Decoding Crypto Alpha: What Is Alpha in Crypto & Why It’s Crucial for Investors

2025/08/20 09:27:02

Alpha, a term once exclusive to traditional finance, has found a new, more dynamic home in the world of crypto. In a market known for its wild swings, simply riding the wave of major assets like Bitcoin is no longer enough for investors seeking a real edge. This guide will decode crypto alpha, explaining what it is and why it's the key to truly outperforming the market.

What Is Alpha in the Crypto Market?

In the field of finance, two terms are crucial for any serious investor: beta and alpha.

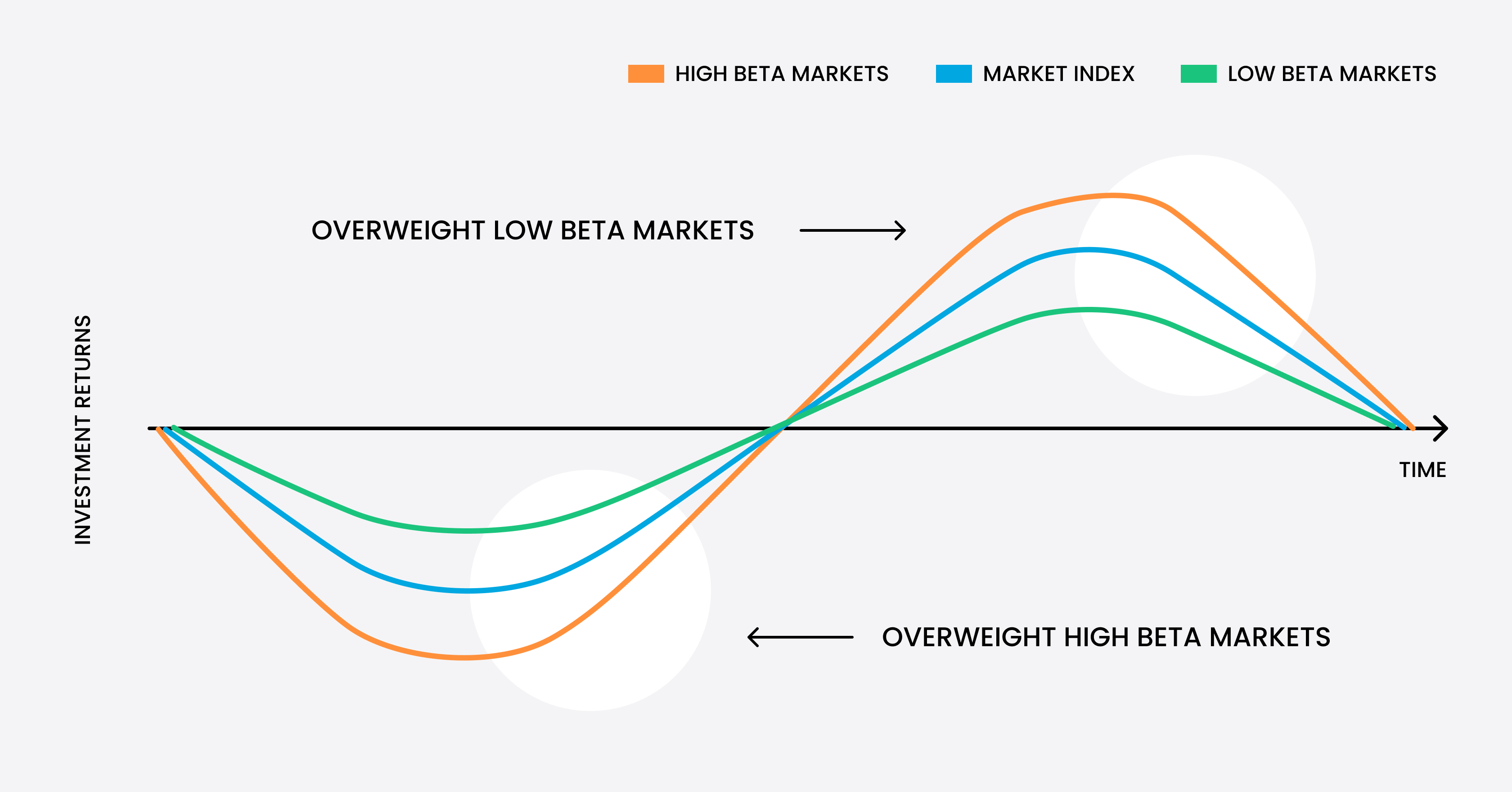

Beta represents the overall volatility and return of the market itself. In traditional finance, if you invest in an S&P 500 index fund, your returns are a direct reflection of the market’s performance—you are essentially buying beta. In the crypto world, Bitcoin (BTC) and Ethereum (ETH) often serve as the benchmarks. If your portfolio simply tracks the price movements of these major assets, you have a high beta.

Examples of beta|Credit: Trading212

While beta is about participating in the market, alpha is about outperforming it. It's the excess return you generate above and beyond what the market itself provides. Alpha is a measure of your skill, your research, and your ability to find opportunities that the broader market has overlooked. It’s the difference between simply holding BTC and actively identifying the next big project that yields a 10x return.

Why is this distinction so crucial in crypto? The crypto market is notoriously volatile. Bitcoin can swing by 10% in a single day, and many investors are content with just riding these waves. However, for those seeking to maximize their gains and truly leverage their knowledge, relying solely on beta isn't enough. Generating alpha is what separates a passive holder from a strategic investor.

Definition of “Alpha”|Image: Investopedia

How Is Crypto Alpha Generated?

Crypto alpha is a direct result of informational asymmetry, strategic insight, or technical skill. It is generated when an investor capitalizes on a market inefficiency or identifies an opportunity that the majority of participants have not yet recognized. This moves beyond merely riding a bull market and involves a deliberate, repeatable process.

Think of two investors in a bull run. The first investor holds a diversified portfolio of top-10 cryptocurrencies, which sees a 50% gain as the overall market rises. Their return is primarily beta. The second investor, through diligent research, identified an emerging layer-2 scaling solution with robust technology and a compelling team. They invested in this token when it was still under the radar. When the token’s technology began gaining traction and was subsequently listed on major exchanges, its price surged by 200%. This investor’s excess return—the 150% above the market average—is a textbook example of alpha. It was not a result of the general market trend but of a successful, research-based investment decision.

Sources of Alpha in the Crypto Ecosystem

The pursuit of alpha in crypto is about more than just finding the next promising token. It’s about leveraging different facets of the decentralized ecosystem to create value.

-

Fundamental Research: This involves a deep dive into a project’s whitepaper, tokenomics, team background, and community engagement. Alpha is generated by identifying projects with strong fundamentals that are currently undervalued by the market. An investor who uncovers a decentralized data protocol with a sustainable business model before the market recognizes its value is generating alpha. The outperformance stems from their unique insight and analysis.

-

On-Chain Analysis: Unlike traditional markets, most blockchain data is public. Alpha can be found by analyzing on-chain metrics such as transaction volume, smart contract activity, and large wallet movements. An investor might use these tools to identify “smart money” moving into a new DeFi protocol and front-run the broader market, thereby earning a return that is not simply due to the market's momentum. This method relies on technical expertise and access to specialized data tools.

-

Market Inefficiencies and Arbitrage: The crypto market is fragmented across hundreds of exchanges and decentralized platforms. This can lead to temporary price discrepancies for the same asset. An investor with the right tools and quick execution can generate alpha by profiting from these price differences. This strategy, known as arbitrage, is a pure form of alpha—it’s a return generated with minimal market risk, stemming solely from the investor’s ability to exploit an inefficiency.

-

Yield Generation Strategies: In the world of decentralized finance (DeFi), alpha is also generated through active participation. By providing liquidity to a decentralized exchange (DEX) or lending assets through a protocol, an investor can earn fees and rewards. These returns are a form of alpha because they are earned on top of any potential price appreciation of the underlying assets. The selection of protocols with high, sustainable yields and the management of associated risks, such as impermanent loss, is a skill-based activity that produces an outperformance.

How to Hunt for Crypto Alpha

The quest for alpha requires a new set of skills and a different mindset. Here's how you can get started:

-

Do Your Own Research (DYOR): This is the golden rule of crypto investing. Before you put a single dollar into a project, read its whitepaper, understand the tokenomics (how the token is distributed and used), and research the team behind it. Does the project solve a real problem? Is the team credible and transparent?

-

Use On-Chain Tools: Familiarize yourself with on-chain analytics platforms like Dune Analytics, Nansen, and Arkham Intelligence. These tools allow you to see where large wallets are moving their money, track the flow of funds into new protocols, and identify potential trends long before they hit the headlines.

-

Engage with the Community: Alpha is often found at the intersection of technology and community. Join project Discord servers, follow key figures on X (formerly Twitter), and participate in forums. Being an active member of the community can give you early access to information and a deeper understanding of a project's potential.

-

Find a Reliable Platform: To execute on these strategies, you need a powerful and secure platform. KuCoin is going to launch its Alpha product soon. With its diverse range of listed cryptocurrencies, advanced trading features, and access to new and emerging projects, it provides a gateway to a wide array of opportunities that go beyond just holding Bitcoin or Ethereum.

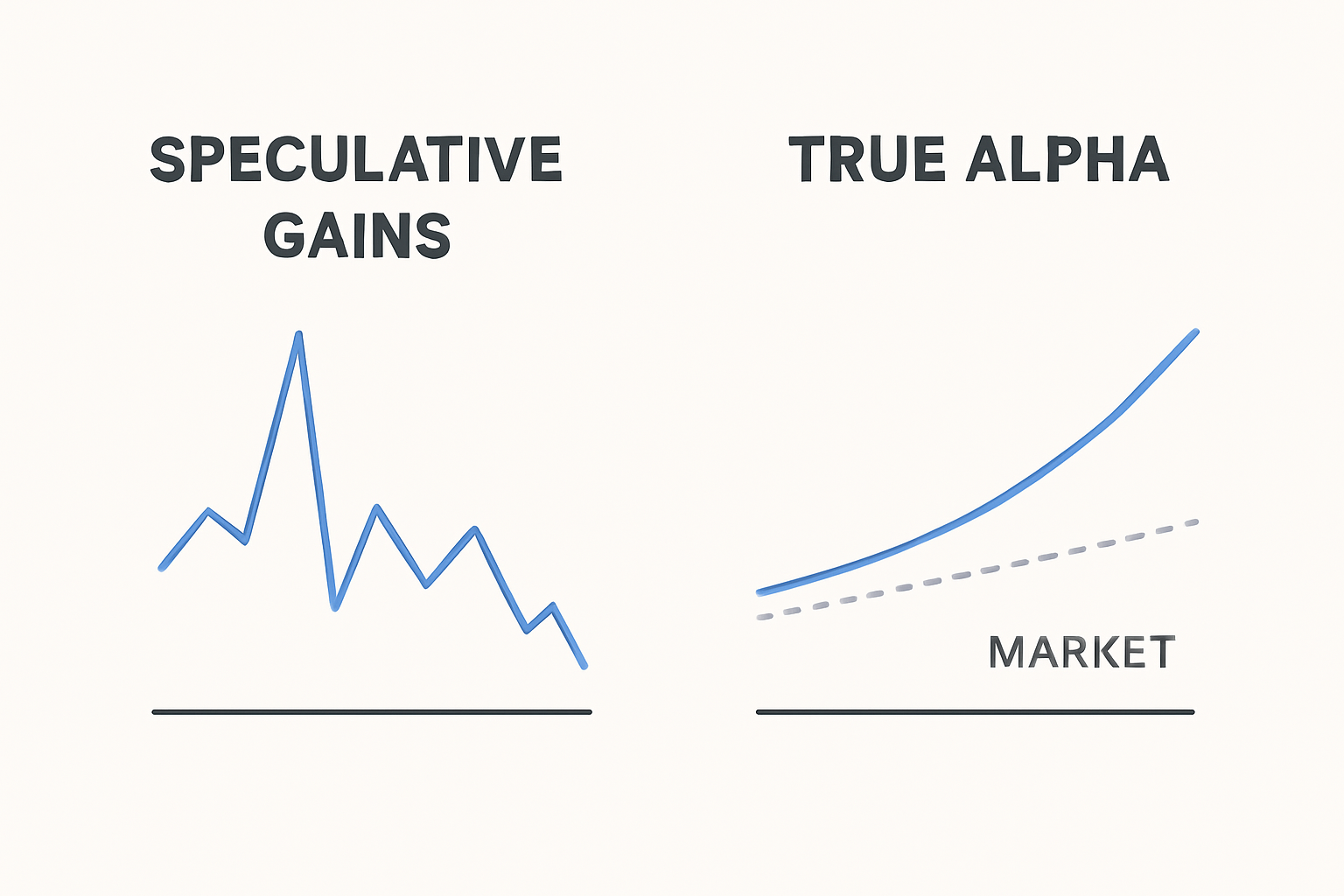

True Alpha vs. Speculative Gains

It is crucial to differentiate true alpha from mere speculative gains or luck. In a powerful bull market, many assets will rise in price. A token that doubles in value while the market index rises by 80% has only generated 20% alpha. Conversely, a token that holds its value or even increases slightly during a bear market when the benchmark is down by 50% has generated significant positive alpha. Alpha is about relative performance, not just absolute profit.

Moreover, a successful alpha strategy must be repeatable. A one-time 100x return from a random token is often a matter of luck, not a demonstrable skill. True alpha is a result of a consistent, logical, and data-driven process that can be applied to different opportunities over time. It requires discipline, continuous learning, and an objective approach to the market's signals and noise.

Final thoughts on Crypto Alpha

Alpha is the metric for outperformance. In the crypto market, it represents the returns you generate that are not simply a result of the overall market's rise or fall. While a passive investor gets beta—the market's general returns—an active investor seeks alpha.

True alpha is born from skill, not luck. It comes from deep fundamental research, on-chain analysis, or leveraging market inefficiencies. A successful alpha strategy is repeatable and objective, whether it's identifying an undervalued project before it gains mainstream attention or earning excess returns through DeFi protocols. Ultimately, alpha is the key to becoming a strategic and disciplined crypto investor, rather than just a passive participant.