Going Long and Going Short in Crypto Futures: The Complete Beginner’s Trading Guide

2025/08/21 09:30:02

In the rapidly evolving cryptocurrency market, besides basic spot trading (buying and selling actual crypto assets), Crypto Futures are becoming increasingly popular. They offer investors a new way to trade, allowing them to profit regardless of whether the market goes up or down.

To truly understand crypto futures, we must first grasp the two core pillars of trading: 'Going Long' and 'Going Short'. By mastering these concepts, you unlock the secret to profiting in both bull and bear markets.

1.What Is a Crypto Future?

(Source: DA Financial Service Singapore)

Simply put, a crypto future is a contract, not the actual crypto asset itself. This contract allows you to buy or sell a crypto asset at a predetermined price at a specific time in the future.

It has three key differences from spot trading that we are familiar with:

-

The Asset Traded: You trade a contract, not real BTC or ETH, which means you don't need to physically own the coins.

-

Two-Way Trading: Spot trading only allows you to "go long," which is to profit from buying low and selling high. Futures trading, however, allows you to go long and go short, providing opportunities to profit whether the market rises or falls.

-

Leverage: Futures trading often comes with a leverage feature, which means you can control a much larger contract value with a small amount of capital, thereby amplifying your potential profits (and risks).

2.What Is 'Going Long'?

"Going long" is a fundamental operation in futures trading. The core idea is: betting on an uptrend.

When you believe the price of a certain cryptocurrency will rise, you choose to 'go long' on the contract.

This logic is perfectly consistent with spot trading—buying low and selling high.

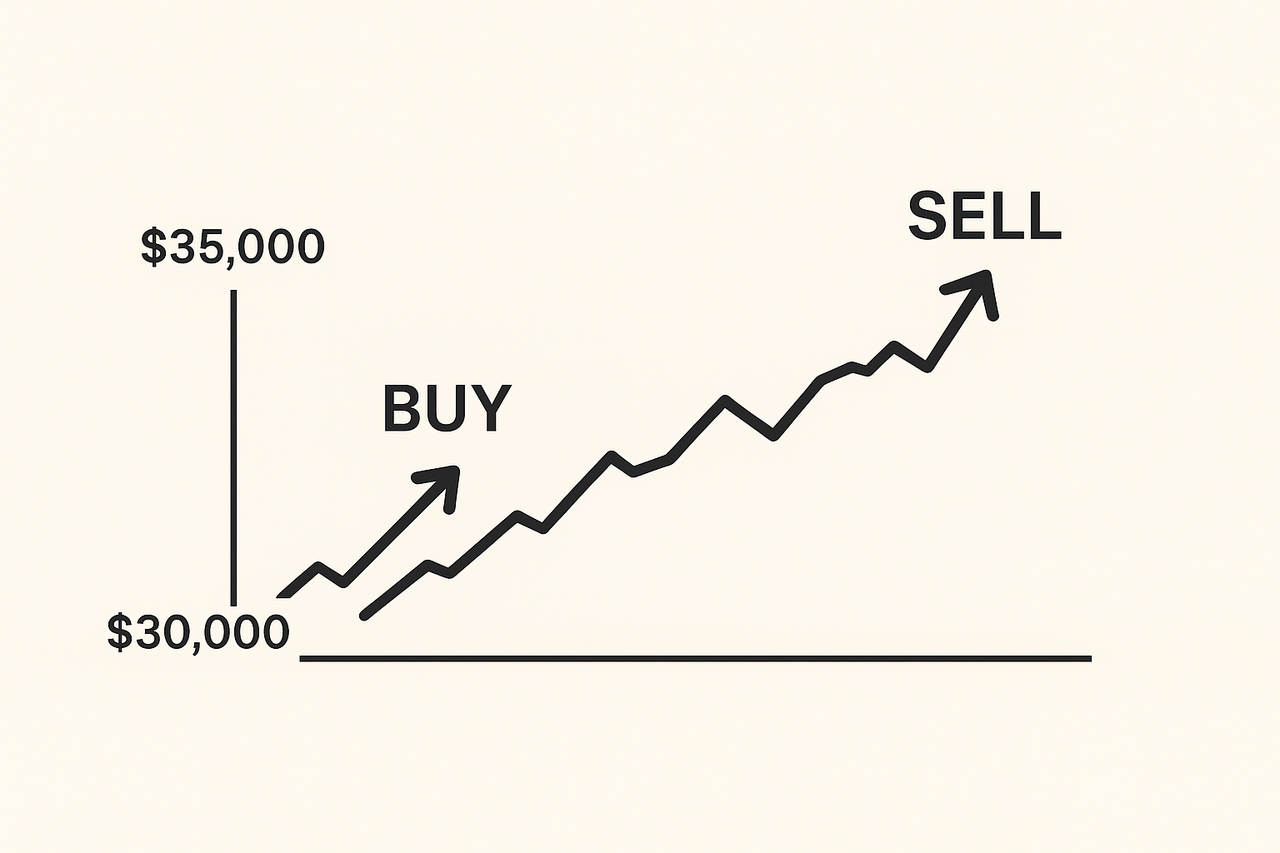

【A Practical Example: Going Long on Bitcoin (BTC)】

-

Assumption: You are bullish on Bitcoin and believe its price will rise.

-

Step 1: Buy. When the BTC price is $30,000, you buy a long position on a Bitcoin futures contract.

-

Step 2: The price rises. A few days later, the Bitcoin price increases to $35,000, as you expected.

-

Step 3: Sell. You close your position by selling the contract at $35,000.

-

Result: Your profit = Selling Price - Buying Price = $35,000 - $30,000 = $5,000.

In futures trading, you only need to put down a small amount of margin (via leverage) to control a contract with the full value of one Bitcoin, thus amplifying your potential returns.

3.What Is 'Going Short'?

"Going short" is what makes futures trading unique. The core idea is: betting on a downtrend.

When you believe the price of a certain cryptocurrency will fall, you choose to 'go short' on the contract.

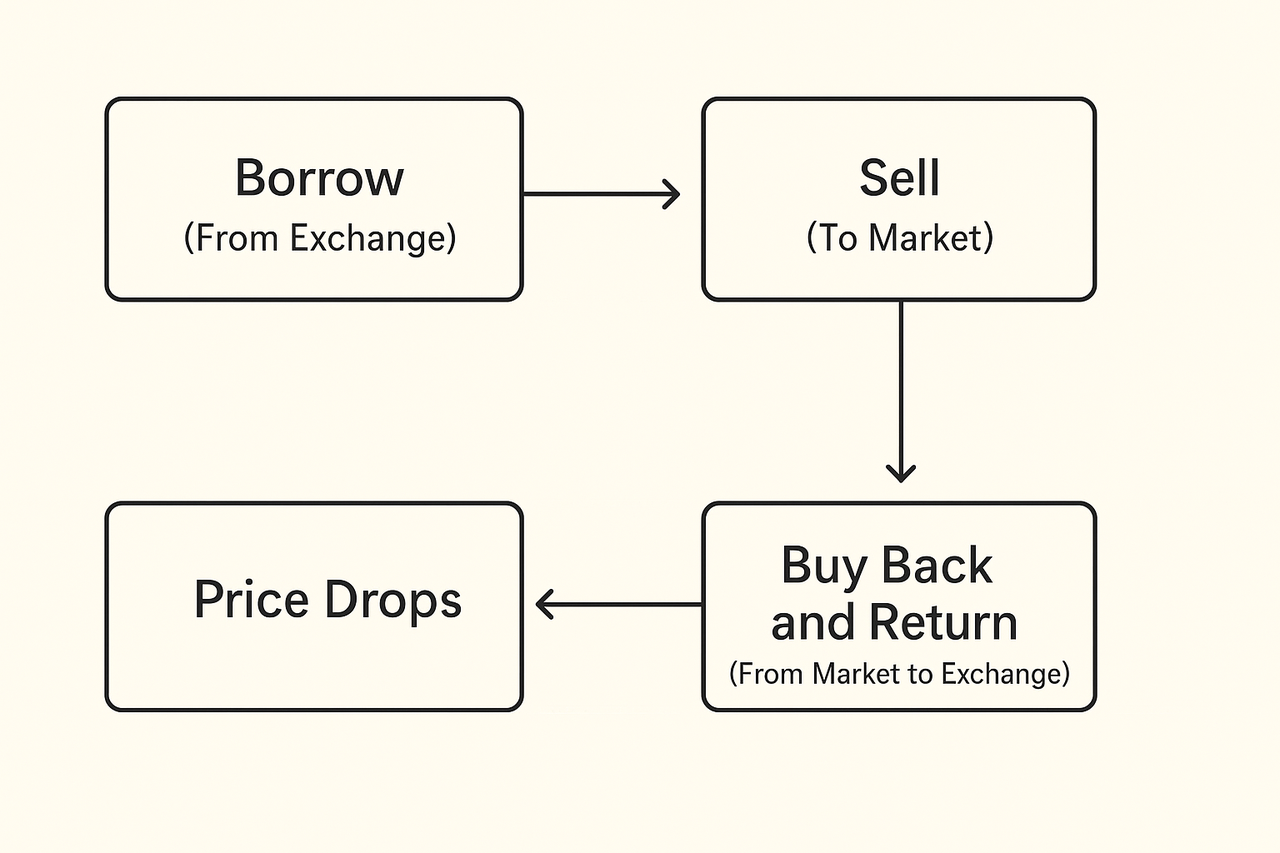

Its operational principle is "sell first, then buy," which might seem counterintuitive at first, but the logic is simple:

【A Practical Example: Going Short on Ethereum (ETH)】

-

Assumption: You believe the price of Ethereum (ETH) will fall, and the current price is $2,000.

-

Step 1: Borrow and Sell. Through a futures contract, you borrow one ETH and immediately sell it at the current price of $2,000.

-

Step 2: The price falls. A few days later, the ETH price drops to $1,500, as you expected.

-

Step 3: Buy back and return. You buy back one ETH at the lower price of $1,500.

-

Step 4: Close the position. You return the ETH to the contract provider, completing the transaction.

-

Result: Your profit = Selling Price - Buying Price = $2,000 - $1,500 = $500 (not including fees).

Going short allows you to profit from a falling market through a reverse operation, which is not possible in spot trading.

4.Why Are 'Long' and 'Short' So Important?

The combination of these two concepts provides cryptocurrency futures trading with immense flexibility and strategic value:

-

Dual-Directional Profitability: It shatters the traditional notion that you can only make money in a bull market and lose money in a bear market. It gives you the ability to profit regardless of whether the market is in an uptrend or a downtrend.

-

Effective Risk Hedging: For investors who hold a large amount of spot assets long-term, the "going short" feature is an important risk management tool. For example, if you hold $100,000 worth of BTC but anticipate a short-term correction, you can hedge that risk by going short on an equivalent futures contract. If the BTC price does fall by 10%, the loss on your spot holdings will be offset by the profit from your futures contract, protecting your overall asset value.

5.How Can a Beginner Trade Futures Safely?

Although "going long" and "going short" offer great opportunities, they are closely tied to the risk of leverage. Please remember: leverage can amplify your gains, but it can also multiply your losses. If the market moves in the opposite direction of your prediction, your account could face liquidation, where all of your funds are forcibly closed out.

【A Liquidation Example with Leverage】

-

Assumption: You have $100 in capital and want to go long on an ETH contract.

-

Action: You use 20x leverage, using your $100 to control a $2,000 ETH long position.

-

Risk: When the ETH price falls, your losses are also amplified by 20x. If the ETH price drops by just 5% ($2,000 x 5% = $100), your account balance will be wiped out, leading to liquidation.

Beginner Safety Advice:

-

Start with spot trading: Before you fully grasp the basics and risk control, stick to zero-leverage spot trading.

-

Start with small amounts: If you decide to try futures, start with a very small amount of capital and very low leverage (e.g., 2x or 3x).

-

Always set a stop-loss: Before placing any leveraged trade, you must set a stop-loss point. This is the most important line of defense to protect your funds.

-

Understand the liquidation price: Before you enter a trade, be sure you know exactly what your liquidation price is.

Conclusion

"Going long" and "going short" are the two cornerstones of the crypto futures market. They provide traders with a new perspective and tools, allowing us to respond more flexibly to market changes. But please always prioritize risk management. Only through continuous learning and cautious trading can you become the ultimate winner in this two-way game.

Further Reading:

-

Futures Trading Guide: https://www.kucoin.com/support/27703947513497

-

Kucoin Futures: https://www.kucoin.com/futures

-

FAQ about Futures: https://www.kucoin.com/support/sections/26683146605849