Breaking Key Resistance: Analyzing the Current Market Momentum of BTC A USD

2025/11/11 13:12:02

Introduction: Why BTC A USD is So Crucial

Bitcoin (BTC) has evolved from a niche experiment into an essential asset class in the global financial system. Of all trading pairs, BTC A USD (Bitcoin against the US Dollar) is undoubtedly the core hub of the global crypto market, serving as the crucial benchmark for crypto health and liquidity. The exchange rate of Bitcoin to the US Dollar—the price of BTC A USD—not only reflects the supply-demand balance for digital gold but also acts as a barometer for global investor sentiment and macroeconomic pressures.

The market is currently at a critical inflection point, with Bitcoin attempting to break through significant psychological and technical resistance levels after a period of consolidation. This article aims to deeply analyze the core factors driving the current momentum of BTC A USD, specifically the twin engines of institutional capital influx and cyclical halving mechanics, and offer forward-looking strategies for various types of investors.

Part I: Historical Review: Price Milestones of BTC A USD

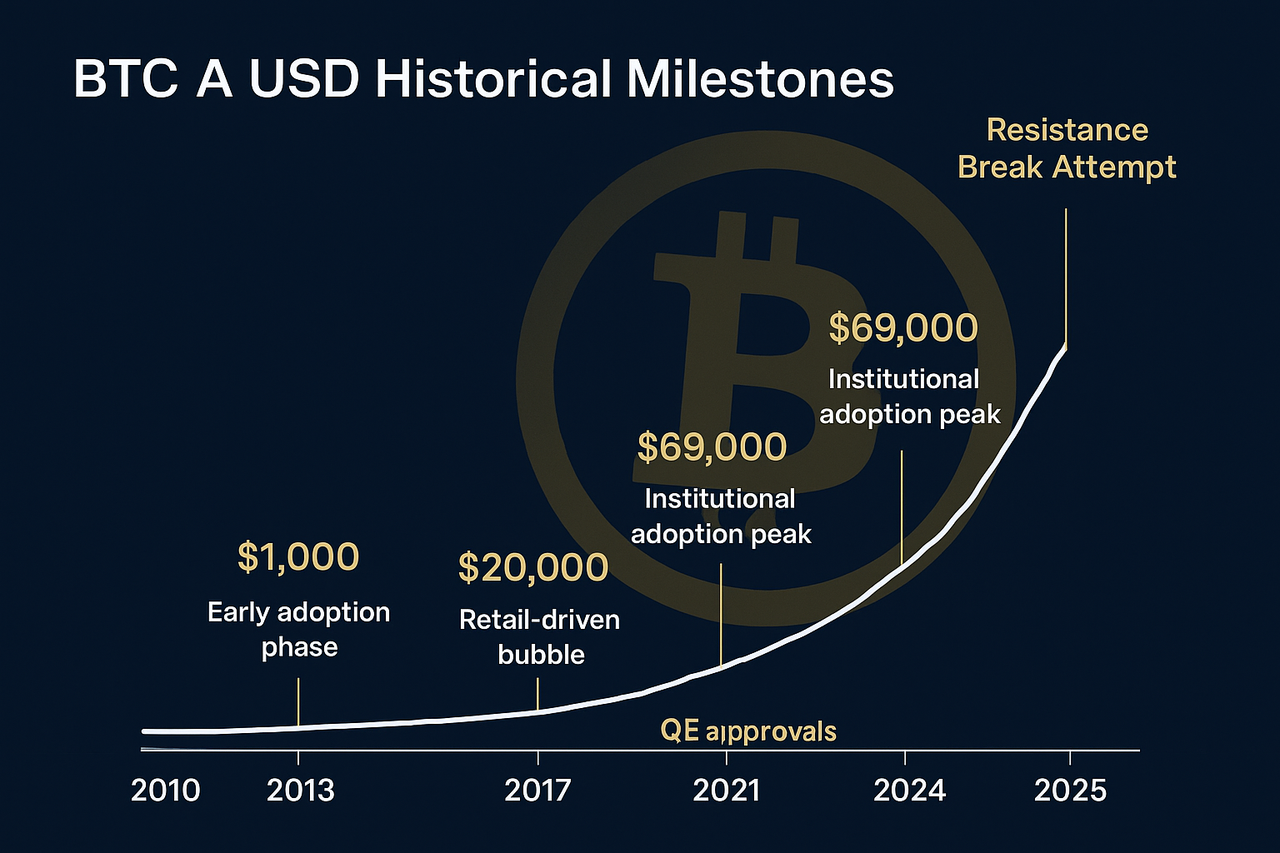

A review of the BTC A USD price movement reveals its characteristics of explosive growth and cyclical volatility. From a few cents initially, to the first breakout past $20,000 in 2017, and then to the all-time high in 2021 driven by quantitative easing and institutional interest, every monumental breakthrough has been accompanied by significant external catalysts.

The 2020-2021 Super Cycle was the most recent peak: faced with economic uncertainty caused by the global pandemic, central banks worldwide implemented massive monetary stimulus. Institutional investors began to view Bitcoin as "digital gold" and an inflation hedge, propelling BTC A USD to new heights. Each historical rally has built a new base value and broader market consensus for BTC A USD, helping us gauge the strength of current support and resistance levels.

Part II: The Dual Core Drivers of BTC A USD Momentum

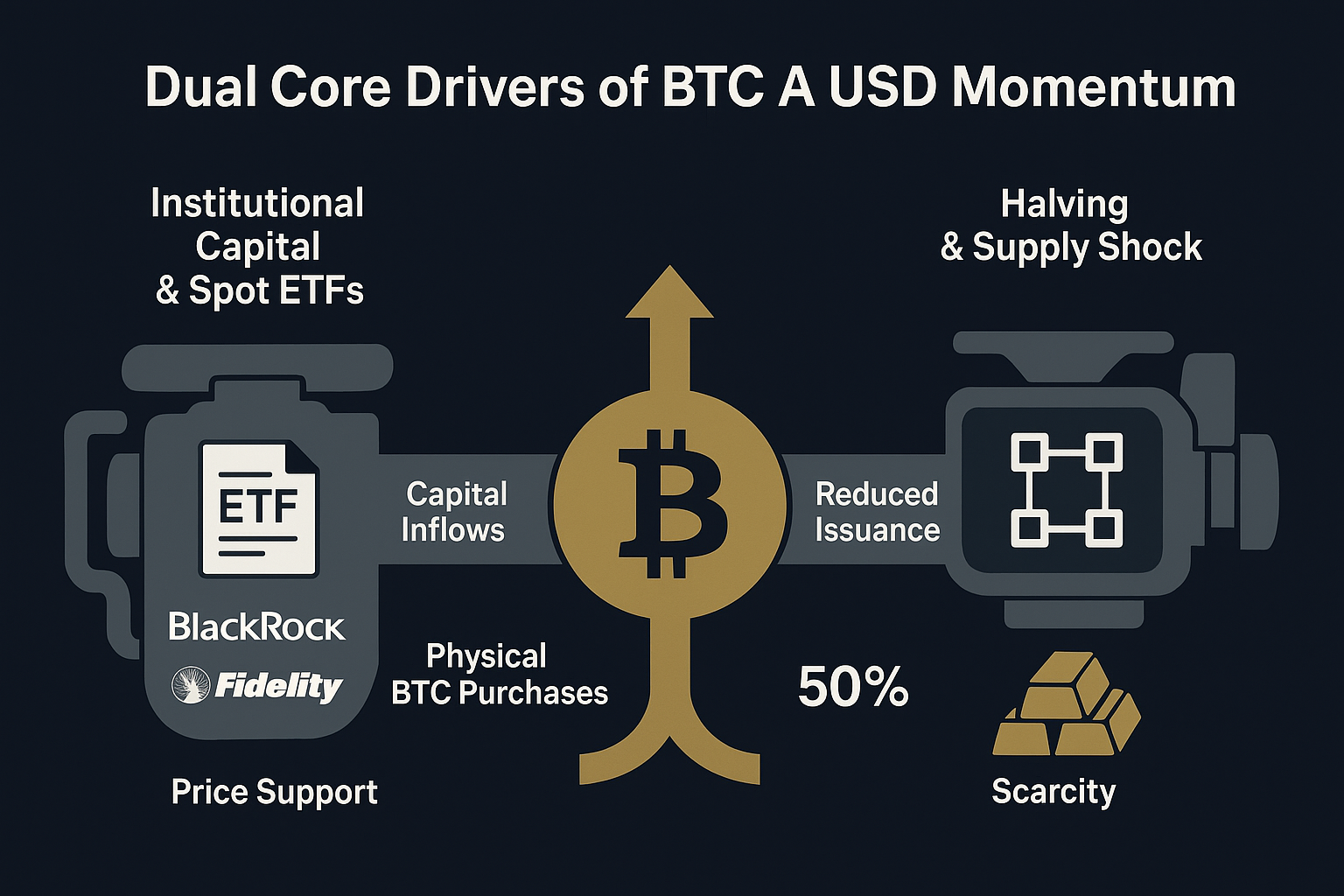

The factors influencing the price dynamics of BTC A USD are now more complex than ever, but the core momentum is driven by institutional adoption and Bitcoin’s inherent deflationary mechanism.

Institutions and Regulation: The Capital Moat Provided by Spot ETFs

The approval and listing of spot Bitcoin ETFs represent the zenith of Traditional Finance (TradFi) embracing digital assets. The flows into these products signify the strategic allocation by major institutions, wealth management firms, pension funds, and potentially sovereign wealth funds.

-

Sustained Net Inflows and Price Discovery: High daily net inflow data is the most direct measure of institutional demand. This represents new, large-scale traditional capital shifting from fiat currency (USD) to BTC. Crucially, this persistent and passive buying pressure forces ETF issuers (like BlackRock, Fidelity) to purchase an equivalent amount of physical BTC on the open market. This is the core force driving the BTC A USD price, providing a solid floor—or "capital moat."

-

Comparison to Gold ETFs: Bitcoin ETFs are expected to follow a trajectory similar to the Gold ETF (GLD), potentially at a faster pace. Traditional financial advisors can now easily allocate BTC A USD as "digital gold" to clients, significantly widening market depth and, over the long term, shifting the price discovery mechanism to align more closely with the high liquidity standards of traditional markets.

Internal Cyclical Event: Halving’s Supply Shock and Lag Effect

The Halving is the most critical supply-side event, occurring approximately every four years, cutting the block reward for miners in half. This effectively doubles Bitcoin's Stock-to-Flow (S2F) ratio, pushing its scarcity closer to that of gold.

-

Supply-Side Shock: The immediate result is a sharp drop in new Bitcoin issuance, with the annual inflation rate falling to around 0.8%, lower than the current annual production of gold. This digital scarcity is the central pillar of the BTC A USD value narrative.

-

Historical Lagging Pattern: Historically, all three previous Halvings (2012, 2016, 2020) demonstrated a similar cycle: significant price appreciation does not happen immediately but typically occurs 12 to 18 months after the event. This lag is necessary for the market to fully absorb the permanent supply reduction and for demand to gradually accumulate pressure against the resulting supply shortage. Therefore, the upcoming Halving is widely anticipated to again be a core narrative driving BTC A USD appreciation.

-

Short-Term Volatility: Investors should be cautious of potential "Miner Capitulation" in the months leading up to the Halving, where less efficient miners may sell BTC due to rising costs, causing short-term selling pressure. However, this is often viewed as the final cleanse before a bull run.

Part III: Macro Environment and Investment Strategy

Macro Environment: The Dollar-Bitcoin "Seesaw"

Despite the massive influence of institutional money and the Halving, BTC A USD remains significantly affected by the global macroeconomic environment:

-

Fed Policy and DXY: The Federal Reserve's interest rate decisions directly impact global liquidity. Tightening cycles pressure risk assets; easing cycles benefit BTC A USD. Conversely, a weakening US Dollar Index (DXY) generally means capital flows into alternative assets, creating favorable conditions for Bitcoin’s rise.

-

Technical Analysis Focus: With institutional participation, key technical levels are paramount. Breaking a critical resistance level (e.g., the all-time high or a key Fibonacci level) can trigger massive algorithmic buy orders, rapidly pushing the BTC A USD price higher. Monitoring key psychological levels, such as $30,000, as long-term support is also crucial.

Future-Oriented Investment Strategies

Given the complex environment and upcoming cyclical events, different investor groups should adopt differentiated strategies for allocating BTC A USD.

-

For Onlookers: Those not yet invested should employ the Dollar-Cost Averaging (DCA) strategy—regularly investing a fixed amount to buy BTC A USD, regardless of the price. This effectively smooths out the entry cost and prevents missteps from trying to "time the market." Purchases should be made through compliant ETF or exchange channels.

-

For Established Investors: Investors should continue to view BTC A USD as a tool for inflation hedging and asset diversification. Due to its low correlation with traditional assets like stocks and bonds, allocating Bitcoin helps reduce systematic risk in the overall portfolio. Furthermore, utilizing on-chain data (like long-term holder behavior) is essential to supplement traditional technical analysis, providing insights into the market's structural supply and demand.

Conclusion: The Long-Term Vision for BTC A USD

The BTC A USD market is transitioning from a marginalized, retail-dominated space into a mature asset class driven by institutional capital and macroeconomics. The current push to break key resistance levels reflects strong market confidence in the long-term value of BTC A USD and positive anticipation for future supply shocks and sustained institutional adoption.

For investors, while short-term volatility is inevitable, Bitcoin's digital scarcity, decentralized nature, and ever-growing network effects constitute its unbreakable long-term value foundation. Understanding the internal and external factors driving the BTC A USD price and adhering to a disciplined investment strategy are key to seizing the opportunity presented by this transformative asset of the digital age.