KuCoin Ventures Weekly Report: Exchange "Universalization" Breakout & Macro Policy Divergence; PayFi & Stablecoins Lead New Primary Market Trends

2025/12/22 21:51:02

1. Weekly Market Highlights

Exchange Monitor: Compliance Onshoring, Blurring Boundaries, and Undercurrents in the Zero-Fee War

This week epitomized the dramatic shifts in the exchange landscape, with clear signals of Centralized Exchange compliance "onshoring" and convergence emerging in late 2025. Top-tier platforms are squeezing the survival space of mid-tier exchanges through two primary paths:

First, CEXs that once temporarily exited core markets due to regulatory pressure are leveraging the current political window (e.g., the Trump administration's crypto-friendly stance) or new compliance pathways to storm back into high-net-worth jurisdictions like the US, UK, and Europe. Second, exchanges represented by Coinbase are dismantling the wall between Crypto and TradFi, establishing "Universal Accounts" as the new industry standard. For other players in the sector, simple spot matching and derivatives businesses are no longer the sole battlegrounds; future barriers to entry will require a combination of more diverse capabilities.

According to Bloomberg, Binance is exploring a capital restructuring to reboot Binance.US. Specific concessions may include reducing founder CZ's controlling stake, actively aligning with the Trump family's crypto project, World Liberty Financial, and seeking deeper interest alignment with global asset management giant BlackRock. To regain its ticket to the US market, Binance appears willing to pay a heavy price in terms of equity and control.

Binance is not an isolated case. In the past month, KuCoin secured registration with Austrac in Australia and a MiCA license in Austria, stepping into the regulated chessboards of Europe and Australia. Last week, two years after exiting the UK market, Bybit chose a cleverer path: resuming UK operations by partnering with the licensed institution Archax (which acts as the approver for its financial promotional content).

Alongside compliance onshoring and expansion, exchange product forms are undergoing an irreversible qualitative change, most notably this year through the dissolution of product boundaries. Platforms like Coinbase and Bitget are breaking the isolation between Crypto and TradFi, making "Universal Accounts" the new industry standard. Coinbaserevealed its ambition in this week's "System Update": no longer content with being just a crypto exchange, it is challenging brokerages. Users can now use USDC in their accounts to buy US stocks directly, or even trade Solana altcoins via an integrated Jupiter aggregator. This means Coinbase is attempting to package "Nasdaq" and an "On-chain Casino" into a single App. Similarly, Bitget launched a "Universal" strategy in offshore markets, allowing users to use USDT as margin to trade Gold, Crude Oil, Forex, and US Stock CFDs. This evolution further enhances the user trading experience, eliminating the need for investors to frequently deposit and withdraw across multiple platforms to allocate different assets.

On the other hand, against the backdrop of product convergence, veteran CEX Bitfinex attempted to stir the market this week with a primal pricing tactic. Bitfinex announced a platform-wide, all-category permanent zero-fee policy. This is not a short-term promotion, but covers spot, margin, perpetual contracts, securities, and even OTC trading; fees are zero for both Makers and Takers. The intent is to siphon market-wide existing liquidity and high-frequency traders through extreme low costs. This exerts uncomfortable pressure on the current brutal CEX battlefield. If competitors start lowering fees or going free, how should CEXs build their own exclusive moats?

The "Hard Mode" of the exchange sector is slowly unfolding. For other players, simple token-to-token matching and contract businesses may no longer be core competitive barriers. The future high ground has shifted to capabilities in compliance channels, capturing real liquidity, cross-asset settlement, and extreme cost control to survive the intensifying war.

2. Weekly Selected Market Signals

Global Monetary Policy Divergence Materializes: A “Hawkish Cut” by the Fed Meets BOJ Rate Hikes, Pushing Risk Assets into a Repricing Phase

Last week, global macro variables centered on two pivotal central bank meetings. The Federal Reserve delivered a widely expected 25bps rate cut at its December FOMC meeting. However, through the updated dot plot and Chair Jerome Powell's remarks, the Fed sent a clear signal: future easing room is limited, and the neutral real interest rate may settle significantly higher than pre-pandemic levels. Simultaneously, on December 19, the Bank of Japan officially raised its policy rate by 25bps to 0.75%, initiating a new tightening cycle. The synchronized yet opposing moves by these two major central banks—shifting away from extreme policies—mark a transition from "coordinated easing expectations" to a new phase of regional divergence and structural maneuvering.

Against the backdrop of the Fed's "cutting but not loosening" stance, the U.S. Treasury yield curve continued its bear steepening trend. While short-end yields retreated following the policy rate cut, long-end yields remained elevated or even edged higher, constrained by high deficits, bond supply pressure, and inflation uncertainty. This combination alleviated short-term financing pressures but simultaneously raised the discount rate for equity assets, weighing on the valuations of high-duration growth stocks and risk assets. Meanwhile, though the BoJ’s hike was partially priced in, its symbolic significance outweighed the rate adjustment itself: the world’s last major central bank to maintain ultra-loose policy is systematically exiting the stage, further clarifying the trend of narrowing U.S.-Japan interest rate differentials.

Data Source: investing.com

After the policy outcomes were finalized, traditional risk assets showed no uniform rally. U.S. stocks oscillated at elevated levels post-FOMC, with AI and high-valuation tech sectors exhibiting divergent performance. Changes in FX and rates markets were more directional: the yen experienced heightened volatility around the BOJ meeting, Japanese bond yields shifted upward across the curve, and the attractiveness of carry trades based on U.S.-Japan yield differentials was systematically reduced. Over the longer term, the trend of Japanese domestic capital repatriating from overseas assets (especially U.S. Treasuries) is likely to persist, weakening demand for U.S. Treasuries, placing ongoing upward pressure on global long-end rates, and influencing the valuation center of global risk assets via the discount-rate channel.

The crypto market quickly reflected this shift in sentiment. Against a backdrop of heightened macro uncertainty, the secondary crypto market continued its pattern of weak consolidation. BTC repeatedly failed to break above $90,000 and retreated toward the mid-range; ETH was struggling around the $3,000 level without establishing an independent trend. High-beta themes and meme sectors faced broad pressure, with only isolated event-driven tokens showing brief spikes that provided limited lift to overall sentiment.

Data Source: tradingview.com

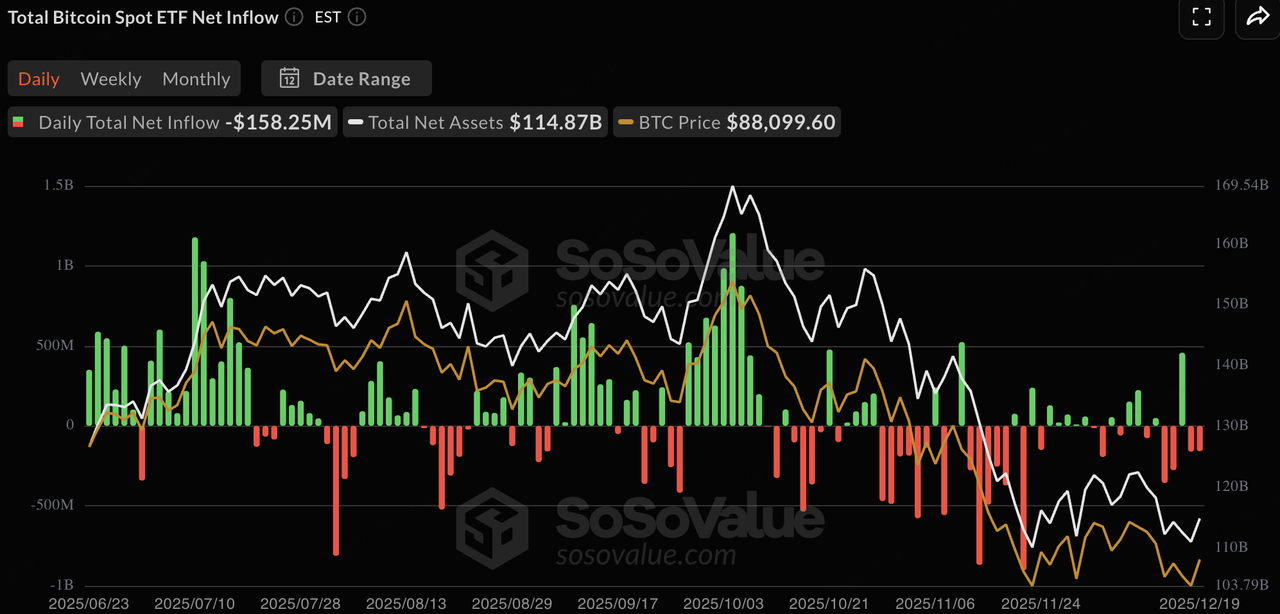

Last week, spot crypto ETFs recorded significant net outflows, indicating that traditional institutional capital, facing uncertainty from “Super Central Bank Week,” prioritized profit-taking and risk reduction ahead of the Christmas holiday. BTC spot ETFs saw weekly net outflows of approximately $500 million, underscoring dominant wait-and-see sentiment among institutions near the $90,000 resistance level and a shift from incremental inflows to stock-game dynamics. ETH spot ETFs performed even weaker, with weekly net outflows reaching about $640 million. When macro uncertainty rises (BOJ hike + Fed hawkish outlook), institutions tend to first trim exposure to high-beta, lower-liquidity assets. Given ETH’s relatively muted gains and on-chain narrative momentum in this cycle, it has become a preferred candidate for defensive reduction in year-end portfolio rebalancing, allowing institutions to free up cash or rebuild Treasury positions.

Data Source: SoSoValue

On-chain liquidity showed slowing growth in total stablecoin issuance. USDT remained the primary source of incremental supply, with a market cap of $186.8 billion, up 0.27% week-over-week, further consolidating its dominance above 60%. USDC declined modestly by 1.62%, reflecting some capital rotation. Other stablecoins displayed clear divergence: emerging/yield-bearing variants such as RLUSD and USYC posted positive growth (+3.19% and +5.09%, respectively), while USDe and DAI continued deleveraging with declines of 1.37%-1.85%. Specifically, USYC, as a yield-bearing stablecoin, passes through short-term Treasury and repo yields to holders (functioning like an on-chain money market fund), offering passive income while maintaining near 1:1 USD pegging and instant USDC redeemability—a feature particularly appealing to institutions during year-end rebalancing to avoid idle cash. Overall, this mild signal suggests capital has not yet exited the crypto market en masse but is waiting for post-holiday opportunities.

Data Source: DeFiLlama

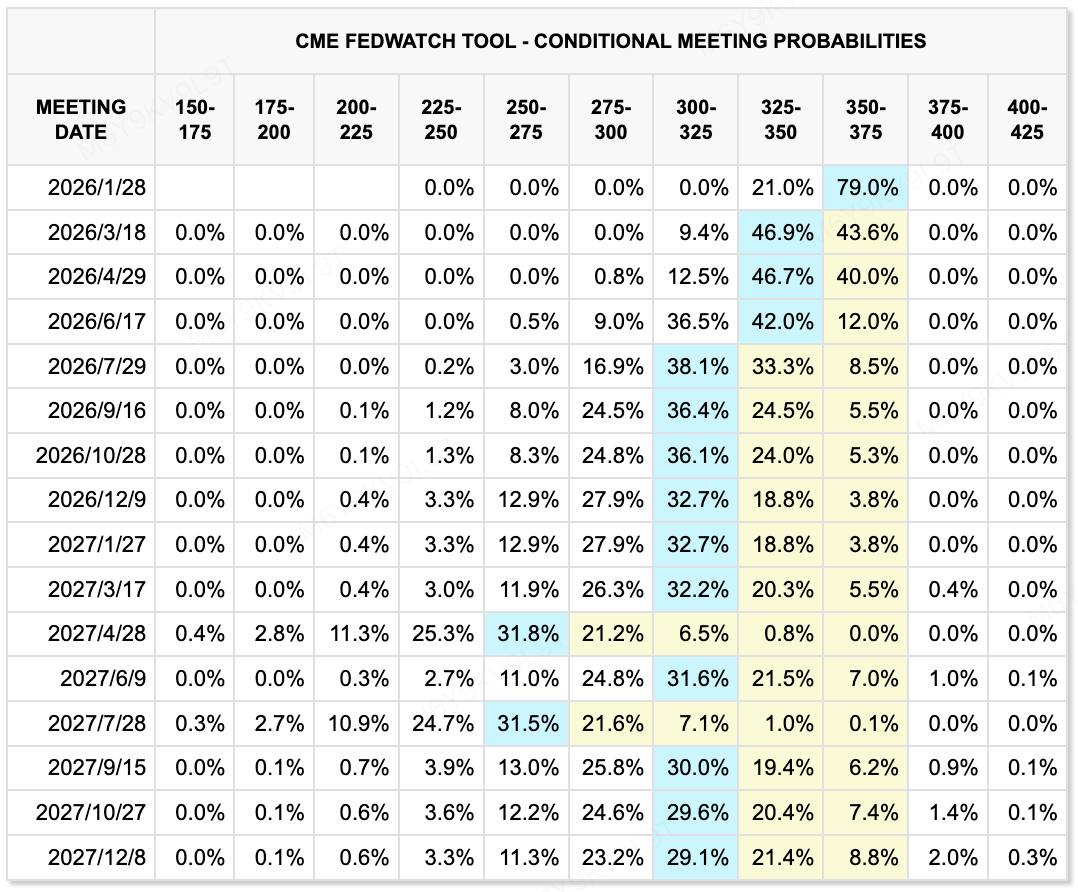

According to the CME FedWatch Tool, markets assign a 79% probability that the Federal Reserve will hold rates unchanged at its January meeting. For the March and April meetings, implied probabilities of additional cuts remain subdued, with no clear pricing of cumulative 50bp easing. The market’s base-case expectation for 2025 points to 25–50bp of total cuts over the year. This pricing path reflects ongoing digestion of inflation dynamics and the broader growth outlook.

Data Source: CME FedWatch Tool

Key Events to Watch This Week:

-

December 23: U.S. Q3 GDP (final), Consumer Confidence Index

-

December 26: Release of Bank of Japan December meeting minutes, providing clues on the timing of the first 2026 rate hike

Primary Market Observation:

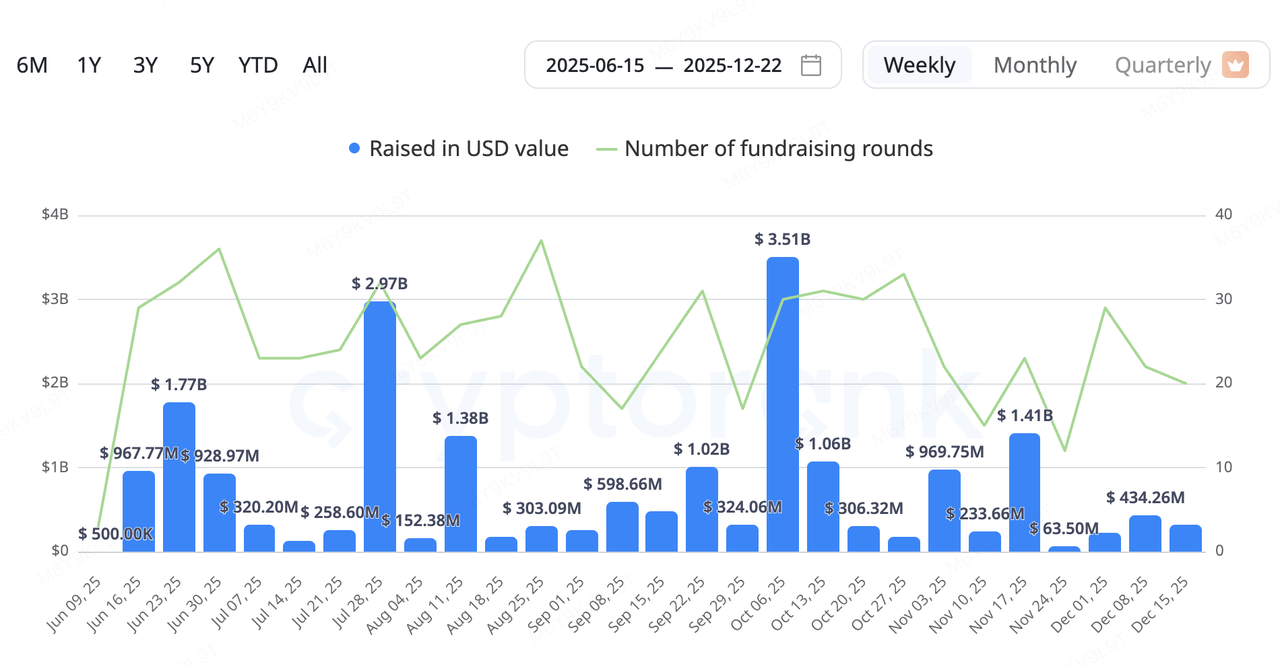

Primary market capital continued to favor infrastructure-oriented projects with tangible real-world applications, with payments, DePIN, data, and AI-related projects emerging as key areas of focus. The DePIN and PayFi sectors were particularly active. Projects such as Fuse (energy networks), DAWN (decentralized broadband), ETHGAS (Ethereum gas abstraction), and Speed (Bitcoin computation layer) announced new funding rounds, reflecting sustained investor interest in narratives centered on mapping on-chain resources to real-world productive capacity. Seasonally, late-stage rounds (Series B and beyond) and strategic investments accounted for a larger share of activity, with capital increasingly emphasizing cash flow potential over early-stage, high-risk optionality.

Data Source: CryptoRank

-

Fuse Energy (formerly Project Zero): The Solana-based energy DePIN project announced a $70 million Series B round led by Lowercarbon Capital and Balderton Capital, with a post-money valuation of approximately $5 billion. Fuse employs a vertically integrated "source-to-socket" model, building renewable energy facilities and supplying power directly to consumers. By internalizing the supply chain and introducing on-chain settlement and governance, Fuse aims to eliminate inefficiencies in traditional energy markets. Founded by former Revolut executives, the project currently serves approximately 200,000 households in the UK.

-

DAWN: Developed by the Andrena team, the decentralized broadband protocol DAWN completed a $13 million Series B round led by Polychain Capital. DAWN allows users to deploy dedicated hardware nodes ("Black Boxes") to provide broadband access in exchange for token incentives, positioning itself as a decentralized alternative to traditional ISPs. While its network purportedly covers millions of households in parts of the U.S., its long-term viability will depend on user conversion rates, hardware costs, and regulatory compliance.

RedotPay: An Emerging Unicorn in Stablecoin-Based Payments

RedotPay announced the completion of a USD 107 million Series B round, led by Goodwater Capital, with participation from Pantera Capital, Blockchain Capital, and Circle Ventures. The round was oversubscribed, bringing total funding raised in 2025 to USD 194 million, and establishing the company on unicorn scale.

Rather than focusing on crypto-native users, RedotPay targets SMEs and freelancers by integrating stablecoin-based settlement with Visa and Mastercard networks. The platform currently supports major stablecoins such as USDT and USDC, offering fiat conversion and merchant settlement services. Funding will be used to expand global licensing coverage (including MiCA in the EU and PSA in Singapore), upgrade risk management systems, and iterate B2B products.

From an industry perspective, RedotPay illustrates one practical implementation path for the PayFi model. By covering stablecoin on-ramps, settlement, and card network interfaces, it seeks to reduce friction in embedding stablecoins into real-world commercial payment flows. Compared with single-layer payment or stablecoin solutions, RedotPay’s progress in localization and regulatory execution across select emerging markets positions it to capture cross-border settlement and “USD-like” payment demand.

Key variables to monitor include the sustainability of user growth, the cost implications of regulatory compliance, and the stability of partnerships with major stablecoin issuers. Overall, the case reflects how stablecoin-centric PayFi is gradually transitioning from concept validation toward commercially viable deployment.

3. Project Spotlight

Another New Stablecoin Launch: $U’s Differentiated Path and Key Risks

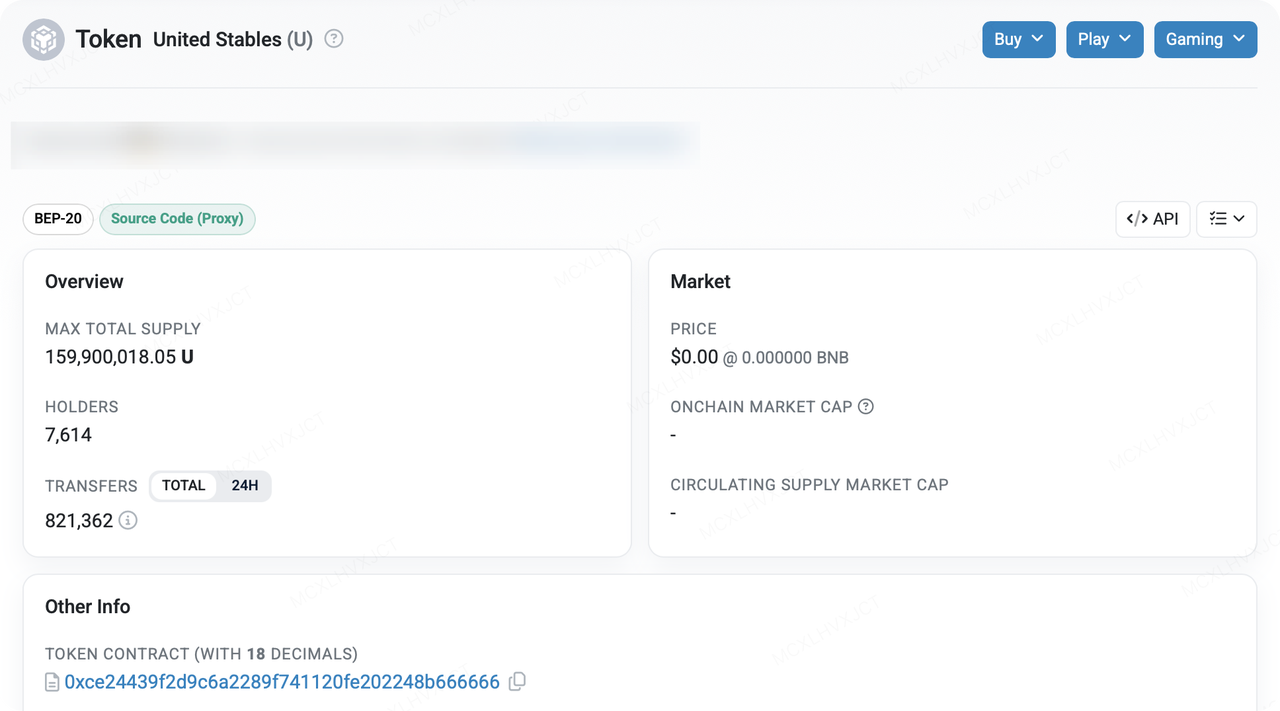

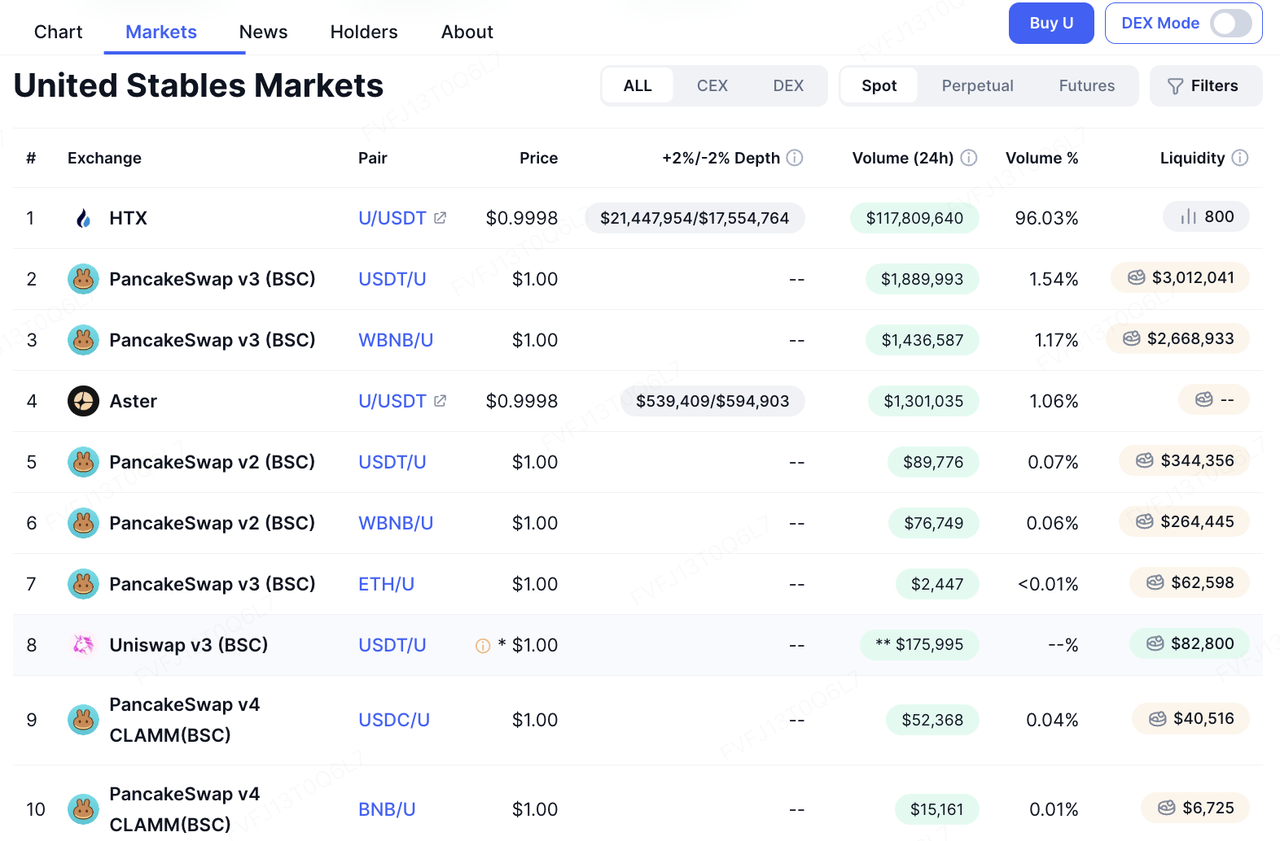

United Stables has recently launched its USD stablecoin, $U, deploying first on both BNB Smart Chain and Ethereum with the stated intent to serve high-velocity capital use cases such as trading, DeFi, institutional settlement, and cross-border payments. Initial attention, however, has been driven more by two “external” catalysts than by organic adoption alone: (1) CZ’s rapid repost on social media, which functioned as a credibility signal, and (2) the team’s aggressive early push on integrations and liquidity programs (DEX, lending, wallets, and CEX support rolled out in parallel), making $U appear to follow a more assertive “launch-and-be-usable immediately” playbook.

On-chain data indicates that $U’s supply expanded quickly after launch. Within fewer than four days, BscScan showed a maximum total supply of approximately 159.9 million tokens and around 7,614 holding addresses. At the same time, HTX-related addresses account for more than 65% of top holders, and HTX has promoted yield products offering up to 20% APY. In a “scale fast at launch” narrative, this level of concentration is not uncommon: it can reflect early institutional minting plus custody/market-making arrangements, and it can also be a byproduct of CEX liquidity and yield programs absorbing supply. That said, for external observers, concentration objectively amplifies two concerns: (1) whether secondary-market liquidity and price discovery are sufficiently distributed, and (2) whether redemption and reserve transparency remain verifiable under stressed conditions.

$U is positioning itself differently from a “single-issuer stablecoin” model, emphasizing an “inclusive stablecoin reserve” approach to aggregate liquidity rather than competing via pure homogeneity against incumbents. Combined with its claimed 0-gas transfer incentives/mechanisms on BSC and rapid DeFi/wallet integrations, this looks more like a strategy of “buying ecosystem mindshare with distribution speed.” Importantly, the core question is not whether the narrative is more compelling, but whether two items can be continuously verified:

-

Whether the reserve composition, custody arrangements, redemption terms, and more frequent third-party attestations are sufficiently clear;

-

Whether depth, slippage, and cross-venue usability of major liquidity pools (DEX ↔ lending ↔ CEX) can keep pace with supply growth—otherwise a structural mismatch can emerge where “supply scales fast, but usability lags.”

On the execution side, $U’s integration path is a relatively direct bet on BSC’s “high-turnover application base.” Integrations with PancakeSwap, Aster, Fourmeme, and ListaDAO—together with wallet support from Binance Wallet, Trust Wallet, and SafePal, plus CEX listing on HTX—give $U broad coverage across trading, staking/lending, meme launch scenarios, and centralized trading access. Notably, Fourmeme has created a dedicated section for $U and is attempting to position it as a primary launch asset for new projects—effectively competing for the role of “denomination unit” in on-chain primary issuance and liquidity bootstrapping. If such path dependence takes hold, $U’s real usage demand would not rely solely on yield subsidies, but could be supported by an internal loop of “launch → trade → market-make → capital recycle.” However, it is also worth noting that $U’s on-chain liquidity pools are not yet particularly deep, and many participants may still be in wait-and-see mode.

Looking ahead, $U’s potential differentiation is concentrated in a combined narrative of “enterprise privacy + AI-native programmable payments.” If the project can deliver stronger privacy protections without sacrificing compliance auditability, and push capabilities such as gasless/signature-based transfers and machine-to-machine payments down to the stablecoin layer, $U may align more closely with an emerging demand curve around “enterprise treasury automation and AI-agent payments.” That said, delivering these capabilities is typically far harder than simply issuing a new stablecoin. Ultimately, the market will validate the thesis using two sets of metrics: (1) cross-scenario usability and retention (real usage in payments/settlement/DeFi), and (2) transparency and compliance credibility (frequency of reserve disclosures, scope of audits/attestations, redemption SLA, and clear playbooks for abnormal scenarios).

From a risk perspective, an “inclusive” reserve structure may improve portfolio-level liquidity, but it also makes risk transmission more complex. When reserves include multiple stablecoins and fiat assets, any compliance action, custody disruption, freezing event, or de-peg affecting any component asset can be amplified into a broader confidence shock through a single $U liability. Second, regulatory and licensing boundaries remain a core uncertainty: the website’s risk and compliance disclosures include jurisdiction-specific applicability statements (e.g., registration/licensing status under certain frameworks), implying that the range of institutionally addressable clients and available distribution channels could fluctuate with regulatory developments. Finally, if on-chain pool depth and swap liquidity do not thicken in parallel, early growth is more likely to be interpreted as “channel-driven volume” rather than genuine “network effects.”

Overall, $U looks like an experimental contender in the post-BUSD stablecoin race. Its upside depends on whether it can translate institutional minting scale into sustainable payment/clearing penetration—and whether it can harden trust through transparency and rules-based redemption mechanisms. Whether short-term momentum persists will depend heavily on ecosystem incentives, practical usability across major DeFi venues, and, critically, whether it can secure stronger distribution tailwinds from major platforms and wallets to form a durable “hold → use → redistribute” loop.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.