KuCoin Ventures Weekly Report: Giants Converge in ADGM, Payment M&A Wave Amid Macro Dynamics, and the Paradigm Shift: Compliant RWAs and the Upheaval of the ICO Era

2025/12/16 01:06:02

1. Weekly Market Highlights

Binance, Circle, and Tether Converge at ADGM: Abu Dhabi Accelerates the Construction of a Global Compliant Crypto Financial Hub

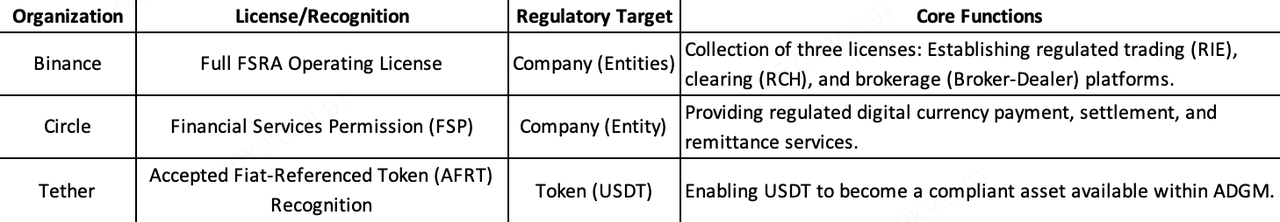

On December 8th and 9th, three leading global crypto institutions — Binance, Circle, and Tether — successively announced that their entities or products had obtained official licenses or regulatory recognition from the Abu Dhabi Global Market (ADGM). This development immediately became a major industry focus. A deeper analysis reveals that while these three approvals differ fundamentally within the ADGM's regulatory framework, they collectively establish an end-to-end, trustworthy digital financial ecosystem.

Among them, Binance obtained a comprehensive set of licenses — a full authorization from ADGM's Financial Services Regulatory Authority (FSRA), becoming the world's first digital asset platform under the ADGM framework to simultaneously hold three licenses: Recognised Investment Exchange (RIE), Recognised Clearing House (RCH), and Broker-Dealer. This "trinity" structure will officially launch on January 5, 2026, with Binance operating its core businesses through three independent entities to ensure compliant operations of its global platform in ADGM. In comparison, Circle focuses on payment innovation, obtaining a Financial Services Permission (FSP) and positioning itself as a Money Services Provider (MSP). This permission allows it to provide regulated payment, settlement, and cross-border services under the ADGM framework. Circle has announced the appointment of former Visa executive Saeeda Jaffar as Managing Director for the Middle East and Africa region, aiming to deepen cooperation with financial institutions, enterprises, and developers to promote the penetration of the USDC stablecoin in the regional ecosystem. In contrast, Tether's progress centers on the asset side: USDT has been approved as an Accepted Fiat-Referenced Token (AFRT), supporting expansion to 12 major public chains, enabling ADGM-licensed institutions to compliantly conduct trading, custody, and settlement of USDT.

Data Source: Compiled by KuCoin Ventures

ADGM was established in 2015 as an independent international financial center in the UAE, regulated by the FSRA. It adopts the English common law system and is equipped with independent courts and arbitration centers. As one of the earliest jurisdictions globally (in 2018) to launch a complete virtual asset regulatory framework, ADGM can cover both traditional finance and digital assets. In traditional finance, ADGM has attracted sovereign wealth funds such as the Abu Dhabi Investment Authority (ADIA) and multiple international institutions (e.g., BlackRock, JPMorgan, Goldman Sachs) to establish regional headquarters or FSRA entities there, primarily due to factors like regulatory transparency, tax environment, and strategic synergy with sovereign capital. In the digital asset field, ADGM's licensing system covers key areas such as FSP, RIE, RCH, and Broker-Dealer, providing institutions with a relatively systematic compliance path.

This influx of the three major institutions into the ADGM signals that Abu Dhabi is establishing itself as the first global center to achieve "full-stack" compliance for crypto finance: Tether's USDT approved as a compliant asset, Circle obtaining permission to provide regulated settlement services, and Binance's core trading and brokerage businesses achieving compliance. Together, these three build a complete compliant ecosystem in Abu Dhabi from the asset layer and settlement layer to the trading layer. This development shows that mainstream participants in the crypto industry are shifting from regions with lower regulatory certainty to mature frameworks like ADGM, based on the common law system with clear regulations. It also reflects a clear trend of the digital asset industry aligning with mainstream financial standards. The Middle East, particularly Abu Dhabi, leveraging its regulatory framework advantages and strategic geographic position, is gradually developing into a digital financial hub connecting Asia, Europe, and the Americas, with the collective entry of these three giants serving as a clear signal of the acceleration of this strategic process.

Looking ahead to 2026, as the AFRT regime becomes fully operational and TradFi-crypto integration accelerates — such as tokenization pilots involving BlackRock, Finstreet, and the Abu Dhabi Investment Authority — ADGM is well positioned to further strengthen its role in the global financial system. It is likely to become an important platform for the deep integration of traditional finance and digital assets, while also opening new opportunities for emerging markets.

2. Weekly Selected Market Signals

Macro Liquidity in Focus: Fed Turns Dovish While Global Central Banks and U.S. Inflation Become the Next Anchors

Last week, the Federal Reserve cut rates by 25bp as expected and signaled in its dot plot that there may be only one further cut in 2026. The overall tone was dovish, but risk assets did not react with a broad-based rally. The AI complex is moving into an “earnings reality check” phase: Oracle’s latest guidance came in below expectations, raising doubts about whether AI infrastructure demand can continue to grow at the previous pace and prompting a valuation reset in parts of the high-multiple tech sector.

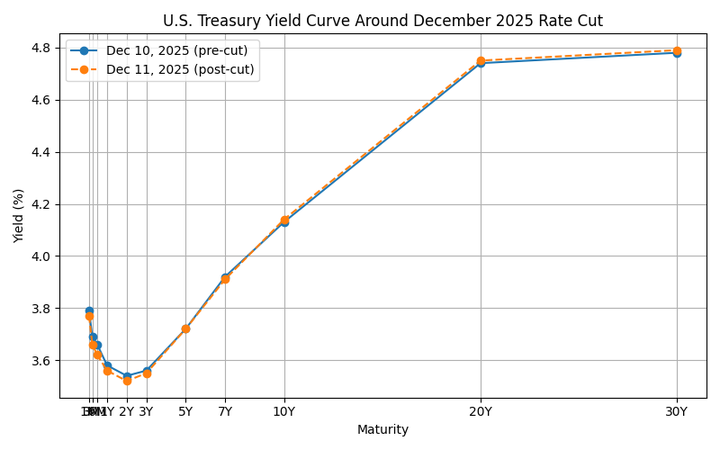

Data Source: Compiled by KuCoin Ventures

On the yield side, the U.S. Treasury curve after the cut has shown a classic “bull short / bear long” re-steepening pattern: the short end (3M–2Y) has moved lower in line with the policy rate and expectations of further easing, while the long end (10Y+) has edged higher amid large fiscal deficits, heavy issuance and lingering inflation uncertainty. This combination eases pressure on short-term funding and money-market rates, but raises the discount rate for equities, putting a cap on valuations for long-duration growth stocks and rate-sensitive financial assets.

For Circle (CRCL), which is now listed on the NYSE and primarily earns a spread on short-duration Treasuries and cash-equivalent assets, a peak and subsequent decline in short-end rates will gradually compress its interest-income run-rate. At the same time, higher long-end yields and a rising equity risk premium put valuation pressure on the stock, as markets reassess both its price elasticity and the sustainability of the past “high-rate dividend” environment. Combined with questions around the company’s growth trajectory and regulatory uncertainty, this is translating into a fairly typical phase of valuation repricing.

Against this backdrop, the tug-of-war between U.S.–Japan rate differentials and global liquidity is becoming a key focus this week. On 19 December, the Bank of Japan will hold its policy meeting, and the market broadly expects a 25bp hike in the policy rate to 0.75%. The hike itself is largely priced in; what matters more is Governor Kazuo Ueda’s definition of “neutral rates” and his forward guidance on the path of further hikes – for example, whether he tones down the current language that rate increases will occur “only if economic activity and prices evolve as expected”. If this meeting clearly signals the start of a new tightening cycle, it will not only reshape the yen and the JGB yield curve, but could also force partial unwinds of global carry trades, alter the marginal flow of U.S. dollar funding into risk assets, and constrain policy space for other Asia-Pacific central banks.

Under multiple macro uncertainties, the secondary crypto market has remained in a “weak consolidation” pattern. BTC has faced clear overhead resistance around $94,000, spending most of the past week oscillating near the $90,000 level; ETH has similarly been range-bound around the $3,000 mark. High-beta on-chain narratives have generally underperformed: the Meme segment’s total market cap at one point fell around 2.6% over 24 hours, and although several Binance Alpha tokens posted strong single-day gains, their ability to lift overall sentiment was limited. Solana Breakpoint 2025 was held in Abu Dhabi on 11–13 December, but in the current subdued environment, conference-related themes did not significantly boost secondary-market attention or SOL price performance.

Data Source: SoSoValue

On the spot ETF side, last week’s flows still look like “moderate repair” rather than a meaningful inflection. BTC spot ETFs recorded net inflows of about $286 million over the week – not enough to decisively reverse prior outflows, and current price levels still appear insufficient to attract strong incremental capital. With selling not surging but buying interest clearly softer, it suggests traditional investors remain cautious in adding crypto exposure, limiting the ability of market sentiment to turn on ETF flows alone. ETH ETFs broadly tracked BTC, with the underlying hovering around $3,000 and weekly net inflows of about $208 million – not yet a distinct, standalone trend. Newly approved products in XRP, SOL, DOGE and other names have seen maximum daily net inflows mostly in the low tens of millions of dollars, implying limited impact on the broader market structure.

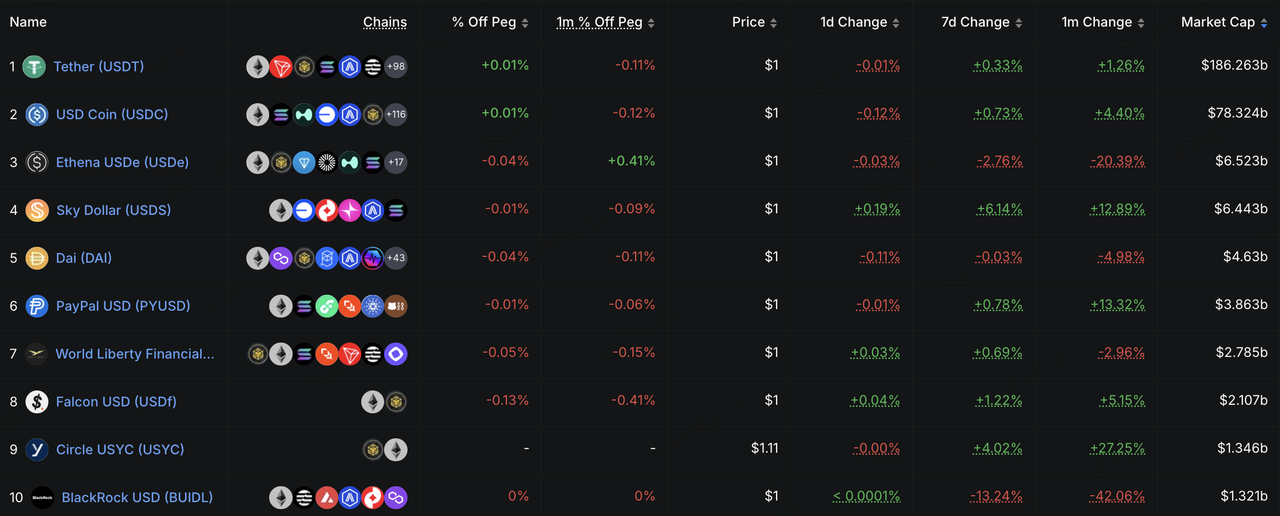

Data Source: DeFiLlama

On-chain liquidity, as reflected by stablecoin supply, continued a modest recovery last week but showed no signs of a “flood‐like” influx – more a slow grind higher. Structurally, USDT maintained slight growth, while other major stablecoins were largely stable. One development worth noting is that traditional brokerages are accelerating efforts to integrate stablecoins into their funding architecture. Interactive Brokers, for example, has indicated in interviews that it is exploring issuing its own stablecoin and allowing clients to fund brokerage accounts with leading stablecoins, with the goal of enabling 24/7 stablecoin deposits and transfers. This direction is highly consistent with its previous moves to offer crypto trading through partners such as Paxos and Zero Hash, and suggests that the “brokerage account + stablecoin funding rail” combination is moving from pilot experiments toward a more strategic build-out.

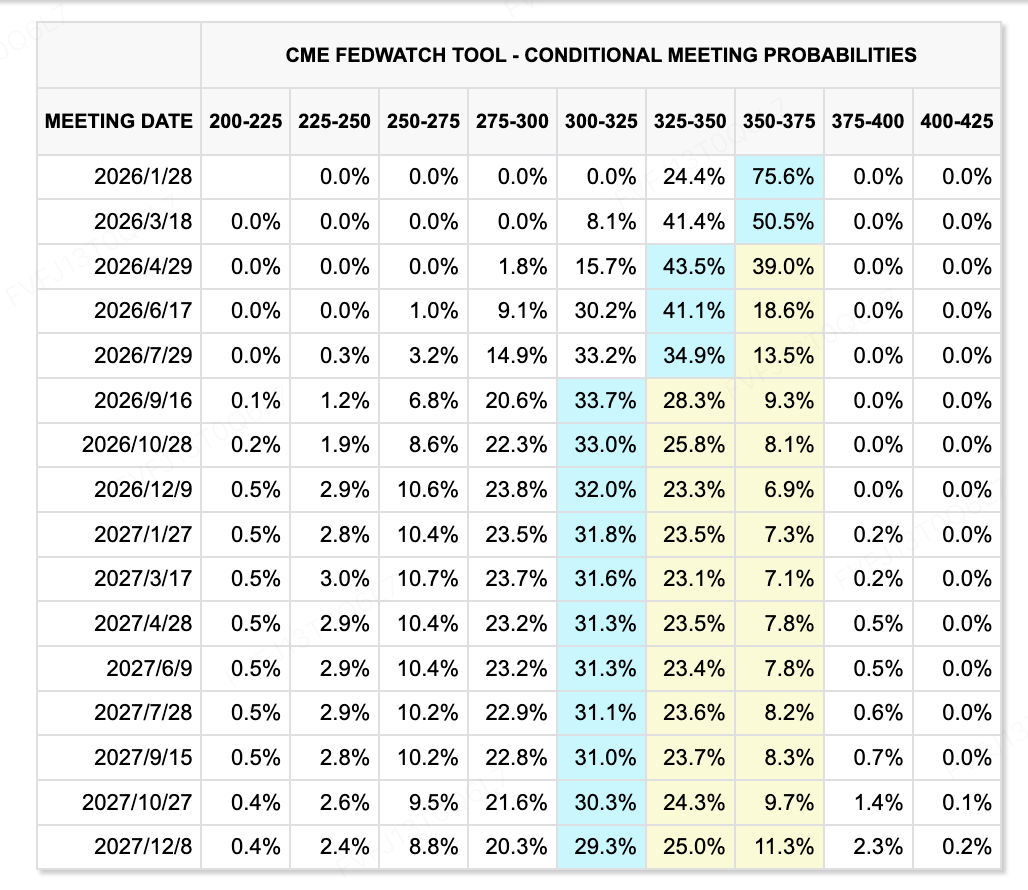

Data Source: CME FedWatch Tool

On the rates-expectations front, the narrative remains fluid. The Fed’s 25bp cut last week was in line with expectations, but the dot plot implies only one further cut in 2026, and there are visible internal divergences over whether inflation or employment should be the primary concern. The willingness to pursue a more aggressive easing cycle appears limited. The delicate balance between “disinflation, asset-price pressure and the risk of financial conditions re-tightening” makes forward pricing of long-term rates more volatile.

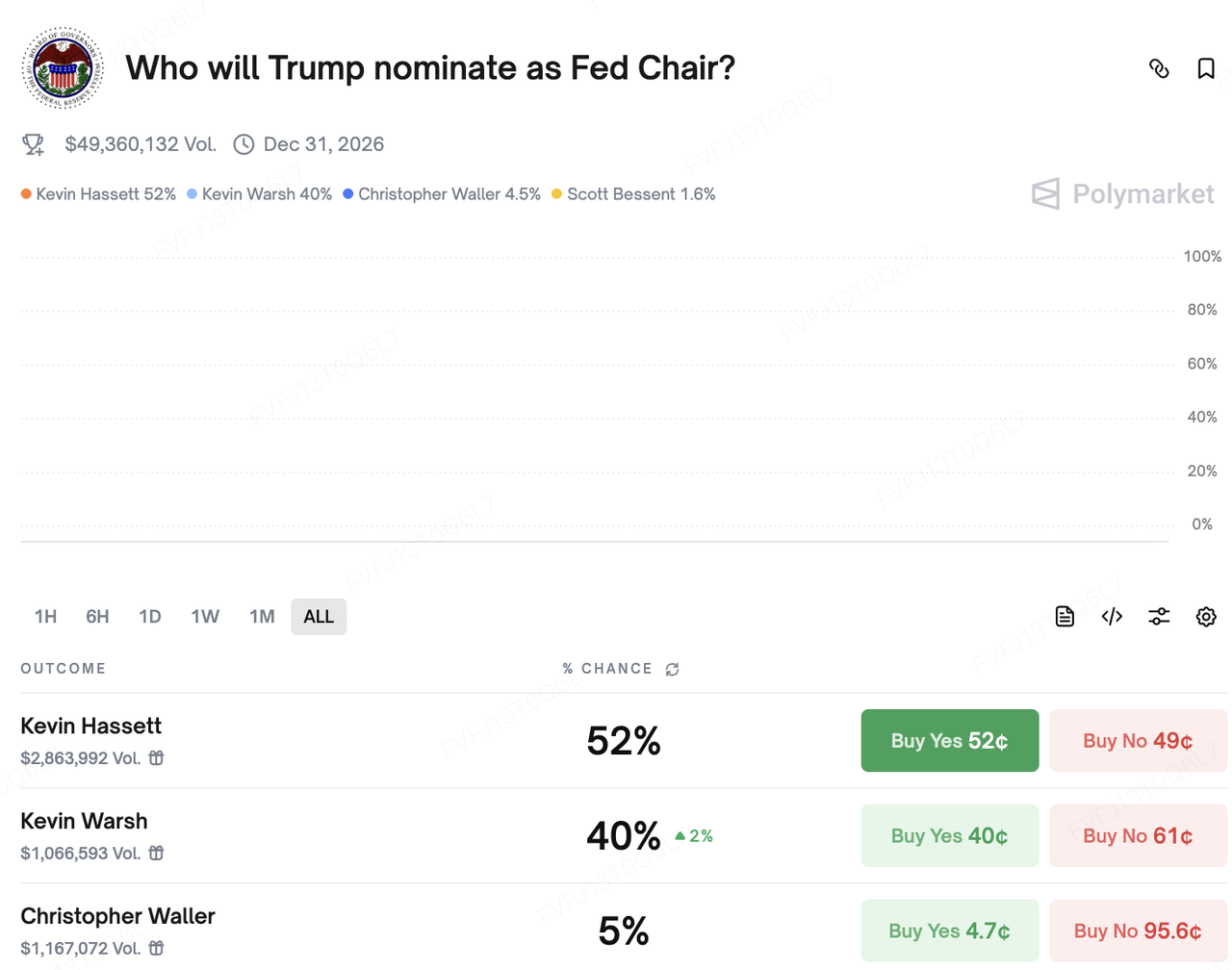

On the political side, the market debate over the next Fed chair is intensifying. Kevin Hassett was previously seen as the frontrunner, but after former President Trump said in a recent interview that he has “basically decided” whom he will nominate, former Fed governor Kevin Warsh’s odds rose sharply. On prediction platform Polymarket, the betting probabilities for Hassett and Warsh are now close to a two-horse race. In broad terms, both are viewed as relatively “dovish–pro-growth–pro-tax-cut” candidates, which reinforces the longer-term narrative of potentially lower real rates; however, their near-term impact on the concrete path of monetary policy still remains to be seen.

Key Events to Watch This Week:

-

15 Dec: China releases data on retail sales, industrial production and property-sector indicators.

-

16 & 18 Dec: The U.S. publishes the first post-shutdown nonfarm payroll report (November nonfarm employment change) and the November CPI report, both critical inputs for reassessing the Fed’s policy path.

-

18 Dec: The European Central Bank and Bank of England announce their latest rate decisions.

-

19 Dec: BoJ policy meeting; markets widely expect a 25bp hike, lifting the policy rate to 0.75%. Governor Ueda’s press conference will be a key driver for global rate expectations and the direction of carry trades.

Primary Market Observation::

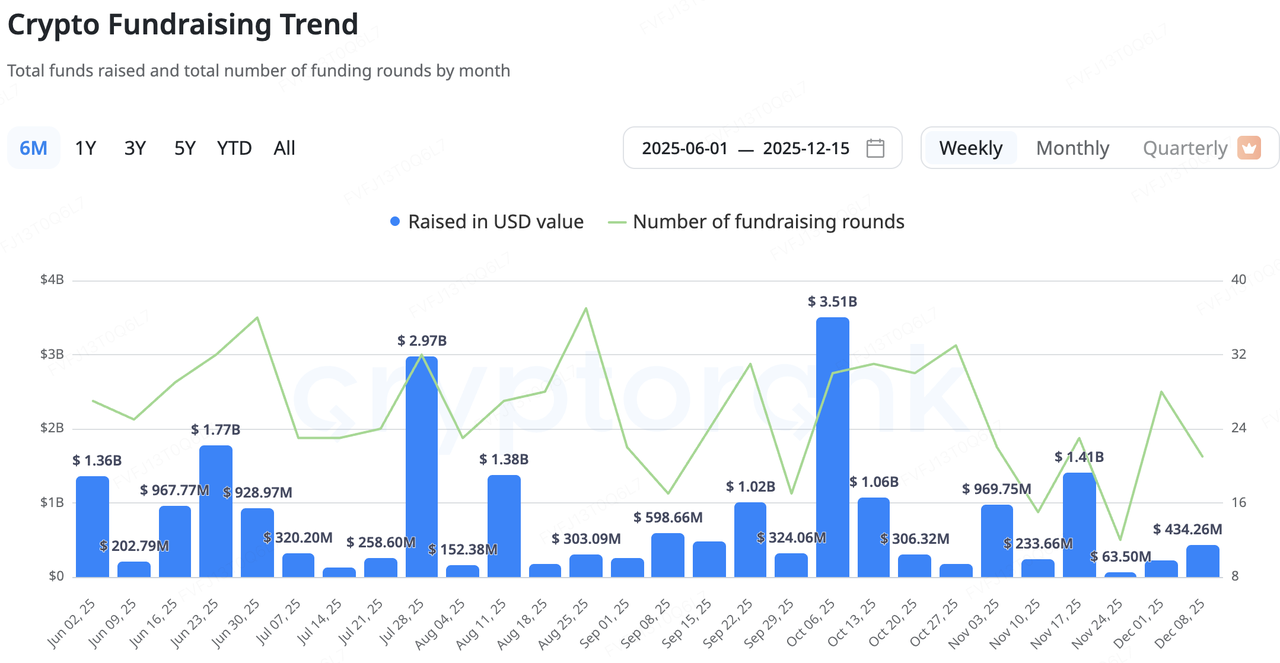

Recently, the crypto native primary market has continued to operate in a “low aggregate volume, cautious structure” regime. CryptoRank data shows that announced deal sizes over the past few weeks remain in the lower band for this year, with average ticket sizes visibly smaller. Incremental capital is gravitating toward “late-cycle” transactions such as M&A, IPO and post-IPO deals, with a clear tilt away from early-stage, high-risk projects and toward infrastructure and regulated platforms with existing revenue and clearer business models.

Within the crypto ecosystem, the recent moves by leading Solana DEX aggregator Jupiter are illustrative. Rather than building lending infrastructure from scratch, Jupiter chose to acquire mature product RainFi as its entry point into the P2P lending vertical, with the two parties planning to co-launch the Jupiter Orderbook P2P lending product in Q1 2026. For Jupiter, this “buy technology + buy team” M&A path both shortens the time from concept to launch and leverages its existing user base to expand its DeFi product map, avoiding the need to repeat a slow “cold-start + trial-and-error” process.

Data Source: CryptoRank

Payment Infrastructure M&A Heats Up: Strategic Synergies over “Cash-Burn Expansion”

More importantly, payment and stablecoin infrastructure is increasingly becoming the focal point of M&A activity. Two undisclosed-amount deals this week – cooperation between U.S. community bank Lead Bank and stablecoin payment infrastructure provider Loop Crypto, and Stripe’s acquisition of mobile-wallet team Valora – point to the same structural direction: building a controllable “bridge layer” between traditional account-based finance and on-chain stablecoin payment stacks.

Lead Bank is a nearly century-old community bank headquartered in Kansas City, Missouri, which in recent years has repositioned itself as a “crypto-friendly bank” serving fintech and digital-asset businesses. In 2024 it completed a Series B round that lifted its valuation into the “unicorn” range. Loop Crypto provides stablecoin payment and treasury-management infrastructure for enterprises, helping B-side clients automate stablecoin flows for payroll, supply-chain settlement, and cross-border payables/receivables. The essence of their partnership is to link regulated bank accounts with Loop’s on-chain payment stack: enterprises can use a single integrated setup to handle fiat–stablecoin funding, position management and on-chain settlement. One end remains aligned with traditional accounting and audit requirements; the other plugs into a more efficient, programmable stablecoin network. It is a textbook example of the division of labor where “banks own the accounts, crypto owns the transport layer.”

Stripe is advancing its crypto payments franchise from an even higher strategic vantage point. After acquiring stablecoin settlement infrastructure provider Bridge in early 2025 to strengthen its back-end settlement and custody capabilities, it has since bought identity/wallet infrastructure firm Privy (front-end identity and key management) and most recently announced that the Valora team will join Stripe, filling a critical gap in mobile-wallet UX and emerging-market reach. Public information suggests the Valora app itself will return to parent cLabs, while the team joins Stripe to accelerate its plan to build a stablecoin settlement network around the Tempo payment chain.

Tempo, co-developed by Stripe and Paradigm, focuses on payments and stablecoin use cases, supports paying gas directly in stablecoins, and has already onboarded major financial institutions such as Mastercard, UBS and Klarna as testnet participants. With this configuration, Stripe has effectively assembled a vertically integrated stack of “back-end settlement (Bridge) + front-end identity/wallet (Privy, Valora) + proprietary payment chain (Tempo)”, shifting its strategic goal from “just a payment processor” to “architect of a full on-chain payment ecosystem”.

Taken together – from Jupiter’s acquisition of RainFi, to Lead Bank × Loop, to Stripe × Valora/Bridge/Privy – a fairly clear evolution path is emerging. On one hand, leading players are using M&A to shorten time-to-market in new verticals and to prioritize use cases that are closer to cash flow, such as stablecoin payments and B2B treasury management. On the other hand, the division of labor between traditional finance and crypto firms is becoming more defined: banks and licensed institutions are responsible for account infrastructure and compliance, while crypto projects provide stablecoins, on-chain settlement and programmable payment rails.

Key variables to watch going forward include: the pace at which this “bank + crypto payment stack” model penetrates real-world enterprise clients; and whether players like Stripe and Lead Bank can build sustainable business flywheels across STaaS (Stablecoin-as-a-Service), proprietary payment chains and white-label wallet solutions. These will determine how far and how fast this new generation of stablecoin and payment infrastructure can scale.

3. Project Spotlight

Compliance Meets the ICO Slump; Wall Street Infrastructure Takes Over the RWA Narrative

The secondary market last week exhibited a distinct sense of dislocation. On one hand, SEC Chair Paul Atkins’ public remarks finally released a signal the crypto world has long awaited—that many ICOs should not be treated as securities. This seemingly opened the "compliance door" the industry has spent years waiting for. Yet, the market did not rejoice. Instead, we witnessed ICO fatigue: star projects backed by top-tier VCs, such as Monad and Gensyn, are increasingly relying on public sales for their debut. However, with post-launch prices repeatedly breaking their issue price, it is clear that user enthusiasm is waning. The "Wild West" ICO era, where a single whitepaper could trigger a wealth movement, has ironically declared its substantial end just as it finally gained legal status.

This collapse of old narratives is equally evident at the application layer. Farcaster, once regarded as the beacon of Web3 social, was recently forced into a strategic restructuring. The team effectively admitted that a vision relying solely on "open protocols" and "social graphs" is insufficient to build a commercial moat. By rebranding its official client and aggressively pushing the transactional Warpcast Wallet, Farcaster is signaling that market demand for Web3 social products that are highly homogeneous with Web2 has been falsified. However, Farcaster’s path to becoming a wallet will not necessarily be smooth. Earlier this year, Argent—the leading wallet in the StarkNet ecosystem—announced a pivot toward NeoBank and payment card services, confirming that the wallet sector is also facing "Red Ocean" competition. Farcaster’s financial compromise reflects a current industry consensus: without the drive of an asset wealth effect, narratives based purely on protocols and infrastructure are facing immense challenges.

While the crypto-native narrative falters, the external RWA (Real World Asset) process has achieved a milestone breakthrough. On December 12, a subsidiary of the DTCC (Depository Trust & Clearing Corporation) received a "No-Action Letter" from the SEC, approving a pilot for tokenizing real-world assets on the blockchain. Simultaneously, rumors circulate that Coinbase will soon launch tokenized stock products, and Interactive Brokers (IBKR) has begun supporting USDC deposits for U.S. users via partners.

The DTCC’s move is fundamentally different from previous crypto-equity projects that used offshore/SPV structures to "detour" regulations. As the de facto monopoly of the U.S. spot securities market, the DTCC processes up to $2.5 quadrillion in securities transactions annually; the vast majority of stocks and bonds traded in the U.S. are cleared and custodied through it. The entry of the DTCC and Coinbase marks the transition of RWA from a fringe experiment to a systemic upgrade of core financial infrastructure. We are approaching a future where U.S. stocks, Treasuries, and various dollar assets fully migrate on-chain at an unprecedented speed.

The dominant crypto market narrative beginning in 2025 and 2026 is vastly different from the 2017 or 2021 visions of geeks and grassroots movements attempting to build a new world outside the system. The once-revered tenets of "permissionless" and "decentralized" are rarely viewed as mandatory commandments in previous cycles. The current cycle is defined by how traditional financial giants and organizations practically utilize blockchain technology to enhance efficiency, making Digital Asset Tokenization (DAT), RWA, and stablecoin payment the new protagonists.

In this cycle of transitioning momentum, market strategies will bifurcate: either embrace the new compliant financial infrastructure represented by the DTCC, or dive deep into the on-chain world to find "outliers" like Polymarket—projects that, while existing in a gray area, solve real pain points and offer genuine disruption. In this "dumbbell-shaped" market structure, the mediocre middle path may well become the greatest risk.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.