BTC Halving Dates: A Full Historical Review, Revealing Bitcoin’s Halving Cycle and Future Price Prediction

2025/11/18 10:36:02

Introduction: BTC Halving Dates—The Most Critical Time Markers in Bitcoin’s Issuance Cycle

4In the world of cryptocurrency, no event generates as much attention—across technical, economic, and market levels—as the Bitcoin Halving. The Halving is a mechanism written into Bitcoin’s underlying code, ensuring that Bitcoin's supply will not grow indefinitely, ultimately capping the total supply at 21 million coins. It directly controls the speed of new Bitcoin issuance by cutting the miners' block reward in half.

These crucial BTC Halving Dates are not only significant milestones in crypto history but also key reference points for investors to forecast market cycles and formulate long-term strategies. For crypto enthusiasts, investors, and macroeconomic observers, an in-depth understanding of the Halving's economic principles and historical effects is central to grasping Bitcoin's narrative as a deflationary asset.

I. Historical BTC Halving Dates Review and In-Depth Case Analysis

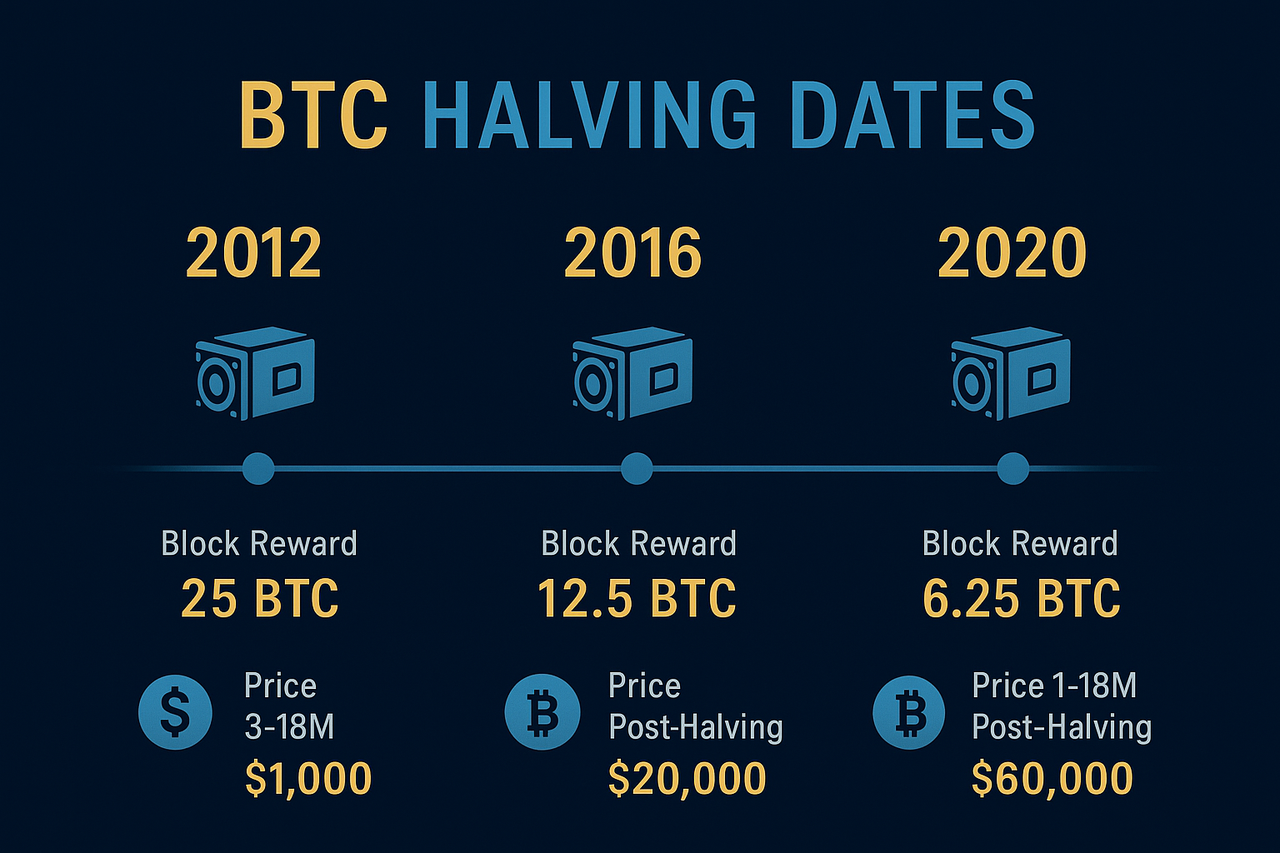

Bitcoin Halving occurs approximately every four years; more precisely, it happens after every 210,000 blocks are mined. Let us first review the three major Halving events that have occurred in history:

|

Halving Event |

Block Height | Approximate Date | Mining Reward (Before) | Mining Reward (After) | Approximate Price Increase 1 Year Post-Halving |

| First | 210,000 | November 28, 2012 | 50 BTC | 25 BTC | Approx. 9,200% |

| Second | 420,000 | July 9, 2016 | 25 BTC | 12.5 BTC | Approx. 2,900% |

| Third | 630,000 | May 11, 2020 | 12.5 BTC | 6.25 BTC | Approx. 680% |

In-Depth Case Study: Macroeconomic Insights from the Third BTC Halving Dates in 2020

The analysis of the third BTC Halving Dates (May 11, 2020) holds particular value because it occurred during an extremely unique macroeconomic turning point: the global pandemic outbreak and the launch of widespread Quantitative Easing (QE) by central banks worldwide.

The Halving's Macroeconomic Context and Catalyst:

-

Traditional Finance Distress: The Halving coincided with a period of global distrust in the traditional fiat currency system due to unprecedented liquidity injections. This environment heavily fortified Bitcoin's narrative as an inflation hedge.

-

Institutional Prelude: In the second half of 2020, public companies like MicroStrategy and Square (now Block) began adding Bitcoin to their balance sheets, introducing it to the mainstream of Wall Street. The combination of shrinking supply (the Halving effect) and exploding demand (driven by institutions and QE) propelled Bitcoin to its all-time highs.

Immediate Impact on Mining Operations:

-

Obsolescence and Upgrade: Miners' daily revenue immediately dropped by 50% after the Halving. This forced the large-scale capitulation and shutdown of older, high-cost, low-efficiency machines (like the S9 series), evidenced by a brief decline in network hashrate.

-

Driving Professionalization: This Halving significantly accelerated the retirement and upgrade of mining hardware, pushing the entire BTC Mining industry toward more industrial, professional, and energy-efficient operations.

Insight: The Halving acts as a catalyst for a bull run, but the price explosion is not an immediate switch. The real rally typically occurs 6 to 18 months after the Halving, as the supply shock accumulates and external macroeconomic conditions align.

II. The Economics of the Halving: Reshaping Inflation and Supply-Demand Dynamics

The core magic of the Halving mechanism lies in its direct control over the Inflation Rate, which fundamentally distinguishes Bitcoin from traditional fiat currency issuance systems.

-

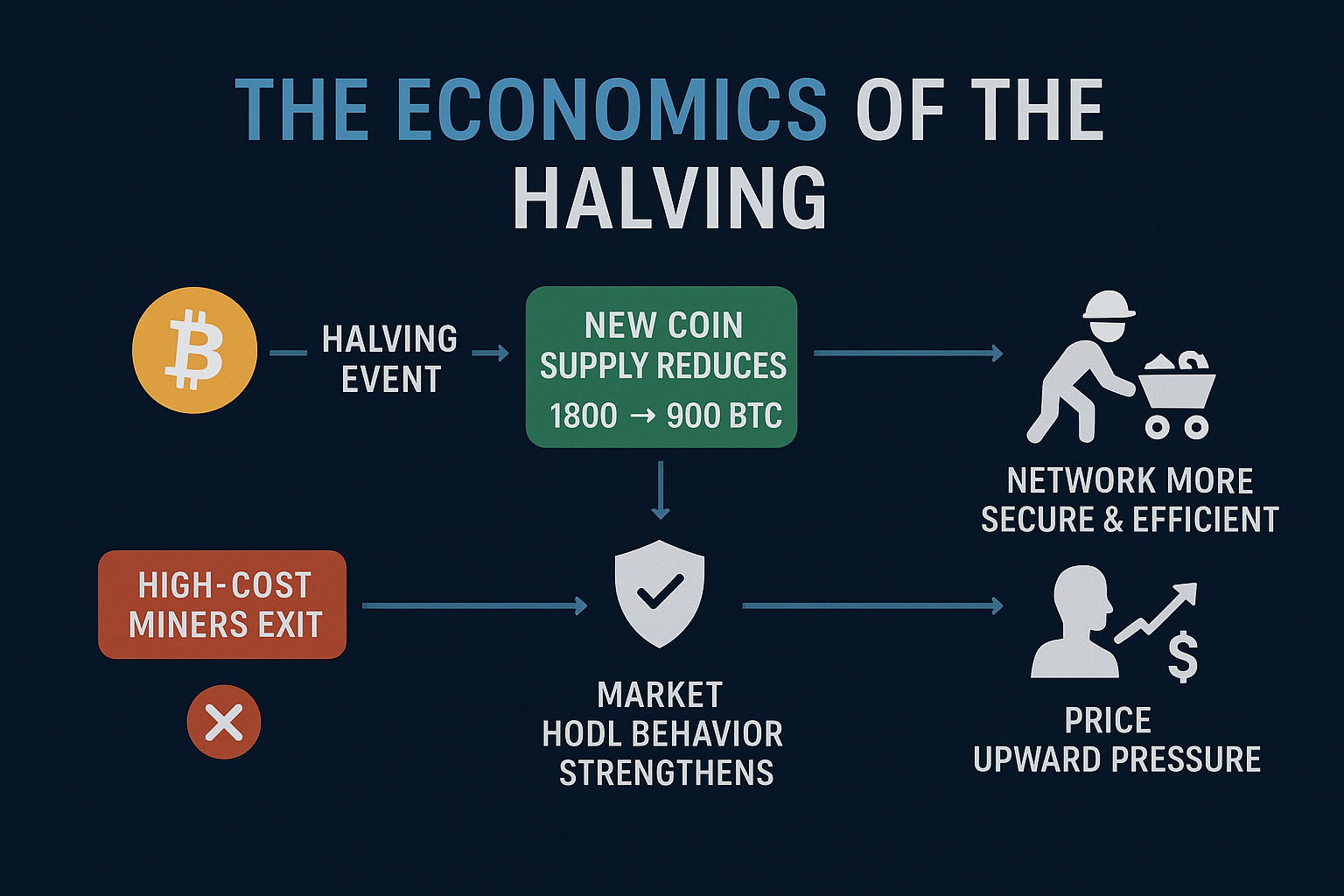

Supply Shock and Scarcity

The Halving mechanism cuts the new supply of Bitcoin in half, and this abrupt tightening of supply is the foundation upon which the Halving's effect on the BTC price is built. For instance, the third Halving reduced the daily new supply to approximately 900 BTC. With demand remaining constant or increasing, this programmatic scarcity heavily reinforces Bitcoin's value proposition as "digital gold."

-

Impact on the Miner Ecosystem

The Halving event is also a cyclical cleansing of the BTC Mining industry.

-

Efficiency-Driven Survival: Only miners with the lowest power costs and highest mining efficiency survive and remain profitable.

-

Enhanced Network Security: By eliminating inefficient participants, the network is ultimately secured by the most professional and well-capitalized miners, which reinforces the long-term security and decentralization of the Bitcoin network.

-

Reinforcement of HODLing Behavior

Market participants and long-term investors often anticipate a price increase around the BTC Halving Dates, thereby strengthening the inclination to HODL (hold for dear life). This behavior further reduces the effective circulating supply in the market, intensifying upward price pressure.

III. Next Halving Prediction and Market Preparation

The next critical milestone is the fourth BTC Halving Dates.

Next Bitcoin Halving Prediction

Based on block height calculations, the next Halving is expected to occur at Block Height 840,000. While the exact date depends on the network's block speed, the general consensus predicts the fourth BTC Halving Dates will arrive around 2028, when the block reward will be halved again to 1.5625 BTC.

Phased Market Response Analysis

Investors typically navigate the Halving cycle through several stages:

-

Year Before Halving (Accumulation Phase): Market sentiment begins to warm up, and early investors and institutions start accumulating positions; volatility is often lower.

-

Six Months Before Halving (Volatility Phase): Media and public attention peaks, price volatility increases, and sharp corrections may occur.

-

Post-Halving Phase (Explosion Phase): The Halving event itself may lead to a brief "buy the rumor, sell the news" correction. However, the true bull market typically erupts within 6 to 18 months post-Halving, as the cumulative effect of the supply shock takes hold.

Understanding the historical patterns of BTC Halving Dates does not mean we can perfectly predict future prices, as each cycle is subject to different macroeconomic backdrops.

Investment Strategies for the Halving Cycle

-

Dollar-Cost Averaging (DCA): The most robust strategy. By buying a fixed dollar amount of Bitcoin at regular intervals, regardless of when the BTC Halving Dates occur, investors effectively diversify risk and avoid buying a market peak.

-

Monitor Supply Dynamics: Investors should closely track Bitcoin reserves on exchanges, miners' selling behavior, and institutional fund inflows, which are crucial indicators of actual supply tightness.

-

Mining Stock Investment: Mining companies face the greatest challenge post-Halving. However, publicly traded mining companies with low power costs and the latest ASIC miners often see greater leveraged returns when the market rebounds.

Key Risk Warnings

-

Macroeconomic Headwinds: Unlike previous cycles, future Halving periods may be constrained by macroeconomic factors like higher interest rates and geopolitical conflicts. The liquidity environment might be less generous than in 2020.

-

"Buy the Rumor, Sell the News" Effect: Excessive hype leading up to the Halving can lead to short-term corrections immediately following the event; investors should avoid blindly chasing pumps during peak excitement.

-

History Is Not Destiny: As Bitcoin's market capitalization grows, its price volatility tends to decrease, meaning future percentage gains may not replicate the spectacular numbers of the early Halving cycles.

Conclusion: BTC Halving Dates Solidify Bitcoin’s Long-Term Narrative

BTC Halving Dates are the core element of Bitcoin’s design—they are not just computational cycles, but the economic driver that defines Bitcoin's long-term narrative of scarcity, deflation, and decentralization. It is these programmed Halvings that distinguish Bitcoin from traditional fiat currencies and cement its status as "digital gold."

For every participant, paying attention to the BTC Halving Dates is akin to paying attention to Bitcoin's core value and its promise of resistance against inflation. Understanding this cycle helps investors formulate more forward-looking and resilient long-term investment strategies.