KuCoin Ventures Weekly Report: Market Weekly: Hyperliquid's Stablecoin War Reshapes Landscape, Amid Macro Recovery Signals & Hot Perp DEX Analysis

2025/09/16 02:27:02

1. Weekly Market Highlights:Redefining the Stablecoin Wars: How a Native Solution Won Hyperliquid's USDH Bid and is Reshaping the Game

Last week, Hyperliquid, the powerhouse derivatives DEX in the DeFi space, hosted a highly-anticipated on-chain bidding war for the issuance rights to its native stablecoin, USDH. The competition attracted a star-studded lineup of renowned crypto firms, including Paxos, Frax, Agora, Ethena, Sky (formerly MakerDAO), Curve, OpenEden, and BitGo. However, the ultimate victor was an upstart team forged specifically for the ecosystem—Native Markets.

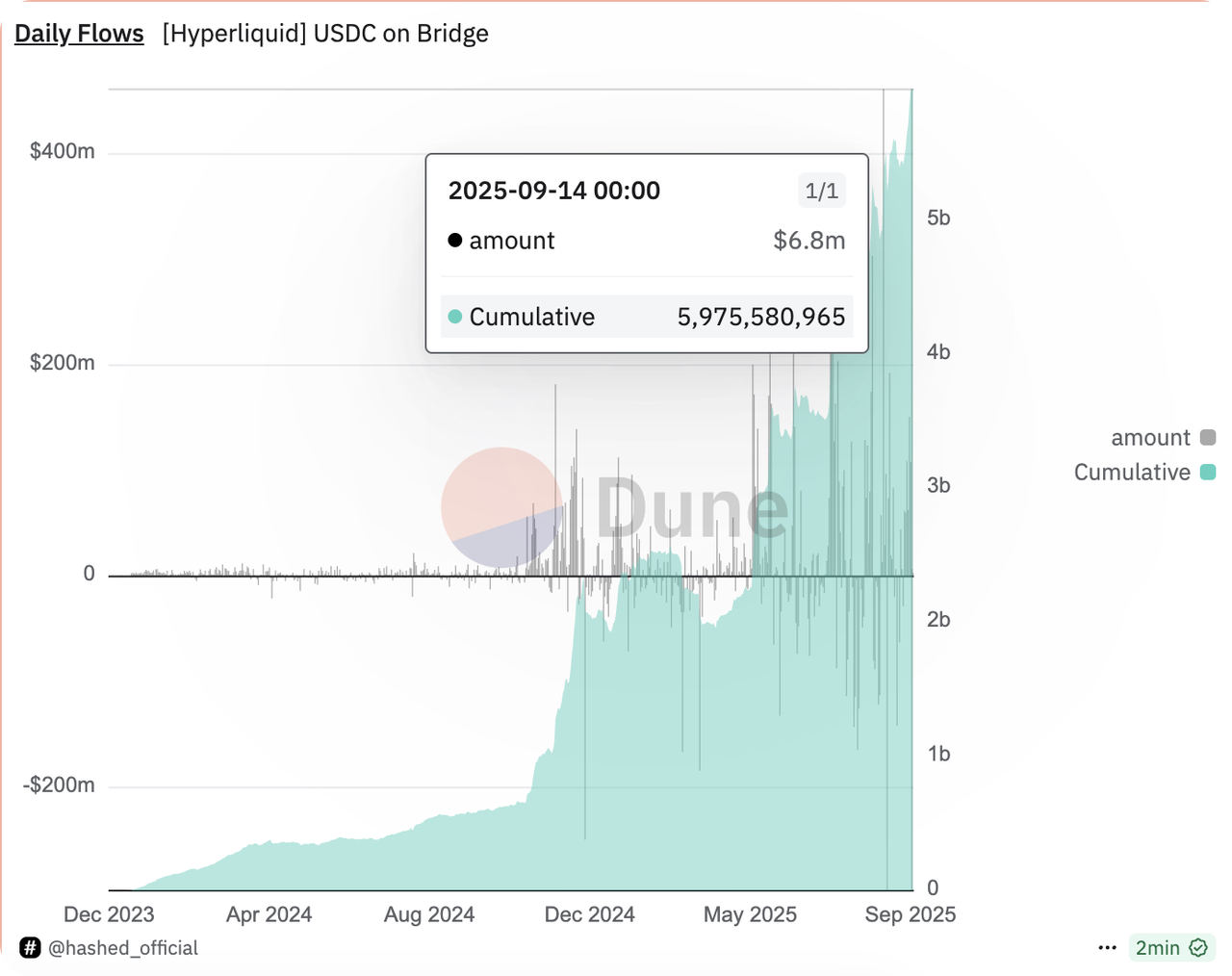

Data Source: https://dune.com/hashed_official/usdc-on-hyperliquid

With its powerful revenue generation and loyal community, Hyperliquid has become a coveted strategic position for all stablecoin issuers. To date, its bridge has attracted over $5.9 billion in USDC, accounting for 8% of USDC's total circulating supply. In the current high-interest rate environment, this float is estimated to generate over $200 million in annual revenue for the stablecoin's issuer. The decision to open up the USDH ticker was a strategic move to internalize this immense revenue stream, break away from reliance on external stablecoins (primarily USDC), and build a deeply integrated, branded stablecoin that captures and reinjects value back into the Hyperliquid ecosystem.

The bidding war was a battle of titans, with proposals centered around security, regulatory compliance (GENIUS Act), revenue sharing, and ecosystem empowerment. A clear trend emerged: "revenue sharing" quickly became table stakes, shifting the competitive focus to team background, distribution power, and unique contributions to the Hyperliquid ecosystem. Every bidder pledged to return a significant portion, if not all, of their reserve yield to the ecosystem, either through direct distributions or HYPE token buybacks.

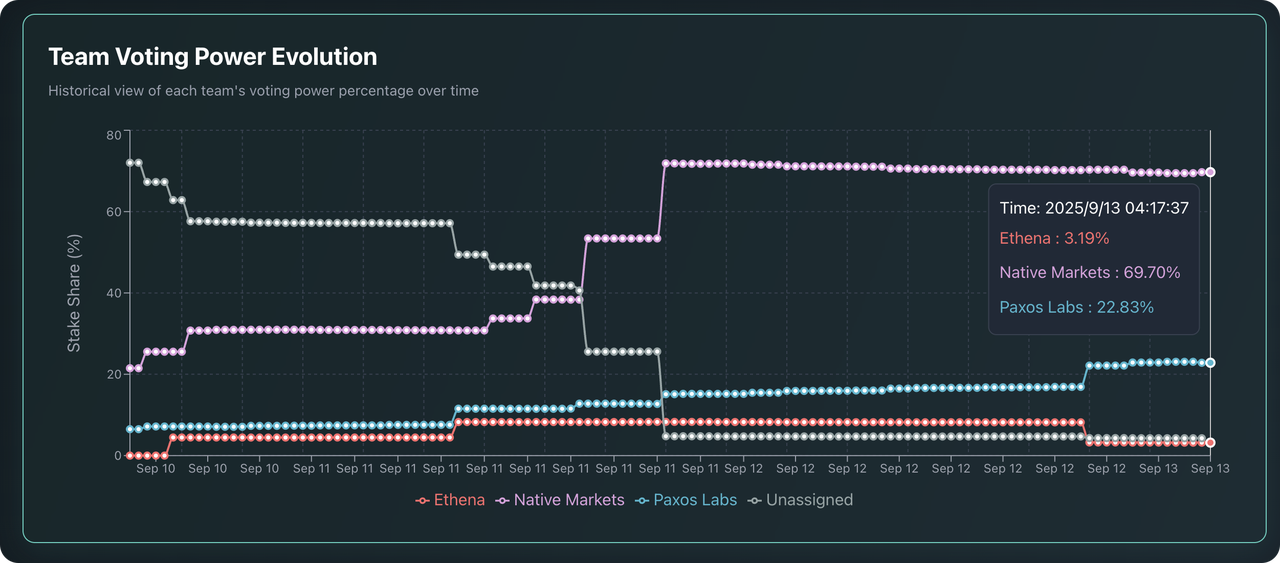

Data Source: https://www.usdhtracker.xyz/

In the end, as the only team entirely dedicated to the Hyperliquid ecosystem, Native Markets' solution won with a landslide victory of 69.7% of the votes.

Native Markets presented a tailor-made product solution with the following highlights:

-

"Issuer-Agnostic" Design: This is the proposal's most visionary feature. While initially partnering with Stripe's subsidiary, Bridge, the architecture is not locked into any single issuer. This means Native Markets controls the USDH brand and product, while the vendor responsible for issuance and reserve management can be flexibly replaced as needed. This greatly enhances USDH's long-term resilience and adaptability.

-

Yield Distribution: 50% of the reserve yield will flow directly into the Hyperliquid Aid Fund (for HYPE buybacks) via an immutable smart contract. The other 50% will be reinvested into USDH's own growth, driving adoption from the front lines in partnership with HIP-3 market deployers, front-end developers, and HyperEVM applications.

-

Reserve Management: Off-chain reserves, consisting of cash equivalents and U.S. Treasuries, will be managed by BlackRock. On-chain reserves will be managed by Superstate via Bridge, combining institutional-grade security with on-chain transparency.

-

Technical Innovation: The team developed a first-of-its-kind CoreRouter smart contract, enabling atomic minting of USDH on HyperEVM with a seamless bridge to HyperCore. The contract has already passed security audits.

With founders deeply embedded in the ecosystem and a technical solution that came well-prepared, Native Markets sent a clear signal to the community. In this showdown, the validators' votes proved a crucial point: for Hyperliquid, pure ecosystem alignment holds more value than the ready-made scale and experience offered by established giants. After all, for the network's validators, a team completely loyal to Hyperliquid with no external conflicts of interest is paramount to maintaining network sovereignty.

Ultimately, the contest was a "win-win" for all participants. The Hyperliquid platform demonstrated its immense leverage as a top-tier distribution channel, forcing stablecoin issuers to recognize that they must "pay for distribution" by ceding the vast majority of their revenue. The rigorous governance process—featuring competitive proposals, extensive community debate, and a final vote by staked validators—also significantly enhanced its brand influence and demonstrated its mature governance. At the same time, the global attention allowed each stablecoin issuer to showcase their powerful "Stablecoin-as-a-Service" (SaaS) capabilities, creating an excellent opportunity for branding and market education.

The birth of USDH is more than just the launch of a new stablecoin. It is a milestone, proving that a platform with a strong moat and a commitment to value accrual can command the attention of industry titans and force them to compete for its benefit. This may well be the dawn of the "Stablecoin 2.0" era.

2. Weekly Selected Market Signals

U.S. Inflation and Labor Data in Sync: Crypto Market Sees Rebound in Liquidity and Risk Appetite

U.S. August CPI data came in broadly in line with expectations, further reinforcing the market’s anticipation of a 25 basis point Fed rate cut next week. While sticky housing and service prices indicate that inflationary pressure has not fully dissipated, weak labor data point to a cooling trend: initial jobless claims rose to 263,000— the highest in nearly four years— and real wages increased just 0.7% YoY, marking a 13-month low. Tariff-induced pricing pressure on goods remained limited. As a result, gold spiked intraday, the dollar index slid, and U.S. stock futures and treasury prices climbed, indicating short-term improvement in market liquidity and investor sentiment.

Last week, Bitcoin ETFs saw substantial net inflows totaling $2.34 billion— a sharp rebound toward YTD highs, providing strong on-market liquidity support. Ethereum ETFs also reversed prior outflows, with $637 million in net weekly inflows. Driven by this, both BTC and ETH posted gains, with SOL leading the pack with a 17% weekly rise. Market risk appetite improved notably, with several newly launched and low-cap tokens showing strong performance. BTC dominance declined by 0.72 percentage points to approximately 53.62%.

Data Source: SoSoValue

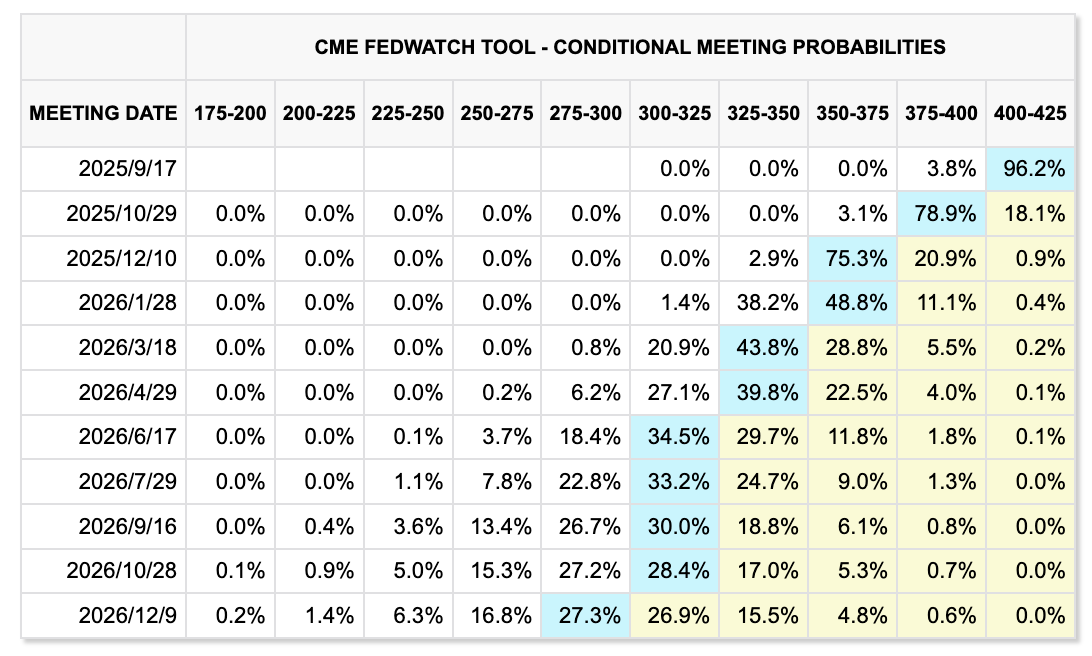

A Reuters survey of 107 U.S. economists showed near-unanimous expectations that the Fed will cut rates by 25bps at its September 17 meeting, with most forecasting another cut in Q1 2026. The rate-cut trajectory appears fully priced in, with expectations now leaning toward three total cuts by year-end. Median forecasts suggest a total 75bps rate reduction in 2026, bringing the Fed Funds Rate down to 3.00%-3.25%.

Data Source: CME FedWatch

Key Macro Events to Watch This Week

September 15: China-U.S. meeting in Spain; China releases intensive August macro data including retail sales, industrial production, and home prices across 70 cities.

September 17: U.S. President Trump expected to begin a state visit to the U.K.

September 18: U.S. FOMC interest rate decision; Bank of England rate decision; Meta to unveil first consumer-grade smart glasses

September 19: Bank of Japan interest rate decision

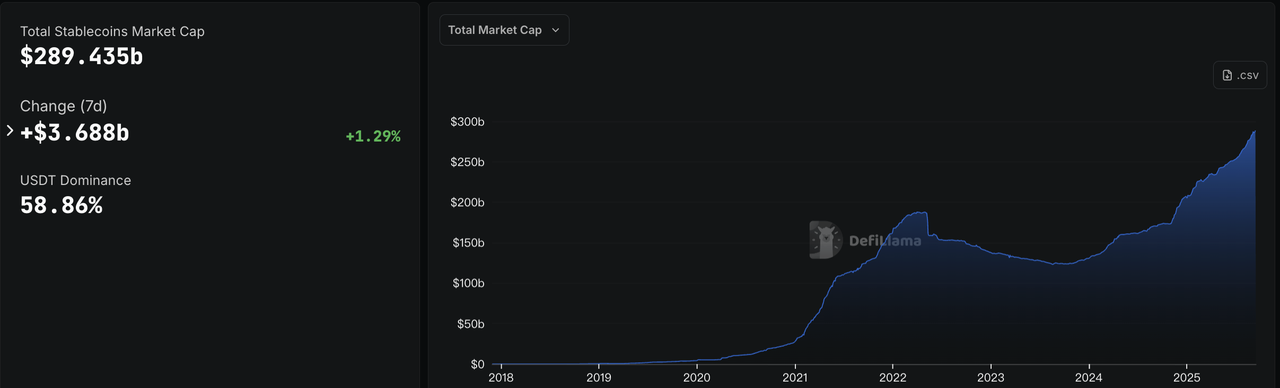

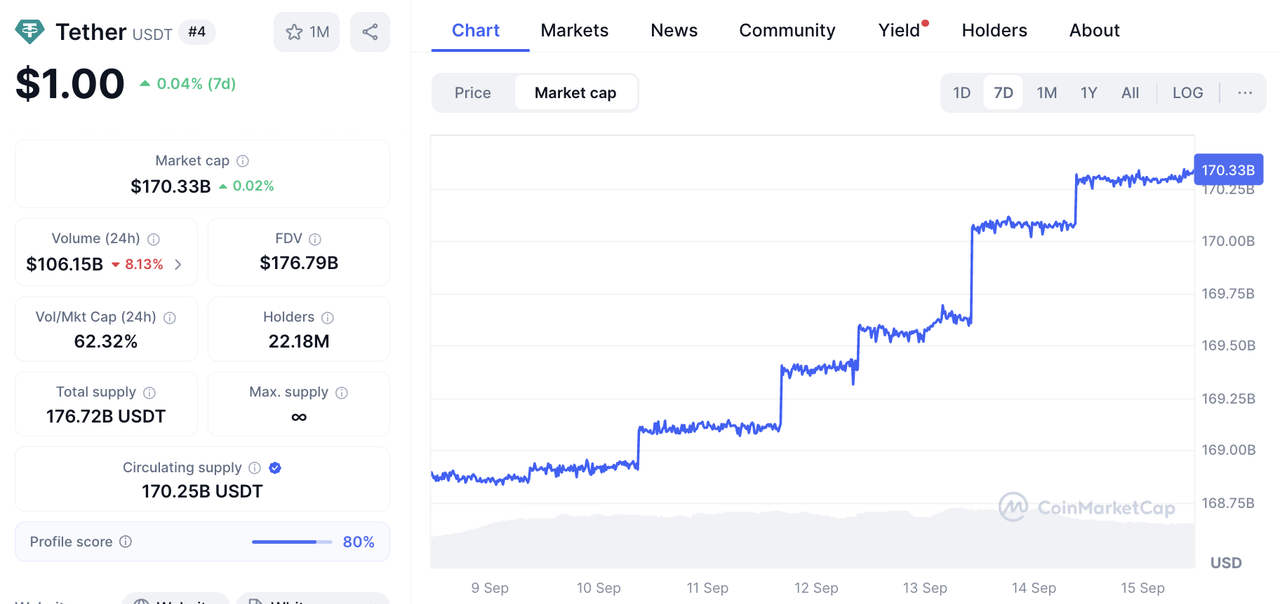

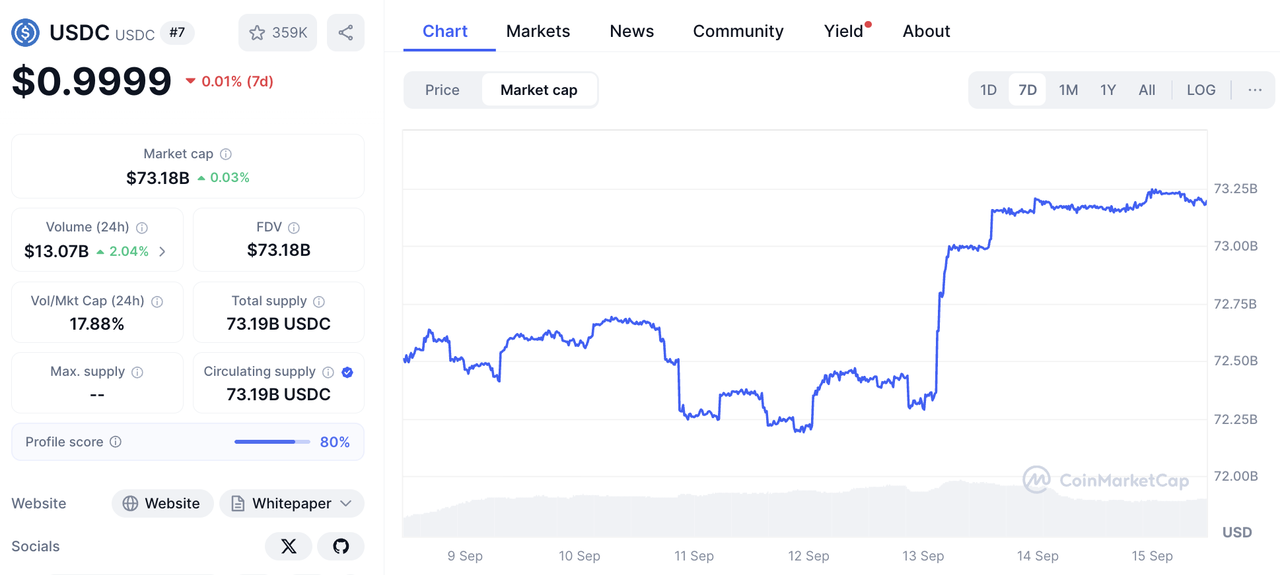

Stablecoin Supply Remains Robust, Market Cap Approaching $290B

Stablecoins continue steady expansion. Over the past week:

-

USDT grew by $1.44B

-

USDC increased by $683M

-

USDe, a yield-bearing stablecoin, surged by $794M following its Binance spot listing

Both traditional and yield-generating stablecoins expanded, indicating capital inflows into the crypto market and supporting the recent uptick in risk sentiment.

Data Source: DeFiLlama

Data Source: CoinMarketCap

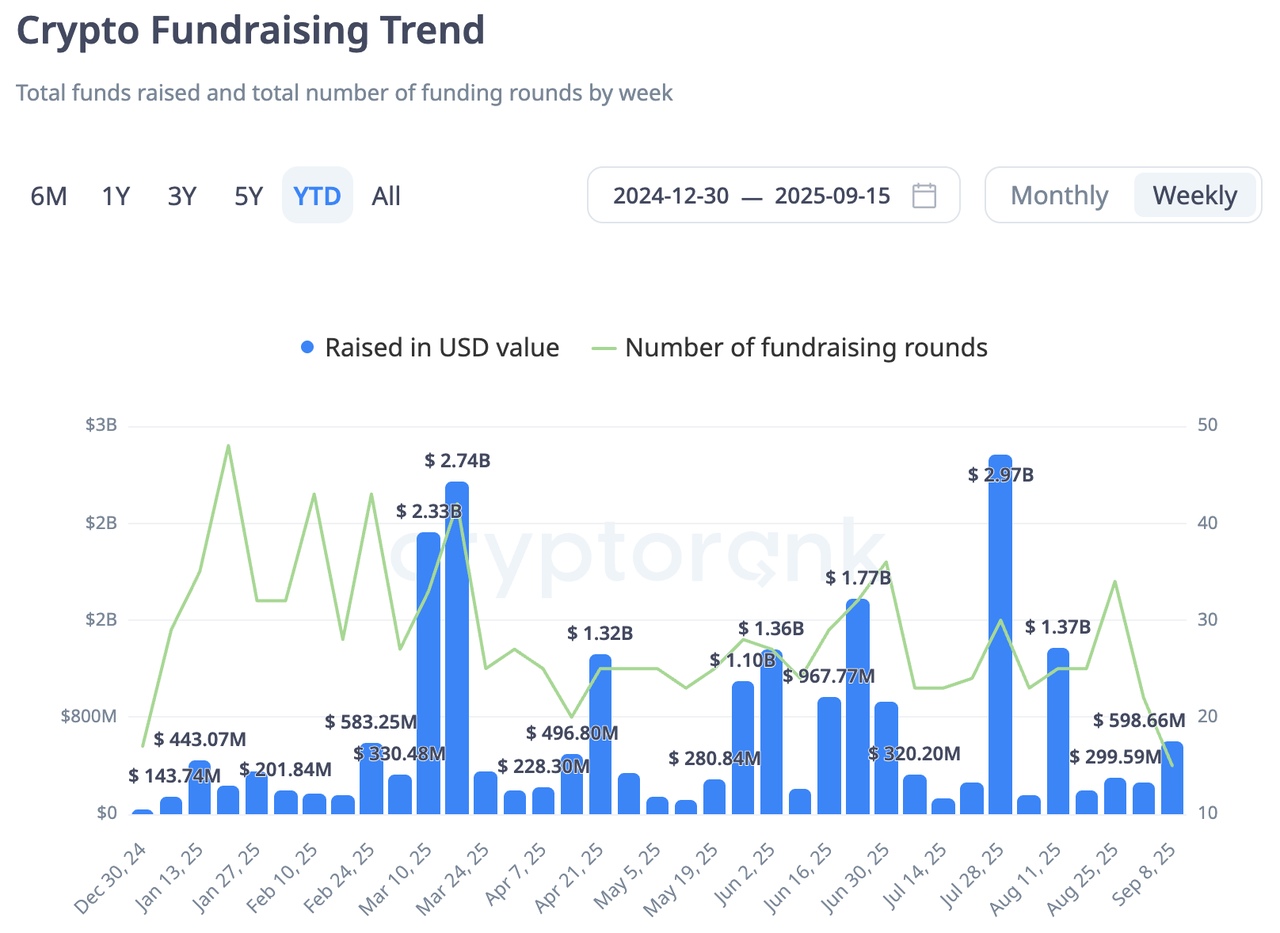

Primary Market Funding Overview: Slight Rebound to $598M, Driven by IPO Deals

Primary market fundraising saw moderate recovery last week, totaling approximately $598M, mainly concentrated in IPO activities.

-

Eightco Holdings (OCTO), a digital asset treasury (DAT)-focused firm, completed a $270M private placement for deploying its Worldcoin treasury strategy

-

Inversion Capital, a blockchain-focused PE firm, raised $26.5M in a seed round backed by Dragonfly, VanEck, ParaFi Capital, Mirana Ventures, and HashKey Capital

Data Source: CryptoRank

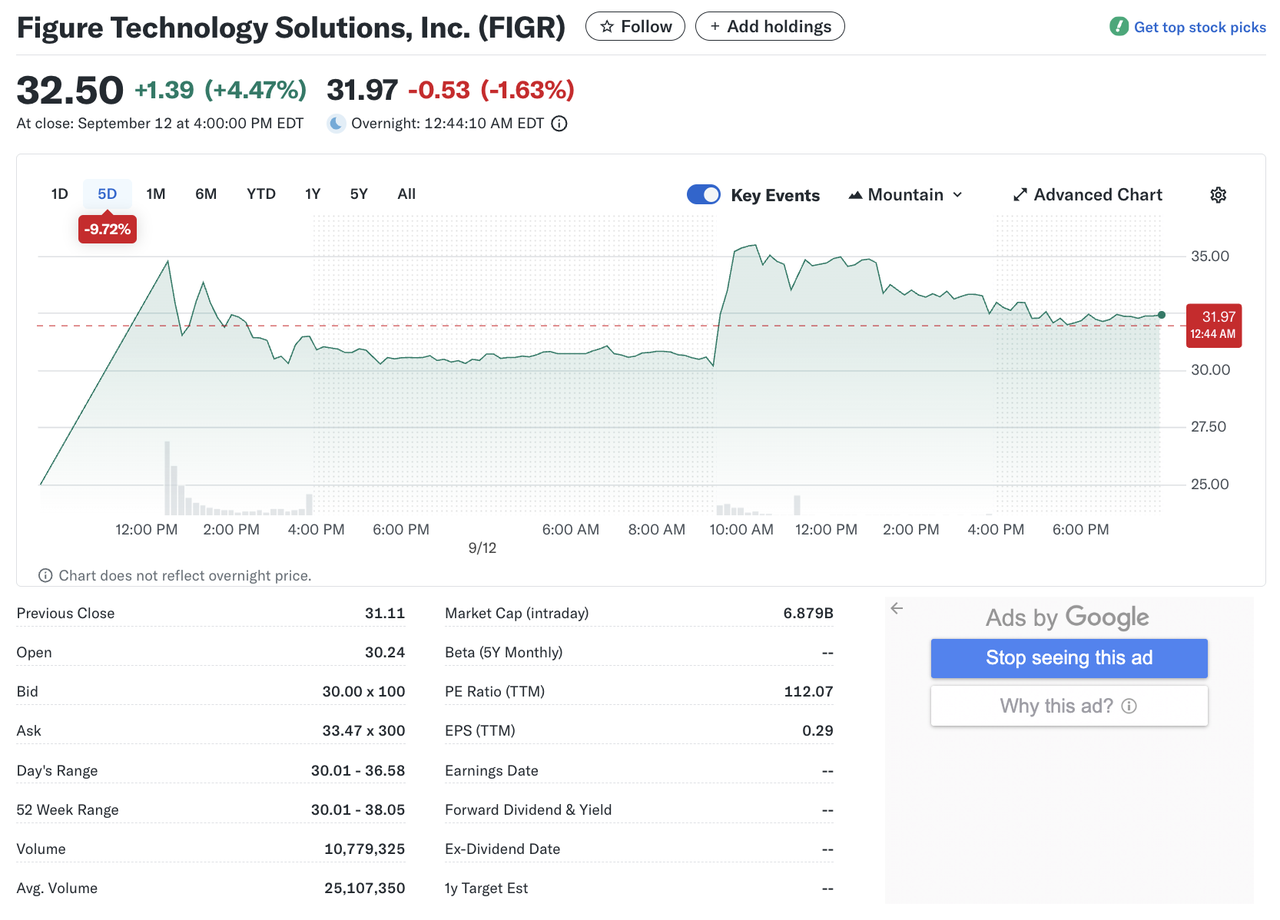

Crypto IPO Boom Continues: Figure & Gemini Raise $787.5M and $425M Respectively

The crypto IPO wave continues to gain momentum, with both Figure and Gemini successfully debuting on Nasdaq—marking one of the most active IPO weeks of 2025 so far.

On September 11 (Thursday), Figure Technology Solutions Inc. (Ticker: FIGR), a blockchain-based consumer lending platform, listed on Nasdaq. The company has scaled profitably, leveraging blockchain in real-world lending scenarios such as home equity loans. Figure raised $787.5M via 31.5 million shares, closing with a market cap of $6.57B, more than doubling its $3.2B valuation from its 2021 VC round.

Data Source: https://finance.yahoo.com/quote/FIGR/

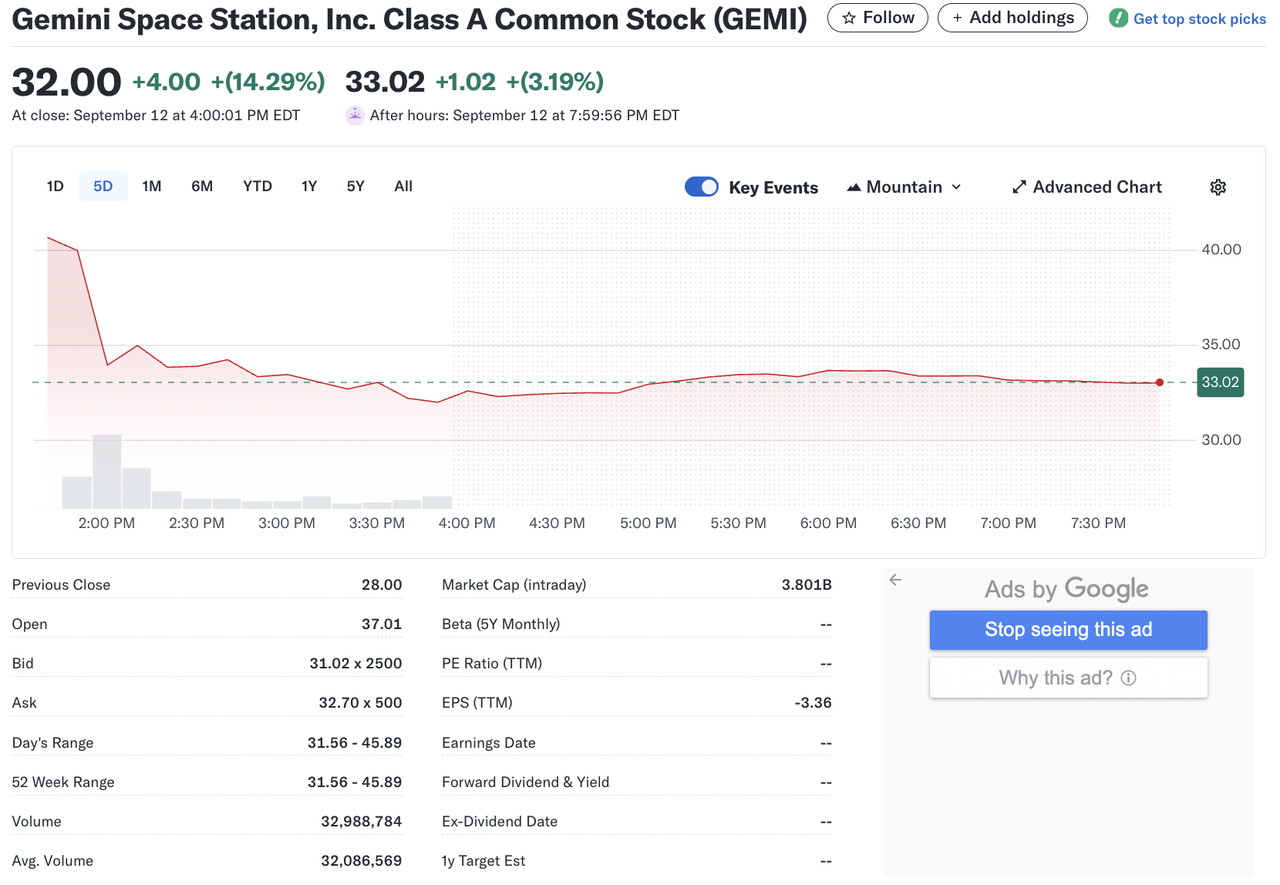

On September 13 (Friday), Gemini Space Station Inc. (Ticker: GEMI), led by the Winklevoss twins, also went public on Nasdaq. Gemini raised $425M at a valuation of approximately $3.3B. The IPO was oversubscribed by more than 20x. GEMI opened at $37.01 (+32.2% from the $28 issue price), surged to $45.89 (+63.9%), and closed at $32 (+14.3%). Reportedly, over 20% of shares were allocated to retail investors, including via online broker platforms and directed share programs.

Data Source: https://finance.yahoo.com/quote/GEMI/

While the IPO was well-received, Gemini's financials remain under pressure, with revenues declining YoY and net losses widening—according to SEC filings. That said, its platform activity and trading volumes are trending upward, reflecting fundamental resilience. Notably, the SEC dropped its 2023 lawsuit accusing Gemini of selling unregistered securities.

With the Trump administration's pro-crypto stance and stablecoin legislation gaining traction, investor enthusiasm for crypto-related public equities has resurged. The successful IPOs of Figure and Gemini reinforce optimism for Web3 firms with strong fundamentals and clear regulatory narratives entering public markets.

Coinbase Acquires Sensible’s Founders to Advance "Everything Exchange" Vision

Coinbase announced the acquisition of Jacob Frantz and Zachary Salmon, co-founders of crypto yield platform Sensible, to help lead its DeFi consumer strategy. Sensible will shut down by October; the acquisition only includes the founders, with other team members’ status undisclosed.

This marks Coinbase’s 7th acquisition in 2025, following deals with:

-

Liquifi (token management)

-

Spindl (Web3 adtech)

-

Deribit (crypto derivatives exchange)

-

Protocols such as Iron Fish, Opyn, and Roam

Coinbase's “Everything Exchange” strategy aims to unify trading, lending, staking, spending, and earning in one platform—expanding into tokenized stocks, prediction markets, and early-stage token sales. Sensible, which previously offered up to 8% APY on BTC, ETH, and SOL staking with instant access, adds critical yield infrastructure to bolster Coinbase's DeFi offerings and user retention.

3. Project Spotlight

Perp DEX: MYX Finance, Avantis, Aster

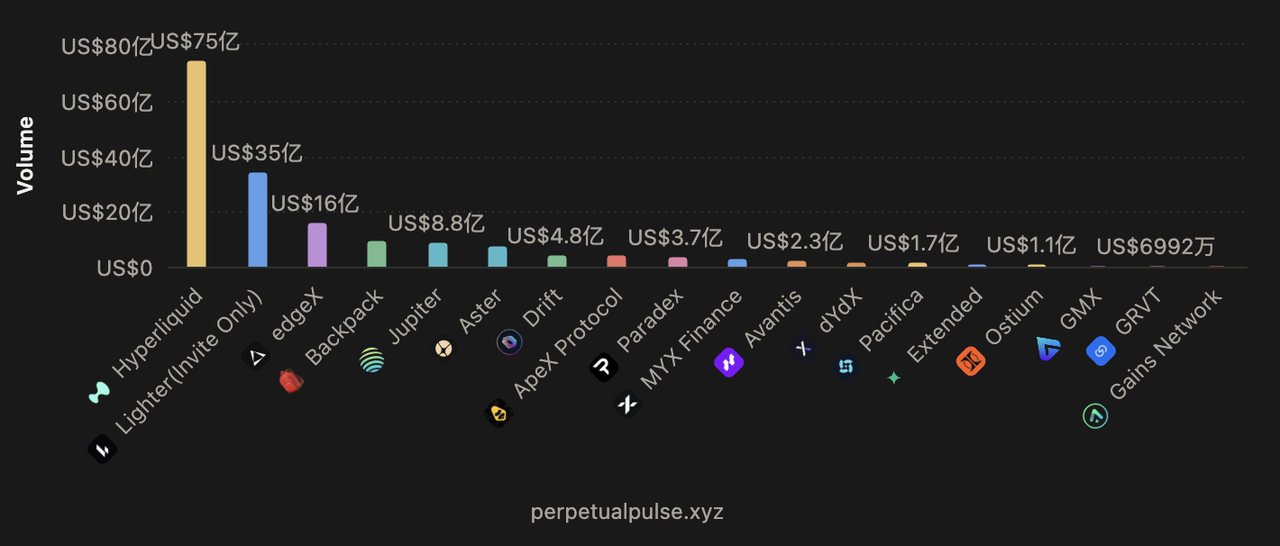

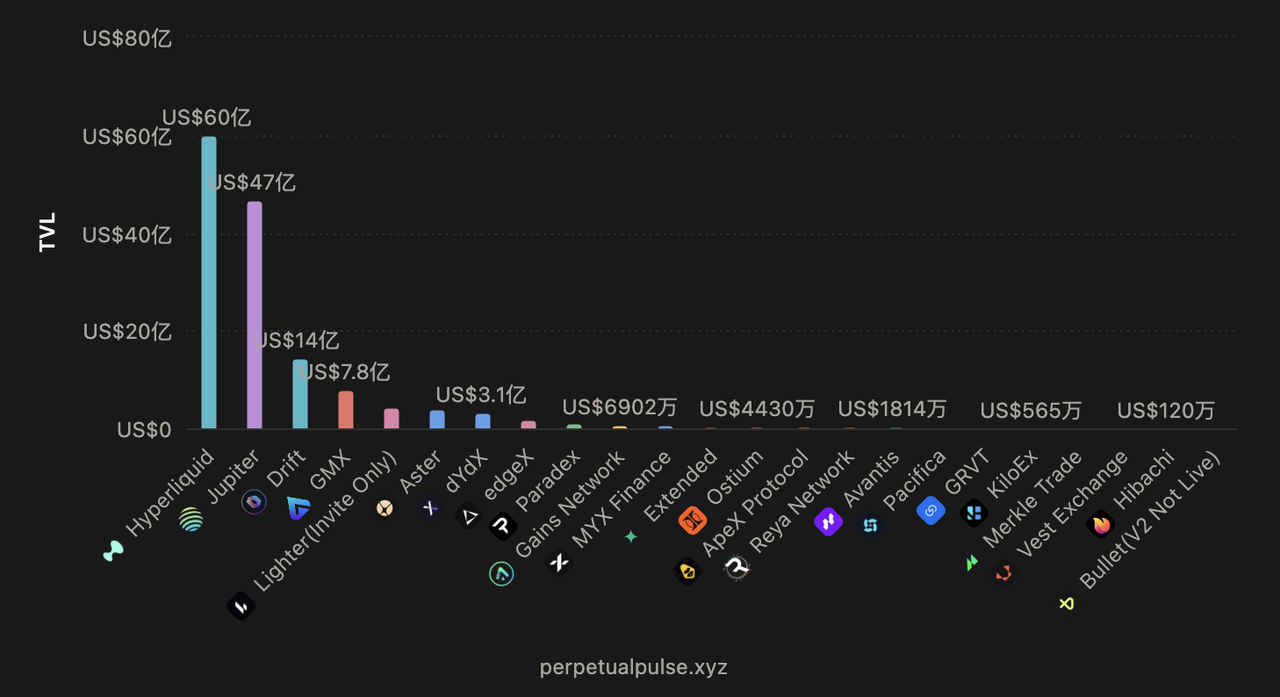

Since Hyperliquid’s TGE shattered the ceiling for Perp DEX tokens, a wave of new Perp DEXs has emerged like mushrooms after the rain. According to data from Perpetual Pulse, there are currently more than 20 Perp DEXs fiercely competing in the market. Most of them adopt strategies such as offering points in exchange for potential airdrops, operating with low or even zero fees, and deliberately or subtly positioning themselves against Hyperliquid in marketing to raise user expectations and stimulate trading volume—this, in turn, has led to increased wash-trading.

On the other hand, in stark contrast to the daily multi-billion-dollar trading volumes, the user assets and open interest on these platforms are often quite low. Currently, including Hyperliquid, only 8 platforms have AUM exceeding $100 million. However, the number of platforms with daily trading volumes over $100 million is twice that, indicating that every dollar on these platforms is being traded 5 to 10 times per day. By comparison, Hyperliquid’s ratio is about 1.2 times.

Data Source: https://www.perpetualpulse.xyz/

Over the past week, Perp DEXs such as MYX Finance, Avantis, and Aster have stirred up significant discussion in the market. The tokens of the first two have performed well on the secondary market—especially MYX, which surged 20x in a single week—while the latter is about to hold its TGE as the largest Perp DEX on BNB Chain.

MYX Finance: Token rose 20x in a week, extremely high FDV/AUM ratio

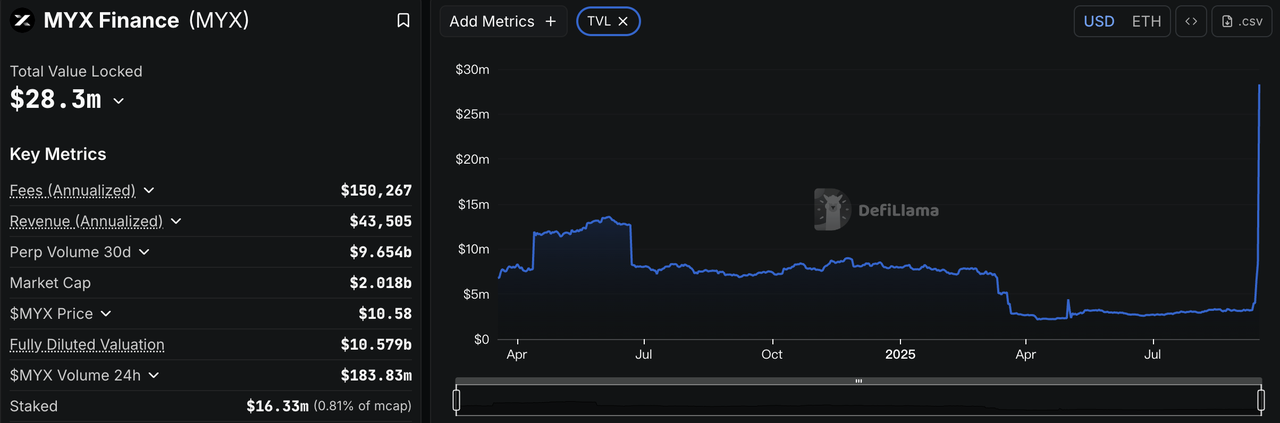

MYX Finance is a Perp DEX backed by investors such as Hongshan and Hack VC. It features a Matching Pool Mechanism (MPM) to enable zero-slippage trading and reduce costs for liquidity providers; and a P2Pool2P system to optimize liquidity and improve efficiency.

Before last week, MYX Finance’s AUM was only around $3–4 million, but following the explosive rise of the MYX token, AUM increased to nearly $30 million. However, this is still highly exaggerated compared to MYX’s market cap and FDV. Even after a significant pullback, MYX’s market cap remains as high as $2 billion, with a FDV reaching $10 billion. The MC/AUM ratio is 66x, and the FDV/AUM ratio is 333x.

Data Source: https://defillama.com/protocol/myx-finance

Bubblemaps’ on-chain analysis revealed that around 100 newly funded wallets almost simultaneously claimed a total of about $170 million in airdrops, raising suspicions of the largest "sybil attack" in history. Given the high concentration of tokens in the hands of a few, the key players may have used a small amount of capital to initiate the initial price surge. Combined with market FOMO, a sharp increase in open interest in derivatives markets, and extreme negative funding rates, this triggered an intense “short squeeze”—where short positions were forcibly liquidated as prices soared, pushing the price up even further.

Such token price surges, as seen with MYX, are not rare. They represent a speculative model not purely driven by narrative or fundamentals, but rather one that relies on high control over token distribution and coordinated derivatives trading—forming a typical short-term speculation pattern driven by “FOMO + short squeeze”.

Avantis: Backed by top-tier institutions, but fundamentals remain average

Avantis is a Perp DEX on the Base network, backed by leading institutions such as Pantera Capital and Founders Fund, as well as support from the Base Ecosystem Fund. After its TGE last week and listing on Binance Alpha, the AVNT token also rose several times. Base network lead Jesse Pollak has publicly supported the project multiple times, and Base community KOLs have compared AVNT to the next Zora.

Data Source: https://defillama.com/protocol/avantis

However, the actual user assets on Avantis remain relatively low. Its daily trading volume is up to 10 times higher than its user assets, very similar to MYX. Observing the leaderboard, one whale’s total trading volume alone accounts for over 1/10 of the platform’s total volume.

As the market improves and Hyperliquid significantly expands the potential of Perp DEXs and user expectations, the trading prices of some Perp DEX tokens on the secondary market often exceed what the fundamental data would suggest. Instead, it becomes essential to assess token distribution concentration, project resources, and capital strength.

Aster, for example, is in a similar position to Avantis. As the main Perp DEX on BNB Chain, it is backed by top-tier resources like YZi Labs, and user expectations for it are very high.

Regardless, since asset trading is one of the most important revenue sources in crypto, Perp DEXs are indeed cash cows. Project teams are all aiming to capture a share of the market currently dominated by Hyperliquid and CEX derivatives platforms.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.