KuCoin Ventures Weekly Report: What Happened to Web3 Social Unicorns? When Gold Is More Trusted Than the Dollar: A Global Crisis of Confidence

2026/01/27 03:27:02

1. Weekly Market Highlights

1. Weekly Market Highlights

Farcaster and Lens Change Hands: A Soft Landing and Hard Reset for the DeSoc Sector

Last week, the Decentralized Social (DeSoc) sector experienced a historic structural shock, with two iconic acquisitions landing within a span of just 48 hours. First, Lens Protocol announced it was handing over stewardship to Mask Network, with the original lead developer Avara (parent company of Aave) choosing a strategic retreat and founder Stani Kulechov stepping back into an advisory role. Immediately following this, Farcaster announced its full acquisition by its core infrastructure provider, Neynar. Co-founders Dan Romero and Varun Srinivasan confirmed their exit, and the original development entity, Merkle Manufactory, plans to return remaining capital to investors.

These two events are by no means accidental market noise; rather, they mark the formal transition of Web3 social from a narrative stage of "Decentralized Idealism" to an integration stage of "Product Pragmatism." This is not merely a change in management, but a profound correction of the industry's value capture logic regarding the "Protocol Layer" versus the "Application Layer."

Data Source: Lens / Neynar Official Blogs

From the perspective of market discussion, user sentiment presents a stark polarization, a divergence that itself reveals a cognitive rift within the crypto community regarding the definition of "success." In the eyes of pessimists, this is a carefully orchestrated "Slow Rug." Many community members expressed disappointment at the exit of the Farcaster founding team. Some sharp criticisms pointed out that "Farcaster, with a $150 million funding background, was ultimately acquired by Neynar, whose funding volume is only in the tens of millions." This "snake swallowing the elephant" outcome is interpreted as a signal of the bursting of Farcaster's valuation bubble and a failure to verify Product-Market Fit (PMF). Furthermore, conspiracy theories about "Base chain potentially intervening in some form to eliminate competition" are rampant, reflecting deep-seated market anxiety about centralized giants further monopolizing on-chain social spaces.

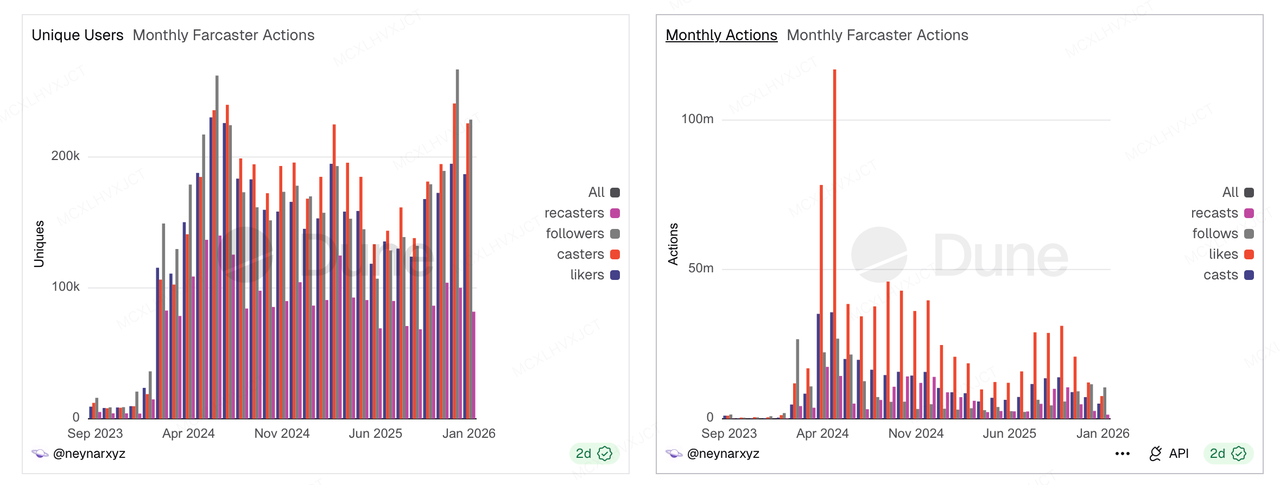

Data Source: https://dune.com/neynarxyz/farcaster

The data reveals a severe "scissors effect" currently facing the Farcaster ecosystem: While the Monthly Active Users (MAU) chart shows that user numbers seemingly maintained a healthy plateau after the explosion in mid-2024 without a catastrophic collapse, the reality is grimmer when combined with the monthly interaction chart on the right. The project's interaction data (Actions) fell off a cliff after peaking in Q2 2024 and has become irreversible, with data in January 2026 being just a fraction of its peak. This means that while the users are technically still there, interaction has plummeted. A significant portion of retained users are likely "zombie accounts" maintaining minimum activity for airdrops or silent accounts with settled assets.

However, there are also voices viewing this as a "beneficial clearing" for the industry. Unlike the catastrophic collapses of LUNA or FTX, Farcaster developer Merkle Manufactory's choice to return remaining funds to investors is seen as a highly responsible act of capital management, avoiding the continued waste of resources in a hopeless direction. Moreover, the "decentralization proposal" quickly initiated by the Farcaster community amidst the panic proves that DeSoc is beginning to demonstrate self-repair capabilities based on community consensus after detaching from the founders' halos.

Over the past three years, the market has been dominated by the "Fat Protocol" thesis, believing that the underlying social graph protocol should enjoy the highest valuation premium—which was the logical support for Farcaster's valuation once reaching as high as $1 billion. However, these two recent mergers are essentially a "reverse swallowing" of the protocol layer by the application and infrastructure layers. Vitalik Buterin made a rare statement of support after Mask took over Lens, issuing a stern warning to the industry by criticizing many crypto social projects for "relying too heavily on tokens and hype." This precisely corroborates the root cause of Farcaster's data collapse—the previous prosperity was a sandcastle built on "financial speculation." At the same time, Vitalik emphasized that the industry needs "better mass communication tools," not speculative casinos. As the new steward of Lens, Mask founder Suji also stated bluntly that the "Strong Finance" model of Friend.tech is wrong, and that "Weak Finance, Strong Social" is the future.

For the new owners of Farcaster and Lens, the priority is no longer simply chasing the grand vision of decentralization, but considering how to expand the user base and activate real interaction on the platform. As the new owner of Farcaster, Neynar is expected to introduce massive AI Agents to provide services, gradually evolving Farcaster into a hybrid network of "human and silicon-based coexistence": humans look for creativity and social connection here, while Agents handle transactions, distribute assets, and organize information. This fundamentally solves the "dead air" or spam-filled cold start problem. Meanwhile, Mask Network, taking over Lens, may use a Web2 Mapping strategy to port real content over from Twitter, introducing external "fresh water" to solve the dilemma of content scarcity on-chain.

It is worth noting that Neynar previously controlled data indexing and APIs, and now controls the protocol itself, completing the identity leap from "shovel seller" to "mine owner" to become an integrated "Data + Protocol" service provider. In the future, they can generate stable cash flow through SaaS models charging developers, rather than relying solely on token prices or market volatility. Ultimately, as long as Vitalik is still using it, and as long as the crypto community still needs a "backup town square" that cannot be arbitrarily banned by traditional giants, DeSoc retains its baseline value. The bubbles of the old era have burst, but the golden age for builders has just begun.

2. Weekly Selected Market Signals

Geopolitical and Policy Uncertainty Intensifies: Safe-Haven Positioning Builds While Risk Assets Remain Under Pressure

U.S. policy uncertainty has risen again this week. Multiple media outlets cited remarks from U.S. Treasury Secretary Scott Bessent that President Trump may announce the next Federal Reserve Chair as early as this week, with “four strong candidates” under consideration. This has materially increased market sensitivity to questions around policy continuity and perceptions of Fed independence. Combined with recurring trade- and geopolitics-related headlines, overall risk appetite has cooled quickly.

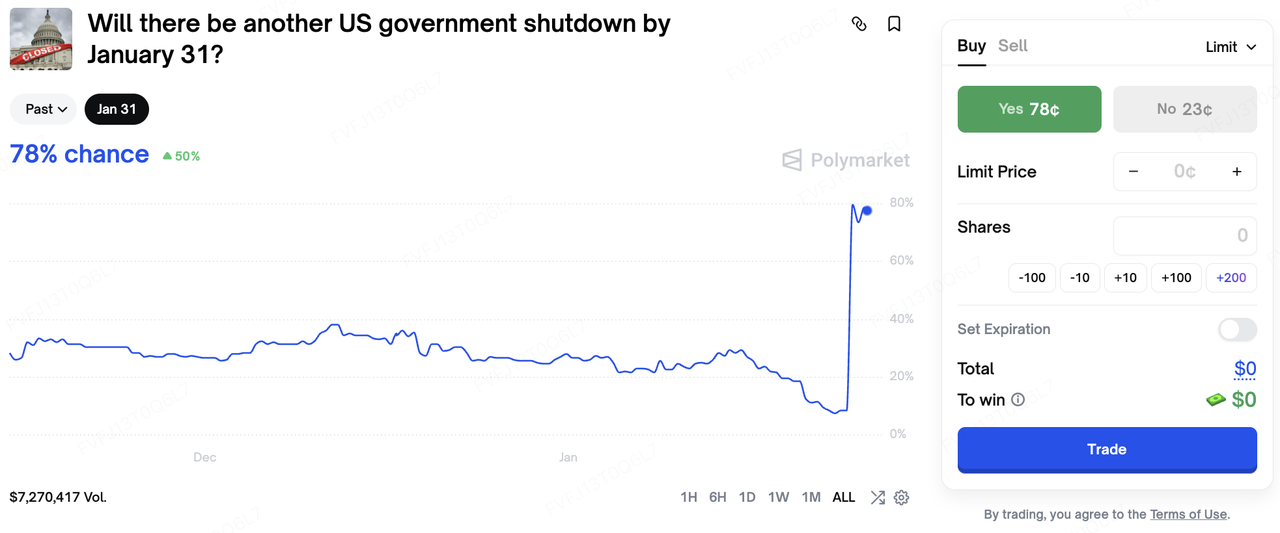

Data Source: Polymarket

At the same time, domestic U.S. political uncertainty has lifted volatility. A second fatal shooting involving a federal law enforcement officer in Minnesota within two weeks has intensified political gridlock in Congress, pushing up perceived shutdown risk at month-end. Polymarket data show the probability of another U.S. government shutdown before January 31 has surged to 77%.

On the trade and geopolitical front, Trump has publicly stated that the U.S. will not impose additional tariffs on the EU on February 1, and said a “framework agreement” has been reached with NATO regarding Greenland. With tensions spanning Venezuela, the Middle East, and Greenland, a series of unconventional moves by the U.S. government is amplifying global risk aversion. With multiple uncertainty vectors moving in parallel, markets appear more inclined to price a “tail-risk premium” first, rather than commit to a single directional trend in risk assets.

In cross-asset performance, the risk-off trade has shown a more “textbook” divergence. Precious metals have become the most direct outlet for hedging: spot gold, amid a convergence of safe-haven demand and a “credit debasement” narrative, was reported by multiple media outlets to have breached the $5,000/oz threshold; silver rose above $100/oz under a similar logic—highlighting a phase of rising preference for non-sovereign credit-linked assets. Meanwhile, FX market stress has also increased. After signals such as “inquiries/communications” from the New York Fed triggered market speculation, expectations for coordinated U.S.–Japan intervention in FX strengthened and the yen rebounded meaningfully—suggesting the “policy signal → FX volatility → risk appetite” channel has re-emerged as a key short-term pricing driver.

Data Source: TradingView

Risk assets, by contrast, have shifted broadly into a defensive posture. Equities and risk assets have come under pressure (index futures retracing, volatility rising across Asia-Pacific risk assets), and crypto has weakened in tandem: BTC has retreated toward key support levels, ETH’s drawdown has widened, and altcoins and other high-beta themes have pulled back as well. This reflects a familiar pattern: when “policy + geopolitics + risk premia” rise together, high-volatility assets often become the liquidity adjustment valve. Importantly, such drawdowns are not always triggered by on-chain fundamentals; they are frequently amplified by cross-market margin constraints, risk-parity deleveraging, and volatility-targeting strategies.

The core logic behind the current turbulence is that Trump’s efforts to reshape international relationships, continued attacks on Fed independence, and the sharp rise in month-end shutdown risk are collectively reshaping investor asset-allocation behavior. Markets are not only pricing geopolitical risk; they are also trading “currency debasement” expectations—driving capital away from traditional USD and U.S. Treasury assets.

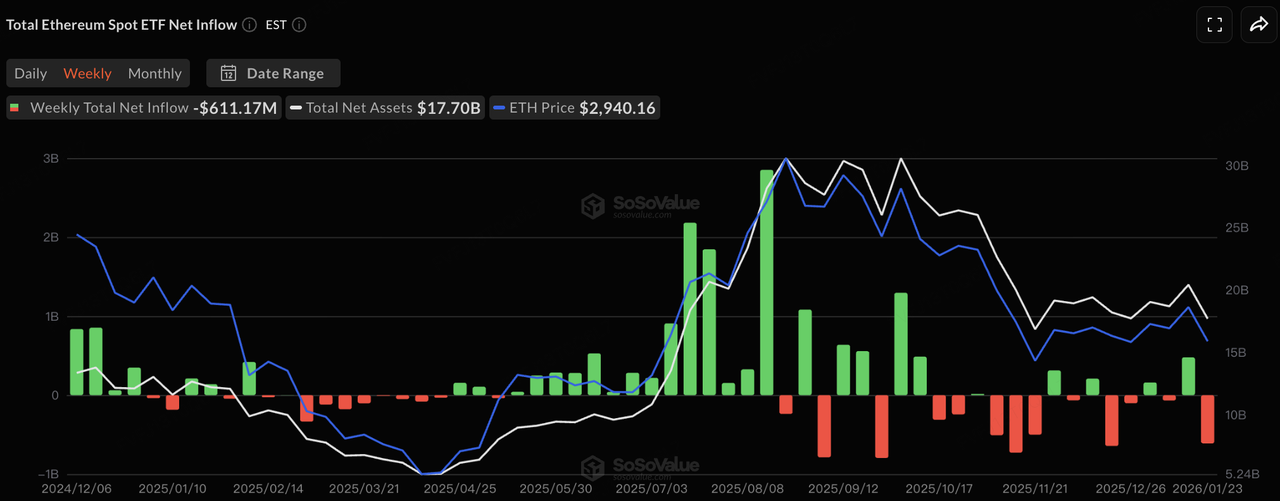

Data Source: SoSoValue

From a flows perspective, outflows in spot ETFs further reinforce the market’s de-risking behavior. Bitcoin and Ethereum spot ETFs have seen large net outflows for multiple consecutive days: BTC ETFs recorded roughly $1.33B in net outflows this week, including a single-day net outflow of $700M on January 21. ETH spot ETFs have also been weak, with four consecutive days of net outflows since January 20; the largest single-day outflow reached approximately $230M, and weekly net outflows totaled $611.17M.

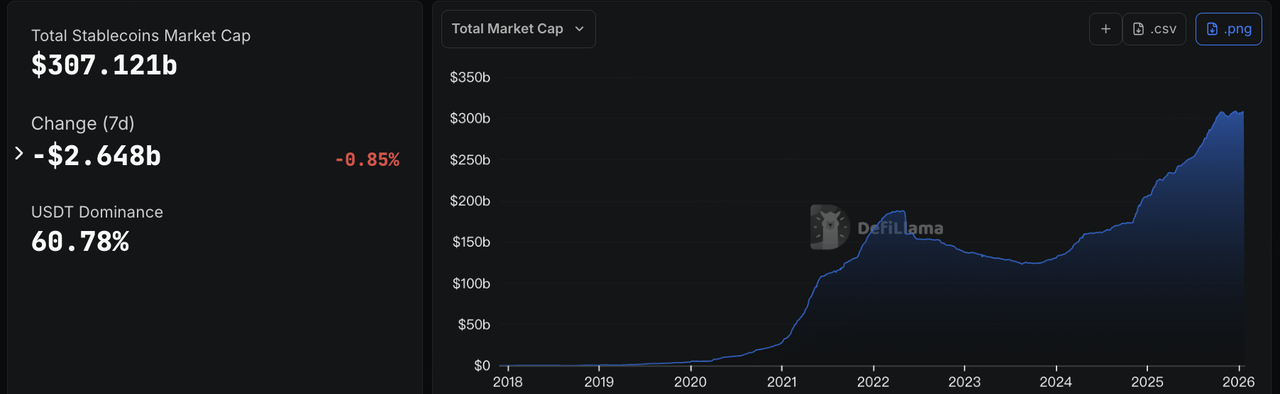

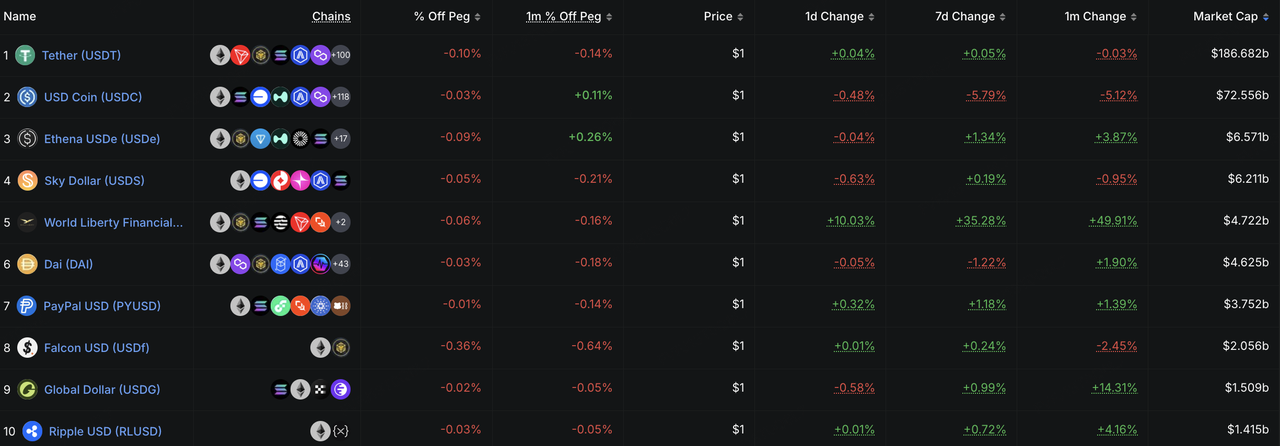

Data Source: DeFiLlama

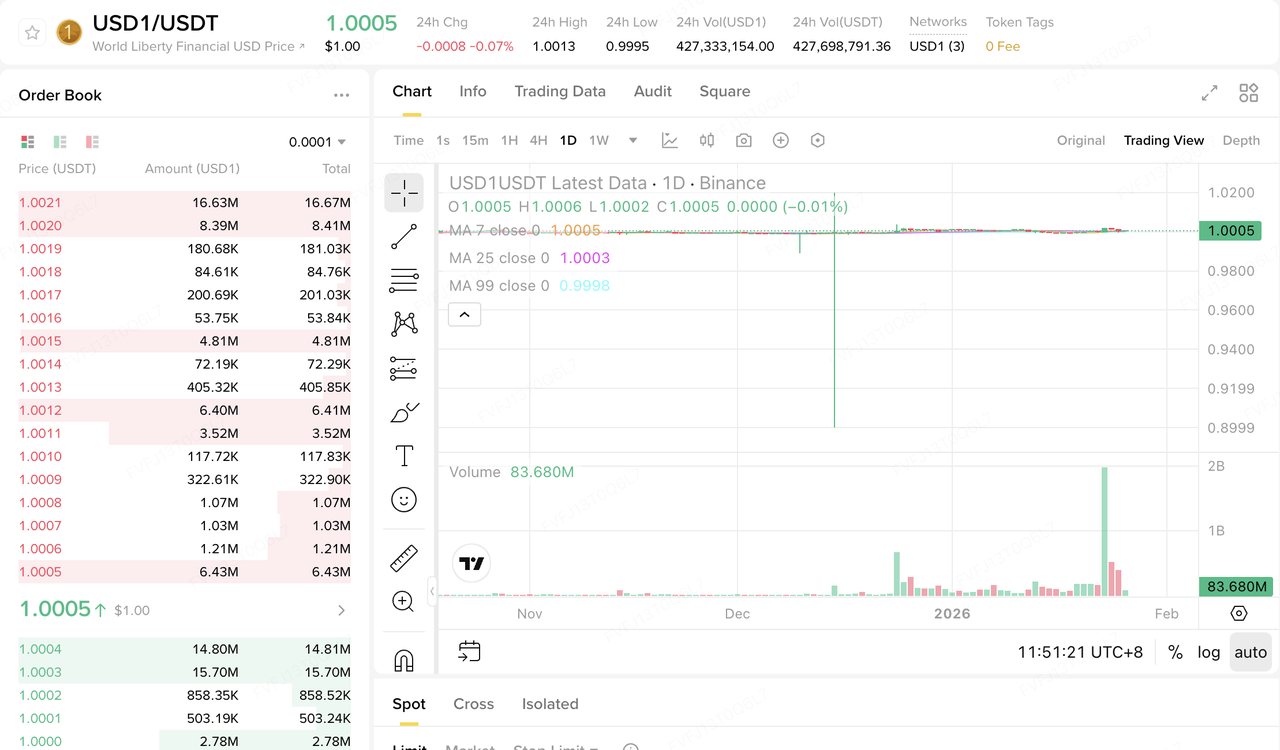

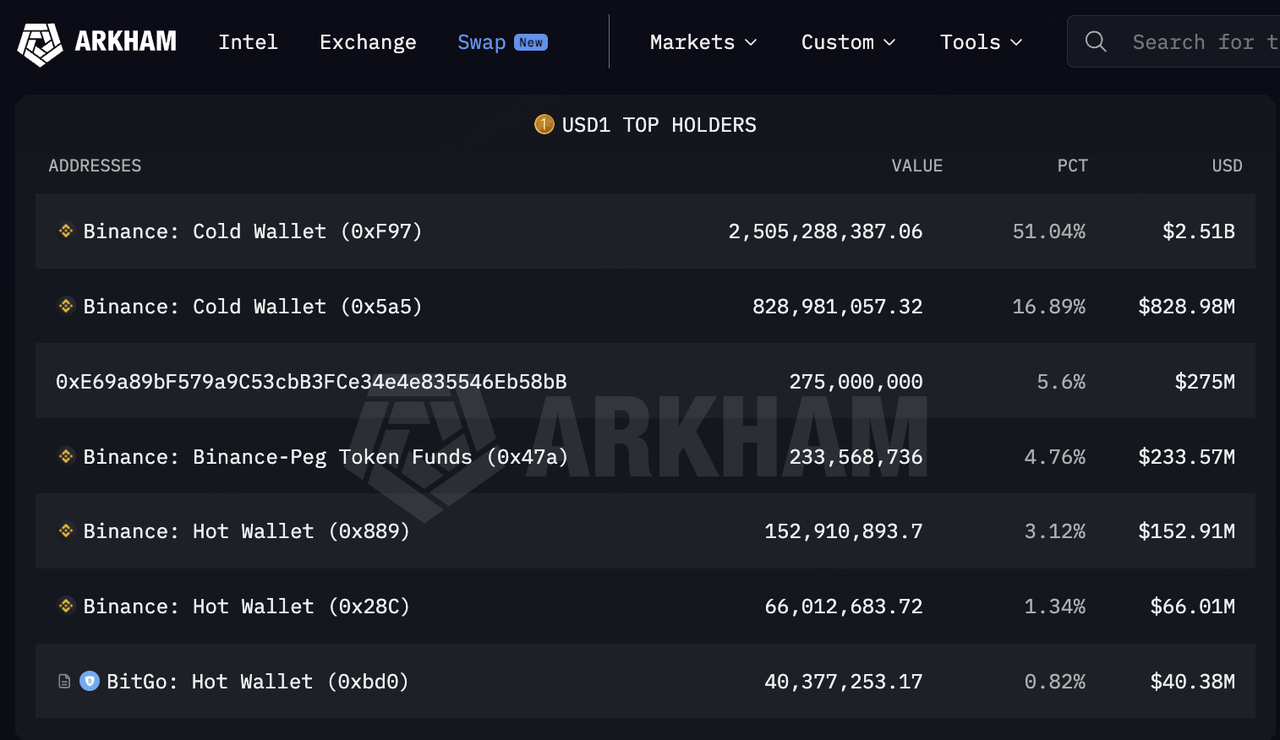

On-chain liquidity has also softened, with stablecoin supply pulling back: total circulating supply decreased by $26.38B WoW (about -0.85%). Structurally, World Liberty Financial USD (USD1) stood out with roughly +35% WoW growth, closely tied to Binance’s January 23 announcement to extend USD1 ecosystem incentive programs. Binance will launch a four-week, $40M WLFI airdrop campaign to reward users holding USD1 across Binance spot, funding, margin, and futures accounts. Following this, Binance’s USD1 spot price versus USDT shifted from a negative premium to a positive premium of 0.19%. In addition, Arkham data indicate that Binance-linked addresses account for as much as 77% of USD1 holdings. In the current risk-off environment, “incentive-driven structural growth” is coexisting with a broader pullback in overall market liquidity.

Data Source: Binance & ARKHAM

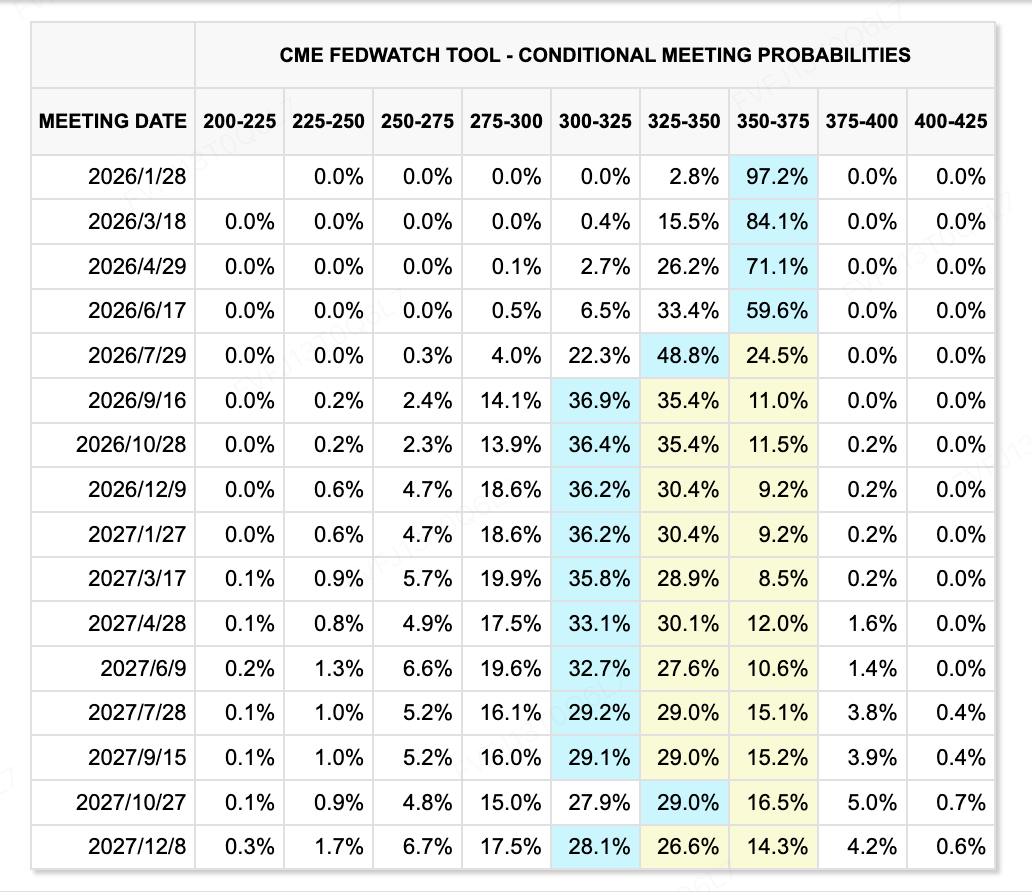

From a macro-liquidity standpoint, markets broadly expect the Fed to hold rates unchanged, with a very low probability of cuts in Q1. The easing window may be delayed until after Powell’s term ends in May. Persistent inflation and continued U.S. growth are pushing out the timing of Fed cuts; meanwhile, geopolitical risks, the Fed Chair nomination process, and renewed shutdown risk may continue to disrupt global risk sentiment. Next week’s focal point is the Fed decision and Powell’s press conference—markets will parse statements line by line for signals on the rate path, especially the timing and magnitude of potential cuts.

Data Source: CME FedWatch Tool

Major Events to Watch This Week:

In addition, “mega earnings week” is underway: Microsoft, Apple, Tesla, as well as Samsung and SK Hynix, will report results in quick succession. AI demand and the semiconductor cycle remain the core watchpoints. These earnings will shape near-term risk appetite and will also influence whether AI-led growth narratives can continue to justify elevated valuation frameworks.

-

Jan 27: U.S. January Conference Board Consumer Confidence; U.S. January Richmond Fed Manufacturing Index

-

Jan 28: Bank of Canada rate decision and Monetary Policy Report; Meta, Microsoft, Tesla report after the close

-

Jan 29 (03:00 GMT+8): U.S. Fed FOMC rate decision; Powell press conference; Apple reports after the close

-

Jan 30: Japan December unemployment rate; U.S. December PPI

Primary Market Financing Observation:

Data Source: CryptoRank

Last week saw approximately 16 disclosed primary-market financing events, with total funding holding around ~$400M. The market continues to exhibit a “lower total volume, later-stage skew” pattern: larger checks are increasingly concentrated in IPOs and RWA / compliant infrastructure—areas where cash flows and regulatory feasibility are easier to verify—while marginal funding for early-stage, high-FDV narrative projects continues to contract. Against this backdrop, two large, signpost events stood out—one aligned with an “opening IPO window,” and the other centered on “RWA / on-chain securities infrastructure re-financing.”

BitGo: Signals from the first major crypto IPO move of 2026

As a representative name in crypto custody and institutional infrastructure, BitGo began trading on the NYSE. The IPO priced at $18/share, with 11.82 million shares offered, raising approximately $212.8M and implying a valuation of about $2B. Public information indicates a first-day open of roughly $22.43, with intraday gains reaching a notably high level.

For the primary market, the significance is not only “who rang the bell first,” but the validation of two broader points: (1) public-market risk appetite within crypto is rotating from narrative back to infrastructure—custody, compliance, and institutional services can be priced more readily using revenue and customer structure; (2) exit optionality is improving at the margin—when the IPO window opens, the discount rate applied by VC/PE and primary capital to “exitability” declines, improving financing feasibility and valuation anchoring for late-stage projects, especially those with licensing and institutional client bases.

More structurally, BitGo’s IPO also reinforces an accelerating coupling of “compliant infrastructure + on-chain financial distribution.” Market attention that moves in tandem with narratives such as Ondo reflects a search for pathways that connect traditional securities to on-chain liquidity. In that stack, custody, settlement, and regulatory reporting are likely to become among the earliest monetizable “fee points.” From a primary allocation perspective, this further shifts attention away from “new chain narratives” and toward “crypto financial pipes” that can be adopted by mainstream institutions.

Superstate: $82.5M re-financing as RWA shifts toward distribution and trading infrastructure

Reportedly, Superstate, built by a team associated with the Compound founder, completed a new round of $82.5M, with investors including Bain Capital Crypto and Distributed Global, among others. The narrative emphasis is on bringing traditional financial assets (including securities-like assets) on-chain in a compliant manner, and serving broader distribution and trading use cases.

The more important “signal value” of this round is what it suggests about the RWA sector’s center of gravity. Over the past two years, markets focused more on “what assets get tokenized (Tokenize What)”; now, the more decisive question is “how tokenization scales—distribution, trading, and a stable fee base under compliance constraints (Tokenize How).” Teams like Superstate may be advantaged by tighter alignment with traditional asset-management and securities-compliance logic. If brokerage, custody, settlement, disclosure, and on-chain composability can be connected, the business model is less dependent on short-term subsidies and more likely to be driven by sustainable, institutionally paid fee lines—management fees, service fees, channel fees, and recurring enterprise demand.

In the context of “later-stage skew,” Superstate’s re-financing complements the BitGo IPO: capital is increasingly assigning higher weights to crypto financial infrastructure that can enter mainstream systems, rather than betting on single hit applications or single-chain narratives. Two verifiable progress vectors remain key to monitor: (1) distribution—whether it can expand through real broker/institution channels with repeatable acquisition; (2) trading/liquidity—whether tokenized assets can achieve sufficiently deep secondary liquidity and efficient settlement to truly close the loop from issuance → trading → settlement.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.