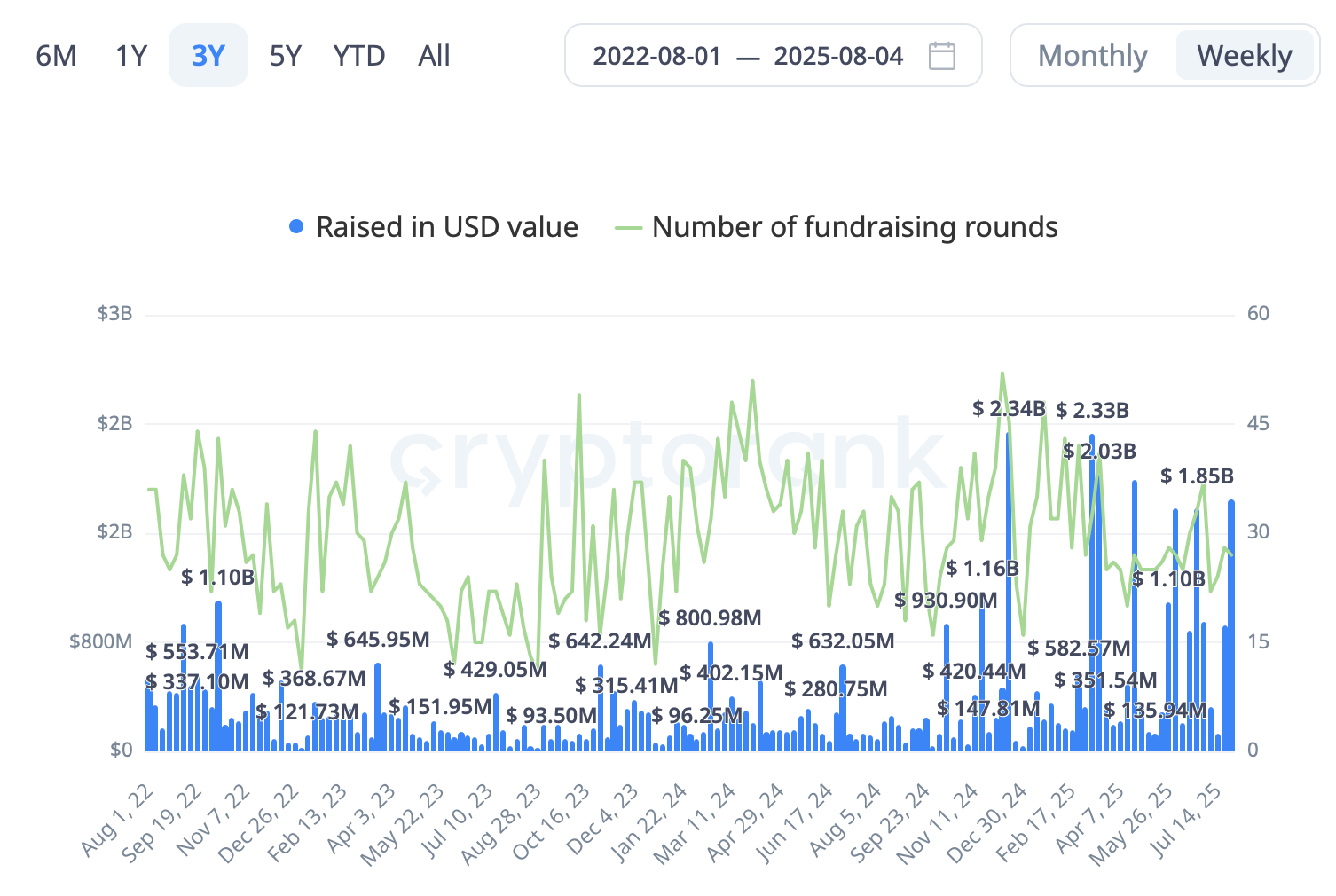

Primary Market Fundraising Observations:

Over the past week, the primary market for investment and financing was relatively active, with a total of 28 deals completed, amounting to approximately $1.85 billion. Apart from treasury-related financing, the hotspots in the primary market this week remained focused on concepts related to stablecoins, RWA, and AI.

-

On July 30, RD Technologies announced the completion of a $42 million Series A2 financing round, with participation from investors including ZA Global, China Harbour, and Sequoia China (HSG). With the Hong Kong "Stablecoin Ordinance" officially taking effect on August 1st, RD, which has been operating in the regulatory sandbox, is expected to be one of the first compliant stablecoins launched in Hong Kong. However, given the strict KYC requirements of the new regulations, the market is closely watching the practical implementation and user experience of related products.

-

Digital identity verification platform Billions announced the completion of a $30 million financing round, with participation from institutions such as Coinbase Ventures, Polychain, and Polygon. The project adopts a "mobile-first, privacy-first" strategy, utilizing zero-knowledge proof technology to achieve secure identity verification without collecting biometric information, aiming to solve the challenge of trusted human-computer interaction in the AI era.

Resource: cryptorank

Layer1 Stable, with USDT as Native Gas, Completes Seed Round Financing

Stable, a Layer1 public chain centered on the use of USDT, announced last week the completion of a $28 million seed financing round. The round was participated in by companies such as KuCoin Ventures, Hack VC, Bitfinex, and Franklin Templeton. Paolo Ardoino, CTO of Tether and Bitfinex, also participated in the round as a project advisor.

Stable's positioning is very clear: to solve the three core pain points of using stablecoins on public chains like Ethereum and Tron—high and volatile gas fees, slow transaction speeds, and a complex user experience. While supporting EVM, Stable enhances the overall efficiency of the blockchain through innovative technology and supports free peer-to-peer USDT transfers, greatly lowering the barrier to entry. It hopes to build a fast, gas-less, seamless cross-chain global stablecoin clearing and settlement network, acting as the future global payment infrastructure to bring an unprecedented efficient and low-cost experience to users and businesses.

Treasury Narrative Continues to Heat Up, Mill City Ventures III Establishes the Market's First SUI Treasury

Nasdaq-listed company Mill City Ventures III has officially announced the establishment of its SUI corporate treasury, becoming the first public company to do so. The company previously raised $450 million through a private placement. This move marks a deep integration between a traditional public company and a major public chain ecosystem.

The offering received strong market support, with a stellar lineup of investors including Pantera Capital, Galaxy Digital, Electric Capital, GSR, and other venture capital firms. Notably, the Sui Foundation also participated in the investment, making Mill City the only crypto treasury strategy on the market today with official foundation backing.

Galaxy Asset Management will serve as the treasury's asset manager. 98% of the financing will be used to purchase SUI. Its treasury currently holds 76.27 million SUI, and company executives have expressed optimism about SUI's application prospects in future AI scenarios.

3. Project Spotlight

Stablecoins Propelled by Dual Drivers: Regulation and On-Chain Applications

Hong Kong's New Stablecoin Rules Implemented: Market Dynamics Under Strict Regulation

Hong Kong's Stablecoin Ordinance officially came into effect on August 1st, marking a substantial step towards stablecoin compliance in a key Asian financial hub. The core principle of this regime can be summarized as "high barriers to entry and strict licensing," requiring all stablecoin issuers operating in or offering services to local users in Hong Kong to obtain a license from the Hong Kong Monetary Authority (HKMA) to operate legally. The rules also mandate stringent KYC/AML protocols, including a ban on serving anonymous users and a requirement to retain user data for at least five years.

The move has prompted mixed reactions in the market. On one hand, the new regulations are designed to mitigate risks and build market confidence, with the first batch of licenses expected to be issued in early 2025. On the other hand, the strict identity verification requirements (initially requiring verification for every holder) stand in stark contrast to the permissionless nature of DeFi, raising concerns about limited on-chain usability and "on-chain segregation" for stablecoins. Furthermore, some OTC desks have temporarily suspended operations due to regulatory uncertainty, while others continue to operate, arguing that non-HKD stablecoins like USDT are not directly constrained by the ordinance, highlighting diverging interpretations of the new rules. In the short term, this "strict-first, stabilize-later" approach is poised to reshape the local stablecoin ecosystem in Hong Kong.

Ethena × Aave: A New DeFi Yield Flywheel Ignites

The recent steep growth curve of Ethena's USDe supply is evident. In its on-chain utility expansion, USDe is igniting a new DeFi yield flywheel through its integration with top-tier lending protocol Aave via the "Liquid Leverage" feature.

Core Mechanism: The "Liquid Leverage" feature allows users to deposit sUSDe (staked USDe, with a ~12% native yield) and USDe in a 1:1 ratio. This not only provides multiple yield streams but, more critically, allows both assets to be used as collateral for recursive borrowing of other stablecoins to amplify leverage. For instance, a 5x recursive borrowing strategy can theoretically achieve an annualized yield of up to 50%, supplemented by substantial Ethena points rewards.

Data Source: Ethena Labs

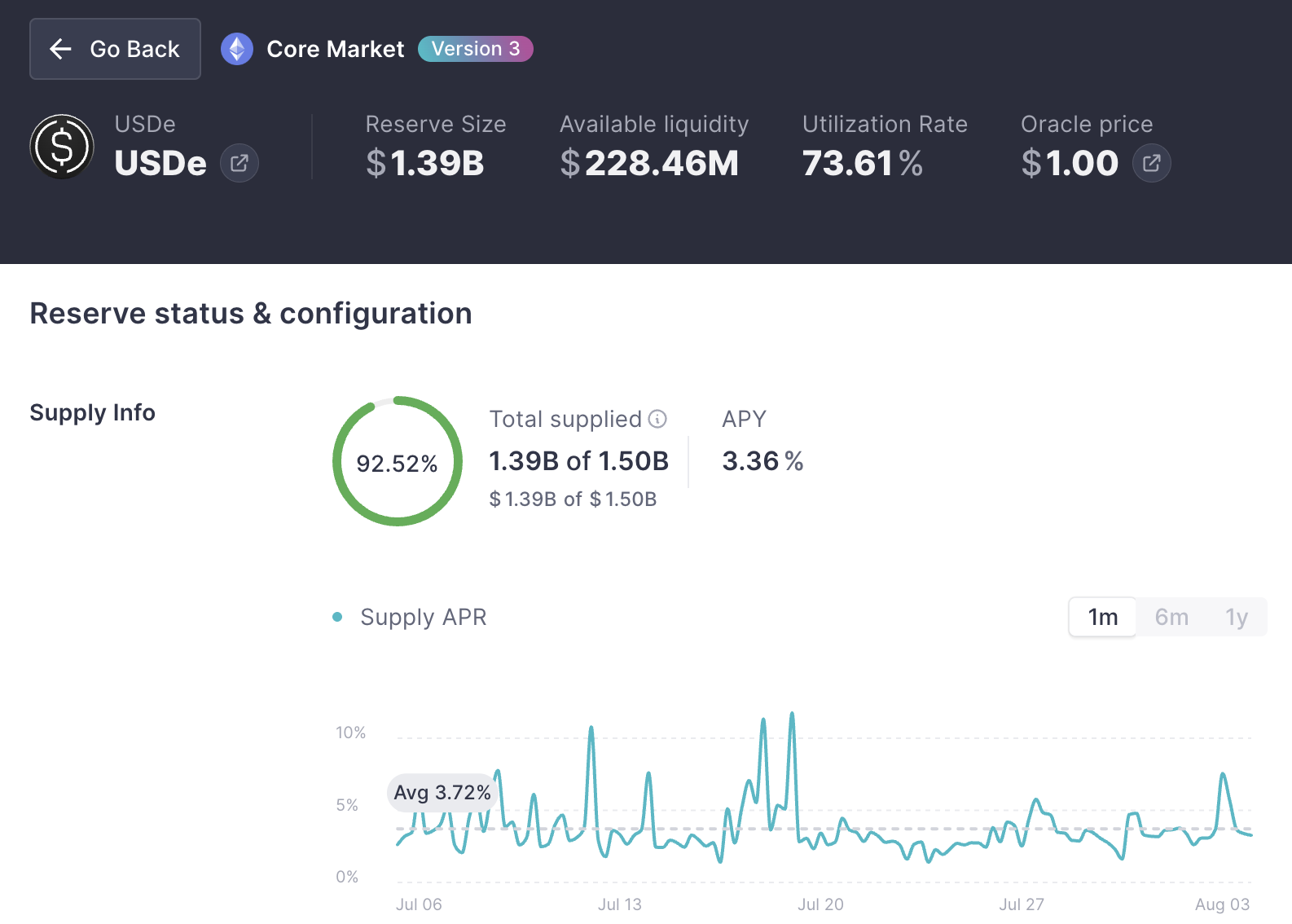

Market Siphon Effect: This has significantly activated the capital efficiency of USDe. As a dominant player in the DeFi lending space (accounting for 62.7% of the total active BTC borrow positions), Aave provides a massive venue for liquidity provisioning for Ethena. Upon launch, the USDe/sUSDe pool's caps were quickly filled. Even after expansion, the capital utilization rate remains high at 92.52%, indicating a prominent siphon effect. Over the past 30 days, Ethena's TVL has grown by over 50%, surpassing $8 billion.

Data Source: AAVE Official Website

Ecosystem Synergy: While Pendle's PT looping strategy may offer a higher theoretical yield ceiling, Aave's solution provides a lower barrier to entry and more manageable risk, potentially reaching a broader user base. A synergistic effect is forming: Ethena provides the native yield-bearing asset, Aave offers the core lending infrastructure and leverage environment, and Pendle acts as a yield amplifier. Together, the three collectively push the ceiling for on-chain stablecoin yield farming.

Hyperliquid to Integrate Native USDC, Solidifying its Native Liquidity Foundation

Hyperliquid, a leading on-chain perpetual platform, is upgrading its liquidity infrastructure. Since early July, its TVL has risen from $4B to $5.5B, with USDC accounting for 86% (~$4.76B), underscoring its dependence on high-quality stablecoins.

Data Source: https://dune.com/kucoinventures/hyper

On July 31st, Circle announced that native USDC and its Cross-Chain Transfer Protocol (CCTP V2) will soon be live on Hyperliquid. The strategic significance of this upgrade is twofold:

-

Eliminating Reliance on Bridged Assets: Hyperliquid is transitioning from its previous dependence on bridged assets (like USDC from Arbitrum) towards a settlement layer with native stablecoins. This not only reduces transaction latency and security risks through CCTP V2's 1:1 capital-efficient transfer model, but also delivers a qualitative improvement to the user experience.

-

Attracting Institutional Liquidity: Having native stablecoin infrastructure is a key prerequisite for attracting large-scale, institutional-grade liquidity. This integration signals the maturing underlying architecture of Hyperliquid, laying a more solid foundation for its long-term competition in the DEX L1 sector.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.