Key Insights:

- XRP price holds key breakout support near $2, keeping the broader bullish structure intact.

- Analysts view historic drawdowns as normal within bigger bullish cycles.

- Aggressive targets rely on adoption, liquidity growth, and overall market strength.

XRP price debate is intensifying as charts revive talk of a possible super-cycle. Analysts are divided between breakout optimism and warnings of unfinished consolidation. The current structure suggests strength, but volatility remains a defining factor.

XRP Price Structure Sparks Renewed Super-Cycle Debate

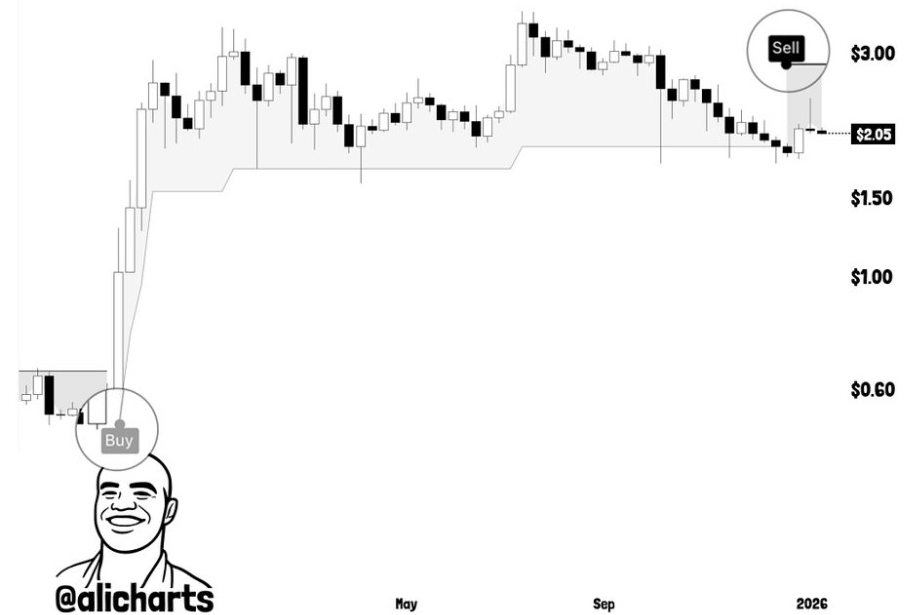

XRP price action has returned to focus after a strong early-2026 rally. The asset rose from less than $1 to almost $3 before entering consolidation. That move confirmed a long-term trend shift and not a brief spike.

Crypto analyst Ali Martinez identified the weekly structure behind renewed super-cycle discussion. He pointed out that XRP is still higher than its previous breakout zone near $2. That level has proven to be structural support several times in recent pullbacks.

From a technical perspective, this trend is a sign of consolidation rather than breakdown. Higher timeframes still show higher lows despite recent weakness. This is keeping the overall bullish thesis technically valid for the time being.

However, momentum has slowed since the 2025 peak. The weekly candles show less volatility and tighter ranges. This indicates XRP price is accumulating energy instead of trending strongly.

Historical Fractals Imply Risk Before Acceleration

While structure is still constructive, downside risk has not gone away. Several analysts emphasized that bullish cycles are usually accompanied by sharp corrective periods. In the past, XRP price has punished late buyers before a massive expansion.

Analyst EGRAG CRYPTO presented a worst-case scenario based on historical fractals. He compared the positioning present with previous XRP cycle structures. Those cycles had drawdowns of 31% to 47% following confirmed breakouts.

Applying that model puts the potential downside at $1.40- $1.20. EGRAG emphasized this would not discredit the long-term trend. Instead, it would be the peak fear within a bullish macrostructure.

He also emphasized that there are no changes in fundamentals. Network development and liquidity conditions still favor long-term expansion.

Breakout and Retest Pattern Supports Continuation Bias

Traders are also keeping an eye on classical chart patterns. XRP price recently broke out of a multi-year ascending triangle. Such structures tend to have prolonged phases of continuation.

Trader JD pointed out a nice breakout and retest on higher timeframes. Former resistance near $2 turned into support. This level has held during several market pullbacks.

The retest phase is crucial for validating trends. Closures above $2 for a sustained close reinforce bullish continuation probabilities. Failure below that zone would weaken near-term momentum.

JD noted that similar setups in past cycles had preceded strong upside expansions. However, he cautioned that patience is needed. Breakouts often consolidate longer than traders anticipate.

Adoption Narrative Clashes with Aggressive Price Target

Beyond charts, narrative momentum is also affecting sentiment. The regulatory advances of and institutional positioning for XRP continue to receive attention. These fundamentals fuel optimistic long-term price projections.

Independent market commentators have recently floated targets of $7 to $9. Some even said long-term scenarios above $100. These projections are based on XRPL becoming a global payment infrastructure at the core.

At current levels near $2.10, the XRP price reflects cautious optimism, with projections for 2026 clustering between $2.50 and $4.00. Optimistic scenarios reach toward $5 to $8 under good market conditions.

These ranges are more in line with liquidity realities. Extreme targets necessitate structural changes in the normal behavior of a cycle. For now, XRP price is between conviction and consolidation.

The post Is XRP Price Entering a Super-Cycle or Setting Up for a Sharp Shakeout? appeared first on The Market Periodical.