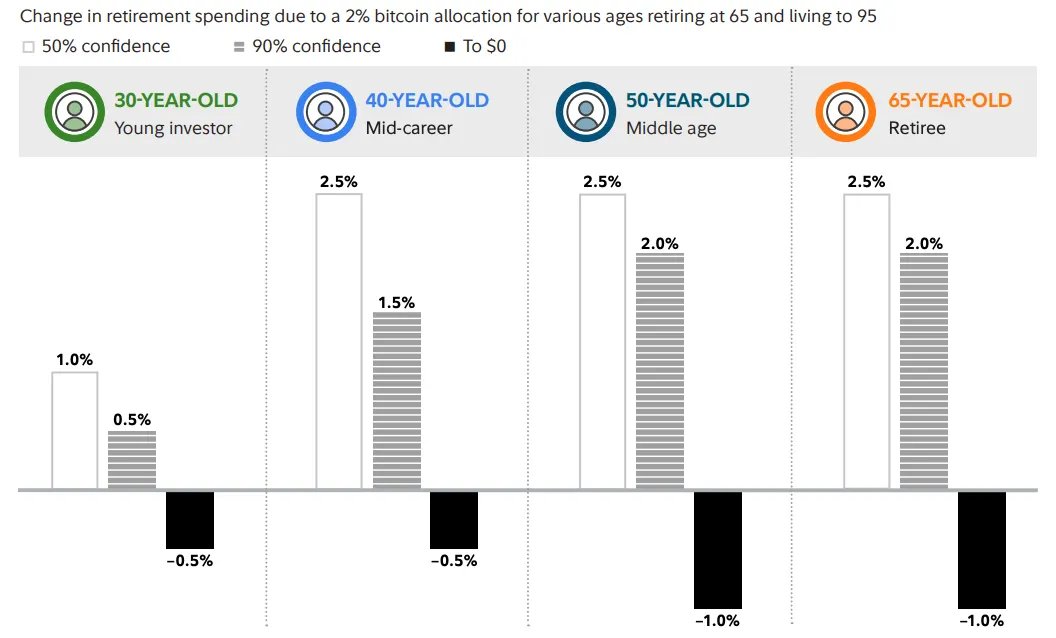

Fidelity’s 2% Bitcoin allocation modeling highlights something institutions need to pay attention to. Mid-career investors may see more meaningful portfolio impact from Bitcoin allocations than younger investors. And the timing explains why. These investors have accumulated enough wealth for exposure to matter, while still having runway to capture adoption gains. Younger investors have time, but not enough capital yet for small allocations to meaningfully affect long-term outcomes. This creates a real issue, as traditional age-based frameworks were not designed to account for this difference. What matters is where clients sit on their wealth curve relative to where Bitcoin sits on its adoption curve. Institutions may need allocation frameworks that account for both timelines.

Share

Source:Show original

Disclaimer: The information on this page may have been obtained from third parties and does not necessarily reflect the views or opinions of KuCoin. This content is provided for general informational purposes only, without any representation or warranty of any kind, nor shall it be construed as financial or investment advice. KuCoin shall not be liable for any errors or omissions, or for any outcomes resulting from the use of this information.

Investments in digital assets can be risky. Please carefully evaluate the risks of a product and your risk tolerance based on your own financial circumstances. For more information, please refer to our Terms of Use and Risk Disclosure.