KuCoin Ventures Weekly Report: Post-Meme Frenzy Deleveraging Sees Billions in Liquidations; Primary Market Booms While Compliant Privacy Sector Gains Traction

2025/10/13 09:36:02

1. From On-Chain Meme Mania to “10/11” Record Liquidations: A Whiplash Week in Crypto’s Secondary Market

At the start of October, BTC made another run at all-time highs, but flows and attention were clearly concentrated on BSC. On Oct 7, BNB broke above $1,300 to a new ATH; per 8marketcap, its market cap reached ~$177.78B, briefly surpassing Tether and climbing to No. 124 in the global asset ranking. The catalyst was a fresh BSC meme wave: on Oct 6, CZ’s social-media interaction ignited Chinese-language communities, and concepts tied to Binance, CZ, and He Yi—such as “Binance Life”—spread rapidly. On Oct 7, “Binance Life” listed on Binance Alpha; with the sector heating up, its market cap peaked above $500M. The on-chain/centralized venue feedback loop produced a visible “siphon effect” into BSC.

Data source: TradingView

Riding the momentum, Binance Wallet and Four.Meme launched MEME RUSH - Binance Wallet Exclusive: during the “New / Finalising” stage, access is limited to Binance Wallet (Keyless) users; once a token hits a $1M migration threshold, it is auto-deployed to DEXs and becomes freely tradable, while also entering the Migrated Rank. In tandem with existing Binance Alpha, Aster perps and Binance spot/derivatives products, this effectively connects the full meme life cycle on BSC — from internal incubation to external liquidity.

Within the first hour, MEME RUSH saw 635 tokens created, 11 migrated, and over $18.16M in internal trading volume. On the social side, KOL discussions on Binance Square accelerated the flow of capital and sentiment. This “internal incubation → threshold-based migration → external scaling” assembly line has, in the near term, reinforced BSC’s competitive edge in memes—while also building crowding and leverage at elevated levels.

At the emotional peak, leverage was high and risk appetite maxed out. After President Trump signaled a restart of trade hostilities, risk assets weakened sharply in the early hours of Oct 11: BTC fell off a cliff from above $120k, and contagion spread across the market. “10/11” joined “3/12” and “5/19” as a historic deleveraging: ~1.6 million accounts liquidated and ~$19.3B cleared—both decade-high records for crypto derivatives. Altcoins cratered in waterfall moves, with 80%–90% single-day drops appearing across many charts, and on-chain liquidity briefly seized. The episode laid bare how fragile high leverage and circular on-chain flows become under an extreme headline shock. The same endogenous flywheels that had been propelling BSC, along with high carry plays elsewhere (e.g., USDe looped leverage), funneled capital into one-way crowding; when macro/policy variables flipped, crowded trades turned into synchronized liquidations.

Data source: https://www.coinglass.com/LiquidationData

By the morning of Oct 13, a softer tone from Trump helped U.S. equity futures and crypto rebound—the “TACO trade” reappeared. After capitulation, volatility eased and tentative long positioning began to rebuild. The week leaves two straightforward takeaways: first, BSC’s “platform–tooling–traffic” flywheel materially improves meme issuance and trading efficiency but also amplifies pro-cyclicality; second, macro policy and liquidity remain the market’s primary anchors. Looking ahead, if macro conditions don’t deteriorate and ETF/stablecoin net inflows persist, selective opportunities under sentiment repair remain plausible—but for high-volatility, concentrated assets, position sizing and risk controls should stay ahead of the narrative.

2. Weekly Selected Market Signals

Geopolitical games triggered the largest liquidation day in crypto history, Perp DEX faced a major stress test under extreme market conditions

On October 11, 2025, the crypto market experienced the largest liquidation event in its history, with nearly $20 billion in leveraged positions wiped out. BTC once fell to as low as $102,000, and ETH briefly dropped below $3,500. The main trigger behind this was U.S. President Trump’s announcement of a new tariff policy targeting China — imposing an additional 100% tariff on Chinese exports to the U.S., on top of the existing 30% tariff, bringing the total tariff rate to as high as 130%. The news immediately caused violent fluctuations across global financial markets.

The crypto market is highly leveraged, with many traders using borrowed funds to make high-risk bets. As one of the amplifiers of the cascading liquidations, USDe played a key role in this large-scale liquidation event. During the market crash, USDe briefly fell to $0.65 on Binance. The USDe depeg directly triggered chain liquidations of leveraged positions, especially those that used USDe as collateral. Additionally, USDe’s yield loop lending further amplified leverage. When the depeg occurred, market makers were forced to rapidly sell Altcoins to inject funds, reduce leverage, or directly liquidate positions to avoid automatic system-wide liquidation of their portfolios. This led to some token order books being entirely cleared out, with prices crashing straight to zero.

However, unlike the Luna/UST collapse, the USDe protocol itself did not suffer any damage. Some analysts have suggested that a premeditated attack may have taken place, exploiting Binance’s valuation system (which uses spot order books rather than external oracles) at a strategically opportune moment. Notably, this occurred just before Binance was set to implement oracle price adjustments for wbETH/ETH and bnSOL/SOL — and USDe, wbETH, and bnSOL all serve as collateral assets for unified margin accounts, and all three experienced short-term, significant depegs.

Under extreme market conditions, the stability of exchange systems was put to the test — especially the recently popular Perp DEXs. Hyperliquid absorbed the highest liquidation volume across the network based on public data, nearing $10 billion. Its HLP Vault grew by $40 million, and the system remained stable, making it one of the biggest winners in this event. Lighter, on the other hand, faced significant challenges. When the system was overloaded and short-term mitigation failed, the team was ultimately forced to issue an outage warning. Lighter’s mainnet services were interrupted, including API, frontend, and trade execution. Backpack experienced order submission delays, along with insufficient liquidity and significant price discrepancies with CEXs — with BTC price differences exceeding $20,000 at one point — resulting in asset prices within the platform falling below fair market value, which in turn triggered mass liquidations.

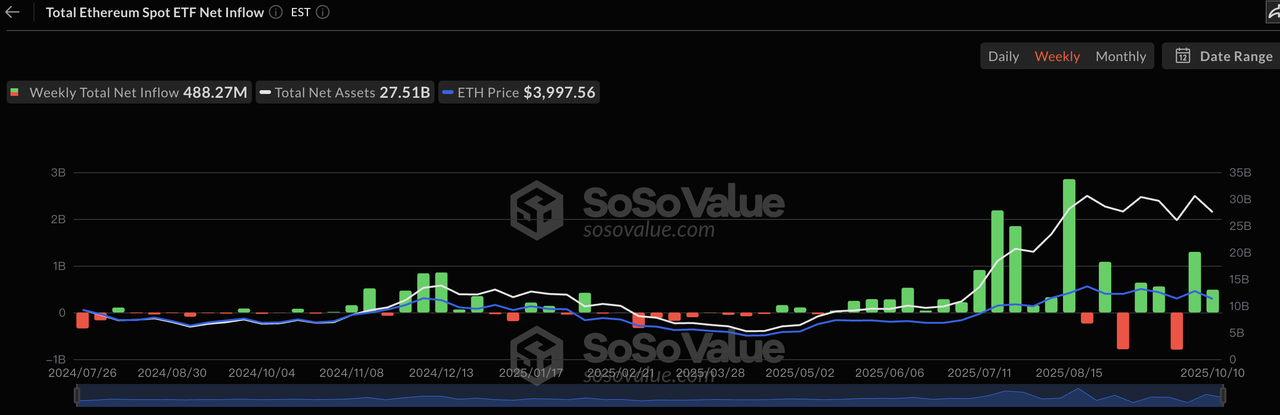

Although this black swan event struck over the weekend, ETF inflows remained quite optimistic as of last Friday. BTC ETFs saw a net inflow of $2.71 billion for the week, while ETH ETFs brought in $488 million. If this trend of ETF inflows continues, it may help recover the losses in asset prices.

Data Source: https://sosovalue.com/assets/etf/us-btc-spot

Similarly, the inflow trend for stablecoins continues. Over the past week, USDT’s market cap steadily increased by $2.89 billion. USDC, affected by market panic, experienced significant fluctuations but quickly recovered, with a net weekly inflow of $489 million.

Data Source: https://coinmarketcap.com/currencies/usd-coin/

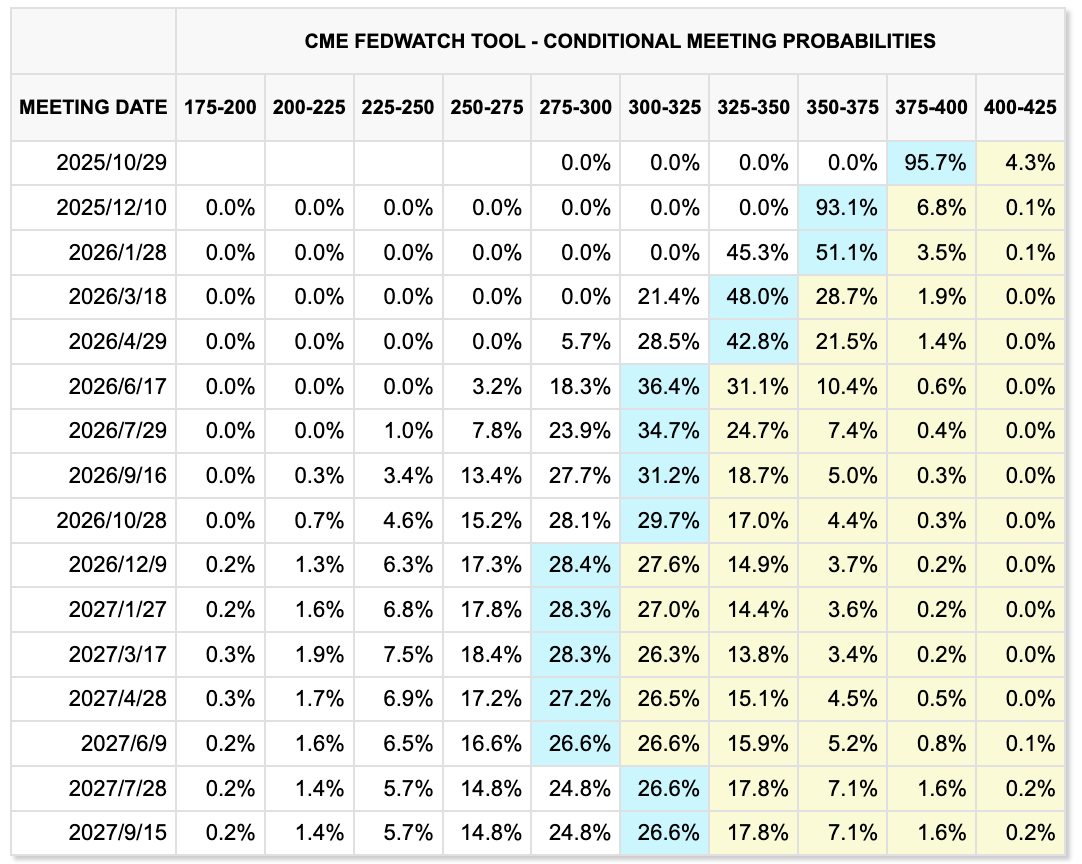

Market analysts believe that Trump’s threat to impose an additional 100% tariff on China may serve as a bargaining chip in another major negotiation, with a low likelihood of actual implementation. Beyond policy maneuvering, attention this month is also focused on whether there will be further interest rate cuts. The market currently predicts a 95.7% probability that the interest rate will be lowered to 3.75%-4% at the October 29 FOMC meeting. Last week, several Federal Reserve FOMC officials indicated that moderate easing is reasonable under the current circumstances.

Major events to watch this week:

-

October 14, 23:30 – Fed Chair Jerome Powell speaks at the National Association for Business Economics U.S. President Trump meets with the President of Argentina

-

October 15, 09:30 – China September CPI (YoY)

-

October 16, 02:00 – Federal Reserve releases the Beige Book on economic conditions 20:30 – U.S. September PPI (YoY) U.S. Initial Jobless Claims for the week ending October 11

-

October 17, 00:00 – G20 Finance Ministers and Central Bank Governors press conference

Primary Market Funding Watch:

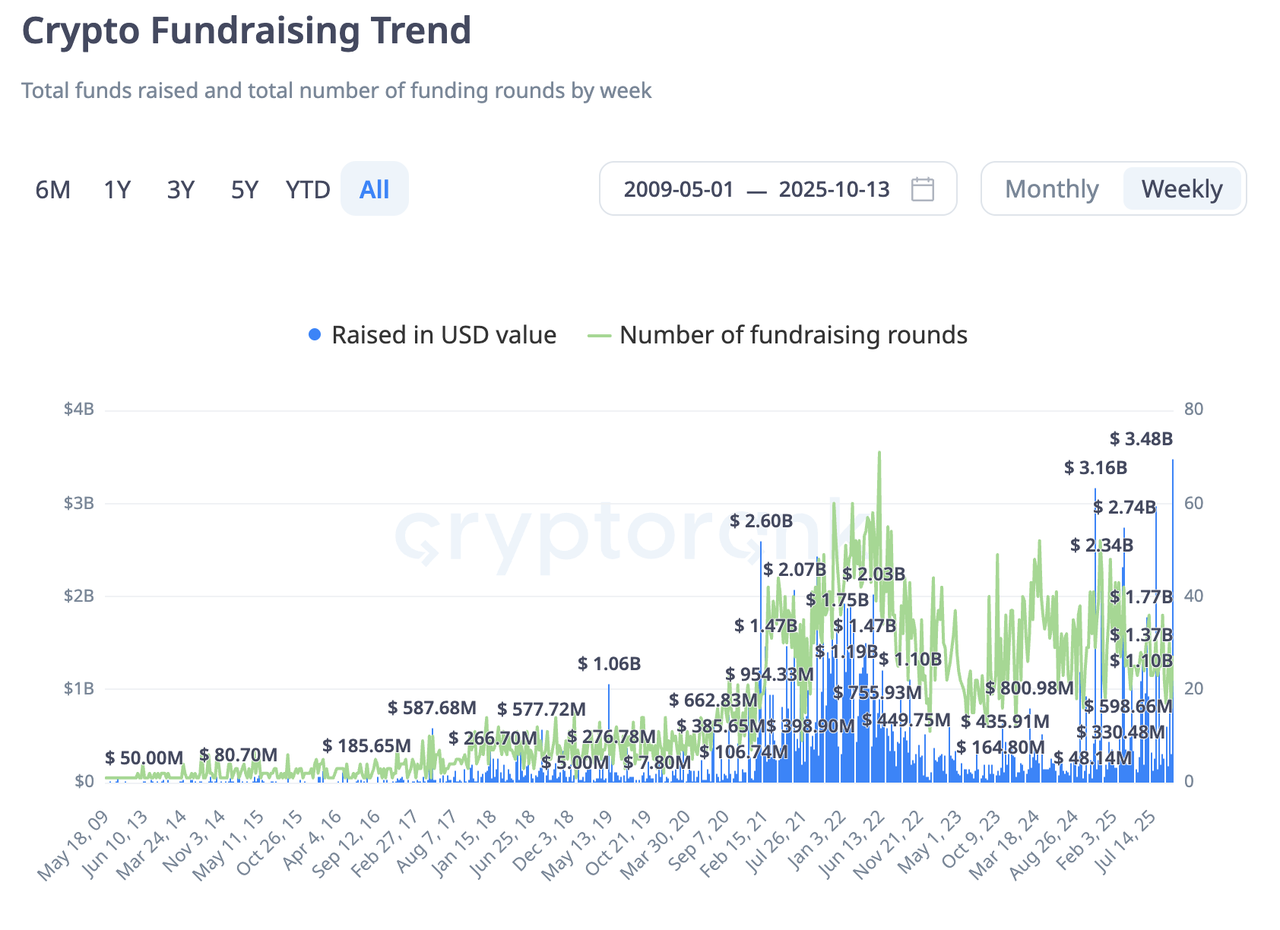

Despite last week's black swan event in the secondary market, crypto primary market funding hit a record weekly high of $3.48 billion. Large-scale funding rounds over $100 million included two post-IPO raises and a head-to-head between two major prediction market platforms. The former consisted of Galaxy Digital raising $460 million through a private placement and DDC securing $124 million in equity financing. On the prediction market front, the New York Stock Exchange parent company, Intercontinental Exchange (ICE), invested $2 billion in Polymarket at a valuation of $8–10 billion, while Kalshi raised $300 million at a $5 billion valuation. There were nearly ten deals in the tens of millions range. Notably, a BTC-denominated life insurance company raised $82 million, and AI mapping project Bee Maps, led by Pantera, secured $32 million.

Data Source: https://cryptorank.io/funding-analytics

Meanwhile: Bitcoin-Denominated Life Insurance with $141 Million in Total Funding

Meanwhile focuses on offering the world’s first regulated life insurance denominated in BTC, allowing customers to purchase life insurance products using Bitcoin, with both policies and payouts settled in BTC. In its first funding round in 2023, Meanwhile attracted OpenAI CEO Sam Altman as lead investor. After three public funding rounds, Meanwhile has raised a cumulative total of $141 million.

The benefit of BTC-denominated whole life insurance is that it allows BTC holders to preserve and pass on their wealth through insurance, while avoiding the risks of fiat inflation—essentially combining the stability of traditional life insurance with the scarcity of BTC.

Meanwhile’s core product, BTC whole life insurance, structurally resembles traditional whole life policies: no fixed term, policies remain in force for life until the insured person passes away. The key difference is that everything is settled in BTC. Meanwhile also plans to expand into BTC-denominated annuities and savings products to address retirement and long-term wealth management needs.

Breaking it down, Meanwhile’s whole life product features:

-

BTC settlement

-

Fixed premiums (premiums are fixed in BTC and not adjusted for market volatility)

-

Death benefit (guaranteed payout of a fixed amount of BTC to beneficiaries, useful for estate planning and intergenerational wealth transfer)

-

Cash value accumulation (measured in BTC)

-

Asset management (the company holds BTC as reserves)

The product is designed with tax optimization in mind. For example, when beneficiaries receive BTC, they benefit from a step-up in basis, meaning the tax basis for the BTC resets to its market value at the time of receipt—helping reduce capital gains taxes. Additionally, after two years of holding the policy, policyholders can borrow up to 90% of the cash value in BTC, structured as tax-free loans under U.S. tax law. The loan amount is valued at the BTC market price at the time of borrowing, aiding in tax optimization.

However, despite the innovative concept and strong funding, the insurance industry’s most critical requirement is long-term stability. Meanwhile, as a crypto insurance pioneer founded in 2023, is still relatively new and faces operational risks due to its limited track record.

Dashcam Mapping Project Bee Maps Raises $38 Million Led by Pantera

Bee Maps is a mapping product launched by Hivemapper. Founded in 2015, Hivemapper originally provided 3D mapping services via drones, and began transitioning in 2022 into a blockchain-based decentralized mapping network. Bee Maps is essentially built on the decentralized Hivemapper network, using crowdsourcing to collect and update global street-level map data. While the Hivemapper network provides the data and technical infrastructure, Bee Maps serves as the user- and developer-facing interface for accessing the mapping service.

The operational logic of Bee Maps can be divided into four key areas: data collection, reward mechanism, data processing & privacy, and data usage.

-

Data Collection: Users must purchase and install a dedicated dashcam provided by Hivemapper. These dashcams automatically record street-view images and collect GPS data while users drive.

-

Reward Mechanism: Users upload their collected map data to earn token rewards, in a model similar to “Drive-to-Earn.” Rewards are calculated based on data quality, the novelty of the coverage area, and the level of demand for the data.

-

Data Processing & Privacy: The Hivemapper network uses AI to process the uploaded image data, generating high-precision mapping information. It automatically blurs personally identifiable information such as faces and license plates.

-

Data Usage: Real-time street views and map data from Bee Maps can be accessed by developers, companies, and government agencies through paid access, enabling the creation of customized applications.

3. Project Spotlight

Fueled by Naval's Shout-Out and an Ethereum Foundation Push, Privacy Is Making a Roaring Comeback

Despite a brutal market-wide sell-off last weekend where many tokens plummeted, the privacy sector, led by Zcash, stood remarkably resilient. Zcash’s native token, ZEC, not only clawed back its panic-selling losses within hours but continued its tear, breaking through key levels on October 13th to set a new high since June 2021 with a staggering 68.21% weekly gain. This powerful performance signals that the privacy narrative, long sidelined by the shadow of regulation, is reaching a critical inflection point.

This ZEC eruption was ignited by a perfect storm of catalysts. The primary driver was a surge in market sentiment: on October 1st, a simple tweet from renowned investor Naval Ravikant—"Zcash is insurance for Bitcoin"—gifted ZEC with a fresh and compelling value proposition. That same day, Grayscale announced that its Grayscale Zcash Trust (ZCSH) was open for subscription, which the market widely interpreted as a green light for compliant institutional capital. This hype was underpinned by solid fundamentals: Zcash is scheduled for a block reward halving in November 2025, which will cut rewards from 3.125 ZEC to 1.5625 ZEC. This deflationary event provides its own narrative fuel. After three long years of consolidation, these combined forces finally unleashed the pent-up momentum.

The reason Zcash managed to dodge the delisting bullet that hit many other privacy coins—and attract traditional capital—is its unique design philosophy. The project treats privacy as an optional right for users, not a mandatory requirement. It offers a sophisticated toolkit of disclosure instruments (like optional transparent addresses, encrypted memos, payment disclosures, and viewing keys) for regulated financial institutions. This allows them to fulfill their duties—such as record-keeping, transaction monitoring, and reporting suspicious activity—without compromising their customers' overall privacy. It also permits entities like exchanges to exclusively support transparent deposits and withdrawals, ensuring they remain fully compliant with regulations.

ZEC’s recent rally isn't a solo act. On October 9th, the Ethereum Foundation unveiled Kohaku, a privacy-focused wallet solution. This isn't just another wallet; it's an SDK (Software Development Kit) designed to let any developer easily integrate features like private transfers, IP masking, and zero-knowledge identity verification into their products.

Previous privacy solutions, like early coin mixers, focused on one thing: obscuring the on-chain link between transactions. But these methods were still leaky, vulnerable to privacy risks from RPC snooping, front-end address correlation, and deposit/withdrawal analysis—not to mention the regulatory headaches. Kohaku aims to systematically plug all these gaps, implementing features like built-in light clients and promoting a "one dApp, one account" philosophy to achieve true end-to-end privacy. More importantly, Kohaku introduces a forward-thinking approach to compliance. Instead of relying on after-the-fact audits, it uses cryptographic tools like zero-knowledge proofs to let users proactively prove their actions are compliant without revealing any underlying details. This fundamentally reconciles the long-standing conflict between privacy and regulation.

Grayscale’s trust opens the door for compliant capital to flow into the privacy sector. Meanwhile, the Ethereum Foundation's push with Kohaku provides a powerful stamp of legitimacy on the entire development roadmap. In this value reassessment driven by a confluence of technological consensus and capital flow, it's foreseeable that the market's focus will remain locked on this space in the short term, likely sparking a new wave of innovation around "compliant privacy."

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.