Decoding BTC Dominance: Is It the Key Indicator for Predicting Altcoin Season and Market Cycles?

2025/11/17 09:36:02

Source:Liquidity provider

The cryptocurrency market is relentlessly dynamic, and price volatility is merely the surface level of activity. For investors aiming for outsized returns, mastering macro sentiment and capital flow is far more crucial than simply tracking candlesticks. Among the many technical and sentiment indicators, one tool, often overlooked by newcomers but central to professional trading strategies, is BTC Dominance (Bitcoin Market Cap Dominance).

This in-depth article is designed to provide all cryptocurrency enthusiasts, investors, and observers with a comprehensive understanding of BTC Dominance's core meaning, market mechanisms, and the most practical investment strategies to help you seize the optimal moment for altcoin positioning and asset optimization during market transitions.

I. Core Concept: What Exactly Is BTC Dominance?

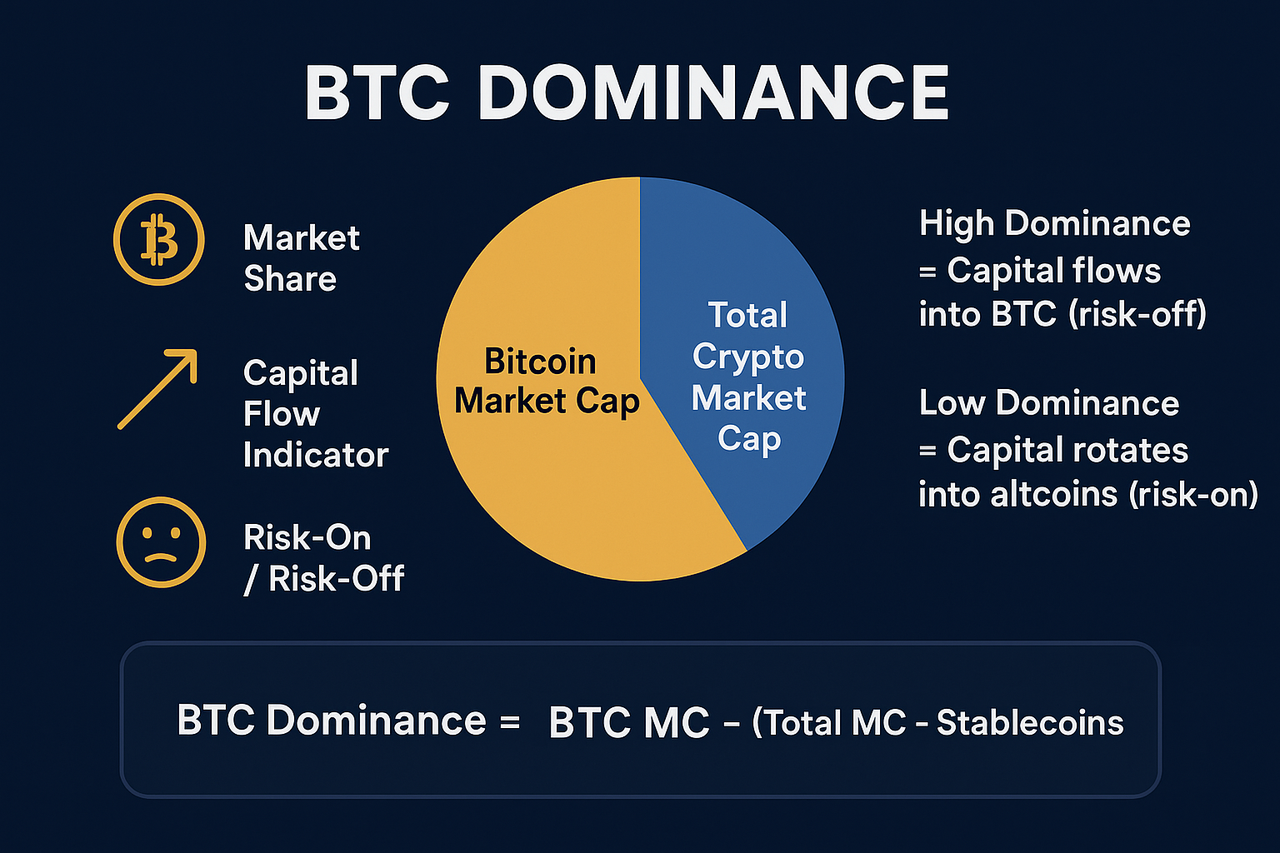

BTC Dominance, as the name suggests, is the percentage of Bitcoin's (BTC) market capitalization relative to the total market capitalization of the entire cryptocurrency market.

The calculation is typically:

$$\text{BTC Dominance} = \left( \frac{\text{Bitcoin Market Cap}}{\text{Total Crypto Market Cap} - \text{Stablecoin Market Cap}} \right) \times 100\%$$

The value of this metric lies in the fact that it does not measure the absolute value of market prices, but rather the relative indicator of capital flow and market sentiment.

Understanding BTC Dominance is of paramount importance to investors because it directly reveals whether the market is in a "risk-off/hoarding BTC" mode or a "risk-on/chasing gains" mode. When this value rises, it signifies that capital is concentrating in Bitcoin, or that altcoins are declining more sharply than Bitcoin. Conversely, when this value falls, it means investors are converting Bitcoin into altcoins, seeking higher risk premiums.

II. The Deep Correlation Between BTC Dominance and Market Cycles

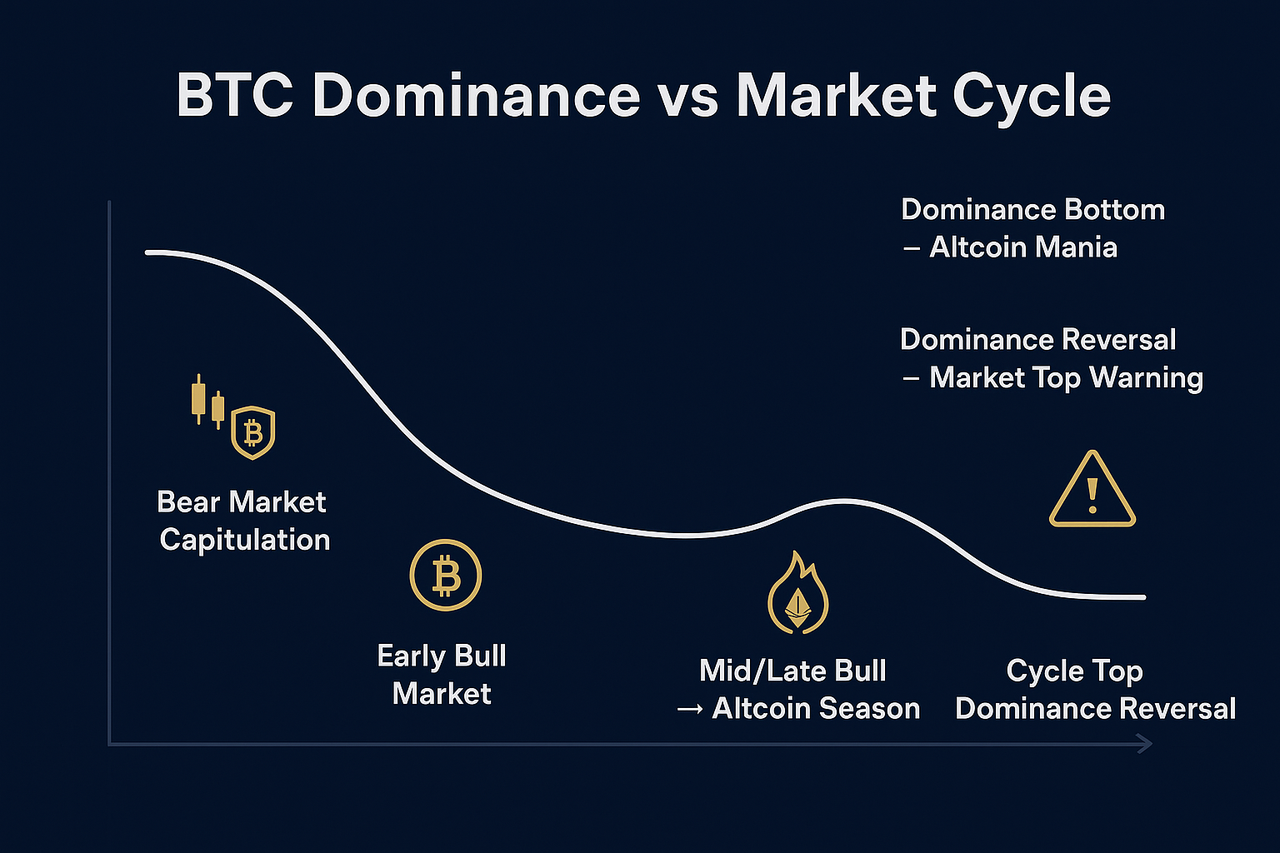

The fluctuation of BTC Dominance is highly synchronized with the bull and bear cycles of the crypto market. A savvy investor can use this indicator to forecast the market's next directional phase—this is the core value of the BTC Dominance analysis and investment strategy.

-

High Dominance Phase (Typically 50% or above): Capital Flight to Safety and Early Bull Market

When BTC Dominance is at a high level, it usually corresponds to two market scenarios:

-

Bear Market Bottom/Panic Phase: During protracted bear markets or times of significant market uncertainty, investors often sell highly volatile altcoins and transfer funds back to Bitcoin, which is perceived as "digital gold," for safety. At this time, Bitcoin's market share remains relatively stable or even increases.

-

Bull Market Kick-off (Phase One): When a new bull market begins, institutional and cautious investors tend to flow into Bitcoin first. Bitcoin leads the rally, capturing market attention, while altcoins have yet to activate. Consequently, BTC Dominance will climb rapidly.

💡 Investor Action: In the High Dominance phase, smart investors should allocate most of their capital to Bitcoin and stablecoins. This is the optimal time to position in Bitcoin while patiently waiting for the next market signal.

-

Low Dominance Phase (Typically 40% or below): Altcoin Season

Low BTC Dominance is the signal all altcoin investors long for. This usually occurs in the mid-to-late stages of a bull market and indicates that market risk appetite has reached a peak level.

-

Mid/Late Bull Market: As the price of Bitcoin firmly establishes new highs, market confidence explodes. Investors believe major market risk has been absorbed and begin seeking higher returns. They rotate profits from Bitcoin (and sometimes Ethereum) into various lower-cap altcoins, chasing "100x" opportunities.

-

Capital Rotation Effect: Capital flows from the safe asset (BTC) into high-risk assets (Altcoins), driving altcoin prices to explode. Naturally, Bitcoin's market share decreases.

💡 Investor Action: Low Dominance presents the best opportunity to aggressively build an altcoin investment portfolio. Based on sector trends and technological innovation, investors should reallocate funds from Bitcoin or stablecoins into carefully selected altcoin assets.

-

The Reversal of BTC Dominance: A Bull Market Top Warning

When BTC Dominance completes a descending cycle and then clearly begins to rebound from a bottom, this is often a strong signal that the market cycle is nearing its end.

-

After the altcoin frenzy reaches its peak, early movers begin to take profits, first selling the riskiest altcoins and converting the funds back into the most liquid asset—Bitcoin.

-

This flight-to-safety behavior causes altcoin prices to begin their collapse, but Bitcoin's market share temporarily recovers due to the inflow of capital, forming a Dominance reversal.

💡 Investor Action: When observing widespread altcoin fatigue alongside a clear rebound in BTC Dominance, this serves as the final warning to lock in profits, step away, or massively shift assets into stablecoins.

III. Investment Practice: How to Strategize Using BTC Dominance

For cryptocurrency enthusiasts, investors, and observers, BTC Dominance is a practical decision-making tool. It helps us answer two central questions: Should I buy altcoins now? and Should I hold Bitcoin or cash?

-

Establishing the "Altcoin Season" Entry Strategy

Investors should not blindly chase altcoins but should use BTC Dominance as the central decision-making metric.

-

Phase I: Observation Period (Dominance > 55%)

-

Strategy: Conservative Holding. Focus on accumulating Bitcoin or maintaining a large cash (stablecoin) position. Most altcoins are still consolidating or slowly declining, and premature entry leads to inefficient capital use.

-

-

Phase II: Positioning Period (Dominance begins to drop below 50%)

-

Strategy: Gradual Accumulation. This is a significant signal of capital rotation. Investors can begin converting 20-30% of their Bitcoin or stablecoins into high-potential altcoins.

-

-

Phase III: Explosion Period (Dominance rapidly falls to around 40%)

-

Strategy: Aggressive Allocation. Altcoin season is in full swing, and market risk appetite is extremely high. This is likely the period of fastest growth for your altcoin portfolio.

-

-

"Contrarian Thinking": The Value of BTC Dominance for Investors

Successful investing often requires contrarian thinking. When the market is universally bullish on altcoins and Dominance is at an extremely low level, that is precisely when risk begins to accumulate.

Beware of the Trap: Many novice investors, attracted by FOMO (Fear Of Missing Out), enter the market only when BTC Dominance hits its low point and altcoin prices are parabolic. However, this is likely the phase where "smart money" is distributing their holdings at the peak.

BTC Dominance acts as the market's thermometer, indicating when to be bold and when to retreat. It helps investors overcome emotional interference and make objective, data-driven decisions.

-

Combining with Other Key Metrics

A professional BTC Dominance analysis and investment strategy is not isolated. To enhance decision accuracy, investors should use it in conjunction with other metrics:

-

Compare BTC/ETH Trends: Ethereum's market cap dominance (ETH Dominance) often acts as a leading indicator for altcoin season. If ETH Dominance is already rising sharply, it typically suggests capital will soon flow into smaller-cap altcoins.

-

Market Fear & Greed Index: When BTC Dominance is low, and the Fear & Greed Index is also in the Extreme Greed territory, this is a double warning signal that the market may be overheating.

IV. Conclusion and Outlook: The Core Value of BTC Dominance

For all audiences interested in cryptocurrency, BTC Dominance is a macro indicator that cannot be ignored.

It is more than just a number; it represents:

-

Capital Flow Direction: Is money flowing from Bitcoin to altcoins, or vice versa?

-

Risk Appetite: Is the market in a state of risk aversion or a frenzy of risk-taking?

By deeply understanding and applying BTC Dominance, cryptocurrency enthusiasts, investors, and observers alike can more effectively navigate complex market cycles. It provides a macro perspective beyond simple price analysis, helping you avoid the mistake of prematurely buying altcoins during a bear market and ensuring you don't miss the biggest wealth creation opportunities during the bull market's altcoin season.

As institutional capital continues to enter and the market matures, Bitcoin's status as a "digital store of value" will further solidify. Therefore, mastering the shifts in BTC Dominance will remain a core skill for every successful cryptocurrency investor.