KuCoin Ventures Weekly Report: Gold's Ascension, Bitcoin's Trial: On the Macro Seesaw, Solana Seeks a Breakout Star

2025/10/20 08:54:02

1. Gold Smashes All-Time Highs as the 'Digital Asset Treasury' Narrative Unravels

Gold stole the show last week, smashing past its all-time high of $4,300/oz to become the first asset in history with a market cap exceeding $30 trillion, capturing the global financial spotlight. This powerful rally is fueled by intense demand for neutral reserve assets from central banks, institutions, and high-net-worth individuals amid a growing "de-dollarization" wave.

Data Source:Bloomberg, Company Filings, ICE Benchmark Administration, World Gold Council

Two key forces are fueling this golden bull run.

First, central banks, led by the People's Bank of China, are strategically stacking gold as a way to diversify their foreign exchange reserves in a complex geopolitical landscape. A Deutsche Bank report highlights that gold's share of global 'forex + gold' reserves has jumped from 24% to 30% in just a few months, while the US dollar's share has dipped from 43% to 40%.

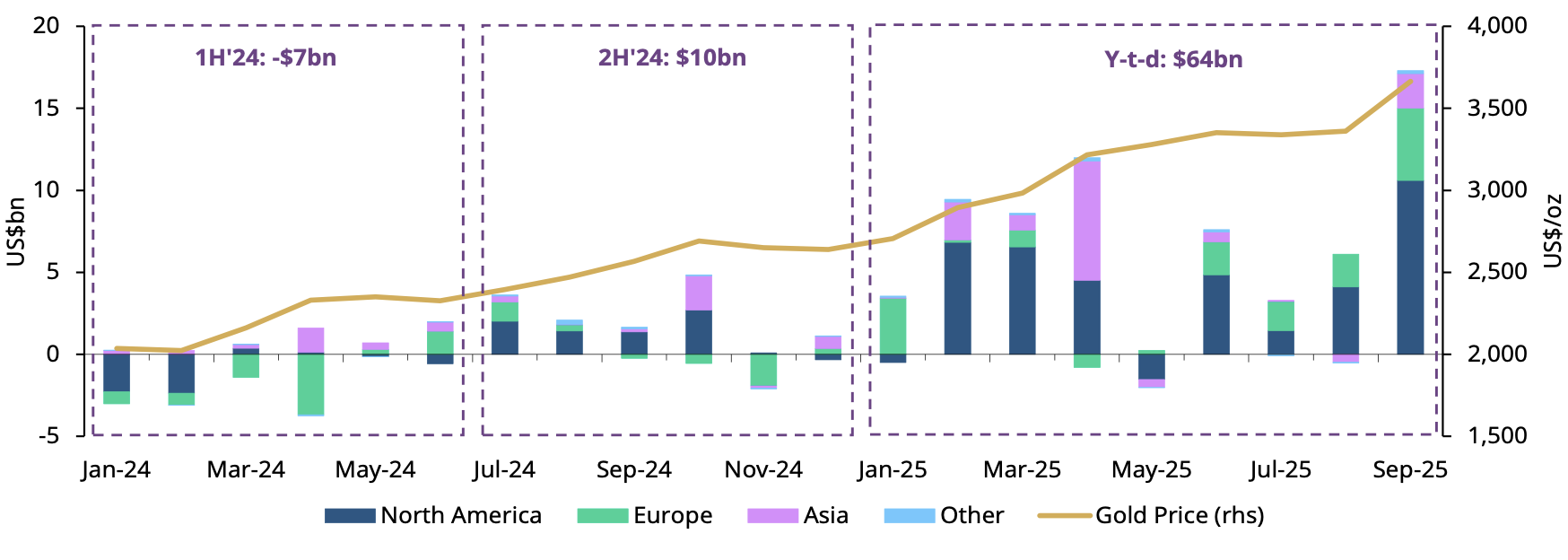

Second, tactical demand from traditional finance (TradFi) is flooding in. According to the World Gold Council, gold ETFs have seen a record $64 billion in inflows this year, with a massive surge in September from North American and European investors. This is a classic defensive play by institutional investors hedging against geopolitical risk, a weakening dollar, anticipated rate cuts, and a potential recession—especially as they look for a safe haven after the US stock market hit new highs.

Data Source:TradingView

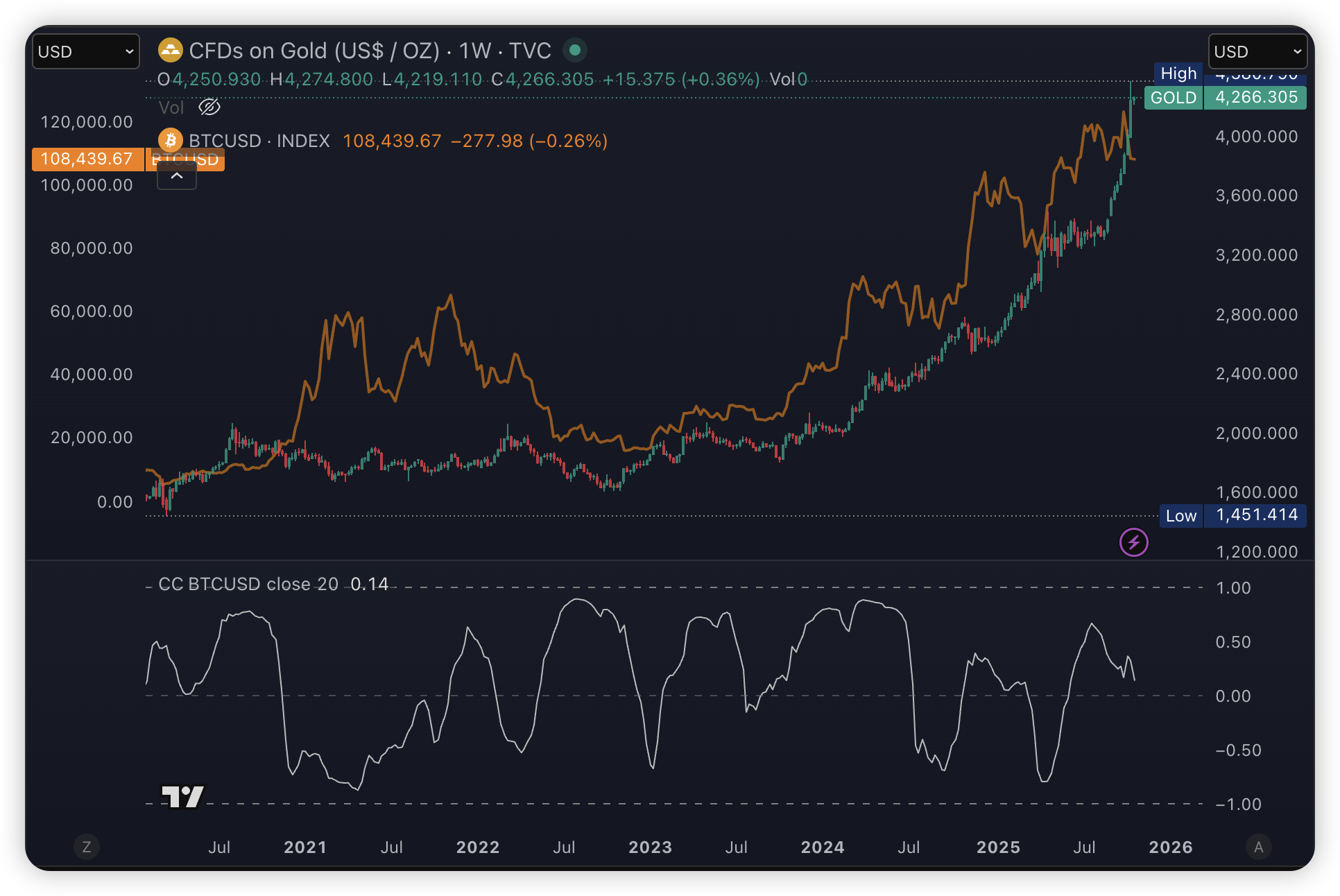

Against this macro backdrop, while the long-term correlation between Bitcoin and gold is strengthening, recent data from September-October reveals a critical short-term divergence. Gold is siphoning massive amounts of traditional capital through mature, compliant ETF channels, while Bitcoin is facing a severe "stress test" on its path to becoming a mainstream macro hedge.

This divergence isn't just about price; it's a fierce reshuffling and battle of investment narratives. Recently, the Digital Asset Treasury (DAT) model—once seen as a key bridge between TradFi and crypto—is experiencing a global crisis of confidence.

Data Source:https://metaplanet.jp/en/analytics

After announcing plans to build a $100M crypto treasury, Nasdaq-listed QMMM Holdings saw its stock skyrocket nearly 10x in three weeks. The party ended abruptly with an SEC trading halt over allegations of social media-driven stock manipulation. When reporters visited its Hong Kong headquarters, they found only an empty, abandoned office. Meanwhile, Japanese-listed Metaplanet has seen its stock plummet over 78% since its June high. Its mNAV ratio (the value of its Bitcoin holdings vs. its market cap) has cratered from a euphoric peak of over a 22x premium to just 0.8, meaning its market cap is now at a discount to the Bitcoin it holds. As BitMine Chairman Tom Lee noted in Crypto Playbook, with several DATs trading below their net asset value, this narrative-driven bubble may have already burst.

Of course, this short-term divergence and the DAT crisis don't fundamentally weaken Bitcoin's long-term value proposition as "digital gold." In fact, they highlight its potential. Gold's recent performance is a clear demonstration of just how massive the capital flows can be when global risk-off sentiment ignites and converges on a consensus asset.

We can foresee that once Bitcoin's market infrastructure and institutional trust mature to a level closer to gold's, it will have a monumental impact on its price, even if it captures just a fraction of that safe-haven capital overflow. Bitcoin's path to becoming a mainstream macro hedge is filled with opportunities, but the journey is long and challenging. The destination, however, is attainable.

2. Weekly Selected Market Signals

Tariffs & Geopolitics Whipsaw Risk Appetite; ETF Flows Turn Negative While Stablecoins Remain a “Buffer”

The shifting path of tariffs and macro expectations drove a brief sentiment repair into last Friday: hopes for easing trade tensions rose, regional banks’ earnings beat, and the three major U.S. equity indices opened lower but finished higher, up more than 1% for the week. U.S. Treasury prices slipped; the 2-year yield rebounded after printing a three-year low, though it still fell for a third straight week. In parallel, headlines about a potential Trump–Putin meeting in Budapest boosted peace bets; precious metals spiked to fresh highs before a sharp intraday reversal — spot gold fell more than 3%, the largest one-day drop since May last year — yet remains up over 60% year-to-date on central-bank buying and ETF subscriptions. The tug-of-war between haven demand and trading flows, layered on top of rising fiscal/debt burdens and perceived threats to Fed independence, produced last week’s cross-asset “seesaw.”

After the “10/11” capitulation-style deleveraging, crypto is still rebuilding risk appetite. Bitcoin briefly broke below $104,000 — a four-month low — before retracing more than half the drop and finishing the weekend as high as $109,445. Altcoin beta underperformed and overall sentiment remains cautious.

Data Source: TradingView

A regulatory “black swan” also hit liquidity. On Oct 14, a Brooklyn federal court unsealed an indictment showing the U.S. Department of Justice recently seized ~127,000 BTC (over $15B), lifting the U.S. government’s on-chain holdings by ~64% in a single day. According to Arkham, U.S. government addresses now hold ~325,447 BTC (~$34.78B), the second-largest holder globally behind MicroStrategy.

With the “10/11” aftershocks, ETF flows weakened: last week saw net outflows of $1.23B from BTC ETFs and $311M from ETH ETFs. Bitcoin’s market dominance edged higher, underscoring the limited breadth of the altcoin rebound.

Data Source: SoSoValue

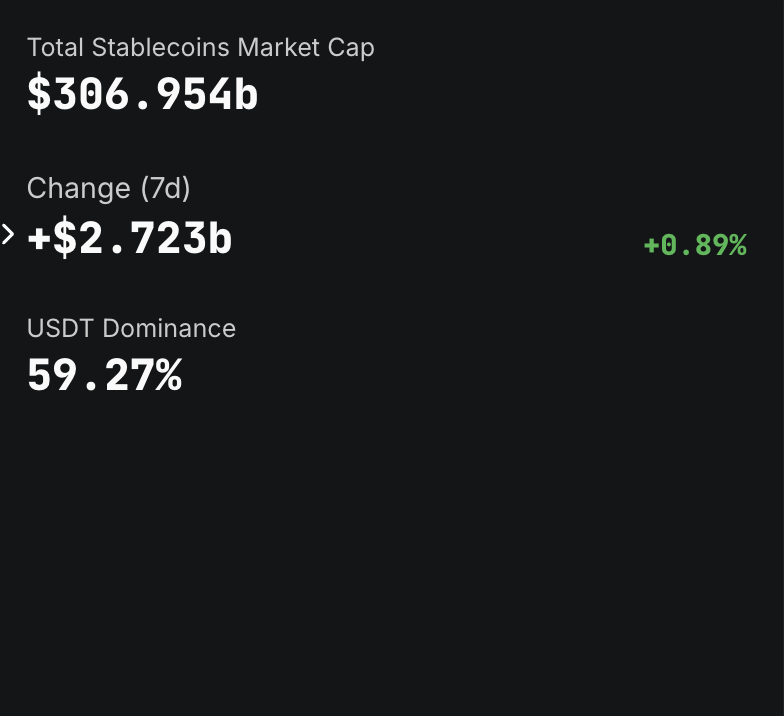

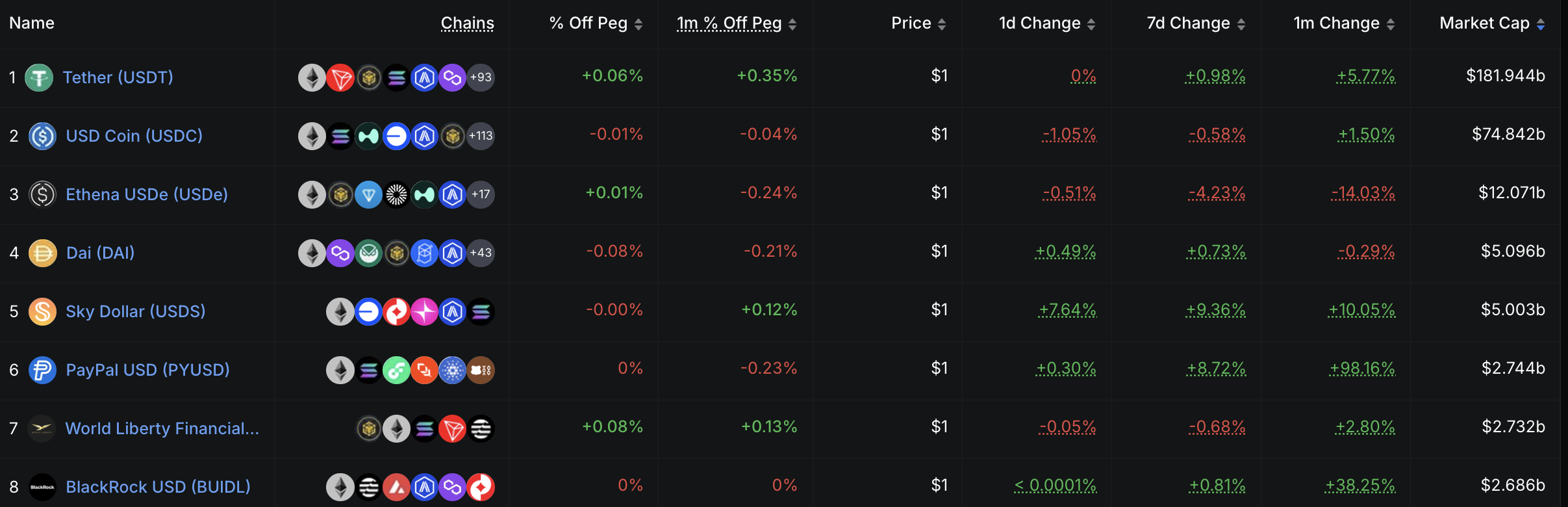

Stablecoins continue to provide a “buffer.” Over the past week, USDT’s market cap increased by roughly $2.0B (+0.98%) while USDC dipped slightly; yield-bearing USDe saw ~$600M of net outflows (-4.23%) amid sentiment and mechanism noise. On Oct 16, PYUSD recorded an abnormal “large mint and burn” sequence within 30 minutes, highlighting operational/process vulnerabilities in centralized stablecoin workflows and, again, the need for issuer transparency and incident discipline.

Data Source: DeFiLlama

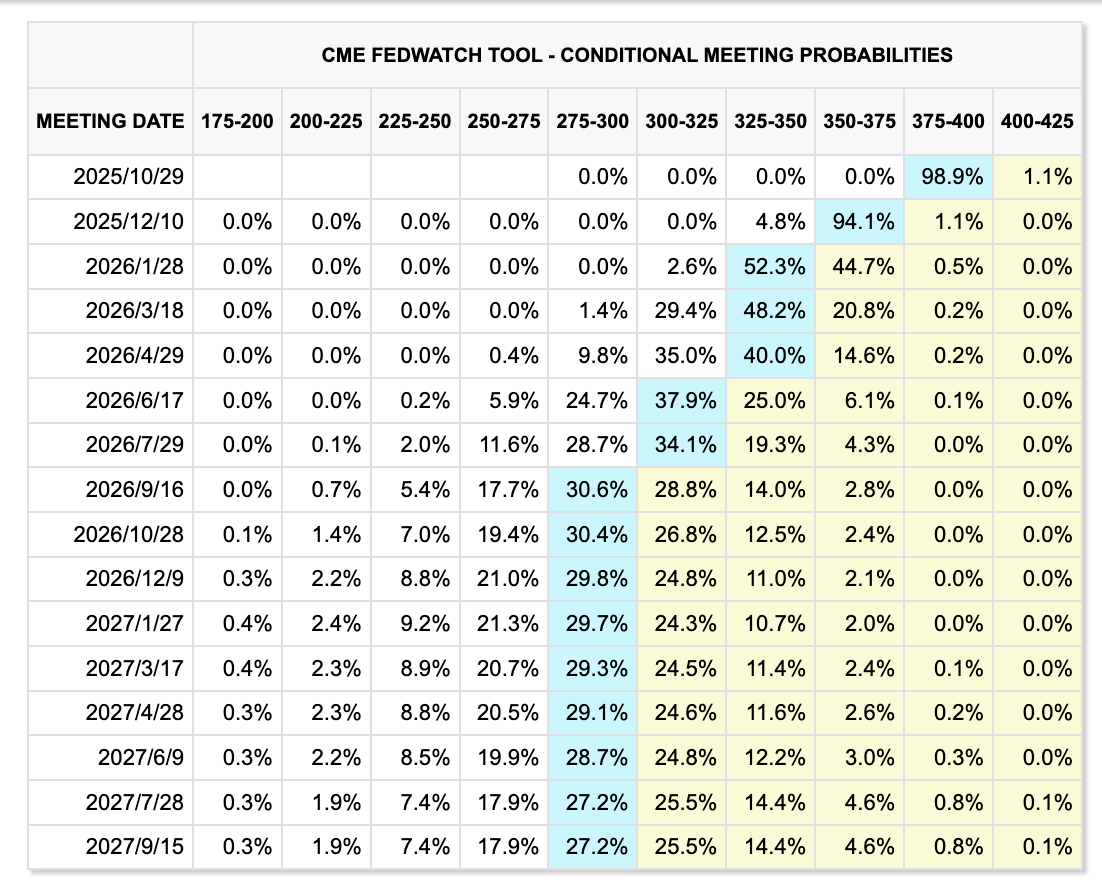

With the U.S. government shutdown ongoing, macro focus is narrowing. Because official releases are delayed, September CPI will print on Oct 24 and serve as one of few “hard-data” anchors. Markets are pricing another 25 bp Fed cut at the Oct 28–29 FOMC. Beyond inflation, investors are reassessing U.S. bank credit quality — disclosures by Zions Bancorp and Western Alliance on suspected fraud-related loans drew attention; this week’s earnings will test whether higher-risk lending is starting to surface.

Data Source: CME FedWatch Tool

Major events to watch this week:

-

Oct 20: China Q3 GDP YoY

-

Oct 21: Federal Reserve Payments Innovation Conference (topics include stablecoins, AI, tokenization)

-

Oct 22: U.S. earnings season ramps up — focus on Tesla, Intel, IBM

-

Oct 24: U.S. September CPI (delayed due to shutdown) and U.S. October Markit Manufacturing PMI

Bottom line: tariffs and geopolitics continue to re-price risk assets at high frequency. Post-“10/11” forced de-risking plus DOJ seizure expectations are capping near-term risk tolerance. Stablecoin net additions and gold’s rebound after a pullback suggest a narrow “risk-off ↔ risk-on” toggle. If CPI and the easing path land in line and ETF outflows stabilize, markets could shift from passive repair to a more structural rebuild; until then, position sizing and risk controls should precede narratives for high-volatility assets.

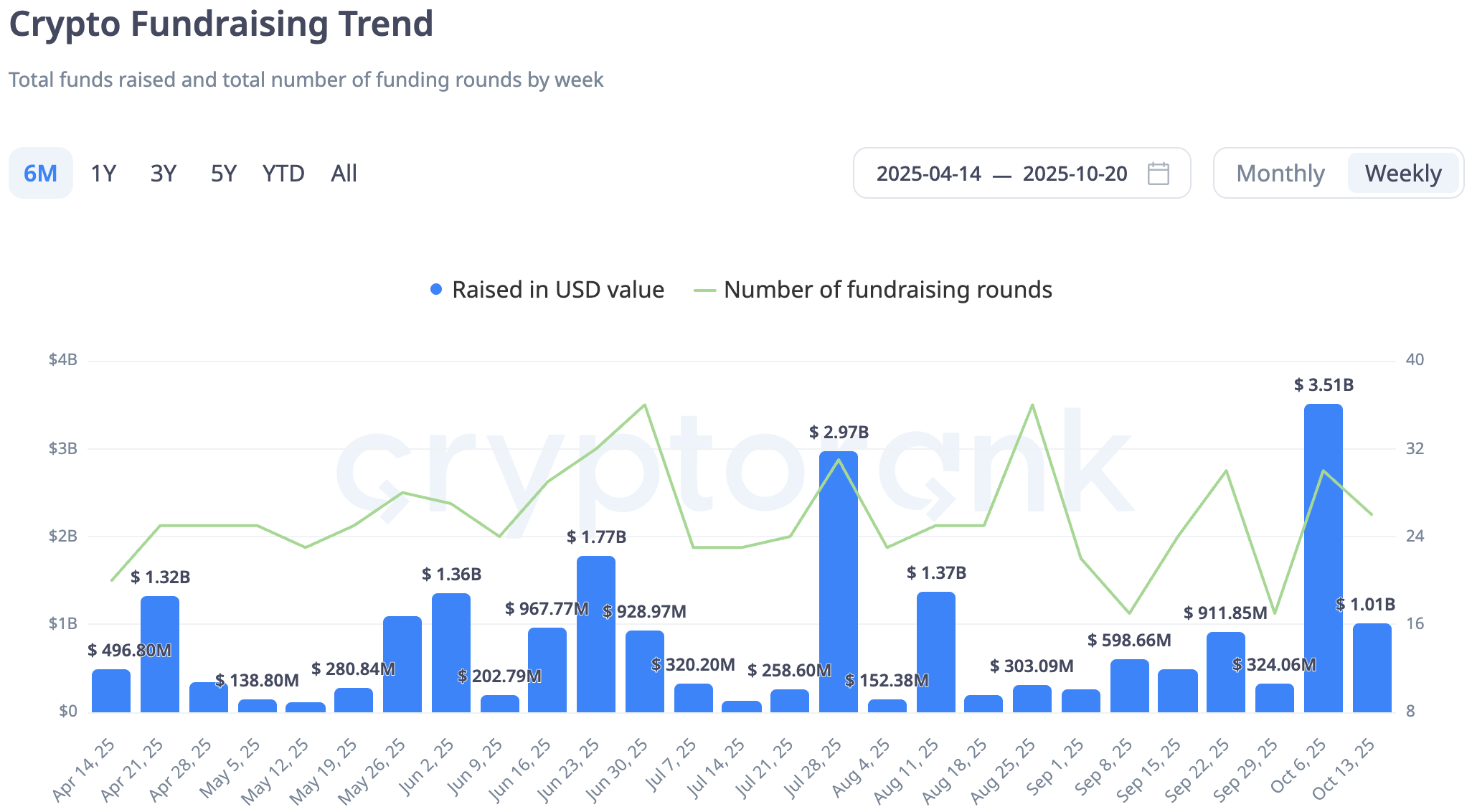

Primary Market Funding Watch:

A TechFlow piece on the decline in new deals by select APAC crypto VCs from 2024 to 2025 sparked debate this week, highlighting funding challenges for small/mid-sized funds. In parallel, weekly crypto primary financing moderated back to roughly $1B, with capital skewing toward “billable, regulated” rails: on one end, compliant regional gateways (licensed exchanges, custody, fiat on/off-ramps); on the other, stablecoin settlement and payments infrastructure (cross-border clearing, merchant acquiring, B2B terms financing). Against a backdrop of slower APAC deployment and some smaller funds pivoting to cash-flow businesses, projects that directly capture fiat flows or enable real-world stablecoin usage emerged as the most sought-after.

Data Source: https://cryptorank.io/funding-analytics

Coinbase invests in CoinDCX — a bet on India’s compliant flows with optionality into the Middle East

Coinbase’s undisclosed investment in India’s regulated exchange CoinDCX (implied post-money valuation ~US$2.45B) is best read as a “channel, brand, and risk-framework” synergy: a capital-light way to secure long-term presence in one of the fastest-growing retail compliance markets while sidestepping direct-operation uncertainties. For CoinDCX, Coinbase’s institutional and compliance halo should accelerate licensing expansion, risk controls, and institutional penetration — and help port its India playbook into offshore corridors such as the Middle East.

Whether this crystallizes near-term value hinges on INR on/off-ramp stability and fee competitiveness; rollout speed of a compliant product stack (custody, savings, earn/payments); depth of bank and clearing-network partnerships; and the ramp in institutional mix and quarterly volumes. Constraints remain in local taxation and data-compliance rules. If fiat channels and custody capacity keep strengthening, CoinDCX could evolve into India’s “compliant flow hub,” while Coinbase re-enters a high-growth frontier at low cost.

YZi Labs leads $50M for Better Payment Network (BPN)

BPN positions itself as a “programmable payments network for the multi-stablecoin era,” using on-chain unified routing and clearing pools, market-making and limit management, and off-chain compliant fiat on/off-ramps and merchant acquiring — a CeDeFi hybrid aiming to compress cross-border settlement from T+1/2 to hours while lowering all-in costs. The $50M round led by YZi Labs will fund expansion across high-demand corridors in the Middle East, Southeast Asia, and Africa; secure local licenses and bank ties; and deepen liquidity and clearing across USDT/USDC/local stablecoins.

Industry implications: once both “stablecoin ↔ fiat” exits are truly open, networks like BPN can serve as payments middleware for consumer wallets, merchant acquiring, B2B settlement, and platform economies — directly increasing stablecoin usability in real trade and daily payments. Success turns on the durability and breadth of fiat-side banking/payment coverage; automation and rigor of KYC/AML/sanctions modules; thickness of clearing pools and quote quality (including FX, spreads, and failure rates); and sustainable real transaction volume and merchant retention. If BPN sequences these pieces correctly, it could be among the first to run a commercial-scale “stablecoin payments” flywheel end-to-end.

3. Project Spotlight

Solana's Leading DEX Meteora Gears Up for TGE, Ditching Traditional Simple Airdrop Models

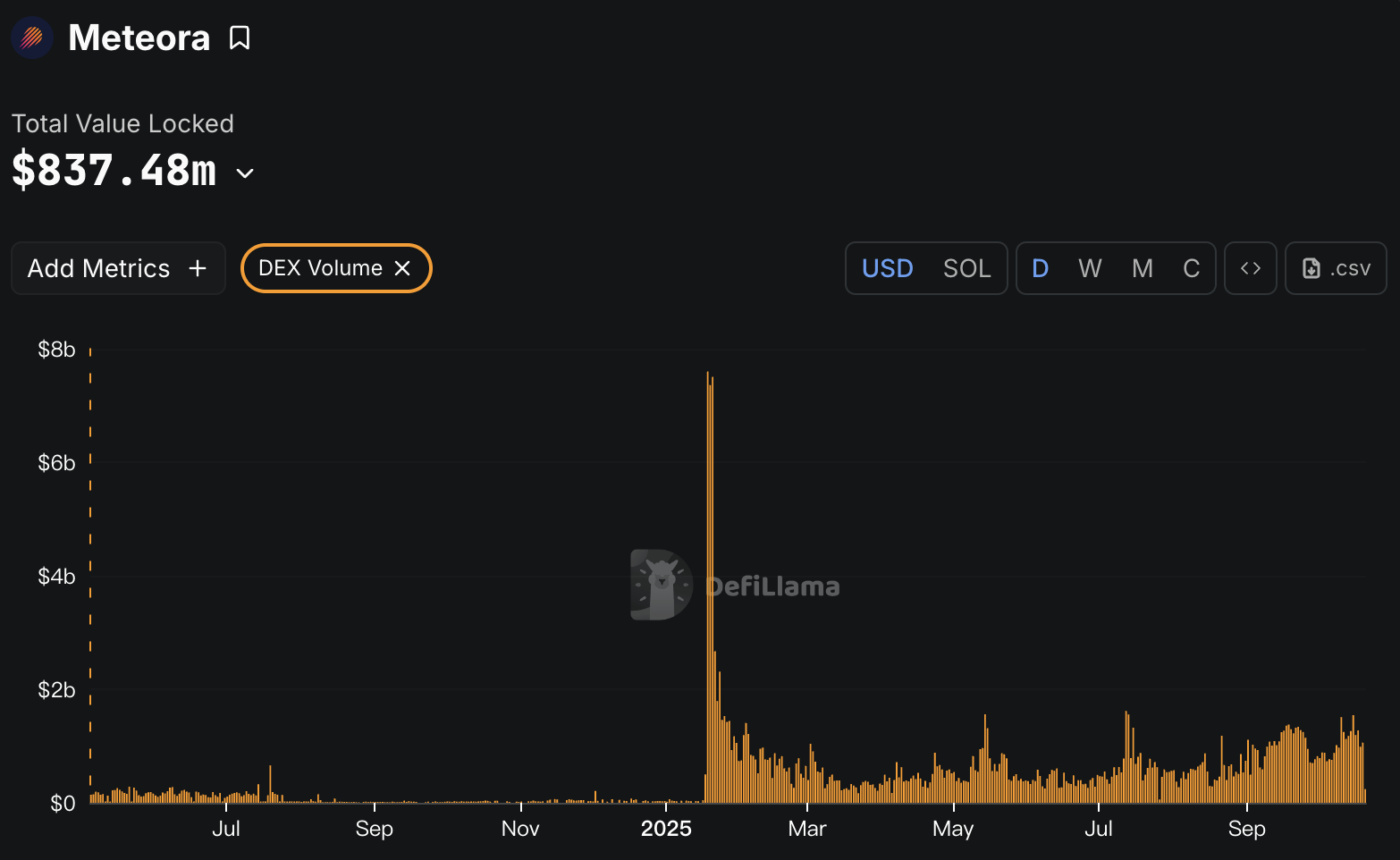

Backed by Solana's largest aggregator, Jupiter, the DEX Meteora has experienced rapid growth this year, with its daily trading volume now nearly surpassing the combined totals of Raydium and Orca. Reflecting on Meteora's development history, the launch of the TRUMP token marked a pivotal milestone. On January 17 this year, U.S. President Trump unexpectedly announced his Memecoin token CA on social media and chose Meteora to deploy its USDC liquidity pool. Over the following two days, the TRUMP "wife" coin, MELANIA, was similarly deployed on Meteora. As users frantically FOMO'd into TRUMP and MELANIA tokens, this surge drove unprecedented trading volumes and fee revenues for Meteora. To this day, the period surrounding the launches of TRUMP and MELANIA remains the highest in Meteora's history for both trading volume and income. It was precisely through this "Trump endorsement" that Meteora gradually gained wider user attention.

Data Source: https://defillama.com

Compared to traditional AMM DEXes, Meteora's core innovation lies in its DLMM mechanism (Dynamic Liquidity Market Maker), which enables liquidity to be highly concentrated within specific price ranges and adapts to market volatility through dynamic parameter adjustments (base fee + volatility-based variable fee), thereby reducing impermanent loss and enhancing LP yields. Additionally, Meteora has introduced Dynamic Vaults, supporting automatic rebalancing and multi-strategy yield aggregation, allowing LPs to deploy funds into various strategies (such as stablecoin arbitrage) with one click, while providing MEV protection via private transaction channels to mitigate front-running risks. This model has enabled Meteora to rapidly attract a cohort of quantitative traders and advanced LP users.

Furthermore, to challenge Pump Fun's monopoly on Solana token launches, Meteora has introduced the DBC launch protocol using dynamic Bonding Curves. More precisely, this is an SDK infrastructure that enables other developers to integrate the SDK and build custom launchers, such as Believe. Currently, Meteora DBC and the launchers built around it have emerged as strong contenders against Pump Fun in the Solana Launchpad arena. To date, starting from the aggregator Jupiter, extending to Meteora DEX, and now including the Meteora DBC launch protocol, the Jupiter ecosystem has encompassed the full spectrum of trading services—Launchpad, DEX, and aggregator—while continuing to expand into on-chain trading ecosystems such as data analytics, the Meme trading terminal AlphaScan, perpetuals, stocks, dark pools, and more.

Just as Meteora's entire product suite emphasizes dynamism, its TGE likewise eschews traditional simplistic airdrops, instead prioritizing community engagement, anti-sniping measures, and sustainable liquidity incentives. At its core, it leverages dynamic AMM and dynamic Bonding Curves to facilitate token distribution and liquidity injection. Meteora's TGE not only distributes tokens but can also directly allocate LP NFTs, creating liquidity dynamics right from launch. Upon completion of the initial liquidity injection, users can opt to claim MET tokens directly; or receive NFTs representing MET/USDC LP shares, which are transferable, mergeable, automatically accrue fees from the first block, and redeemable at any time. Claiming MET outright resembles a call option or naked long position, betting on MET price appreciation for profits; whereas LP NFTs function like neutral or volatility-selling strategies, capturing trading fees as "premiums" but exposing holders to impermanent loss (IL).

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.