Stablecoin Trading Volume Surpasses Visa: Is Crypto Entering a Utility Phase?

2025/12/19 09:51:02

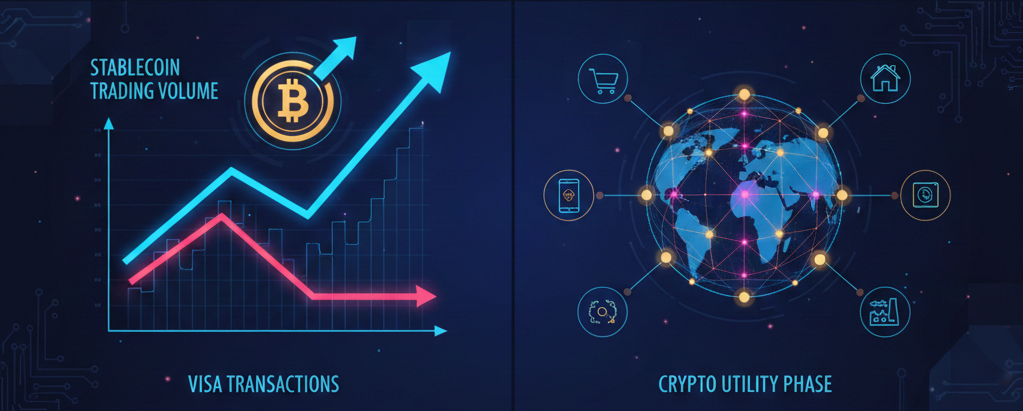

The cryptocurrency landscape is evolving rapidly, moving beyond speculative trading toward practical utility and transactional use. A striking indicator of this transition is that stablecoin trading volume recently surpassed Visa’s global transaction volume, reflecting both the growing scale of the crypto market and its maturation in terms of liquidity and utility. Stablecoins, which are digital assets pegged to fiat currencies, have emerged as critical tools for trading, remittances, DeFi lending, and cross-border payments. Unlike highly volatile cryptocurrencies, stablecoins provide price stability, making them ideal for facilitating transactions and preserving value during turbulent market conditions.

For investors and traders, the rise of stablecoins represents more than just a convenience—it signals a structural shift in crypto markets toward practical adoption. Understanding this phenomenon helps market participants identify liquidity trends, anticipate market rotations, and develop informed trading strategies.

Market Data and Volume Analysis

Recent metrics underscore the increasing dominance of stablecoins in crypto transactions. For instance, daily trading volumes for USDT, USDC, BUSD, and DAI collectively exceeded $95 billion, surpassing Visa’s estimated daily transaction volume of roughly $85 billion. This milestone highlights the growing role of stablecoins as both a trading medium and a vehicle for capital movement within the crypto ecosystem.

| Stablecoin | 24h Trading Volume | Market Cap | On-Chain Activity | Top Use Case |

| USDT | $45B | $83B | High | Payments, exchange liquidity |

| USDC | $28B | $35B | Moderate | DeFi, remittances |

| BUSD | $15B | $19B | Moderate | Exchange liquidity, lending |

| DAI | $7B | $7.5B | High | Lending, DeFi transactions |

Stablecoin usage now surpasses many traditional payment networks, indicating that the crypto ecosystem is moving into a utility-driven phase, where transactional function, liquidity provision, and cross-border movement of capital play a central role.

Drivers Behind Surging Stablecoin Volume

Several factors have contributed to the recent surge in stablecoin trading volume. First, macroeconomic uncertainty, including inflation and interest rate fluctuations, has led investors to seek capital preservation tools within crypto markets. Stablecoins provide a mechanism to hedge against volatility without exiting the digital asset ecosystem entirely.

Second, the growth of decentralized finance (DeFi) has increased the utility of stablecoins. Lending platforms, automated market makers, and derivatives protocols rely heavily on stablecoin liquidity to facilitate transactions and maintain efficient markets.

Third, cross-border payments and institutional adoption have further propelled stablecoin activity. Enterprises, trading desks, and payment providers increasingly leverage stablecoins for fast, low-cost transfers, particularly in regions where traditional banking infrastructure is limited or expensive.

Lastly, stablecoins play a critical role in crypto trading. During periods of market volatility, traders often convert volatile assets to stablecoins to lock in gains or hedge positions. This behavior amplifies trading volumes and reinforces stablecoins’ role as the backbone of crypto market liquidity.

Market Implications

The rise of stablecoin trading volume has several important implications for crypto markets. Firstly, it reflects growing market adoption and maturation, suggesting that the ecosystem is moving beyond speculative trading to more practical use cases. Increased stablecoin volume enhances overall liquidity, making it easier for traders to execute large orders without significant slippage.

Secondly, high stablecoin usage indicates enhanced market resilience. During periods of crypto market stress, stablecoins act as a safe harbor, allowing investors to temporarily reduce exposure to volatile assets while remaining within the crypto ecosystem.

Thirdly, the dominance of stablecoins affects derivative markets. High stablecoin liquidity allows for greater leverage and more efficient futures and options trading. Exchange-traded derivatives are increasingly denominated in stablecoins, facilitating seamless settlement and reducing counterparty risk.

Finally, regulatory scrutiny may increase as stablecoins approach mainstream adoption levels similar to traditional financial networks. Investors and traders should monitor regulatory developments to anticipate potential impacts on liquidity, issuance, and market access.

Behavioral and Sentiment Analysis

The surge in stablecoin activity is also driven by behavioral and sentiment factors. Retail investors often use stablecoins as a “safe parking space” during volatile periods, enabling quick re-entry into BTC or altcoins when market conditions stabilize. Institutional players, including hedge funds and corporate treasury departments, rely on stablecoins for operational efficiency, capital allocation, and risk management.

Social sentiment metrics further illustrate this trend. Discussions on Twitter, Telegram, and Reddit frequently highlight the practical uses of stablecoins, including payments, remittances, and trading. Increased social engagement correlates with higher on-chain stablecoin activity, creating a feedback loop where visibility and utility reinforce adoption.

Trading and Investment Strategies

Traders and investors can leverage the stablecoin surge in several ways. In the short term, stablecoins provide a liquid vehicle to manage exposure, hedge positions, and capture market opportunities without exiting the crypto ecosystem. For example, during periods of BTC or altcoin volatility, converting holdings to USDT or USDC preserves value while maintaining the ability to re-enter positions rapidly.

For mid- to long-term strategies, stablecoin usage indicates market maturation. Investors can allocate portions of their portfolio to stablecoins to manage liquidity and reduce drawdown risk. Additionally, participation in DeFi protocols using stablecoins allows for yield generation, such as through lending or staking, while minimizing exposure to volatile assets. KuCoin provides integrated Spot, Futures, and DeFi markets where users can utilize stablecoins efficiently. New users can sign up for a KuCoin account to access trading, liquidity pools, and analytics for informed decision-making.

Case Study: Stablecoin Volume vs Visa Transactions

In November 2025, the cumulative daily trading volume of top stablecoins reached $95 billion, exceeding Visa’s estimated $85 billion in daily transactions. BTC and altcoins continued to trade actively, with market participants converting profits to stablecoins during minor corrections. This case highlights the dual role of stablecoins: as a trading hedge during market swings and as a practical payment instrument for real-world use cases.

| Metric | Stablecoins | Visa |

| Daily Transaction Volume | $95B | $85B |

| Transaction Speed | Seconds | 1–3 days |

| Access | Global crypto ecosystem | Limited by banking infrastructure |

| Use Case | Trading, DeFi, payments | Retail and corporate payments |

This comparison emphasizes that crypto is increasingly functioning as a practical financial network, with stablecoins at its core, supporting liquidity, trading efficiency, and cross-border transactions.

On-Chain and Liquidity Metrics

Monitoring on-chain and liquidity metrics provides insight into the behavior driving stablecoin dominance. Exchange inflows of USDT and USDC often spike during periods of BTC and altcoin volatility, reflecting investor hedging behavior. Total value locked (TVL) in stablecoin-based DeFi protocols has steadily increased, indicating sustained demand for yield generation. Open interest in stablecoin-denominated derivatives highlights the role of stablecoins in enabling leveraged trading and efficient settlement. These metrics collectively suggest that stablecoins have become central to crypto market infrastructure, influencing liquidity, pricing efficiency, and risk management.

Conclusion

The recent milestone of stablecoin trading volume surpassing Visa transactions signals a structural shift in the crypto market toward utility and adoption. Stablecoins now serve as the backbone of liquidity, risk management, and practical transactions within the ecosystem. For traders and investors, this trend presents opportunities to manage exposure, capture short-term market swings, and participate in DeFi yield strategies. Platforms like KuCoin provide the tools, analytics, and access necessary to navigate this evolving market efficiently. Understanding the implications of rising stablecoin usage allows participants to anticipate market rotations, optimize portfolio allocation, and position strategically in both volatile and stable market conditions.