Key Insights:

- XRP price registered a 428% surge of inflow in a week despite $454M outflows across the market.

- Technical rejection near $2.10 puts the short-term focus on the $1.95-$1.90 support area.

- Germany and Canada took the lead in XRP inflows as US-based crypto products saw heavy redemptions.

XRP price is grabbing intense attention as capital flows are spiking despite broad market weakness. Technical signals now clash with speculative narratives and fluctuating regional investment trends. Traders are considering the risks of a breakout that leads to continuation or of a rejection that leads to rejection.

XRP Price Rumors Fuel Narrative Shock

XRP price sentiment changed after renewed speculation surrounding institutional adoption. Crypto commentator John Squire pointed to reports that BlackRock could partner with Ripple for tokenized real-world assets.

The claims have gone unconfirmed, but the reaction in the market was immediate across the social platforms. Traders treated the rumor as a change in the structure and not as a short-term catalyst.

Tokenization on the XRP Ledger would put XRP in an institutional settlement infrastructure. That narrative is consistent with Ripple’s focus on regulated financial use cases that it has been pursuing for years.

However, there has been no formal statement coming out of BlackRock or Ripple. Investors are therefore considering the development to be speculative. Historically, XRP price has reacted strongly to partnership expectations, but sustained moves usually depend on confirmation rather than anticipation.

The rumor causes volatility pressure in the price as it approaches technical inflection zones. Without validation, speculative premiums can unwind quickly.

XRP Price Rejection Near $2.10 Increases Downside Risk

Short-term charts have XRP price struggling around a well-defined resistance band. Analyst Kamran Asghar pointed to repeated rejection around the $2.10 level.

His analysis pointed to bearish confirmation after a serious attempt at a rally. Price failed to hold above resistance, triggering momentum divergence. Asghar cited $1.95 and $1.90 as probable downside targets. These levels are consistent with earlier areas of consolidation.

The rejection followed a sharp impulse price move, often subject to retracement. Volume also tapered near resistance, where it reinforced exhaustion signals.

From a structural aspect, XRP price is still above the higher timeframe support. However, a loss of $2.00 may cause short-term selling pressure to accelerate. Traders are now paying attention to whether buyers defend the $1.90 region. Failure there would undermine the broader bullish narrative.

Breakout and Pullback Structure Keeps Continuation Alive

A contrasting view is centered on classic breakout behavior, rather than rejection. Analyst EGRAG CRYPTO highlighted a textbook breakout, pullback, and hammer sequence.

According to his framework, XRP price broke above major resistance earlier. The current pullback is a retest rather than a trend failure.

EGRAG stressed the importance of confirmation candles at support. A bullish hammer may confirm continuation probability. He put a 60-65% probability of upside continuation if support holds. Longer consolidation is 25-30%.

More severe pullbacks are still possible if higher timeframe support breaks. Invalidation is on the $1.60 to $1.40 range. This structure is similar to historical accumulation phases in previous cycles. Continuation requires patience instead of immediate expansion.

Institutional Flows Reinforce XRP Price Divergence

Capital flow data provided a fundamental layer for the technical debate. XRP price varied significantly from the overall market trends last week.

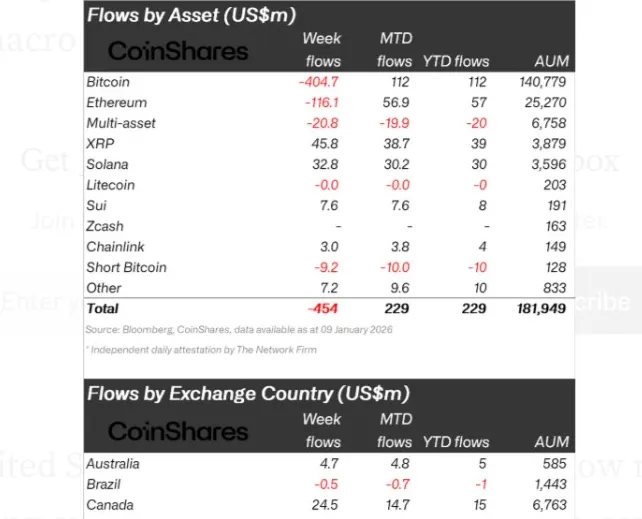

According to CoinShares, $45.8 million in weekly inflows came to XRP. That was a 428% rise from the previous week.

The spike was during a $454 million crypto market outflow period. Investor sentiment was off since Fed rate cut expectations faded. The United States had the lead in terms of redemptions with $569 million in outflows. Germany and Canada had contrasting trends.

Germany had the highest inflows with $58.9 million, followed by Canada with $24.5 million. Switzerland added $21m over the same period. Bitcoin absorbed $405 million in outflows, while Ethereum lost $116 million. XRP crypto, Solana, and Sui were exceptions to the outflows.

This regional divergence suggests selective institutional positioning. Changes in non-US capital allocation are linked to the strength of XRP price.

The post XRP Price Eyes Continuation as Inflows Surge Despite Broad Crypto Outflows appeared first on The Market Periodical.