Diving into BTC Mining Pools: How It Works and Why Is Important

2025/08/19 09:33:02

The story of Bitcoin mining is often romanticized as a modern-day gold rush—an individual with a home computer striking it rich by discovering a block of digital gold. While this was a reality in the early days of the network, the landscape has evolved dramatically. Today, the Bitcoin network's astronomical difficulty makes solo mining a financial impossibility for all but the most well-funded entities. The era of the individual miner has given way to a new paradigm: the Bitcoin mining pool.

Mining pools represent a crucial shift from individual competition to collective collaboration. They are the backbone of modern Bitcoin mining, providing a means for thousands of miners, from small-scale enthusiasts to industrial-sized operations, to pool their computational resources, or "hash rate," to increase their collective chance of finding a block. This article will delve into the mechanics of btc mining pools, exploring their function, the various payout mechanisms that govern them, and the challenges they present to the network's decentralization.

From Solo to Syndicate: The Evolution of Mining

Image: BitcoinWiki

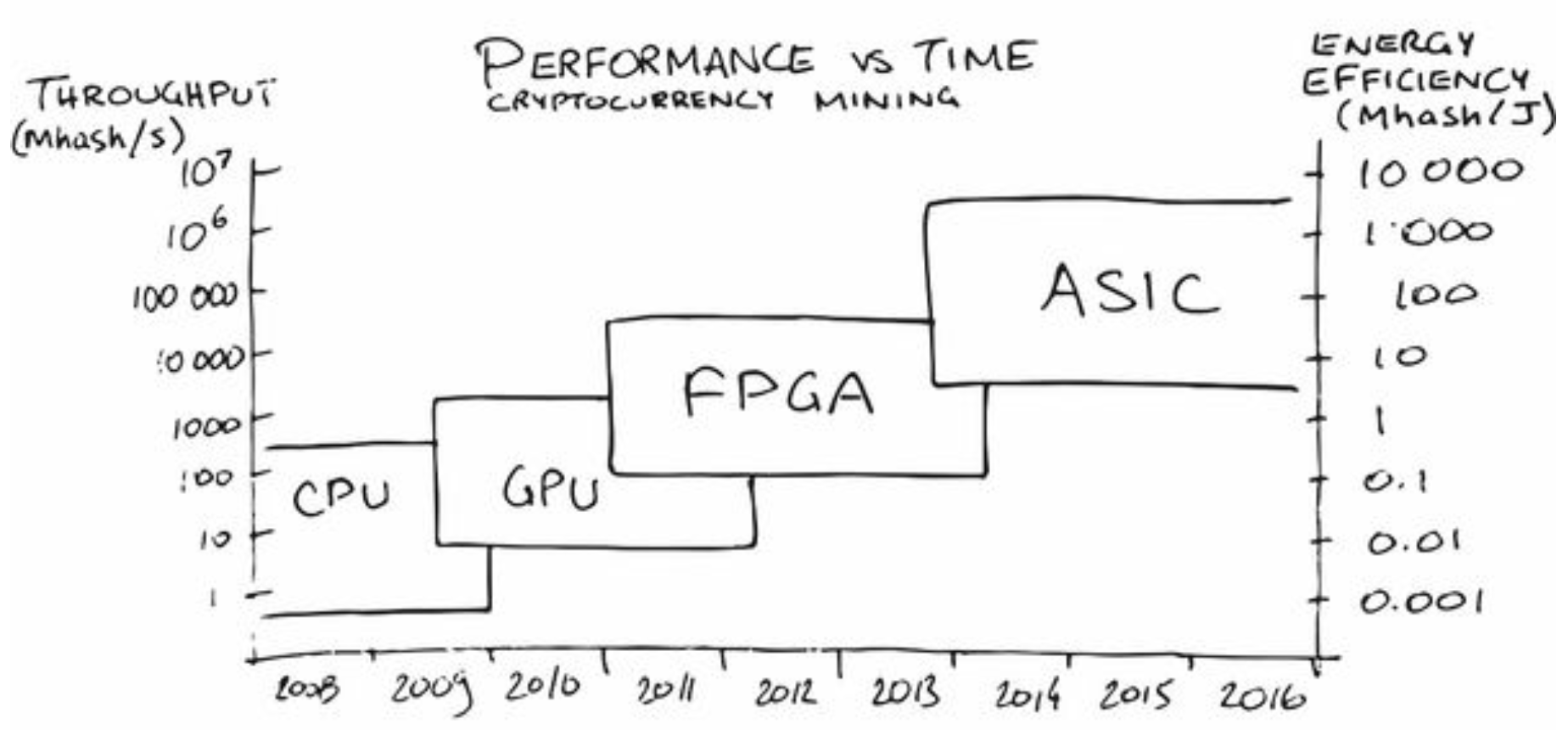

In Bitcoin's infancy, the network's difficulty was so low that a miner could find a new block using a standard CPU (Central Processing Unit). This was quickly followed by the use of more powerful GPUs (Graphics Processing Units), which offered a significant performance boost. However, the true game-changer was the introduction of Application-Specific Integrated Circuits (ASICs) in 2013. These machines were designed for one purpose and one purpose only: to mine Bitcoin. ASICs offered a massive leap in efficiency and hash power, rendering CPUs and GPUs obsolete for Bitcoin mining.

This technological arms race, coupled with the ever-increasing network difficulty, made the process of finding a block an incredibly rare event for a single miner. The variance was simply too high. A solo miner could invest thousands of dollars in equipment and electricity and go years without ever finding a block, making their endeavor unprofitable. This is the problem that btc mining pools were created to solve. They act as a central coordinator, aggregating the hash power of countless miners to create a force that is far more likely to find a block and earn the reward.

The Role of the Mining Pool

A mining pool is essentially a group of miners who agree to combine their computing power to mine blocks and split the rewards proportionally to the amount of work they contributed. The pool is managed by a central operator who handles the technical aspects, such as distributing the work, verifying contributions, and paying out rewards.

The key concept that underpins the operation of a mining pool is a "share." A share is a unit of work that a miner submits to the pool operator as proof of their contribution. It's essentially a block header with a hash that is lower than the target difficulty of the pool, but not low enough to be a valid Bitcoin block hash. The pool operator uses these shares to measure each miner's hash rate and, subsequently, their contribution to the pool's overall effort. The more shares a miner submits, the greater their share of any block reward the pool finds.

Image: Wikimedia Commons

Payout Mechanisms: How Rewards Are Distributed

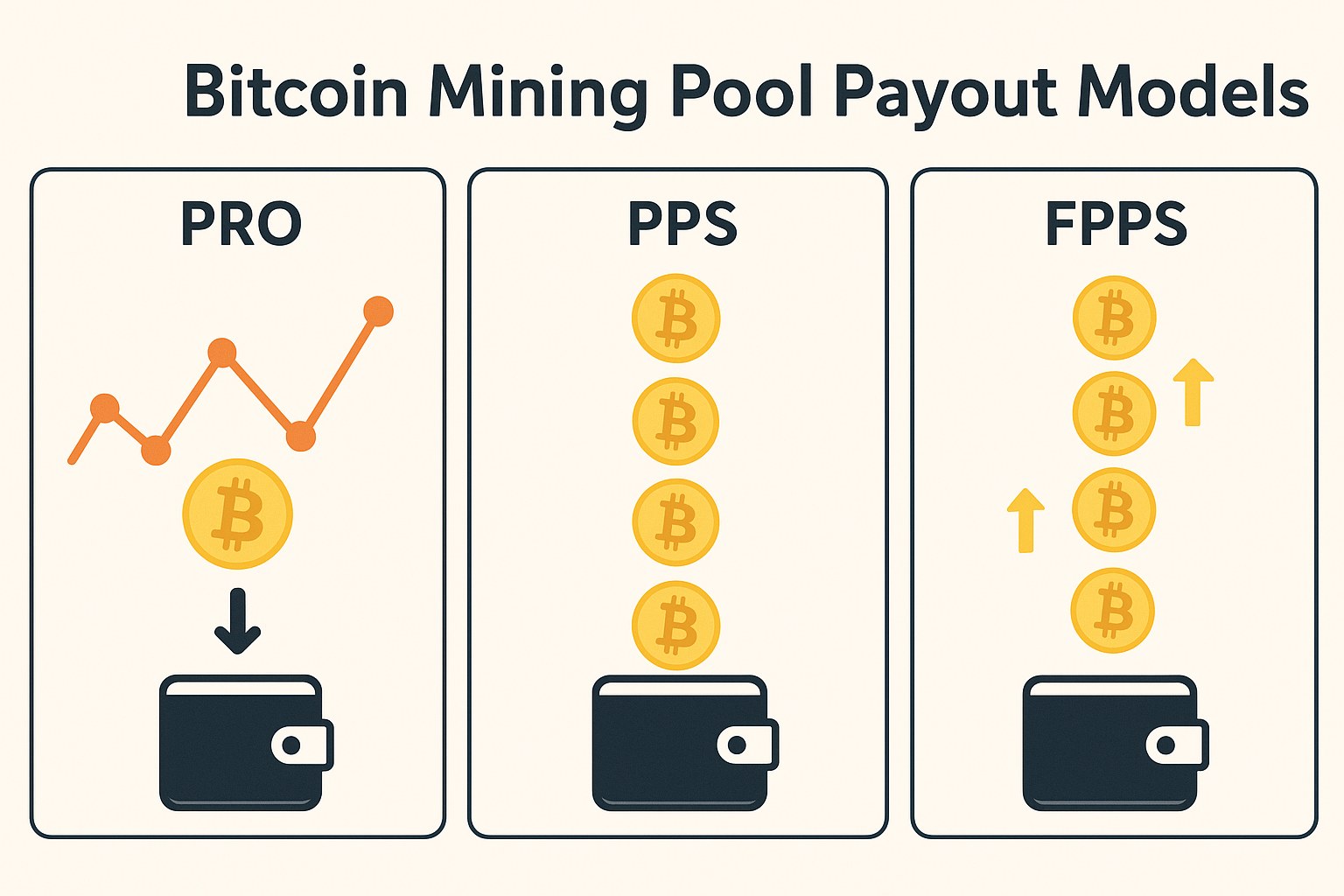

The way a pool distributes its rewards is defined by its payout mechanism. There are several different models, each with its own advantages and disadvantages for both the miner and the pool operator.

-

Proportional (PRO): This is one of the simplest methods. When a block is found, the reward is distributed to miners in proportion to the number of shares they have submitted during the round. A "round" is the time between the pool finding two consecutive blocks. The downside is that earnings can be volatile, as miners only get paid when a block is found, and some rounds can be very long.

-

Pay-Per-Share (PPS): This method offers a more stable income. A miner is paid a fixed amount for each share they submit, regardless of whether the pool finds a block or not. The pool operator takes on the risk of not finding a block, which is why they typically charge higher fees for this model. The payment per share is calculated based on the current block reward and the network difficulty.

-

Full Pay-Per-Share (FPPS): FPPS is an evolution of PPS. In addition to the block reward, it also distributes the transaction fees associated with the transactions in the mined block. This provides a more accurate and higher payout for miners. As transaction fees have become a more significant part of the total block reward, this model has grown in popularity. Many modern mining pools, such as the one at https://www.kucoin.com/mining-pool, use this or a similar model to ensure miners get a fair and consistent return.

Potential Challenges and Risks: The Centralization Paradox

Image: Atomic Wallet

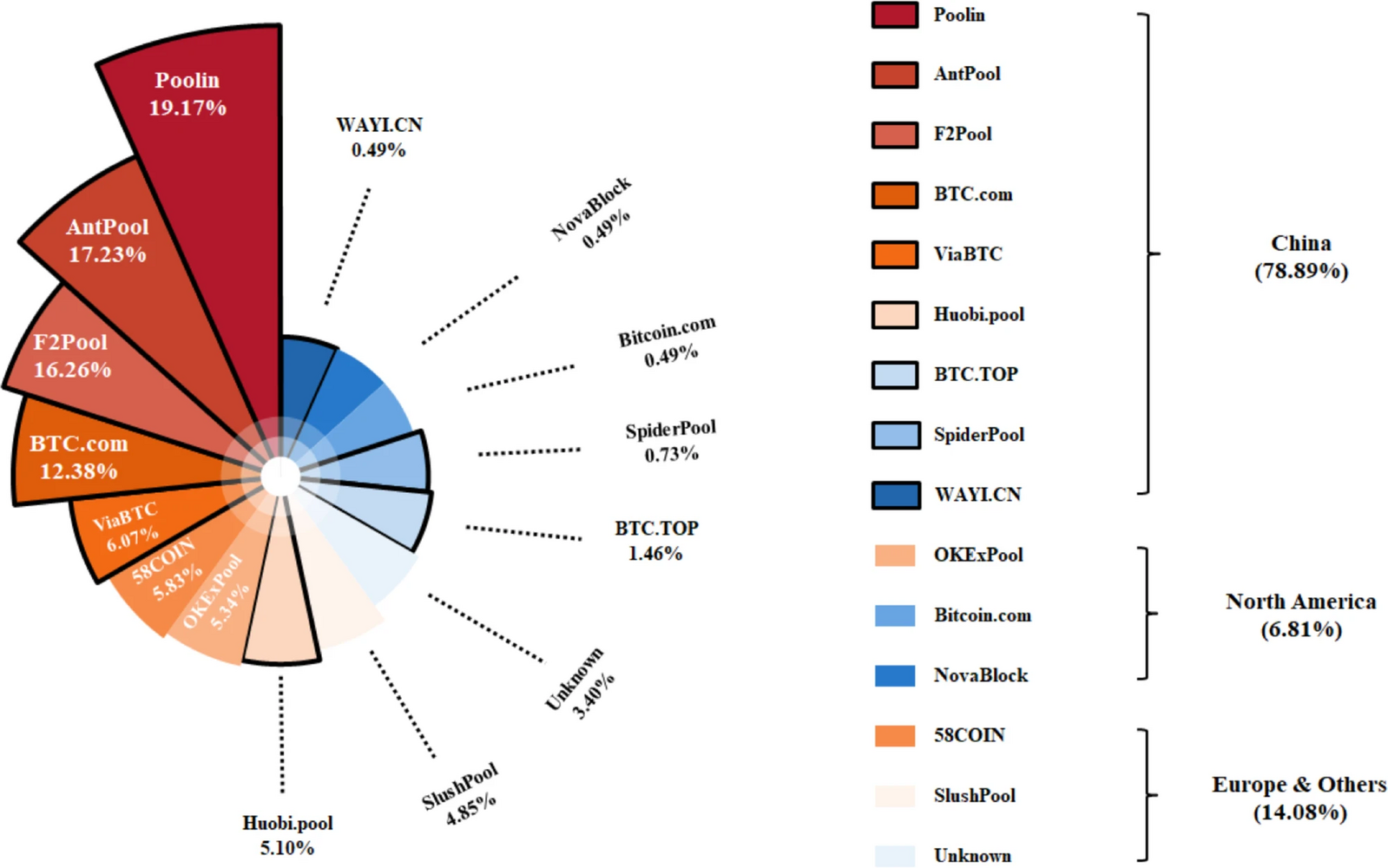

While mining pools offer undeniable benefits to individual miners, they also introduce potential risks to the Bitcoin network. The primary concern is centralization.

When a small number of large pools control a significant portion of the network's hash rate, it creates a concentration of power that could, in theory, be used to launch a "51% attack." This is a theoretical attack where a single entity controls more than 50% of the network's hash rate, giving them the ability to potentially double-spend coins or prevent new transactions from being confirmed.

While a 51% attack has never successfully occurred on the Bitcoin mainnet, the concentration of hash power in a few large pools is a constant point of discussion within the Bitcoin community. Miners themselves also face risks when choosing a pool, including:

-

Pool fees and transparency: Some pools charge high fees or have opaque fee structures that eat into a miner's profits.

-

Pool reliability: A poorly managed or unreliable pool can have downtime, meaning miners are contributing their hash power for no reward.

-

Potential for pool "laggards": A miner could be contributing valid shares, but the pool operator could be dishonest and not report them correctly, reducing the miner's payout.

Choosing the Right Pool for You

For a miner looking to join a pool, a careful evaluation is necessary. Key factors to consider include the pool's fee structure, its payout mechanism (PPS, FPPS, etc.), its reputation within the community, and its size. While a larger pool often offers more stable and frequent payouts, some miners prefer smaller pools to help promote network decentralization.

When evaluating your options, consider pools that are not only reliable but also offer competitive advantages. For instance, KuCoin Mining Pool is a notable example that has gained traction for its robust services. Its primary advantage lies in its adoption of the Full Pay-Per-Share (FPPS) payout model, which ensures miners receive a higher, more stable income by distributing not just the block reward but also the transaction fees. This model, combined with their highly competitive fees and a focus on transparency, makes it a compelling choice. Furthermore, its seamless integration with the broader KuCoin ecosystem allows for easy asset management and trading, offering a convenient, all-in-one solution for miners.

You can learn more about its offerings at the detailed tutorial and join the pool at https://www.kucoin.com/mining-pool.