KuCoin Ventures Weekly Report: Crypto Treasury Diversification and Financial Engineering Paradigm, ETH Institutional Accumulation and XRP Korea Surge, xAI Companion and Trends Protocol Reshape Social Value

2025/07/21 11:06:59

1. Weekly Market Highlights

A New Paradigm in Corporate Crypto Treasuries: Asset Diversification and Financial Engineering Innovation

Corporate cryptocurrency treasury strategies are undergoing a profound evolution, marked by two core trends: the expansion of reserve assets from Bitcoin to a diverse range of tokens, and the shift in financing methods from simple purchases to complex financial engineering. This signifies the transformation of crypto assets to a strategic tool for active capital management and market cap optimization by public companies.

Asset Diversification: From BTC to a Diverse Array of Tokens

The digital vaults of public companies are no longer confined to BTC. A growing array of assets, including ETH, SOL, XRP, as well as emerging AI (TAO), Meme (DOGE), and exchange tokens (BNB, HYPE), are being incorporated into corporate treasuries. This wave of diversification is creating new narrative hotspots and trading opportunities in the market.

Prominent examples of this trend abound:

-

Major Assets: SharpLink Gaming (SBET), with backing from ConsenSys, established an ETH treasury, sparking a short-term surge in its stock price. Traditional energy firm VivoPower (VVPR) is pivoting entirely to become an XRP-centric treasury following a $100M investment led by a Saudi prince. Meanwhile, Mobility provider Webus (WETO) also plans to raise funds to build a strategic XRP reserve and integrate it into its global cross-border payment network.

-

Diversified Baskets & Yield: Everything Blockchain (EBZT) invested $10M across five assets including SOL and XRP, pioneering a strategy of diversified crypto reserves and staking for yield generation among U.S. public companies.

-

Platform Tokens: Windtree (WINT) announced plans to launch a BNB treasury strategy with up to $200M in financing, positioning it to become the first Nasdaq-listed company to offer direct investment exposure to BNB.

-

Niche & Thematic Bets: TAO Synergies (TAOX) invested tens of millions to acquire the AI-sector token TAO, becoming its largest public holder globally.

-

Meme Coins: Even meme coins are gaining traction. Bit Origin (BTOG) announced a plan to raise $500M to purchase DOGE, hinting at a strategy to align with Elon Musk's X platform payment narrative for market cap management.

These cases clearly demonstrate that corporate allocation logic has expanded beyond simple value storage to encompass diverse objectives such as thematic bets on specific sectors, ecosystem integration, yield generation, and narrative-driven strategies.

Financial Engineering Innovation: Leveraging Traditional Tools for a Web3 Narrative

This treasury boom is not merely about buying crypto with existing cash. It involves sophisticated, large-scale, and replicable capital operations using established financial instruments, centered on a "finance-acquire-manage" closed-loop model.

-

PIPE (Private Investment in Public Equity): The "Narrative Catalyst." Companies offer discounted shares to institutions to quickly raise capital for crypto purchases, while the news of "institutional backing" boosts the stock price. SharpLink is a prime example, though it also faced significant volatility from subsequent selling pressure from unlocked shares.

-

SPAC (Special Purpose Acquisition Company): The "Fast-Track to Public Markets." Entities holding substantial crypto assets can merge with a SPAC to bypass the rigorous scrutiny of traditional IPOs, directly listing as a "crypto treasury" concept stock.

-

ATM (At-The-Market) Offering: The "Flexible ATM." After announcing a treasury strategy, a company can continuously sell new shares at market prices to fund ongoing crypto acquisitions. This method offers flexibility but risks diluting existing shareholder equity.

-

Convertible Bonds: "Low-Cost Leverage." Emulating MicroStrategy, companies issue low- or zero-coupon convertible bonds to finance crypto purchases. This strategy can amplify returns in a bull market but carries the future risks of equity dilution upon conversion or debt repayment challenges in a bear market.

Behind this playbook are prominent crypto VCs like UTXO Management, ConsenSys, Pantera Capital, and Galaxy Digital. They collaborate with public companies to merge traditional capital market tools with cutting-edge Web3 narratives, creating a scalable new paradigm for "crypto treasuries."

However, investors chasing "crypto treasury" stocks must be wary of the following risks:

-

Liquidity & Information Asymmetry Risk: Institutional investors entering through PIPE deals at a discount have a preferential exit. Retail investors, often buying in on positive news, can be left holding the bag when early backers cash out and liquidity drains.

-

Valuation Bubbles & Sentiment Risk: Many of these companies have weak core business operations, with their market caps heavily reliant on crypto speculation. If market sentiment sours, their valuation bubbles can burst rapidly.

-

Debt Leverage & Equity Dilution Risk: Taking on significant debt to acquire crypto magnifies operational risk. In a downturn, companies may be forced to sell assets to repay debt, triggering a cascade effect. In an upturn, bond conversions can dilute existing shareholders' equity.

-

Compliance & Transparency Risk: With underdeveloped accounting standards for digital assets, companies engaging in complex capital maneuvers may lack financial transparency. Future regulatory tightening could impact their valuations and ability to raise capital.

The evolution of corporate crypto treasury strategies reflects a growing recognition of the value of digital assets by traditional capital. However, it is also fraught with risks stemming from financial innovation and regulatory arbitrage. When engaging with this trend, investors must look beyond the surface-level narratives to critically assess the underlying asset quality, capital structure, and potential risks of each case. In capital markets, new stories are constantly emerging, but rationality and risk management remain the cornerstones of investing.

2. Weekly Selected Market Signals

Institutions Boost ETH Holdings, ETH/BTC Surges; XRP Gains Korean Investor Interest; sUSDe APY Returns to 10%

Over the past week, BTC prices have shown consolidation at high levels, reaching an all-time high of approximately $123k on July 14, before dipping to a low of $115.7k on July 15 and subsequently rebounding, with volatility ranging between $1k and $7k. Meanwhile, ETH has surged over 26% this week, with the ETH/BTC ratio rising from below 0.025 to above 0.031, signaling strong bullish momentum.

ETH's surge is driven by sustained institutional accumulation. According to SER data, U.S.-listed companies Bitmine and SharpLink Gaming, which hold ETH as part of their treasury strategies, have surpassed the Ethereum Foundation to become the largest and second-largest known ETH-holding entities, with 300.7k ETH (worth ~$1.13 billion) and 280.6k ETH (worth ~$1.05 billion), respectively. Other public companies increasing ETH holdings include Bit Digital and BTCS. The rise in ETH prices alongside these companies’ stock prices creates a synergistic effect, likely encouraging more firms to invest in ETH, reminiscent of the earlier “BTC strategy” investment wave among public companies. Unlike BTC, which is primarily held, ETH can be staked for yield to secure the Ethereum network or used in DeFi for returns. This drives usage of DeFi protocols and boosts related DeFi tokens, with UNI up over 23% and ENA up over 40% in the past week. Moving forward, focus on DeFi protocols with low MC/TVL ratios, as rising TVL could enable them to capture more real revenue.

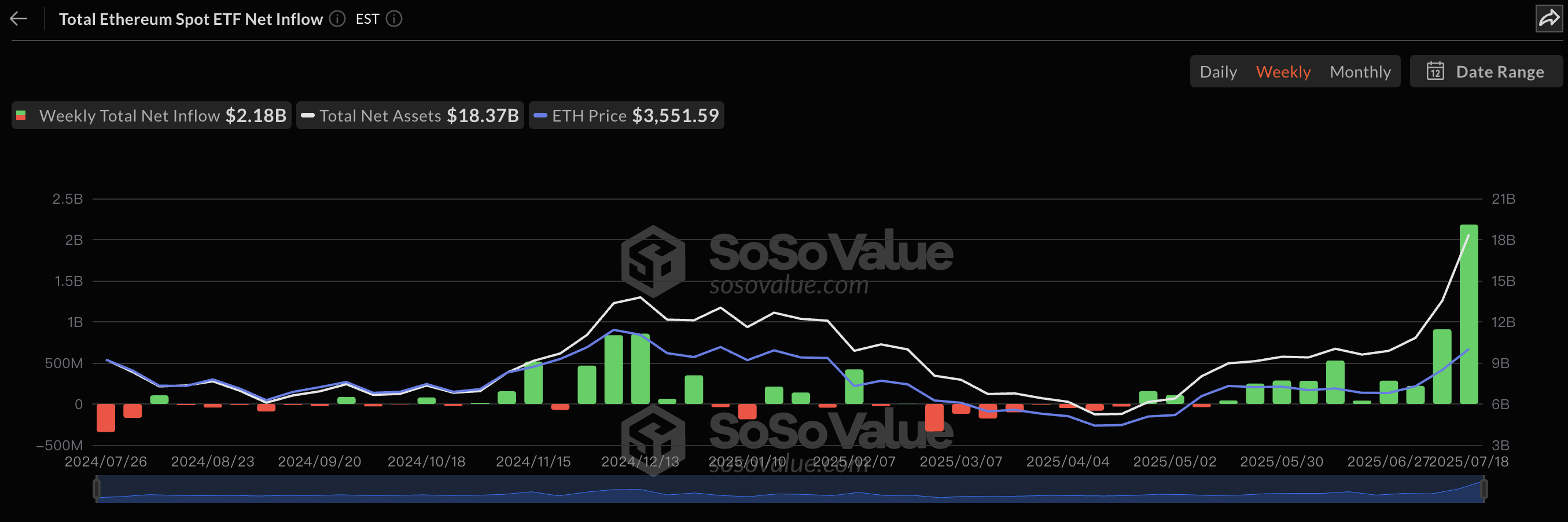

ETH ETF saw a record-breaking net inflow of $2.18 billion in a single week, with strong institutional buying power significantly driving ETH’s price surge. BTC ETF recorded net inflows for six consecutive weeks, with a single-week net inflow of $2.39 billion.

Beyond institutional buying power, ongoing policy breakthroughs are reshaping cryptocurrency valuations. On July 17, the U.S. House of Representatives passed three crypto-related bills: the Clarity for Digital Assets Act, the GENIUS Act for U.S. Stablecoin Innovation, and the Anti-CBDC Act. The GENIUS Act became the first major crypto legislation signed into law by the President. Following the stablecoin legislation, SEC Chair Paul Atkins indicated plans to introduce an “amnesty” for asset tokenization to encourage new transaction forms and establish infrastructure for tokenized securities trading systems. If this “amnesty” progresses smoothly, it could lead to a significant surge in on-chain stock trading, tokenization of real-world assets, and high-leverage derivative trading of tokenized assets.

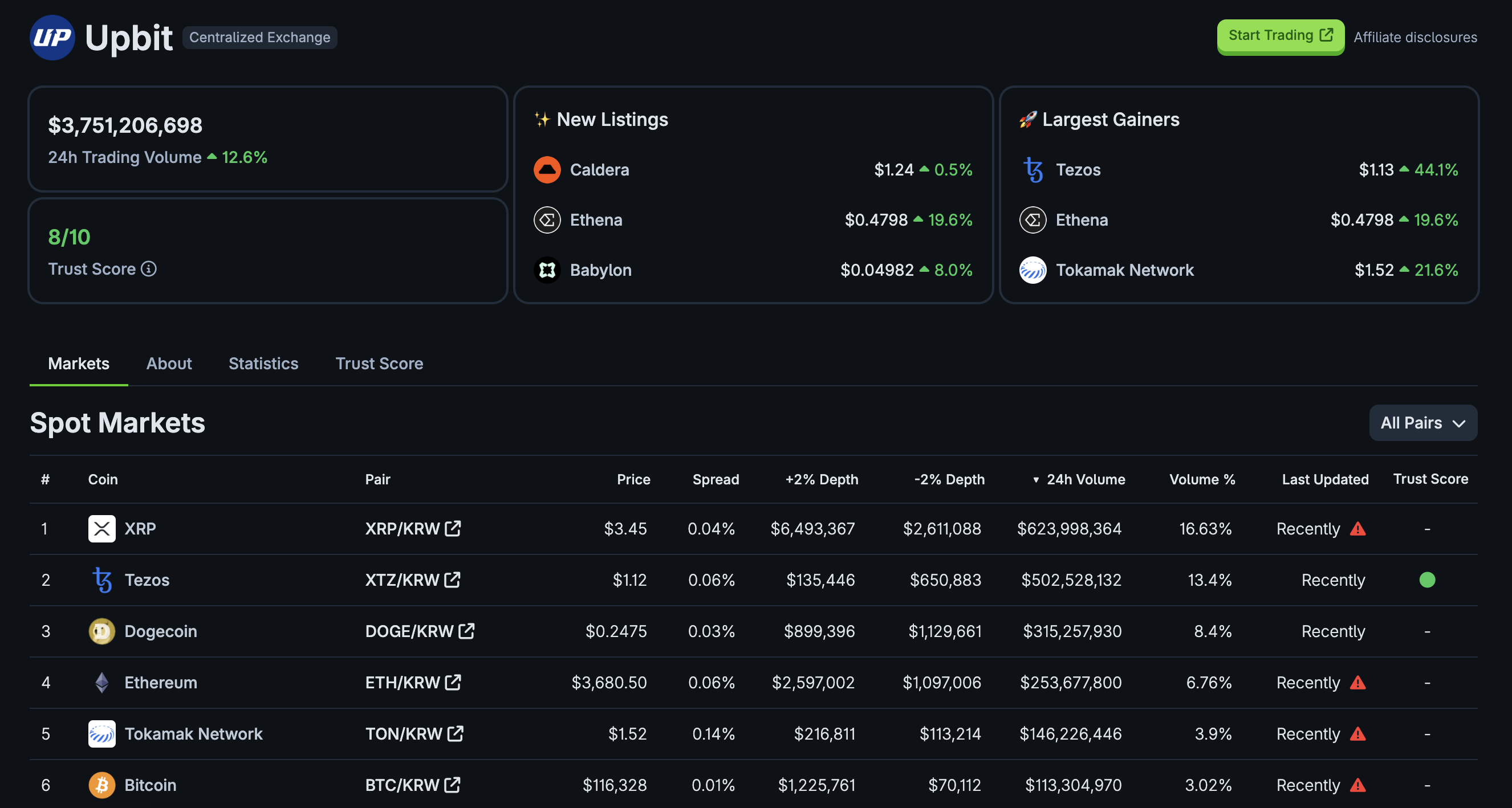

Notably, XRP continues to dominate trading on South Korea’s largest exchange, Upbit. In the past 24 hours, XRP/KRW trading volume was approximately 5-6 times higher than BTC/KRW. An early 2025 survey of South Korean crypto investors showed XRP surpassing ETH in popularity, ranking second only to BTC. Additionally, on the prediction market Polymarket, the probability of a Ripple ETF being approved in 2025 stands at 86%.

Data Source: https://www.coingecko.com/en/exchanges/upbit

Over the past week, USDT supply increased by approximately $2.115 billion, while USDC supply grew by $810 million. Notably, Aptos’ stablecoin market cap surpassed $1 billion this week, overtaking Sui to become the Move-based blockchain with the highest stablecoin market cap. Sui’s stablecoin supply dropped by 19% over the same period, with its largest stablecoin, USDC, seeing a 24.7% decline in supply. Whether this signals a market shift toward the Move ecosystem warrants attention, especially since Sui has significantly outperformed Aptos in token price and market cap since their launches.

Data Source: https://www.coingecko.com/en/coins/tether

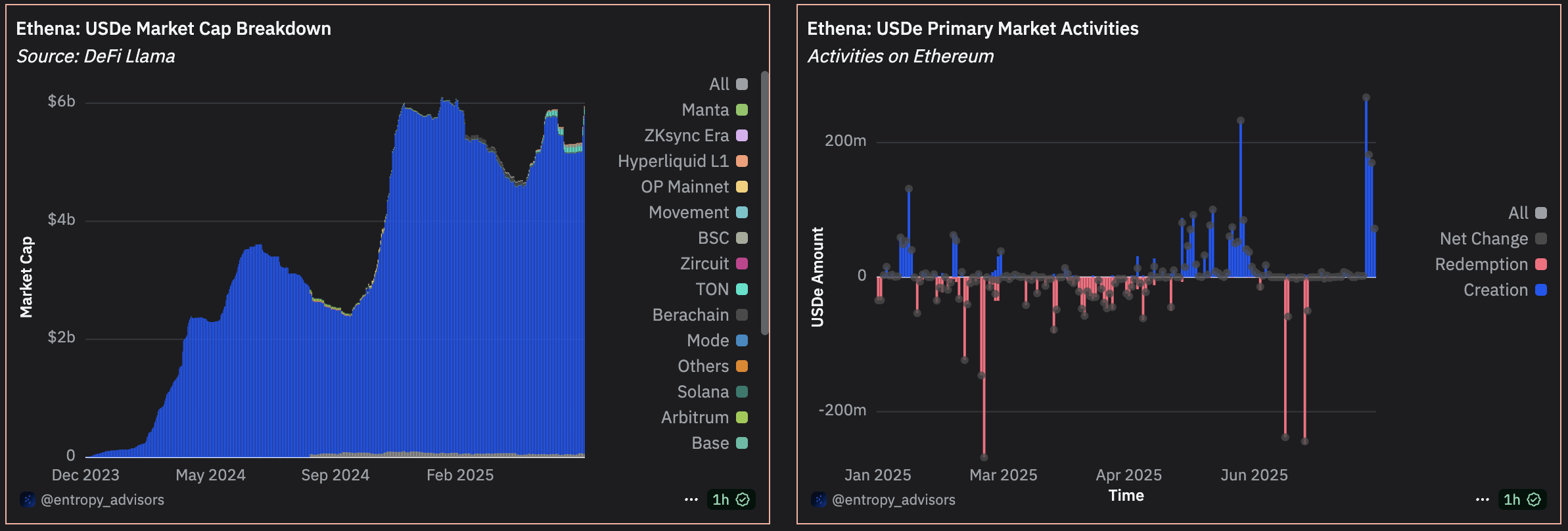

As sUSDe APY returns to 10%, Etheena’s yield-bearing stablecoin USDe has reclaimed a $6 billion market cap after five months, with a single-week net minting volume of $267 million on July 17, marking the third-highest single-day record. Stablecoins are a key bridge for TradFi entering the crypto space, with payments and yields being central focus areas, and sUSDe APY serves as a benchmark for stablecoin yield rates.

Data Source: https://dune.com/entropy_advisors/ethena-usde

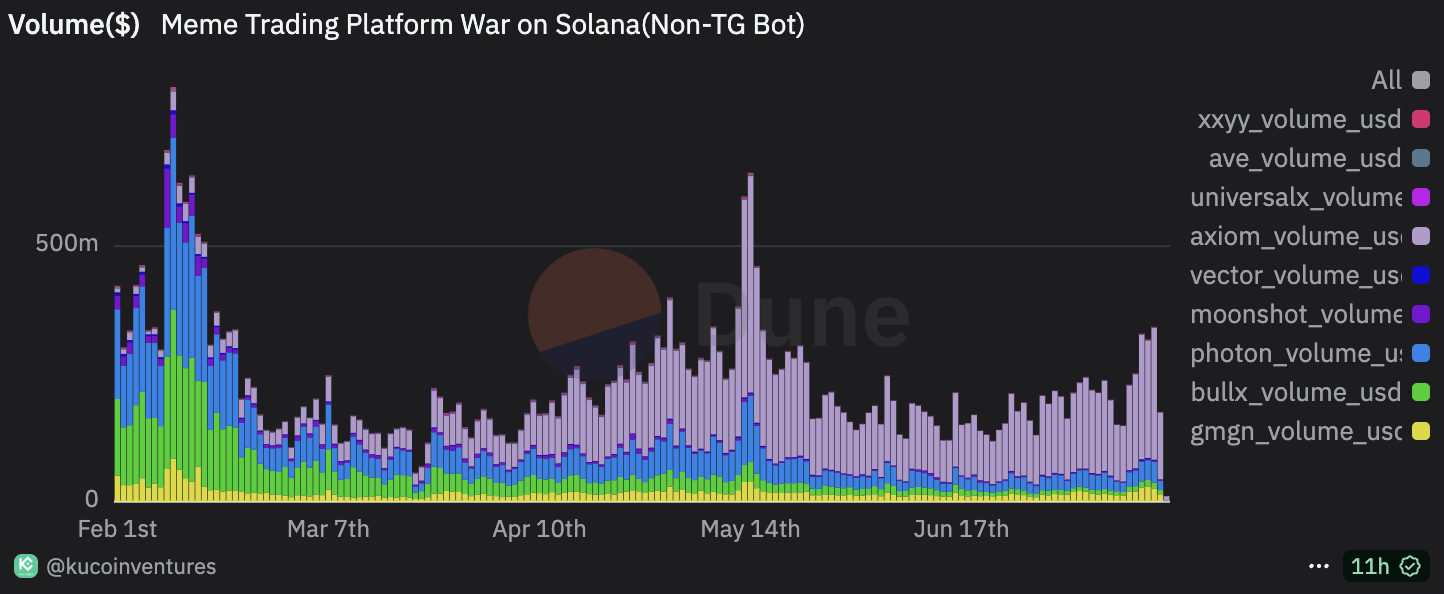

The competition between LetsBONK and Pump.fun is intensifying, with signs of a rebound in on-chain trading volume. Meme trading platforms have seen trading volumes exceed $300 million for three consecutive days, marking a high since the May ICM narrative. Axiom continues to dominate with a 70% market share. However, in terms of absolute daily trading volume, there remains a significant gap compared to May and February, with recent activity more concentrated on cexs and large-cap coins.

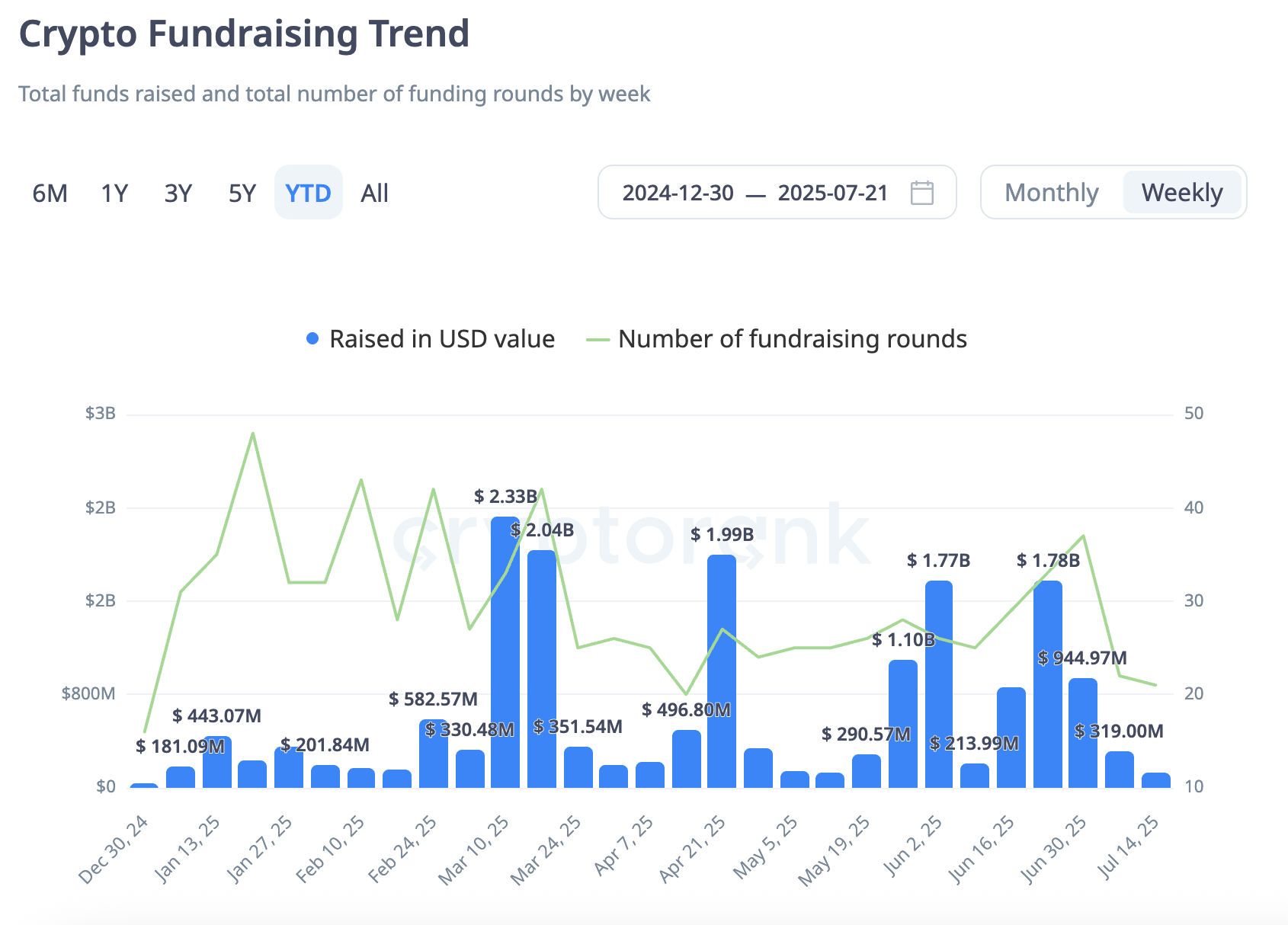

Primary Market Financing Observation

Last week's primary market financing activity was relatively quiet, with 21 new projects raising $133 million. Notably, Spiko and Ephemera secured financings exceeding $20 million each.

Data Source: https://cryptorank.io/funding-analytics

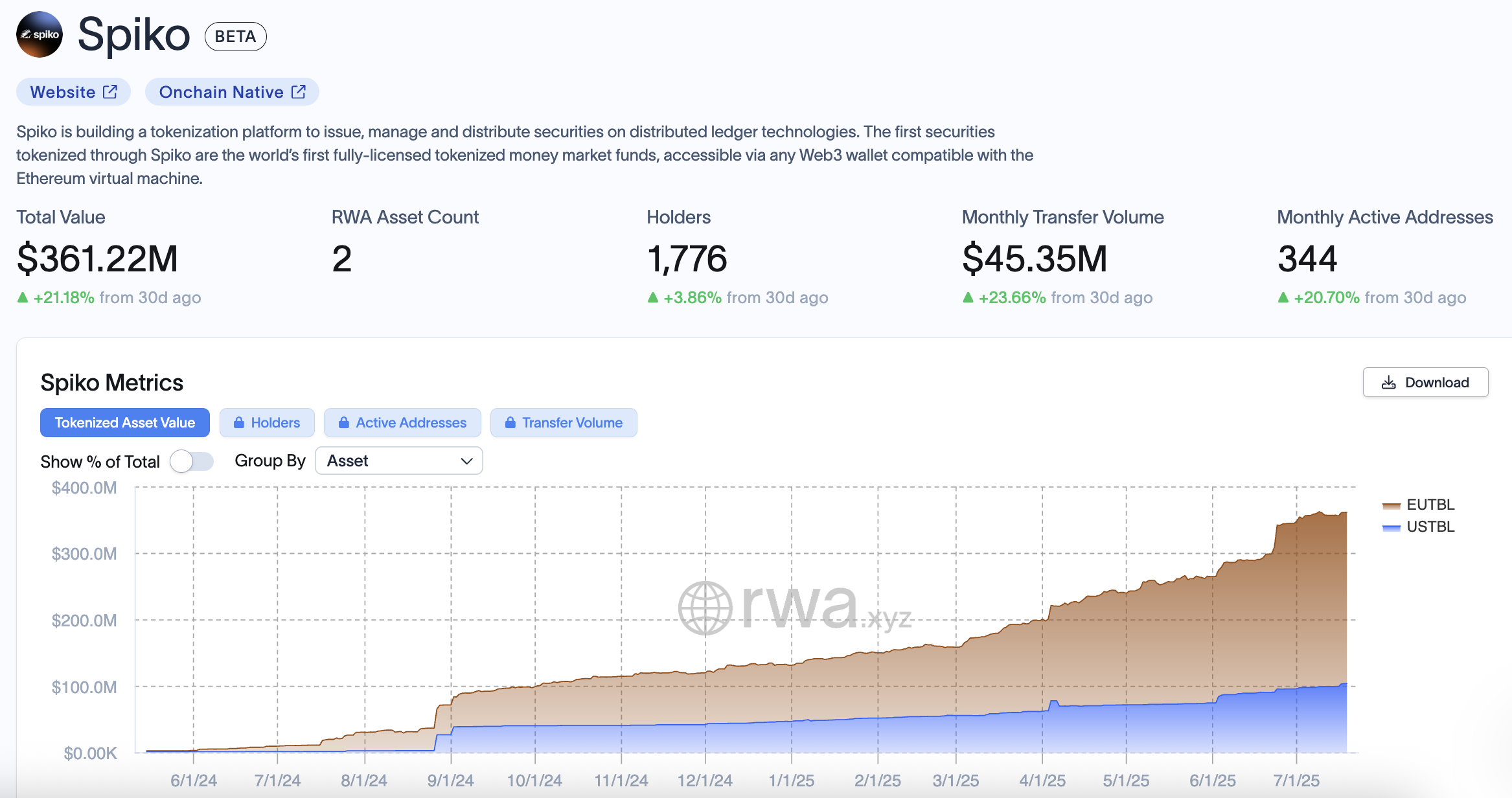

Investment in Tokenized Euro and U.S. Debt MMFs: French Compliant Tokenization Firm Spiko Raises $22 Million

Spiko, a compliant real-world asset (RWA) tokenization company, announced last week that it secured $22 million in a funding round led by Index Ventures, bringing its total funding to $26 million across multiple rounds. Spiko is a French company, approved by the French Financial Markets Authority (AMF), authorized to provide tokenized sovereign bonds for individuals and businesses. Currently, Spiko offers tokenized products EUTBL and USTBL, backed by euro-denominated and U.S. dollar-denominated bonds, respectively. In the future, Spiko plans to expand into UK government bonds and arbitrage strategy products between CME commodity spot and futures markets. RWA data indicates that Spiko’s tokenized products have an on-chain value of approximately $361 million, with EUTBL at $258 million and USTBL at $103 million.

Data Source: https://app.rwa.xyz/platforms/spiko

Taking Spiko’s euro-denominated bond tokenization product EUTBL as an example, compliant users who pass KYC must first deposit funds into the Spiko platform via bank transfer to Spiko Funds’ custodian bank, CACEIS Bank—the asset servicing arm of Crédit Agricole (USTBL is custodied by The Bank of New York Mellon). Once the deposit is verified, users’ funds begin earning daily interest from EUTBL. EUTBL’s underlying assets are invested solely in treasury bills with maturities of less than 6 months, issued by high-credit-rated Eurozone countries such as Germany and France, with the portfolio’s average maturity not exceeding 2 months. Additionally, up to 10% of the assets are held in euro cash balances to facilitate instant withdrawals. When users request a withdrawal on the Spiko platform, they must specify a target bank account that matches the Spiko platform account holder. Typically, euro withdrawals are settled on the same day, while USD withdrawals are processed within 0-2 business days.

Spiko does not charge fees for deposits or withdrawals; instead, it deducts an annual fee of 0.25% from accrued interest, prorated based on holding days. CACEIS serves as both the custodian of user assets and the fund administrator responsible for calculating daily investment returns and net asset value. Additionally, PricewaterhouseCoopers acts as the statutory auditor for Spiko Fund.

Notably, purchasing Spiko’s tokenized bond products requires tax compliance based on applicable laws in each country or region. Individual French tax residents must pay taxes on realized capital gains, with options of a flat 30% tax rate or a progressive tax rate combining 17.2% social security contributions and marginal income tax. The standard corporate tax rate is 25% on realized gains. Non-French investors are exempt from French taxes on capital gains from Spiko Fund but must comply with their local tax regulations for investment income.

Building On-Chain Communication: Private Social Builder Ephemera Secures Two Consecutive Funding Rounds from a16z

Ephemera, the parent company of the decentralized communication protocol XMTP and the privacy-focused chat app Convos, has secured significant investments. In September 2021, XMTP raised $20 million in a Series A round led by a16z. This was followed by a $20 million Series B round, with additional investment from a16z, co-led by a16z, Faction, and Union Square Ventures, with participation from Coinbase Ventures.

In simple terms, XMTP enables on-chain users (wallet addresses) to engage in messaging and group chats, and it has been integrated into Coinbase’s Base app. Within the Base app, XMTP’s end-to-end encrypted messaging allows users to conduct peer-to-peer conversations, share content, interact with AI agents, and send/receive funds, similar to platforms like Messenger or WeChat. XMTP also enables Base app users to access a unified messaging inbox across applications, blockchains, and domains. For instance, if a user has accounts on other XMTP-supported apps, their messages can sync to the Base app. XMTP seamlessly integrates with open protocols like Farcaster and Zora Coins, which are also part of the Base app ecosystem. Additionally, XMTP emphasizes privacy protection, censorship resistance, and spam protection, enhancing user experience while maintaining security and privacy.

Convos, akin to a decentralized version of Signal, is a privacy-first encrypted communication app that supports end-to-end encrypted messaging between user addresses. Currently in early access, Convos offers features such as address-based communication, friend-sharing links, human verification protection, pay-to-say functionality, “Be Yourself” features, and private transactions.

3. Project Spotlight

The focal point of last week's secondary market discussions clearly converged on the core theme: the financialization of emerging digital interactions.

xAI's "AI Companions" Launch: A Social Experiment Blending Suggestive Themes and Trading Frenzy

Last week, Elon Musk's artificial intelligence company, xAI, launched a new feature called "Companions" for its large language model, Grok 4. This move is seen as a significant step for Grok to differentiate itself amid intense AI competition, deepen user relationships, and explore business models (currently available only to SuperGrok subscribers at a $30 monthly fee). However, its initial characters sparked controversy in the market due to their risqué content. The officially promoted characters were a virtual figure named Ani and a foul-mouthed red panda named Rudi. To cater to popular aesthetics, Ani was specifically designed with common Japanese anime elements: a 2D-rendered style, yellow twin-tails, Lolita-style attire, and a "tsundere," playful, and even slightly suggestive speaking style.

Amid continuous retweets and interactions from Musk, coupled with debates among KOLs and the media, the high popularity and controversial nature of the Ani character quickly spread to the secondary market. A memecoin of the same name, based on her likeness, saw its market capitalization briefly surpass $87 million before settling around $35 million, becoming one of the most-watched trading assets of the week.

Following the female character, Musk continued to interact with fans on social media, soliciting names for a male virtual persona, and on the 18th, announced the chosen name: Valentine. On the 21st, Musk further revealed plans to release "Baby Grok," a child-friendly version of the AI chatbot focusing on kid-safe content, which, to some extent, addressed the criticism that the virtual persona Ani's dialogue was "not suitable for children." Related memecoins with the same names also attracted trader attention, but their overall market cap and trading volume have not yet matched that of the initial Ani token.

Overall, throughout this process, Musk maintained a highly interactive stance with his followers, incorporating "nurturing" or "developmental" elements into the project's evolution to enhance the audience's sense of involvement and dedication. On the asset and trading level, this once again validates the current market logic that "attention is paramount." The greater the controversy, the more speculative liquidity it tends to attract.

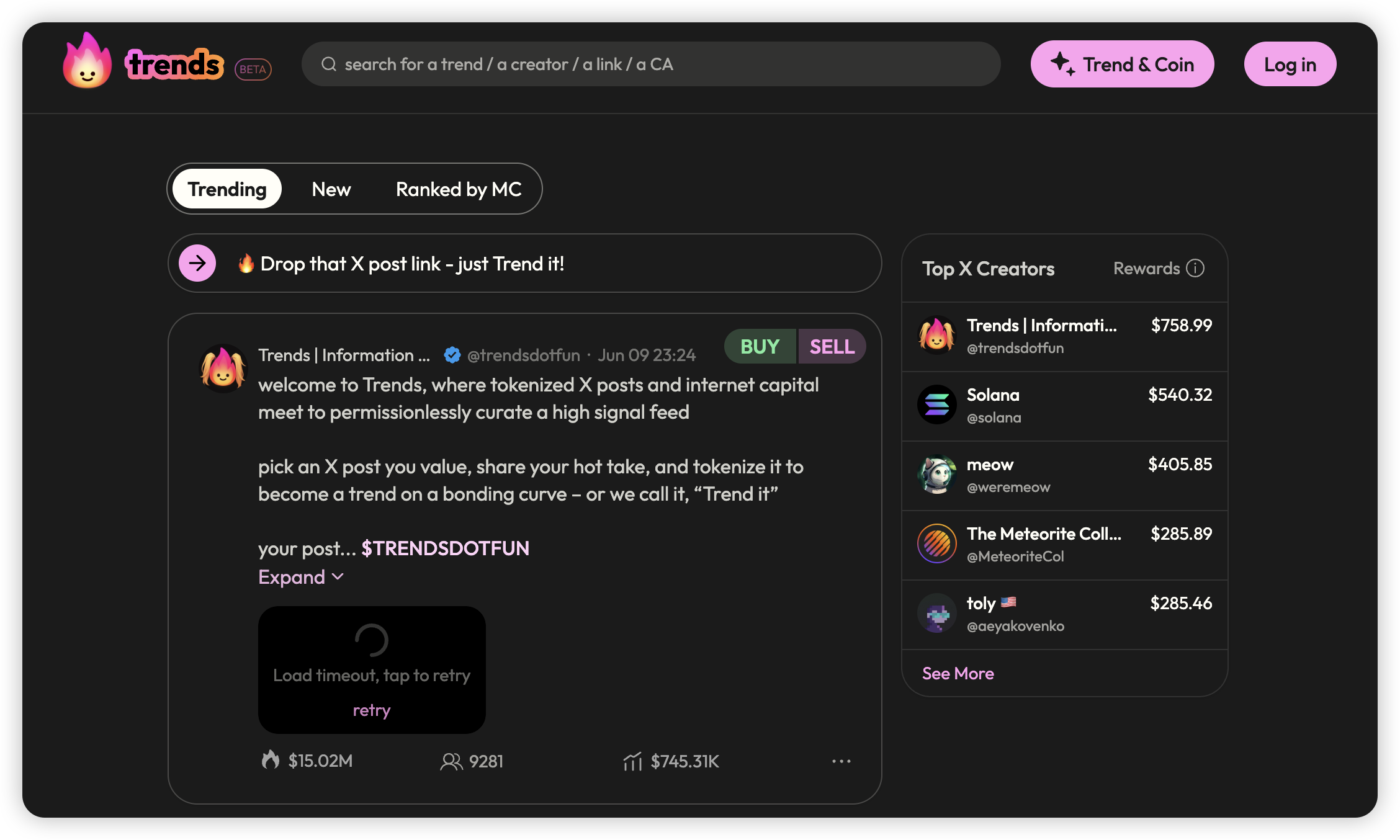

Trends Protocol Goes Live: Aiming to Reconstruct Social Value, Anchored by On-Chain Capital

Mable Jiang, former Chief Growth Officer at FSL (Stepn's parent company) and a former partner at Multicoin Capital, announced the creation of the social protocol Trends. Her strong personal background, impressive lineup of investors, and disruptive concept immediately garnered significant market attention upon its launch.

Previously, Trends was known as OpenFriend.Tech, a social on-chain reputation protocol based on Friend.tech, designed to help users more easily manage points and view rankings. The project received support from various Solana-ecosystem entities, institutions, and founders. Angel round participants included the founder of Solana, the Jupiter team, the FSL team, the founder of LayerZero, partners at Multicoin Capital and Dragonfly Capital, and the co-founders of FSL, although the specific funding amount was not disclosed.

Trends aims to merge the flow of information with the flow of value. It seeks to create the shortest path from "conviction" to "profit and loss," enabling every social interaction (like a "like") to carry economic weight (e.g., "1 like = $1 buy-in"), thereby realizing the concept of "opinion as a position." The core product idea is to tokenize social media content, including X posts (and in the future, TikTok videos). Currently, the product allows a specific word from an X post to be tokenized as a MEME ticker. The platform officially calls this process: Trend it.

When a user pastes a tweet link into the Trends platform, it automatically detects keywords in the tweet. The user can then select a ticker to create a MEME token with one click. Subsequently, the platform creates a bonding curve on Meteora to provide initial liquidity and a trading venue for the MEME token. A single post can only be used to launch one meme token on the platform, following a first-come, first-served principle. The feature allowing other users to mint a token based on someone else's post helps solve the "cold start" problem common to new social media platforms.

The key features of this mechanism are its openness and scarcity, designed to capture and trade the "tipping point" of specific information or ideas. However, the project's barrier to entry is not particularly high, meaning it could be quickly imitated by competitors. Whether its popularity and asset issuance model will gain widespread adoption, and whether it can produce a truly representative trading asset, remains to be seen and will be tested by the market.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer: This content is provided for general informational purposes only, without any representation or warranty of any kind, nor shall it be construed as financial or investment advice. KuCoin Ventures shall not be liable for any errors or omissions, or for any outcomes resulting from the use of this information. Investments in digital assets can be risky.